BoJ’s YCC adjustment triggers modest yen rebound

JPY: BoJ adjusts YCC to make more flexible but stresses not policy tightening

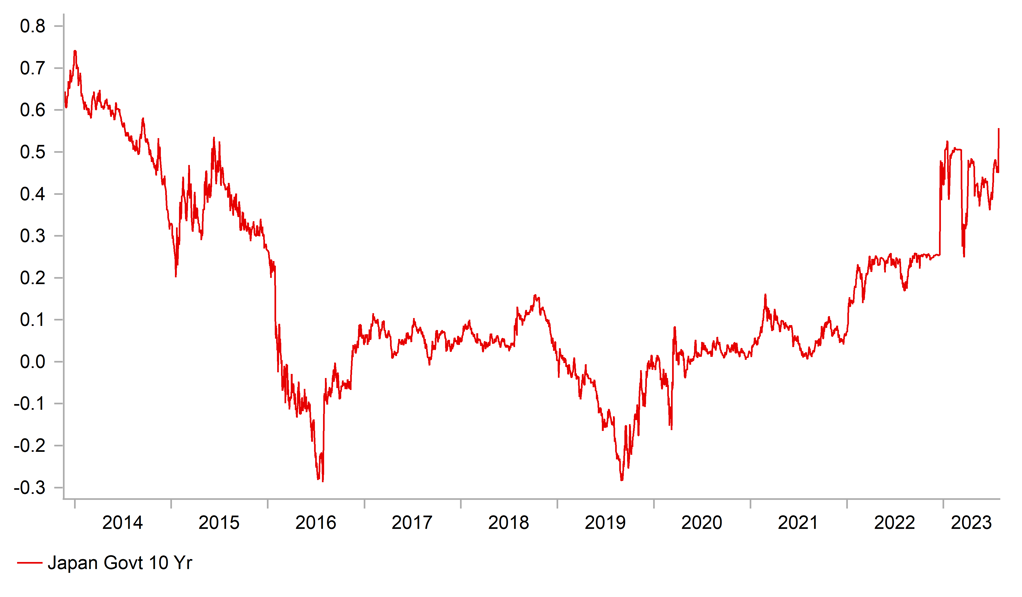

The yen has strengthened overnight following the BoJ’s latest policy meeting resulting in USD/JPY falling to an intra-day low 138.07 as it continues to move further below the peak from the end of last month at 145.07. The yen has strengthened in response to the BoJ’s decision to adjust YCC policy settings to make them more flexible. Previously the BoJ had set a target for the 10-year JGB yield at 0.0% and allowed it to fluctuate within a +/-0.5% band. It had “strictly” capped the 10-year JGB yield by fixed-rate purchase operations at 0.5%. Under the new regime with greater flexibility, the BoJ will now strictly cap 10-year JGB yields by fixed-rate purchase operations at 1.0%. It means that even though the BoJ will continue to allow 10-year JGB yields to fluctuate in the range of around plus and minus 0.5ppts from 0.0%, the upper and lower bounds of the range are now used as “references” and “not rigid limits” in its market operations. In response to the policy announcement, the 10-year JGB has adjusted higher and hit an intra-day high overnight of 0.58%. It is the highest rate for the 10-year JGB yield since September 2014. Under the new more flexible regime the BoJ will allow the 10-year JGB yield to rise as high as 1.0%.

While the BoJ took action to make YCC more flexible in line with our expectations, it also emphasized that the sustainable and stable achievement of the price stability target has not yet come into sight, and thus will patiently continue with monetary easing. That judgement was backed up by the updated inflation forecasts from the Outlook for Economic Activity and Prices report. The report revealed a significant upward revision to the Japanese style core inflation forecast (CPI less fresh food) for the current fiscal year by 0.7ppt to 2.5% but more importantly the inflation forecasts for the following year were left more or less unchanged at 1.9% for FY2024 and 1.6% for FY2025. The BoJ did though judge that risks to inflation outlook for the current and next fiscal years are skewed to the upside.

With the BoJ still not confident that inflation can be sustained at their 2.0% target, the BoJ is trying to differentiate today’s decision to make YCC more flexible from any future decisions to tighten monetary policy. Governor Ueda described today’s move as enhancing the sustainability of monetary easing rather than tightening. It sends a signal that the BoJ is not yet ready to tighten monetary policy through raising interest rates. The commitment to maintain negative rates should help to dampen speculation over rate hikes through the rest of this year helping to dampen upward pressure on yields and the yen. Overall the developments are line with our expectations and we maintain our forecast for further yen upside in the year ahead (click here).

BOJ ALLOWS 10YR JGB YIELD TO MOVE ABOVE 0.5% & UP TO 1.0%

Source: Bloomberg, Macrobond & MUFG GMR

EUR: ECB signals it is close to the end of their hiking cycle

The euro has continued to trade at weaker levels following yesterday’s ECB policy update. It has resulted in EUR/USD falling back to just below the 1.1000-level which is an important support level. The pair had been threatening to break out of the 1.0500 to 1.1000 trading range that has been in place for most of this year prior to the ECB’s policy update. We still believe current price action is a temporary setback for the pair rather than a sustained reversal lower given our expectation that further US dollar weakness will lift the pair back into a higher range between 1.1000 and 1.1500 through the rest of this year.

As we highlighted in our FX Focus report (click here), the main surprise yesterday was the clear signal from the ECB that it is close to the end of their hiking cycle. The updated policy statement signalled that the key ECB interest rates will be “set at” sufficiently restrictive levels for as long as necessary to achieve a timely return of inflation to the 2% medium-term target. It was a subtle but important change in wording from the July statement in which the ECB signalled that the key ECB interest rates will be “brought” to levels sufficiently restrictive to achieve a timely return of inflation to the 2% medium term target and will be kept at those levels for as long as necessary. The change in wording indicates that the ECB is more comfortable now that it has raised rates sufficiently to bring inflation back to target. While it did not explicitly signal that the end of the hiking has been reached, it does imply that any further hikes from here will be modest. The ECB’s policy focus will be more on keeping rates at higher levels going forward.

In the press conference President Lagarde provided a further indication that yesterday’s hike could be the last in the cycle. When asked if the ECB has more ground to cover, she replied that “at this point I wouldn’t say so”. That is conditional on the incoming data. The ECB still has an open mind on policy decisions in September and beyond. She indicated that the decision in September could be a hike or a pause. The main reason why the ECB could still hike in September is that the labour market in the euro-zone will likely remain tight and wage growth has likely accelerated further in Q2 adding to concerns over the risk of more persistent inflation. At the same time core inflation is expected to remain uncomfortably high.

Yet the updated policy communication has raised the bar for another hike. It is becoming harder to justify hiking rates further into restrictive territory when inflation has peaked, the euro-zone economy continues to remain weak and there is building evidence that tighter monetary policy is feeding through to the euro-zone economy. The release this week of the weak ECB bank lending survey showing loan demand from corporates falling to a record low and weak money supply growth will have given the ECB more confidence that rates are now sufficiently restrictive. In light of these developments, we have dropped our forecast for a final ECB hike in September.

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

GE |

13:00 |

German CPI (YoY) |

Jul |

6.2% |

6.4% |

!! |

|

US |

13:30 |

Employment Cost Index (QoQ) |

Q2 |

1.1% |

1.2% |

!! |

|

US |

13:30 |

PCE Price index (YoY) |

Jun |

3.1% |

3.8% |

!! |

|

CA |

13:30 |

GDP (MoM) |

-- |

0.3% |

0.0% |

!! |

|

US |

15:00 |

Michigan Consumer Sentiment |

Jul |

72.6 |

64.4 |

!! |

Source: Bloomberg