USD/JPY drops back below 150.00 after BoJ “exit” comments

JPY: BoJ continues to prepare markets for an exit from loose policy settings

The yen has been the best performing G10 currency overnight resulting in USD/JPY falling back below the 150.00-level. The main driver for the yen’s rally overnight were further hawkish comments from the BoJ who are continuing to prepare market participants for an imminent end to their negative rate policy. BoJ board member Hajime Takata stated overnight that the BoJ’s price target is finally coming into sight. As a result, he stated that it is ok to shift gear to provide less monetary easing. He emphasized that the BoJ needs to a mull a nimble and flexible response for an exit from the current loose monetary policy settings. One of the reasons cited for giving him more confidence in the BoJ achieving their 2.0% inflation target was that he is hearing more views that wage growth will be better than in 2023 although he wants to confirm the faster pace of wage growth and investment. The comments support our outlook for the BoJ to begin raising rates as soon as at the next policy meeting on 19th March. He did caution though that he wouldn’t plan to keep raising rates over and over, and added that there are various policy options to tighten policy. The Japanese rate market is currently expecting the BoJ to begin raising rates in April and to deliver a second follow up rate hike later this year. We continue to believe that the BoJ’s imminent policy shift away from loose policy settings will help to provide more support for the deeply undervalued yen.

However, it will also require the Fed to begin lowering rates to narrow the policy divergence with the BoJ. As we have seen at the start of this year, building investor optimism over a softer/no landing for the US economy has encouraged US rate market participants to scale back expectations for Fed rate cuts this year which has helped to lift USD/JPY back towards last year’s highs. It leaves market expectations more closely aligned with the Fed’s own plans to deliver three rate cuts this year. We still believe that the Fed will end up cutting rates more than they are currently planning but the recent run of stronger US economic activity and inflation data at the start of this year is currently challenging our view. Our outlook for USD/JPY to fall back below the 140.00-level later this year is built on the assumption that growth in the US will moderate in response to higher rates and inflation will continue to slow back towards the Fed’s goal. The release today of the latest US PCE deflator report for January is expected to confirm that inflation pressures picked up at the start of this year following a marked slowdown in the second half of last year when the core deflator slowed to an annualized rate of 1.9%. The Bloomberg consensus forecast is expecting the core PCE deflator to increase by a faster rate of 0.4%M/M in January. It highlights that the road to achieving the Fed’s goal will be bumpy but we remain confident that the direction of travel is lower.

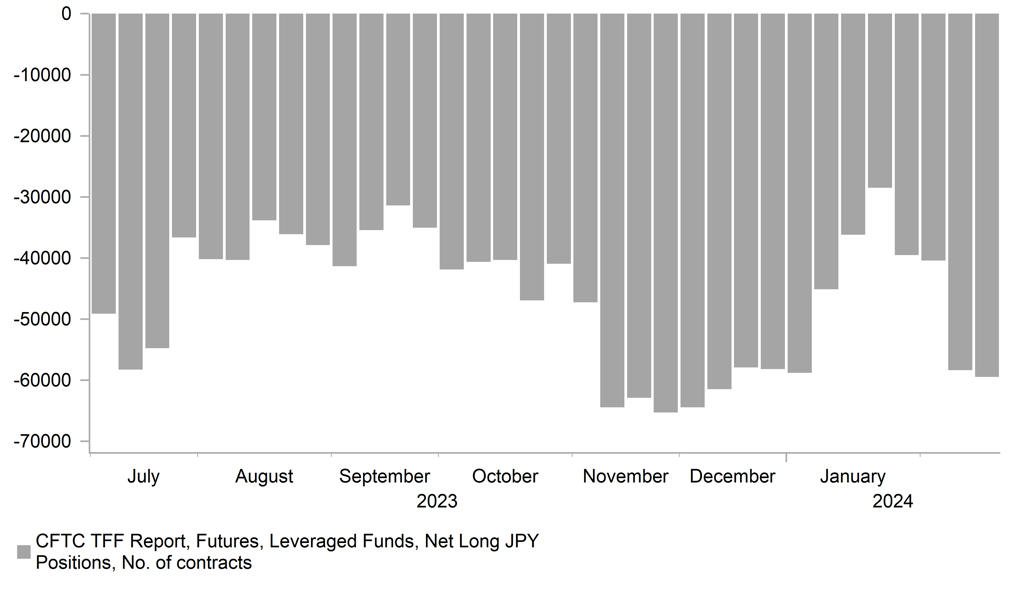

SHORT JPY POSITIONS HAVE BEEN REBUILT THIS MONTH

Source: Bloomberg, Macrobond & MUFG GMR

GBP: UK budget next key event for pound after strong start to the year

The pound has been consolidating at higher levels this month after strengthening in January. We continue to hold a short EUR/GBP trade recommendation which is befitting from the higher yields on offer in the UK but has struggled to break below support at the 0.8500-level this month. The next key event for the pound in the week ahead will be the government’s upcoming budget announcement on 6th March. The pre-election budget is expected to provide fiscal giveaways that could provide fresh impetus for a stronger pound. In their preview for the upcoming budget, economists at the Resolution Foundation noted that the OBR may mark up their outlook for real GDP to reflect forecasts for stronger population growth. The bigger population forecasts and the drop in government borrowing costs since last year’s Autumn Statement are expected to provide around GBP10 billion more of fiscal headroom. Government borrowing so far this fiscal year to December has also been running around GBP9 billion below expectations in the Autumn Statement. As a result, the Resolution Foundation estimates that the government has just over GBP20 billion of fiscal headroom for next week’s Budget which they highlight is “somewhat less than the average headroom against fiscal rules since 2010 (GBP27 billion). The government has strongly signalled that they intend to use the fiscal headroom to deliver tax cuts.

While the size of the potential fiscal giveaway is unlikely to be sufficient to significantly alter the performance of the UK economy, it could discourage the BoE from delivering an earlier rate cut in May or June. It is one of the reasons why the UK rate is more confident that the BoE will lag behind the Fed and ECB when cutting rates this year, and has been contributing to the pound’s outperformance at the start of this year alongside favourable conditions for carry trades/improving risk sentiment. The timing of the first BoE rate hike is currently not expected until August compared to in June for both the Fed and ECB. BoE Deputy Governor Dave Ramsden also drew attention earlier this week to the Bank of England’s plans for continuing to shrink their balance sheet. The BoE is currently committed to scaling back Gilt holdings by GBP100 billion a year since October. The comments from Deputy Governor Dave Ramsden captured market attention after he stated that the BoE could continue running down QE holding even after hitting “preferred minimum range of reserves” which is estimated to sit between GBP335 billion and GBP495 billion. Unlike the Fed, he noted that the BoE could unwind the APF fully and the level of the PMRR should not affect this judgement. The BoE would then use different liquidity instruments to meet commercial banks’ financial stability demand for reserves. While the comments do not immediately impact BoE policy action, it does suggest that there is scope for divergence further down the road between the BoE and other major central banks in how they continue to implement QT.

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

GE |

08:55 |

German Unemployment Change |

Feb |

6K |

-2K |

!! |

|

GE |

09:00 |

German Buba President Nagel Speaks |

-- |

-- |

-- |

!! |

|

US |

11:30 |

Corporate Profits (QoQ) |

Q4 |

-- |

3.7% |

! |

|

GE |

13:00 |

German CPI (YoY) |

Feb |

2.6% |

2.9% |

!! |

|

US |

13:30 |

Core PCE Price Index (MoM) |

Jan |

0.4% |

0.2% |

!!! |

|

US |

13:30 |

Initial Jobless Claims |

-- |

209K |

201K |

!!! |

|

CA |

13:30 |

GDP (QoQ) |

Q4 |

-- |

-0.3% |

!! |

|

US |

15:00 |

Pending Home Sales Index |

Jan |

-- |

77.3 |

! |

|

US |

15:50 |

FOMC Member Bostic Speaks |

-- |

-- |

-- |

!! |

|

US |

16:00 |

Fed Goolsbee Speaks |

-- |

-- |

-- |

! |

|

US |

18:15 |

FOMC Member Mester Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg