BoJ maintain view of rate hikes to come despite yen surge

JPY: Stronger yen fails to alter BoJ stance

The yen is modestly weaker this morning with the US dollar stronger against most currencies as the FX markets consolidate after last week’s sharp drop for the dollar. China equities are underperforming which is weighing on Asian currencies and there seems little prospect of a near-term turn in poor investor sentiment. The Shanghai Composite is down 11% from the year-to-date high in May. Over the same period of time, the S&P 500 has advanced 6% despite the recent wobble on fears over a hard landing for the US economy.

That period of financial market volatility in late July / early August does not seem to have deterred the BoJ much in their messaging on the direction of monetary policy going forward. Even after a 20-big figure plunge in USD/JPY, the rhetoric from the BoJ has not altered greatly. The latest comments today were from Deputy Governor Himino who gave a speech to local leaders in Yamanashi. At the beginning of the speech he reiterated the view that the economy will move in line with the BoJ’s forecasts for both GDP and inflation. This was an important first point as the recent sharp appreciation of the yen and the decline in global commodity prices could have allowed BoJ officials to conclude that at the very least the inflation risks were turning to the downside. Given Japan’s self-sufficiency rates in energy and food are low relative to other countries like Germany and the US, the import inflation determinant is more important for Japan and therefore FX could be viewed as more important.

But despite this, the message from Deputy Governor Himino was the same as Governor Ueda’s – that if the economy unfolds as is expected, more rate hikes will be required. Himino acknowledged it was possible the recent market moves could alter the achievement of the goals but maintaining the view was in part predicated on the assumption of a soft landing for the US economy. If you consider that the 2-year JGB yield is today below an initial high from May and well below the current year-to-date high in July, there is scope for market yields to move higher.

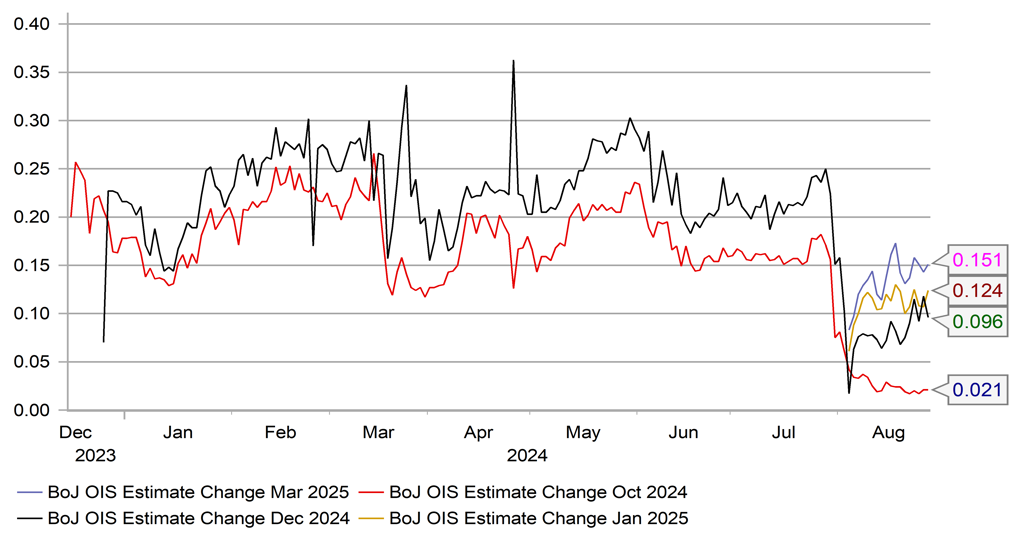

So while Himino repeated that the BoJ will watch the markets “with a sense of urgency” after the recent turmoil, the sharp rebound in risk could see that comment being dropped soon and the focus shift to the timing of the next rate hike. There is just 15bps of hikes priced by March of next year, which in our view is much too low. A soft landing for the US economy will likely allow for one or possibly two rate hikes. With Governor Ueda arguing that Japan’s policy framework has now been “normalised”, 25bp clips in future moves seems likely. A shift higher in front-end yields therefore seems likely to us which will act to limit appetite for yen selling and as we have stated, the plunge in USD/JPY has changed expectations of JPY direction and perceived risks and the BoJ’s recent communications will help reinforce that.

OIS IMPLIED ESTIMATE CHANGE IN BOJ POLICY RATE AT KEY MEETINGS AHEAD

Source: Macrobond & Bloomberg

MXN: Further selling on domestic, not global, factors

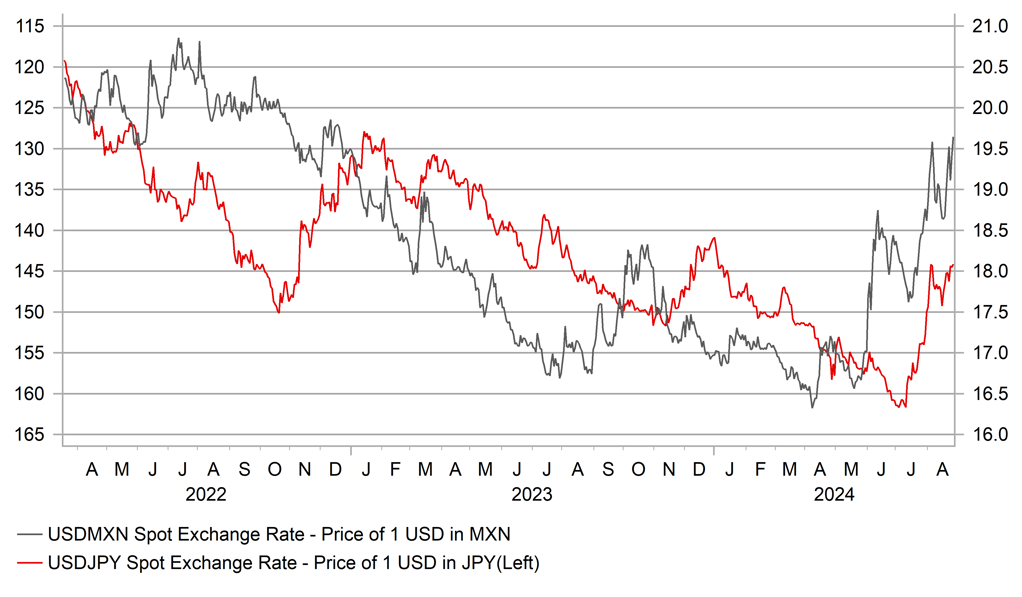

For market participants trying to get a sense of how much of the yen carry position may still exist after the surge of the yen in late July into early August we could look at price action yesterday that certainly suggests less impact from yen carry influences in certain areas of the financial markets going forward. Specifically, yen shorts versus the high-yielding LatAm currencies, and in particular the Mexican peso look to have been lightened considerably and to an extent that will limit further volatility over the short-term. The peso weakened sharply yesterday but the move was much more specific to Mexico and the plunge had limited impact on the yen which suggests less positioning that would have forced the yen to gain much more – USD/JPY was down less than 0.2% and highlights further that the “fast money” from leveraged speculative accounts have likely been cut considerably. The IMM data released last Friday certainly highlighted a broader reduction in long MXN positions with Leveraged Funds and Institutional Investors cutting longs to the smallest total since March 2022 when the global inflation shock commenced and there was a notable pick-up in yen short positioning as well.

If MXN carry via JPY has diminished notably, it likely means that the negative correlation between USD/MXN and USD/JPY will not return any time soon. This correlation has already weakened given the domestic political factors in Mexico undermined MXN performance although indeed we would argue this contributed to the appetite to liquidate long MXN/JPY positions. Yesterday, a key congressional committee cleared AMLO’s legislative plan to overhaul the judiciary in Mexico and bring in a popular vote system for electing judges. Many fear this will in fact lead to increased corruption and undermine the independence of the judiciary. Given AMLO’s Morena Party won a super-majority in the June elections, getting this passed in Congress by the required two-thirds majority is very feasible although the majority in the upper house is two seats short of the two-thirds supermajority.

Still, this MXN underperformance could certainly extend further. USD/MXN broke to a new high yesterday, to a level not seen since December 2022. Banxico hasn’t helped the situation with a 25bp rate cut that divided the policy committee. The Deputy Governor has expressed his opposition to the easing given the danger to inflation expectations due to the depreciation of MXN. If we are incorrect and JPY shorts vs MXN remain sizeable, there is certainly a risk of further JPY strength if MXN selling persists over the coming days.

USD/MXN HITS HIGHEST SINCE DECEMBER 2022 – JPY SHORTS LIKELY REDUCED NOTABLY LIMITING JPY IMPACT

Source: Macrobond & Bloomberg

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

IT |

09:00 |

Italian Industrial Sales (YoY) |

Jun |

-- |

-4.80% |

! |

|

IT |

09:00 |

Italian Industrial Sales (MoM) |

Jun |

-- |

-0.90% |

! |

|

SZ |

09:00 |

ZEW Expectations |

Aug |

-- |

9.4 |

! |

|

EC |

09:00 |

M3 Money Supply (YoY) |

Jul |

2.7% |

2.2% |

! |

|

FR |

11:00 |

France Jobseekers Total |

Jul |

-- |

2,834.5K |

!! |

|

US |

12:00 |

MBA Mortgage Applications (WoW) |

-- |

-- |

-10.1% |

! |

|

UK |

13:15 |

BoE MPC Member Mann |

-- |

-- |

-- |

!!! |

|

US |

23:00 |

FOMC Member Bostic Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg