LDP leadership election result endorses BoJ’s policy outlook

JPY: Takaichi surprises but Ishiba wins it in 2nd round

USD/JPY initially surged on the back of the surprise result in the first round of LDP leadership election which saw the nine candidates whittled down to just two – Sanae Takaichi and Shigeru Ishiba. Takaichi won the support of 72 LDP Diet members and 109 from LDP members for a combined 181 votes while Ishiba won the support of 46 Diet members and 108 LDP members for a total of 154 votes. In the final head-to-head, the result has just been called and Shigeru Ishiba has won the leadership election with 215 votes to 194 votes for Takaichi. So the initial selling of the yen has reversed sharply as market participants remove the risk of Japan’s government returning to a more pro-Abenomics type economic policy of pushing for monetary easing and large fiscal stimulus, which Takaichi was a strong advocate of.

But this result was extremely close with the vote split in the 2nd round 52.6% versus 47.4% and hence one takeaway from this election is that within the LDP there remains notable support for not raising rates and for a return to the policies of former PM Abe.

But Shigeru Ishiba is known as someone who has opposed PM Abe in the past and is much more aligned with the current policy direction of the BoJ. On 10th September, Ishiba presented his plans and wants to keep pushing policies that will “decisively” beat deflation and he promised to work strongly to lift wage growth and strengthen consumer spending. He voiced support for the BoJ’s policy stance and said he would introduce policies to protect households from rising mortgage rates. Ishiba has also hinted at resetting the US relationship and wants to renegotiate the terms of US soldiers based in Okinawa. He has also advocated playing a greater role in improving relations with China and building an Asian focused alliance rather than being more explicitly aligned just with the US. A Trump victory in November could result in tense relations between Japan and the US.

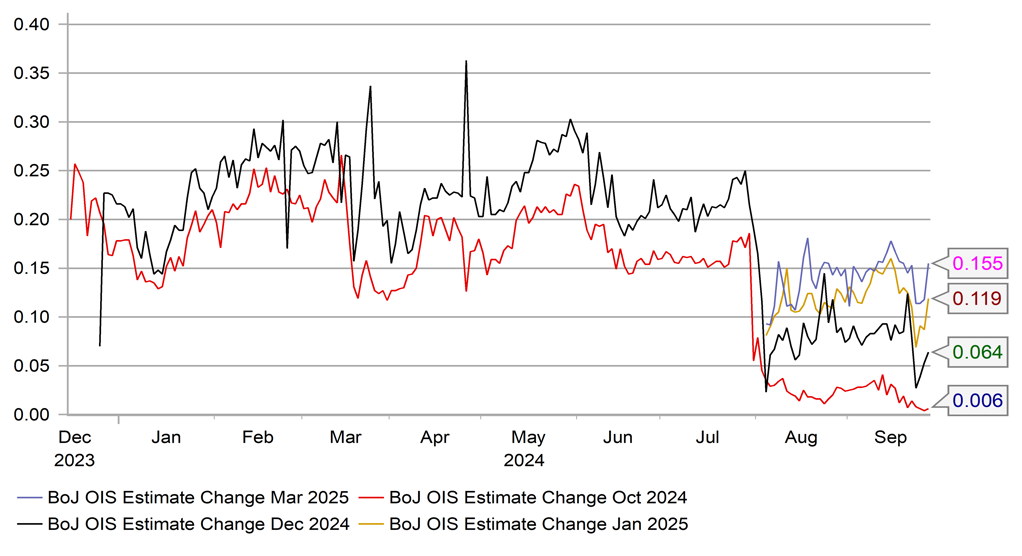

But next now will be the scheduled press conference at 10am BST when we will hear more on Ishiba’s plans. He stated on 10th September that there would be an economic plan put in place “swiftly” but in regard to monetary policy we can think of Ishiba as the continuity candidate with not much bearing on the outlook for monetary policy. An October rate hike was already highly unlikely given the recent communications from Governor Ueda. A December rate hike remains plausible now under the leadership of Ishiba who supported the action taken by the BoJ on 31st July. LDP members would have viewed Ishiba as the stronger candidate amongst the general public who could therefore lead a successful general election campaign. This is fifth time lucky for Ishiba in an LDP leadership election but his victory will be a clear indication of support for the policy stance of the BoJ. We will cover the implications for the yen from this election result later in our FX Weekly.

OIS BOJ PRICING – ISHIBA’S VICTORY POINTS TO CONTINUITY AND SUPPORT FOR BOJ POLICY TIGHTENING

Source: Macrobond & Bloomberg

CHF: SNB cuts with more to come

The announcement of a 25bp cut by the SNB yesterday highlighted one clear fact – the SNB feels constrained by the limited capacity to ease the monetary stance and wish to use what remains sparingly. The decision was in line with the consensus but we argued that the SNB should have been bolder given the current inflation level. They could have been bolder by cutting 50bps and providing a strong message that it would turn to FX intervention to halt the appreciation of the franc given the SNB was at risk of missing its inflation goals to the downside over the medium-term. But of whether the SNB had been more aggressive today or not it would not have masked the reality of the limits of the lower bound are very real for the SNB relative to other G10 central banks, bar the BoJ.

The OIS curve in Switzerland implies a further 60bps of cuts by June which takes the policy rate to between 0.50% and 0.25%. But the 60bps of easing expected in Switzerland by mid-year is in sharp contrast to the 150bps from the ECB, 125bps from the BoE and 170bps from the Fed. Even the RBA which has yet to cut and is communicating more hawkishly than any other G10 central bank (again bar the BoJ) is priced to cut by about 90bps by mid-year.

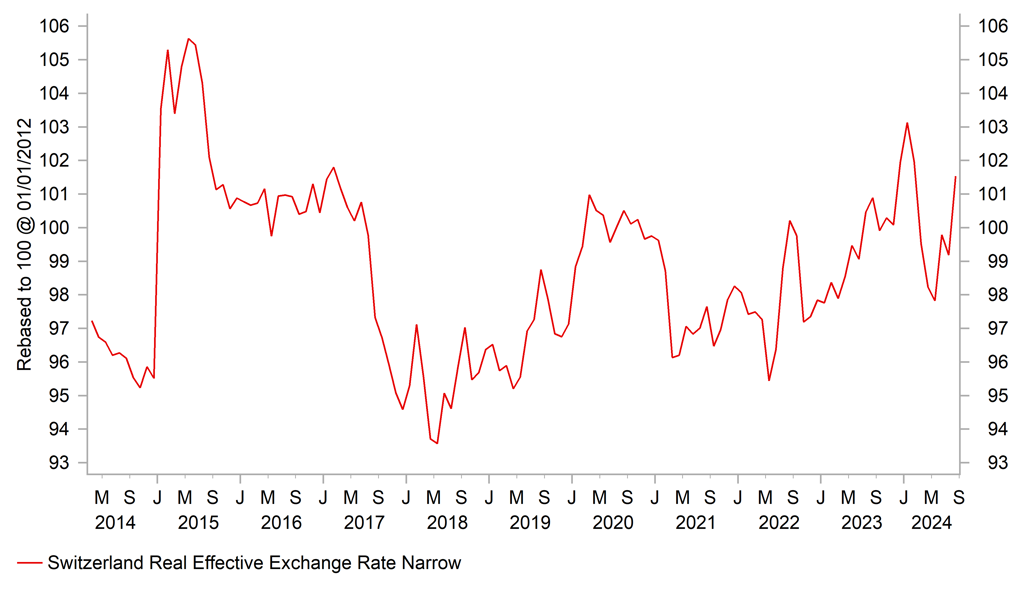

The communications from the SNB yesterday were as expected given the cut was smaller than many expected. Outgoing SNB President Jordan stated further rate cuts “may become necessary in the coming quarters” while incoming President Schlegel stated on Bloomberg that “it is likely” that further cuts will be required. The Monetary Policy Statement yesterday revealed inflation forecasts considerably lower than in June with the Q4 2025 level cut from 1.1% to 0.5% and in Q4 2026 from 1.0% to 0.7%. The final estimate as of Q2 2027 was estimated to be 0.6%. These are big reductions and was acknowledged in the statement with inflationary pressures having “decreased significantly”. The statement cites franc appreciation over the three-month period since the last meeting as a key factor with imported goods and services inflation contributing to the decline.

With inflation now projected so low over the coming years and with growth in the euro-zone still sluggish, it seems a more pro-active FX intervention policy will be inevitable as a key tool in curtailing further downward inflation pressures going forward.

BIS REAL EFFECTIVE EXCHANGE RATE FOR CHF HAS SHOWN RENEWED UPSIDE MOMENTUM

Source: Bloomberg & MUFG Research

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

GE |

08:55 |

German Unemployment Change |

Sep |

13K |

2K |

!! |

|

GE |

08:55 |

German Unemployment Rate |

Sep |

6.0% |

6.0% |

!! |

|

NO |

09:00 |

Unemployment Rate n.s.a. |

Sep |

2.00% |

2.00% |

! |

|

EC |

09:15 |

ECB's Lane Speaks |

-- |

-- |

-- |

!! |

|

EC |

10:00 |

Business and Consumer Survey |

Sep |

96.5 |

96.6 |

! |

|

EC |

10:00 |

Consumer Confidence |

Sep |

-12.9 |

-12.9 |

! |

|

EC |

10:00 |

Services Sentiment |

Sep |

5.6 |

6.3 |

! |

|

EC |

10:00 |

Industrial Sentiment |

Sep |

-9.8 |

-9.7 |

! |

|

UK |

11:00 |

CBI Distributive Trades Survey |

Sep |

-17 |

-27 |

! |

|

GE |

12:15 |

German Buba President Nagel Speaks |

-- |

-- |

-- |

!! |

|

US |

13:30 |

Core PCE Price Index (MoM) |

Aug |

0.2% |

0.2% |

!!!! |

|

US |

13:30 |

Core PCE Price Index (YoY) |

Aug |

-- |

2.6% |

!!!! |

|

US |

13:30 |

Goods Trade Balance |

Aug |

-100.20B |

-102.84B |

!! |

|

US |

13:30 |

PCE Price index (YoY) |

Aug |

2.3% |

2.5% |

!!! |

|

US |

13:30 |

PCE price index (MoM) |

Aug |

0.2% |

0.2% |

!!! |

|

US |

13:30 |

Personal Income (MoM) |

Aug |

0.4% |

0.3% |

! |

|

US |

13:30 |

Personal Spending (MoM) |

Aug |

0.3% |

0.5% |

!! |

|

US |

13:30 |

Real Personal Consumption (MoM) |

Aug |

-- |

0.4% |

!!! |

|

CA |

13:30 |

GDP (MoM) |

Jul |

0.1% |

0.0% |

!! |

|

US |

15:00 |

Michigan Consumer Sentiment |

Sep |

69.0 |

67.9 |

!! |

|

US |

18:15 |

FOMC Member Bowman Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg