USD rebounds on Trump’s tariff threat as US tech sell-off adds to uncertainty

USD: Trade tariff risk flares up alongside US tech stock sell-off

The US dollar has rebounded strongly overnight after selling extended at the start of this week. It has helped to lift the dollar index back up to the 108.00-level after hitting a fresh low yesterday of 106.97. The main trigger for the turnaround for the US dollar overnight has been protectionist trade comments from President Trump. When asked about a report that incoming Treasury Secretary Scott Bessent favoured starting with a global tariff rate of 2.5%, President Trump stated that he didn’t think Bessent supported that and wouldn’t favour it himself. He wanted the tariff rate to be “much bigger” than 2.5%. He also pledged to put tariffs on specific sectors including semiconductors, pharmaceuticals, steel, copper and aluminium, and strongly suggested that he could impose tariffs on automobiles imported from Canada and Mexico. He has already threatened to implement 25% across-the board tariffs on Canada and Mexico from as soon as 1st February. The comments highlight that Trump remains a strong supporter of tariffs, and supports our view that initial relief amongst

market participants after tariffs weren’t implemented at the start of his second term is likely to prove short-lived. He told a gathering of House Republicans that “as tariffs on other countries go up, taxes on American workers and businesses will come down and massive numbers of jobs and factories will come home”. He repeated his call for Republicans to cut the corporate tax rate to 15% from the current rate of 21% for companies that make their goods in America.

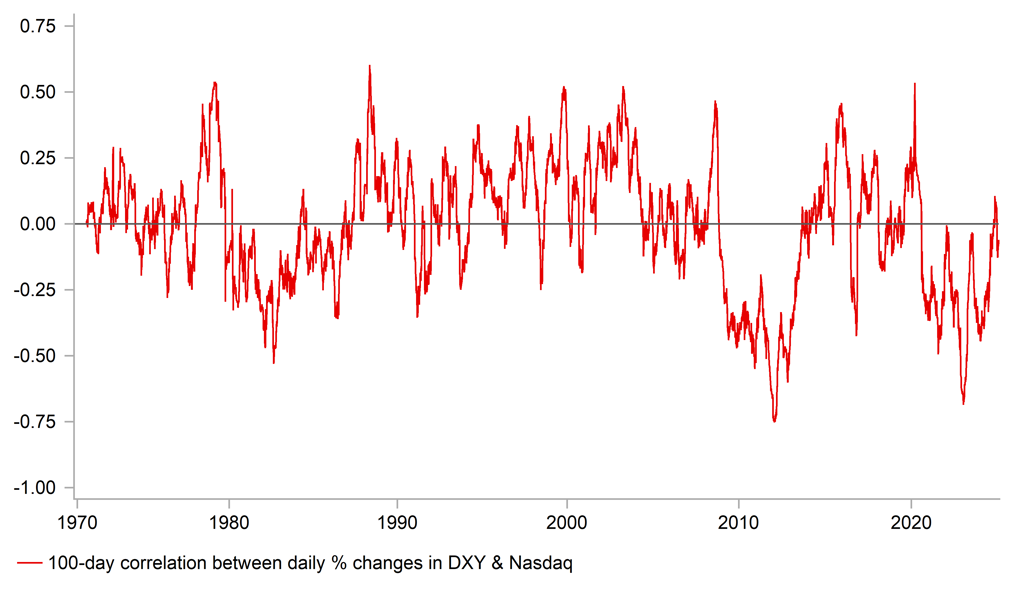

Trump’s comments have helped the US dollar to rebound after it came under some further selling pressure at the start of this week alongside the abrupt sell-off for US tech stocks yesterday. The Nasdaq composite index declined by just over 3% driven by weakness in the AI stocks. Nvidia fell even more sharply losing almost 17% of its value following reports that a new AI model developed by Chinese start up DeepSeek has cast doubt on future demand for chips produced by Nvidia. The new AI model is reportedly more efficient and requires less chips to run. Nvidia has called the new DeepSeek model an “excellent AI advancement” while adding that “inference requires significant numbers of Nvidia GPUs and high-performance networking” as it attempts to downplay initial fears over the negative impact on future demand. The heavy sell-off in US tech stocks yesterday triggered a flight to quality in financial markets that benefitted the yen and Swiss franc. USD/JPY hit a low of 153.72 but has since risen back up to the 156.00-level overnight fully reversing yesterday’s move. The US dollar initially weakened rather strengthening alongside the traditional safe haven currencies of the yen and Swiss franc. A deeper sell-off in US tech stocks poses downside risks to our outlook for a stronger US dollar (click here) especially if driven by a paring back of expectations for continued US exceptionalism. US tech stocks like long US dollar positions are a heavily crowded trade.

CORRELATION BETWEEN DAILY PERFORMANCE OF USD & NASDAQ

Source: Bloomberg, Macrobond & MUFG GMR

JPY: Political uncertainty could complicate timing of next BoJ rate hike

It has been a volatile start to the week for the yen. After strengthening sharply yesterday driven by a pick-up in safe haven demand triggered by the sharp sell-off in US tech stocks, it has since largely reversed those gains. At the start of this week USD/JPY has traded within a wider range between 153.72 and 156.25 with the pair currently trading close to levels prior to last week’s BoJ policy meeting at around the 156.00-level. As we highlighted in our latest FX Weekly (click here), we believe that the BoJ’s relatively hawkish policy update was supportive for a stronger yen. Governor Ueda signalled clearly that they plan to raise rates further if the outlook for Japan’s economy continues to evolve in line with their expectations. The upgrade to the inflation outlook provided justification for last week’s rate hike. In response our colleagues in Tokyo are now expecting the BoJ to hike rates again in July but also flagged that there is a risk of an even earlier hike at the start of May when the next Outlook for Economic Activity and Prices report is released. One potential complication for the timing of the BoJ’s next rate hike is the upcoming Upper House election in Japan that is scheduled to take place on 27th July and could make the BoJ wary of tightening policy in close proximity in June (17th) or July (31st). The Japanese rate market is pricing in only an outside chance of an earlier hike in May or June and around 15bps of hikes by July.

The more challenging domestic political situation in Japan was highlighted overnight by reports that Prime Minister Ishiba’s government risks rejection of its annual budget if it doesn’t concede more ground to the Democratic Party for the People who are pushing for a calling on tax-free income to be lifted to JPY1.78 million, and will not accept the ruling coalition government’s current proposal. Prime Minister Ishiba needs to secure passage of the annual budget to demonstrate he can run policy effectively with his minority coalition and shore up his leadership of the party ahead of the Upper House election. The ruling LDP and Komeito coalition government are also negotiating with the Japan Innovation Party who want to make school education free for all students.

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

09:00 |

ECB Bank Lending Survey |

-- |

-- |

-- |

! |

|

US |

13:30 |

Durable Goods Orders (MoM) |

Dec |

0.1% |

-1.2% |

!! |

|

US |

13:55 |

Redbook (YoY) |

-- |

-- |

4.5% |

! |

|

US |

14:00 |

House Price Index (YoY) |

Nov |

-- |

4.5% |

! |

|

US |

14:00 |

S&P/CS HPI Composite - 20 n.s.a. (YoY) |

Nov |

4.2% |

4.2% |

!! |

|

US |

15:00 |

CB Consumer Confidence |

Jan |

105.9 |

104.7 |

!!! |

|

US |

15:30 |

Atlanta Fed GDPNow |

Q4 |

-8.0% |

3.0% |

!! |

|

EC |

17:00 |

ECB President Lagarde Speaks |

-- |

-- |

-- |

!! |

|

JP |

23:50 |

Monetary Policy Meeting Minutes |

-- |

-- |

-- |

!! |

Source: Bloomberg