Ishiba election gamble backfires prompting further yen selling

JPY: LDP loses majority, fuelling political uncertainty

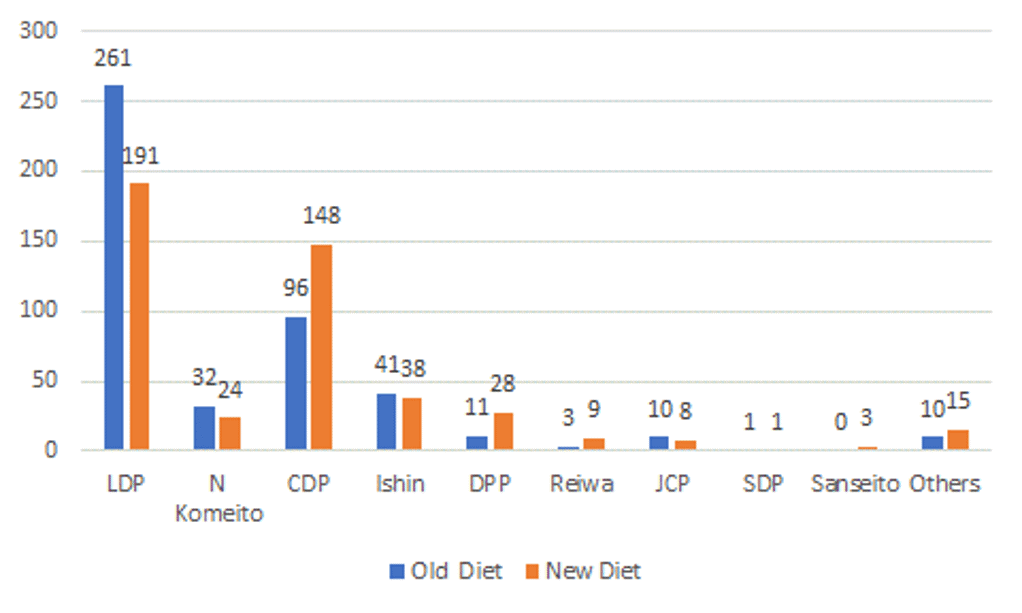

Yen selling is currently picking up as London traders respond to the news that the LDP-led coalition has lost its majority in the general election yesterday that opens up a period of political uncertainty. PM Ishiba’s gamble to immediately hold a general election in the face of voter anger over the LDP funding scandal now looks foolish and his position as PM is clearly under threat. The LDP lost a huge 70 seats and in the new Diet will have 191 seats. Its long-standing coalition partner New Komeito lost 8 seats to hold 24 seats. That means the LDP coalition won 215 seats, well short of the 233 seats required to hold an overall majority. The remainder of the Diet, comprising of seven other political parties and others not affiliated to a party, hold 250 seats. The main opposition party – the Constitutional Democratic Party of Japan (CDP) won 52 seats to hold 148 seats. Nippon Ishin will be the next largest party with 38 seats, although it lost 3 seats. The Democratic Party for the People (DPP) will be the next largest party, winning 17 seats to hold 28 seats in the new Diet. Non-affiliated ‘others’ is the next largest block, holding 15 seats, for a gain of 5 seats.

So where to from here for the LDP and PM Ishiba? Firstly, PM Ishiba’s position while fragile will depend on his ability to reach an agreement to govern. CDP leader Yoshihiko Noda has stated he will try and form a government given his party is the largest outside of the LDP-led coalition but in reality the LDP-New Komeito coalition remains in the strongest position to reach a deal given it is only 18 seats short of the required majority total.

The DPP looks on paper the best prospect of the LDP coalition reaching a deal for a stable coalition government. DPP leader Yuichiro Tamaki denied speculation of a deal with the LDP but did then add that the party would consider working with others in order to achieve the policy goals of DPP. The DPP roots, like the CDP, are from a split in the previous main opposition party, the Democratic Party of Japan with the DPP deemed as more conservative and potentially therefore more aligned with the LDP. A key policy for the DPP is to expand non-taxable income and is therefore aligned with PM Ishiba’s plans to boost the economy with tax give-aways to protect households from the cost of living crisis. Still, Ishiba more generally has been ideologically more supportive of fiscal consolidation and does again point to Ishiba’s position being under threat.

‘All things equal’ it could be argued that this sudden new political uncertainty could mean BoJ policy could be on hold for longer. But all things aren’t equal and the renewed yen selling could indeed encourage the BoJ to act sooner. An alignment with the DPP, if that materialises, could mean bigger fiscal stimulus plans ahead that again could encourage the BoJ to act sooner. Over the short-term, the movement of the yen will be important and this election coming ahead of the key US employment report on Friday, the US presidential election next Tuesday and the FOMC next Thursday will likely take precedent in shaping BoJ policy expectations. A move back toward the highs of earlier this year above the 160-level would mean a hike by the BoJ in December is certainly in play.

BIG LOSSES FOR THE LDP BUT STILL THE LARGEST SINGLE PARTY

Source: Bloomberg

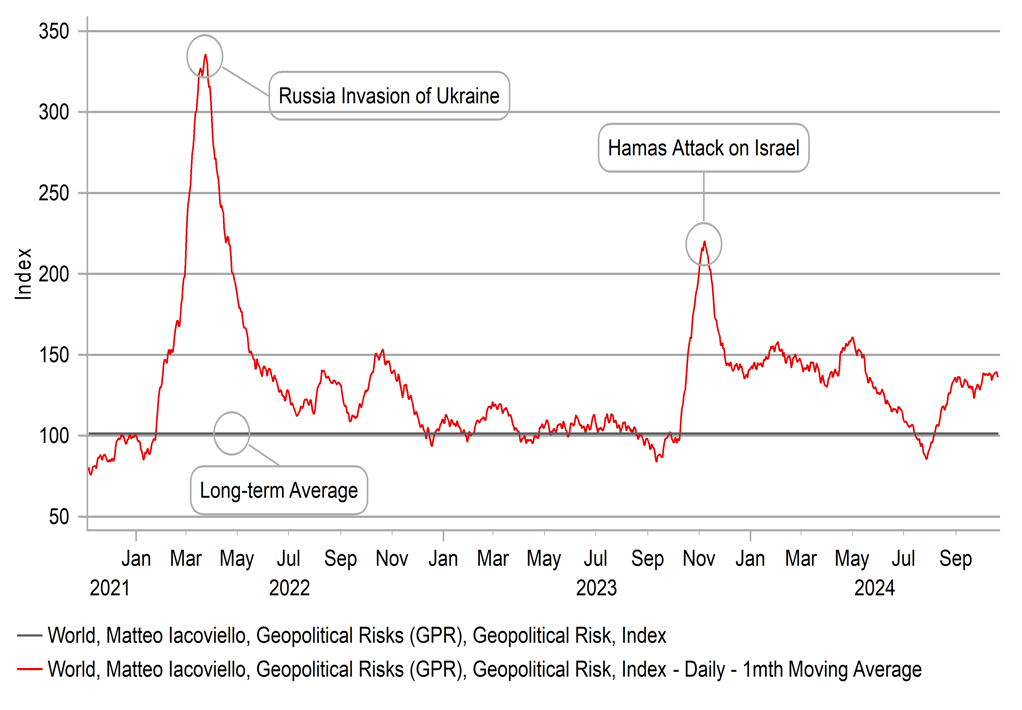

USD: Israel’s retaliatory strikes avoid nuclear & energy production facilities

The other main development over the weekend has been the decision by Israel to launch retaliatory strikes against Iran. According to media reports, Israel hit Iran with three waves of attack focusing on “missile manufacturing facilities” that it claimed were used to produce the missiles that Iran fired at Israel on 1st October. It also reported struck “surface-to-air missile arrays and additional Iranian aerial capabilities, that were intended to restrict Israel’s aerial freedom operation in Iran according to an DF announcement. The Israeli military has since announced that the retaliatory strike has been completed and the mission was fulfilled. The precise nature of the retaliatory strikes which avoided Iran’s nuclear facilities and energy production sites should help to limit the impact on financial markets at the start of this week. Crude oil prices have opened this week a lot lower with Brent crude currently down 4.0%, hitting a level not seen since Iran’s attack on Israel on 1st October. President Biden had warned Israel that it would not support a strike on Iran’s nuclear sites and stated that Israel should consider alternatives to attacking Iran’s oil fields.

In response to the retaliatory strikes, Iran has claimed that the strikes caused only “limited” damage, and that the attack has been successfully intercepted and countered by their integrated air defence system according to their state-run news agency IRNA. The National Air Defence Headquarters went on to say that the Israeli strikes were a “provocative attack” but made no mention of a possible response. Market participants will now be watching closely to see whether the conflict escalates further should Iran choose to respond by launching tit-for-tat strikes of its own. At the current juncture, the nature of the retaliatory strikes provides some encouragement that tensions in the Middle East are less likely to intensify in the near-term. At the margin it will help to ease upside risks for the USD although is not sufficient to reverse the recent strong upward trend that has been encouraged by the building expectations for a Trump victory in the US election and Red Sweep. Please see our latest FX Weekly for more details (click here).

GEOPOLITICAL RISKS REMAIN ELEVATED

Source: Macrobond

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

CA |

09:30 |

BoC Gov Macklem Speaks |

-- |

-- |

-- |

!!! |

|

UK |

11:00 |

CBI Distributive Trades Survey |

Oct |

-9 |

4 |

! |

|

CA |

12:30 |

Wholesale Sales (MoM) |

Sep |

-- |

-0.6% |

!! |

|

US |

14:30 |

Dallas Fed Mfg Business Index |

Oct |

-- |

-9.0 |

! |

|

CA |

17:30 |

BoC Gov Macklem Speaks |

-- |

-- |

-- |

!! |

|

EC |

19:45 |

ECB's De Guindos Speaks |

-- |

-- |

-- |

!! |

|

JP |

23:30 |

Jobs/applications ratio |

Sep |

1.23 |

1.23 |

! |

|

JP |

23:30 |

Unemployment Rate |

Sep |

2.5% |

2.5% |

! |

Source: Bloomberg