USD caution evident despite recent yield pick-up

USD: Positioning data highlights caution

As we enter the final week of May FX price action today highlights a lack of conviction over the scope of US dollar strength ahead. Short-term yields in the US have been drifting higher with the 2-year UST note yield only slightly below the 5.00% level. PMI data last week helped lift the dollar but there has been a lack of carry-through no doubt with an eye to the flow of incoming tier-one data we will get next week that will provide a more credible picture of the direction of the US economy.

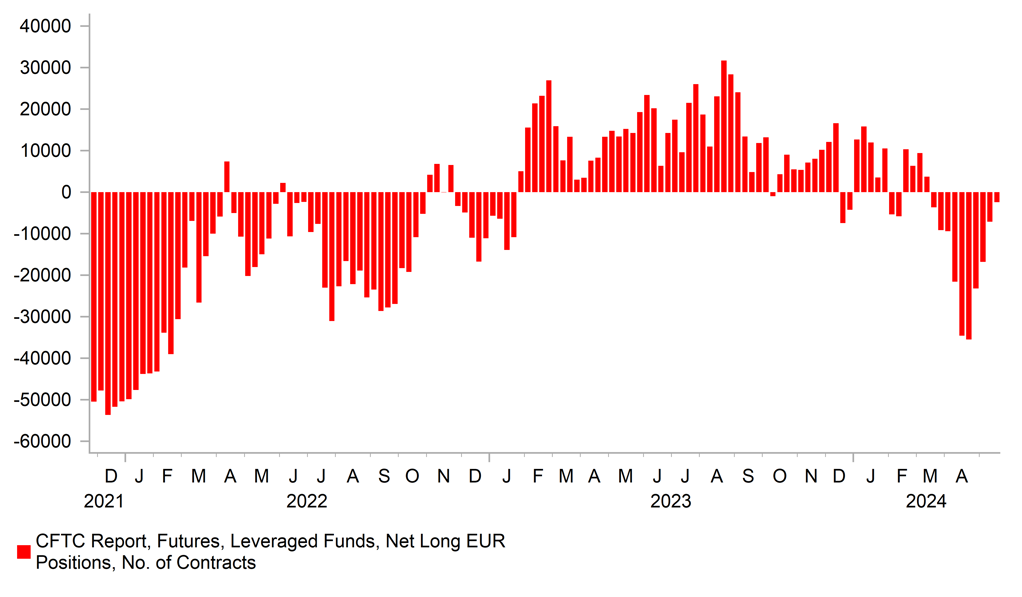

The IMM positioning data released on Friday covering the week to last Tuesday certainly highlight caution on one hand but also continued appetite for carry in a market where volatility remains exceptionally low. The change in Leveraged Funds’ positioning in the latest week highlighted close to across-the-board dollar selling. Leveraged Funds EUR buying resulted in the outstanding short position falling to the smallest level since the middle of March. The implied GBP buying was the largest in the latest week was the largest since the start of April. The data also confirmed implied NZD and AUD buying as well with the short AUD position now outstanding the smallest since mid-March. Where we did see implied US dollar buying in the positioning data was versus the Swiss franc and the Japanese yen. CHF selling was modest but the outstanding short CHF position is close to the high hit two weeks ago which was the largest since May 2022.

After three weeks of JPY short positions being reduced, Leveraged Funds returned to yen selling with the largest increase in JPY shorts since the week ending 16th April. Asset Managers were big yen sellers with the increased short the largest since the middle of March. Clearly, investors remain unconcerned over the prospect of the BoJ hiking rates again and/or believe the scale of carry on offer is worth the risk of a sudden rebound of the yen.

See below, but the risk of the BoJ becoming more active in hiking than expected is growing. Today we had very telling data from Japan – the Services PPI data revealed a YoY increase of 2.8% in April – when tax increase periods are excluded, it was the biggest increase since September 1991. Like elsewhere, service inflation is more linked to wage growth, the labour market and domestic inflation conditions, and we believe this will embolden the BoJ to hike rates more actively than expected.

LEVERAGED FUNDS HAVE BEEN CUTTING EUR SHORT POSITIONS

Source: CFTC; Macrobond

USD & JPY: Focus in R* in assessing policy outlooks

Last Friday Fed Governor Waller gave a speech at the Reykjavik Economic Conference on the level of R* which is certainly in focus now that the latest FOMC minutes highlighted an increasing debate within the Fed over whether the current level of the federal funds rate is restrictive enough given the lack of evidence of much of a slowdown in economic growth. Waller’s speech focused more on the longer-term R* derived through the 10-year UST bond yield. Factors in the past that supported demand for US Treasuries drove R* lower. Demographics via increased demand for safe assets as workers approached retirement age, regulatory obligations of banks to hold more bonds, the Asian Financial Crisis that sparked increased central bank reserves and US Treasury demand all helped lower longer-term yields. Waller’s speech implied that some of these factors could change and then honed in on the US fiscal outlook that is set to alter that demand-supply balance in favour of a higher R*.

Waller made clear after his speech that he didn’t see anything yet to persuade him against the view that the R* is still “relatively low”. Nonetheless, this increased debate on the implied neutral policy stance could have an increasing impact on lifting market yields if the economy fails to slow. It’s early days since the FOMC minutes highlighted the debate on the restrictiveness of the policy stance that means the markets might now be more sensitive to incoming data that is stronger than expected – like last week’s PMI data that doesn’t tend to move markets much.

Interestingly, yesterday BoJ Deputy Governor Uchida gave a speech at the 2024 BoJ-IMES Conference titled “Price Dynamics in Japan over the Past 25yrs” and spoke also on the R* and the asset bubble bursting and chronic weak demand creating mild deflation which became the “social norm” and hence wasn’t just an economic phenomenon.

Uchida in his speech placed a lot of emphasis on the importance of the labour market and the stability in the labour market helping contribute to wages stagnating as part of this social norm. Supply of labour in the last decade of the mild deflation era was helped by older workers staying in the labour market thus increasing labour participation. With this positive fading, wages are rising which may result in a shift from this social norm. Uchida confidently stated that “labour market conditions have changed structurally and irreversibly”. The BoJ is assessing whether this will lead to a break in the “social norm” but he suggested so which we would argue is consistent with our view that the markets continue to under-price the potential BoJ tightening that lies ahead.

BOJ POLICY RATE OUT TO 3YRS STILL COULD BO TOO LOW IF LABOUR MARKET CHANGE BREAKS JAPAN “SOCIAL NORM” OF DEFLATION

Source: Macrobond & Bloomberg

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

UK |

11:00 |

CBI Distributive Trades Survey |

May |

-24 |

-44 |

! |

|

CA |

13:30 |

IPPI (MoM) |

Apr |

0.8% |

0.8% |

! |

|

CA |

13:30 |

IPPI (YoY) |

Apr |

-- |

-0.5% |

! |

|

CA |

13:30 |

RMPI (YoY) |

Apr |

-- |

0.8% |

! |

|

CA |

13:30 |

RMPI (MoM) |

Apr |

3.1% |

4.7% |

!! |

|

US |

14:00 |

House Price Index (YoY) |

Mar |

-- |

7.0% |

! |

|

US |

14:00 |

House Price Index (MoM) |

Mar |

0.5% |

1.2% |

! |

|

US |

14:00 |

House Price Index |

Mar |

-- |

423.0 |

! |

|

US |

14:00 |

S&P/CS HPI Composite - 20 (MoM) |

Mar |

-- |

0.6% |

! |

|

US |

14:00 |

S&P/CS HPI Composite - 20 nsa(MoM) |

Mar |

-- |

0.9% |

!! |

|

US |

14:00 |

S&P/CS HPI Composite - 20 (YoY) |

Mar |

7.3% |

7.3% |

!! |

|

US |

14:55 |

FOMC Member Kashkari Speaks |

-- |

-- |

-- |

!! |

|

US |

15:00 |

CB Consumer Confidence |

May |

96.0 |

97.0 |

!!! |

|

US |

15:30 |

Dallas Fed Mfg Business Index |

May |

-- |

-14.5 |

! |

|

US |

16:30 |

2-Year Note Auction |

-- |

-- |

4.898% |

!! |

|

US |

18:00 |

5-Year Note Auction |

-- |

-- |

4.659% |

!! |

|

US |

18:05 |

Fed Governor Cook Speaks |

-- |

-- |

-- |

!! |

|

US |

18:05 |

FOMC Member Daly Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg