USD/JPY picks up ahead of this week’s BoJ policy meeting

USD: Will the nonfarm payrolls report support expectations for Fed cuts?

The major currency rates have remained relatively stable overnight following on from last week’s modest rebound for the US dollar. It brought an end to the run of four consecutive weekly declines for the dollar index which has risen back up towards the 100.00-level after hitting a year to date low of 97.921 on 25th April. The US dollar derived some support last week from building investor optimism that President Trump may further reverse the disruptive trade policies he has put in place during his second term in the coming months including significantly lowering the current “unsustainable” tariff rate of 145% applied to imports from China. At the same time, President Trump stated clearly that he has no plans to fire Fed Chair Powell which has helped to restore some much-needed confidence in US policymaking after the big hit to confidence that has taken place during most of this month triggered initially by the “Liberation Day” tariffs announcement on 2nd April.

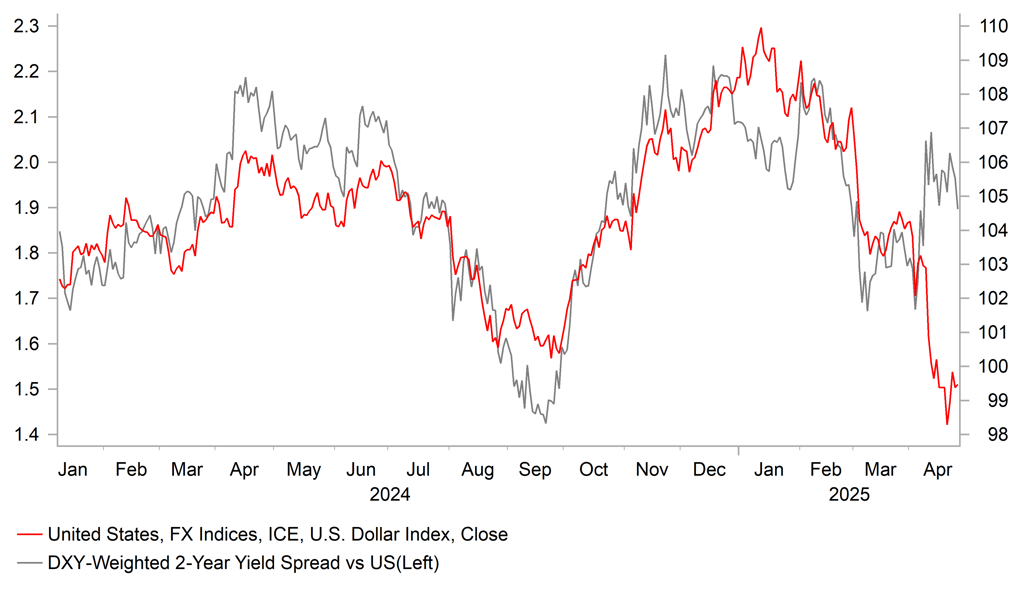

The improvement in investor confidence in US policymaking was also evident by last week’s performance of the US bond and equity markets. The S&P 500 equity index continued to rebound and has now reversed most of the losses initially sustained following the “Liberation Day” tariffs announcement when it fell by almost 15%. Similarly, the US bond market has been rebounding since US yields hit a high on 9th April. The 30-year US Treasury yield has fallen back towards 4.70% moving further below the year to date high of 5.02%. However, we remain unconvinced that the policy u-turn announced so far will be sufficient to trigger a sustained rebound for the US dollar with current tariff rates still hugely disruptive to global trade and the US economy. The release on Friday of the latest University of Michigan survey for April provided further evidence that US consumer confidence has already taken a big negative hit from heightened policy uncertainty and tariff disruption. The headline measure of consumer confidence has fallen sharply by 21.8 points to 52.2 in April which is one of the lowest levels on record dating back to the late 1970’s.

Dovish comments from Fed officials at the end of last week indicated that they are ready to lower rates if downside risk to growth materialize. Fed Governor Waller stated “it wouldn’t surprise me that you might start seeing more layoffs, a tick up in the unemployment rate going forward if the big tariffs in particular come back on. If I see a significant drop in the labour market, then the employment side of the mandate, I think, is important that we step in”. However, he doesn’t expect the tariffs to have a significant impact on the Us economy before July signalling that he currently favours waiting until the September FOMC meeting before beginning to cut rates unless the labour market weakens more quickly than expected. The release of the latest nonfarm payrolls for April on Friday will be scrutinized even more closely than normal for evidence of weakness in the labour market. Employment growth in Q1 slowed to an average of 152k jobs/month bringing it back into line with the average over the past year while the unemployment rate continues to consolidate between 4.0% and 4.2%. US rate market pricing for one or two cuts by June or July will require evidence of loosening labour market conditions in the coming months.

YIELD SPREAD GAP NARROWS BUT IS STILL SUBSTANTIAL

Source: Bloomberg, Macrobond & MUFG GMR

JPY: Room for further JPY strength even if BoJ expresses more caution

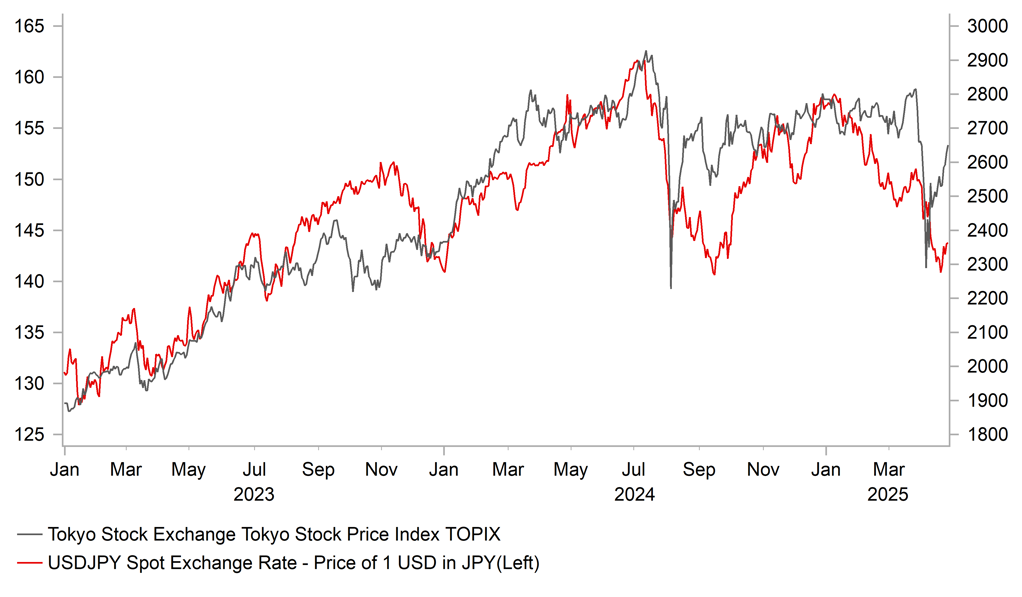

The tentative improvement in global investor risk sentiment contributed to the underperformance of the yen over the past week alongside the other traditional safe haven currency of the Swiss franc. It has resulted in USD/JPY rising back up to the 144.00-level after briefly falling below the 140.00-level at the start of last week. The weaker yen and improving risk sentiment have helped to fully reverse “Liberation Day” losses (~15%) for the Japanese Topix equity index overnight.

The main event for the yen this week will be the BoJ’s latest policy meeting. It will be the first policy update since President Trump’s “Liberation Day” tariffs announcement. The BoJ will have to take into account the negative impact of trade disruption when they set monetary policy in the week ahead. At the previous policy meeting in March, the BoJ had already expressed caution when Governor Ueda stated that “it is not easy to make a judgement” on whether they are getting closer to their goal given high uncertainty surrounding trade and other policies from overseas while indicating he hoped things would become a clearer at the beginning of April. In light of the higher tariffs imposed on trade between Japan and the US including the 10% universal tariff, 25% tariffs on autos & certain parts, and on steel & aluminium, the BoJ is expected to lower their forecast for economic growth in Japan for the current fiscal year. The current GDP forecast of 1.1% for FY2025 is expected to be revised down by around 0.5ppt.

At the same time, the core inflation forecast for FY2025 is expected to be lowered modestly towards 2.0% to reflect waivers for high-school fees, the hit to demand from tariffs and lower energy prices. However, the updated forecasts should still show inflation remaining close to target in the coming fiscal year signalling that the BoJ is likely to normalize policy further if the economy evolves as expected. The significant upside surprise from the Tokyo CPI report for April was supportive for further policy normalization in Japan. However, trade disruption will discourage the BoJ from hiking rates further in the near-term. A quick trade agreement between the US and Japan to reverse tariff hikes could give the BoJ more confidence to hike rates further but that appears unlikely until later this year. The Japanese rate market has already pushed back expectations for the timing of the next BoJ hike from June-July to September-December. There are currently around 9bps of hikes priced in by July compared to around 15bps for October. The dovish repricing that has already taken place should help to dampen JPY selling in response to more cautious BoJ policy communication this week unless they go further even than expected and completely drop plans for further rate hikes which appears unlikely at the current juncture.

Overall, the developments do not change our view that the JPY is likely to strengthen further alongside slowing global growth which will encourage other major central banks including the Fed to deliver deeper rate cuts that continue to narrow yield differentials with Japan. Over the past week officials from the BoE, ECB and Fed have all indicated that they are ready to lower rates in response to evidence of weakening economic growth in the coming months. Please see our latest FX Weekly report for more details (click here).

USD/JPY VS. JAPANESE EQUITY MARKET

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

UK |

11:00 |

CBI Distributive Trades Survey |

Apr |

-21 |

-41 |

! |

|

CA |

13:00 |

Canadian Federal Election |

-- |

-- |

-- |

!! |

|

EC |

14:00 |

ECB's De Guindos Speaks |

-- |

-- |

-- |

!! |

|

US |

15:30 |

Dallas Fed Mfg Business Index |

Apr |

-- |

-16.3 |

! |

Source: Bloomberg