USD on track to close lower in 2023

G10 FX: 2023 has proven to be a year of reversals for financial markets

The US dollar staged a modest rebound yesterday potentially supported by year end related flows, although it still leaves the dollar index close to year to date lows. The dollar index has weakened sharply since the start of November when it has declined by around -5.5%. As a result, it has given back all of the year to date gains recorded earlier his year and is on track to record its first calendar year decline since the first year of the COVID pandemic in 2020. The main trigger for the recent US dollar sell-off has been intensified market speculation over earlier and deeper rate cuts from the Fed next year. The US rate market is currently fully pricing in the first 25bps rate cut in March of next year, and a total of around 156bps of cuts by the end of next year. As a result of the recent dovish repricing, US yields are also on track to close lower in 2023. The 2-year US Treasury bond yield is currently trading at 4.27% compared to the close at the end of last year at 4.43% while the 10-year US Treasury bond yield is closer to unchanged at 3.84%. It marks a sharp turnaround from just a couple of months ago when yields were surging higher on the back of concerns over rising US bond supply, robust US growth and fears that the Fed would have to raise rates closer to 6.00%. The emergence of more convincing evidence that a marked slowdown in US inflation is underway has been the main trigger for the recent sharp correction lower for US yields and the US dollar with the Fed indicating at their latest policy meeting that they are starting to consider cutting rates next year although there has been some pushback against market expectations for the first rate cut to be delivered as early as in March.

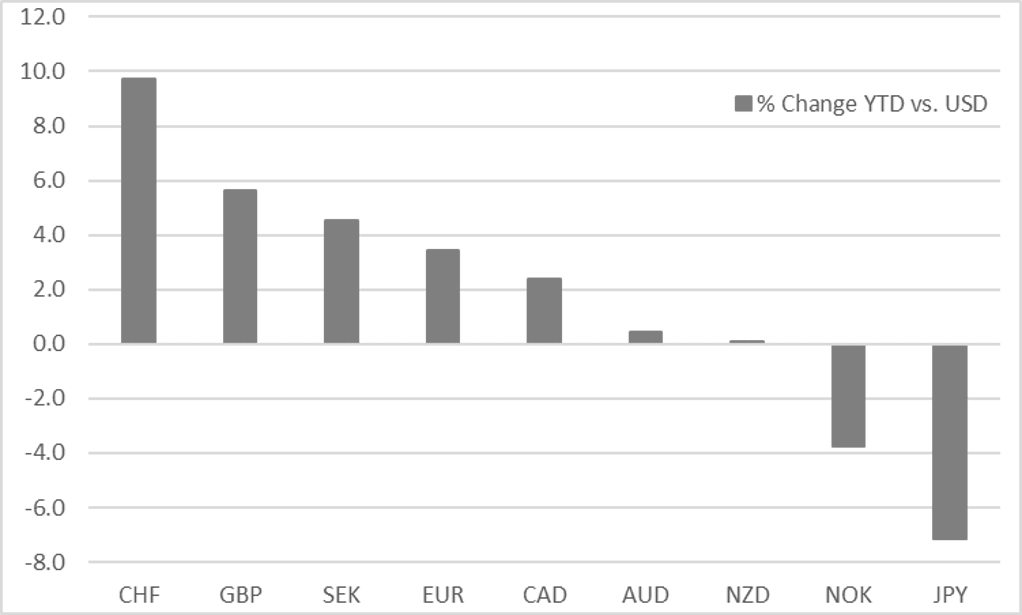

While the US dollar is currently on track to be the third worst performing G10 currency in 2023, the top performing currencies have all be European currencies which have on the whole recovered lost ground from last year when they were hit hard by the negative shock from the Ukraine conflict which has since eased as energy prices have fallen back. The price of Brent is currently trading at USD77.51/barrel compared to last year’s close of USD85.91/barrel and last year’s high at the peak of the Ukraine shock of USD139.13/barrel. It has been a similar story for natural gas prices in Europe. The Netherlands TTF day ahead gas price is currently around -56% lower than at the end of last year and around -90% lower than at the end of last year. It has helped European currencies to move back closer to pre-Ukraine conflict levels from in early 2022. At that time EUR/USD was trading closer to 1.1300, cable was trading close to 1.3500 and USD/SEK closer to 9.4000. After this year’s gains the euro, pound and Swedish krona are trading closer to those levels but have not fully recovered the heavy losses sustained in 2022.

The one European currency that has continued to outperform this year has been the Swiss franc. It is on track to close at its highest level against both the euro and US dollar since early 2015 when it briefly surged higher after the SNB removed the 1.2000 floor that had been in place for EUR/CHF. The Swiss franc has been a consistent stand out performer since the COVID shock hit. It has strengthened sharply against both the euro and US dollar since the start of 2020 by +16% and +15% respectively. The Swiss franc initially benefitted from it role as a safe haven currency when COVID shock first hit, and then from fears over higher inflation. More recently, the Swiss franc has continued to strengthen even as inflation fears have eased. Heightened recession risks in Europe and intensifying speculation over earlier and deeper ECB and Fed rate cuts have continued to provide support for the franc.

In contrast, the yen, Norwegian krone, and to a lesser extent the Australian and New Zealand dollars have continued to underperform this year. The yen is still on track to close around -7% lower against the US dollar in 2023 even after the recent rebound from deeply undervalued levels. The BoJ’s reluctance to tighten policy while other major central banks continued to hike rates through the first half of this year contributed to yen weakness. The yen’s use as a funding currency has also been supported by more stable financial market conditions in 2023. It has seen financial market volatility drop back from elevated levels recorded last year after the negative shock from the Ukraine conflict hit markets. JPMorgan’s Global FX volatility measure has fallen from a peak of 13.23 in September of last year to the current reading of 8.13 and has returned back to levels that were in place prior to the Ukraine conflict in early 2022. It has created a more favourable external backdrop for FX carry trades. There has only been one brief period earlier this year where FX volatility jumped higher back in March when fears intensified over the health of US regional banks and Credit Suisse was then taken over by UBS to help contain negative spill-overs to European banks.

The Australian and New Zealand dollars have failed to fully benefit from the improvement in global investor risk sentiment this year. Global equity markets have staged a strong rebound in 2023 after bottoming in autumn of last year. MSCI’s ACWI global equity index is on track to close just over 20% higher in 2023, and has largely reversed most of the losses sustained last year. It remains almost 4% lower than at the end of 2021. The Australian and New Zealand dollars have been held back this year by ongoing concerns over the health of China’s economy. The economic rebound after COVID restrictions were removed late last year has proved disappointing. Weak global growth has provided a weak backdrop for commodities. Bloomberg’s commodity price index is on track to close down by around -12%, and recently hit its lowest levels since 2021 providing a headwind for commodity currencies.

G10 FX PERFORMANCE IN 2023

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

SZ |

08:00 |

KOF Leading Indicators |

Dec |

97.0 |

96.7 |

!! |

|

SZ |

08:00 |

Official Reserves Assets |

Nov |

-- |

731.2B |

! |

|

NO |

09:00 |

Central Bank Currency Purchase |

Jan |

-- |

1,400.0M |

! |

|

GE |

12:10 |

German Buba Balz Speaks |

-- |

-- |

-- |

!! |

|

US |

14:45 |

Chicago PMI |

Dec |

51.0 |

55.8 |

!! |

Source: Bloomberg