Tariff speculation intensifies once more – uncertainty a constant

USD: Heightened uncertainty will weigh on growth

The back-and-forth on tariff speculation continues with the US dollar strengthening broadly in the FX markets yesterday. Still, there remains an air of investors not fully believing Trump’s latest comments yesterday that the 25% tariffs on Canada and Mexico will indeed go into force next week on 4th March. There was an added surprise of Trump suggesting an additional 10% tariff on China following the 10% implemented on 4th February. Or was Trump confused and forgot he had already gone ahead with the China tariff? Who knows, and it is certainly not surprising if even Trump himself has lost track of what he has done and what is planned! USD/MXN yesterday gained a meagre 0.30% while USD/CAD jumped just 0.65%. CAD was the fourth best performing G10 currency yesterday and MXN in LatAm, the 2nd best after BRL. Given USD/MXN spiked through the 21-level and USD/CAD touched close to 1.4800 on 3rd February on fears of imminent implementation of these tariffs, it is clear that scepticism remains high. Perhaps Trump is trying to drive Canada and Mexico to a better near-term deal given discussions are ongoing. We believe it still makes sense for an agreement for the USMCA renegotiation date (July 2026) to be brought forward and negotiations to take place under that framework. After all, the USMCA is Trump’s deal so both sides can argue a renewed deal can take place via the current framework. The only issue with that logic is that Trump’s current gripe relates to the border and drugs and illegal immigrants coming over the border and hence this is something to could be negotiated outside of the USMCA framework.

Another possible reason for market scepticism is the damage this will do to the US. Census Bureau data on merchandise imports to the US indicates that in 2024 imports from these three countries combined totalled USD 1,357bn, which amounted to 42% of total US goods imported last year. If these tariffs go ahead next week we will see a notable and quick impact on actual inflation over the coming months. Data on consumer confidence already shows the negative impact and rising inflation expectations related to the threat of tariffs and we will likely see a further hit to confidence and a further slowdown in consumer spending.

Weaker growth combined with elevated inflation, which seems inevitable initially if these tariffs go ahead, would likely see a further decline in real yields in the US which would certainly counter the demand for the dollar directly coming from increased tariffs. We are currently showing a 4-5% gain for the US dollar in general across much of G10 on the assumption of tariff action (although we assumed Mexico & Canada would be delayed) but the negative implications for the US and the lack of a coherent strategy may mean the net positive impact on the dollar is less than we have been assuming.

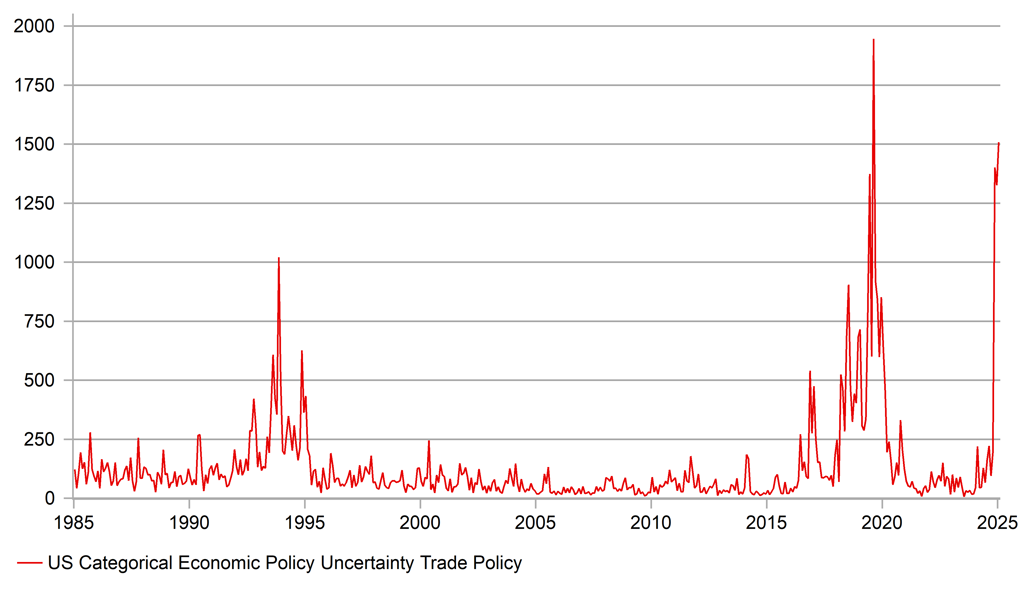

US CATEGORICAL ECONOMIC POLICY UNCERTAINTY – TRADE POLICY

Source: Bloomberg, Macrobond & MUFG GMR

JPY: Upside risks prevail

The Trump tariff comments yesterday have certainly prompted some selling in equities with the S&P 500 down 1.6% and the Nasdaq 2.8% lower, and indicates the concerns highlighted above of a negative hit to the US economy if imports of such a size are tariffed at such a high level from next week. Growth concerns and risk-off trading remains the dominant force in the UST bond market rather than inflation concerns with the 2-year and 10-year yields currently trading at new year-to-date lows. In our view that will continue to provide support for the yen even with the threat of tariffs on Japan remaining. The broad gains for the dollar means USD/JPY has advanced, but by less than the dollar against other currencies, meaning JPY on a TWI basis continues to strengthen. The BoJ’s nominal effective exchange rate yesterday advanced to its highest level since the beginning of October last year with further gains looking feasible today as well. While JGB yields have declined today, in part in sympathy with the US move, yields have advanced much further than investors had expected at the beginning of the year and that will continue to provide JPY support. Last week, the 10-year JGB yield hit 1.45%, the highest since 2009.

JGB yields are also lower today following weaker than expected CPI data. The Tokyo headline annual CPI rate slowed from 3.4% to 2.9% in February, the core from 2.5% to 2.2% with the core-core unchanged at 1.9%. Fresh food prices eased after showing strong gains in recent months. The annual CPI rate for fresh food slowed from 23.1% to 18.4%. However, the reintroduction of energy subsidies helped ease inflation with energy costs slowing from 13.3% YoY to 6.9% in February.

So the inflation data is unlikely to have much bearing on the BoJ’s deliberations. Perhaps more important today was the comment from BoJ Deputy Governor Uchida who stated that JGB yields should be determined by market forces suggesting there are limited BoJ concerns over the sharp move higher in JGB yields since the start of the year. Underlying inflation pressures remain resilient and continue to justify the more hawkish communications from the BoJ. Falling equity markets and declining front-end yields if sustained will likely continue to keep the yen under upward pressure.

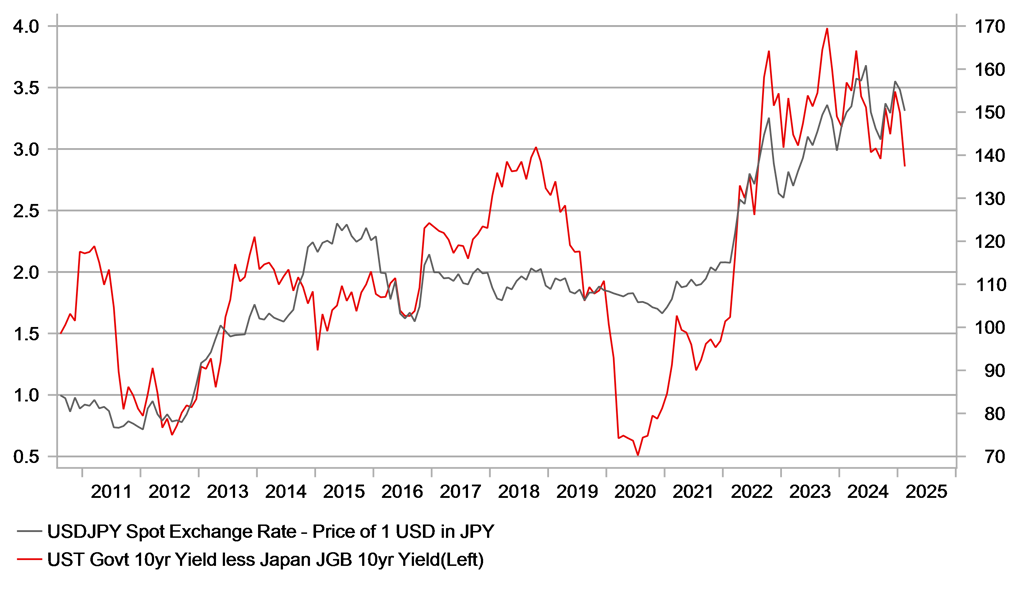

US-JP 10-YEAR SPREAD POINTING TO FURTHER USD/JPY DECLINE

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

GE |

08:55 |

German Unemployment Change |

Feb |

14K |

11K |

!! |

|

GE |

08:55 |

German Unemployment Rate |

Feb |

6.2% |

6.2% |

!! |

|

IT |

10:00 |

Italian HICP (MoM) |

Feb |

0.1% |

-0.8% |

! |

|

IT |

10:00 |

Italian HICP (YoY) |

Feb |

1.8% |

1.7% |

! |

|

GE |

13:00 |

German CPI (YoY) |

Feb |

2.3% |

2.3% |

!! |

|

GE |

13:00 |

German CPI (MoM) |

Feb |

0.4% |

-0.2% |

!!! |

|

GE |

13:00 |

German HICP (MoM) |

Feb |

0.5% |

-0.2% |

!! |

|

GE |

13:00 |

German HICP (YoY) |

Feb |

2.6% |

2.8% |

!!! |

|

US |

13:30 |

PCE Price index (YoY) |

Jan |

2.5% |

2.6% |

!! |

|

US |

13:30 |

PCE price index (MoM) |

Jan |

0.3% |

0.3% |

!! |

|

US |

13:30 |

Core PCE Price Index (MoM) |

Jan |

0.3% |

0.2% |

!!!! |

|

US |

13:30 |

Core PCE Price Index (YoY) |

Jan |

2.6% |

2.8% |

!!! |

|

US |

13:30 |

Goods Trade Balance |

Jan |

-116.90B |

-122.01B |

!! |

|

US |

13:30 |

Personal Income (MoM) |

Jan |

0.4% |

0.4% |

! |

|

US |

13:30 |

Personal Spending (MoM) |

Jan |

0.2% |

0.7% |

!! |

|

US |

13:30 |

Real Personal Consumption (MoM) |

Jan |

-- |

0.4% |

!!! |

|

US |

13:30 |

Wholesale Inventories (MoM) |

Jan |

0.1% |

-0.5% |

! |

|

CA |

13:30 |

GDP (MoM) |

Dec |

0.2% |

-0.2% |

!! |

|

CA |

13:30 |

GDP (YoY) |

Q4 |

-- |

1.49% |

!! |

|

CA |

13:30 |

GDP (QoQ) |

Q4 |

-- |

0.3% |

!! |

|

CA |

13:30 |

GDP Annualized (QoQ) |

Q4 |

1.9% |

1.0% |

!! |

|

US |

14:45 |

Chicago PMI |

Feb |

40.5 |

39.5 |

!! |

Source: Bloomberg