An important week of major central bank policy updates

JPY: Will yen strength be sustained after BoJ policy update?

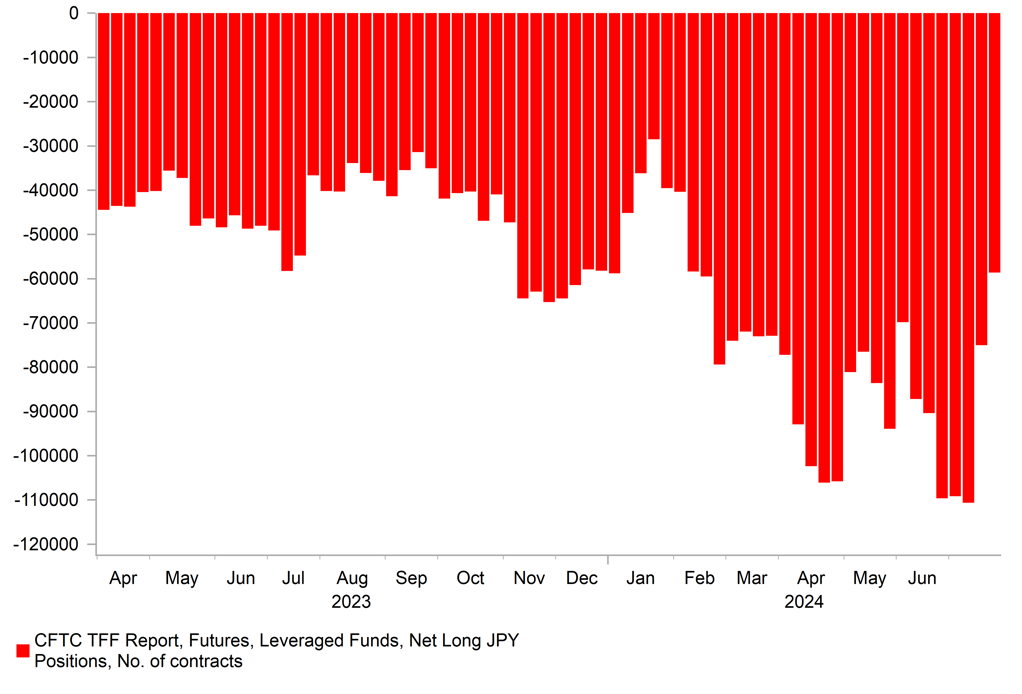

The major FX rates have remained relatively stable at the start of this week ahead of the key event risks of the BoJ’s and Fed’s last policy meetings on Wednesday followed by the BoE’s latest policy meeting on Thursday. The yen has continued to trade at stronger levels ahead of the BoJ meeting after recording its third consecutive week of gains against the US dollar when it hit a low last week at 151.94. The release of the latest IMM report revealed that Leveraged Funds have sharply cut back short yen positioning in the previous two weeks by almost half. In the week ending the 9th July short yen positions totalled 110,635 contracts but those have been cut to 58,596 contracts in the week ending 23rd July. It is the smallest short yen positions held by Leveraged Funds since the week ending 13th February, and those positions were likely cut back further last week. The yen’s upward momentum was reinforced last week by the continued liquidation of FX carry trades. The JPY has outperformed last week alongside the other low yielding funding currency of the CHF while the higher yielding emerging currencies of the MXN, HUF and BRL underperformed.

Other Asian currencies such as the KRW, CNY, MYR and THB have all benefitted alongside the JPY from position liquidation highlighting that market participants were short Asian currencies. Sentiment towards Asian currencies has deteriorated recently in response to slowing growth momentum in China. The increasing likelihood of former President Trump winning the election in November and imposing higher tariffs on China have reinforced those growth concerns. President Biden’s decision to not seek re-election and his likely placement by Kamala Harris as the Democrat nominee has encouraged expectations that the election will be more closely contested but Trump still appears to be in a strong position. According to PredictIt, the probability of Trump winning the election has fallen back to around 53% from a recent high of 69%. While the unwinding of short positioning has helped lift the yen and other Asian currencies, the move is unlikely to be sustained unless backed up by a change in fundamentals. We continue to believe that slowing growth momentum in China, the PBoC’s decision to lower rates (click here) further last week, and the heightened risk of higher tariffs being imposed on China will remain headwinds for the CNY and other Asian currencies in the 2H of this year.

The main event risk for USD/JPY this week is the BoJ’s upcoming policy meeting on Wednesday. As outlined previously, we have been expecting the BoJ to hike rates by a further 15bps alongside announcing detailed plans to slowdown the pace of JGB purchases. However, our colleagues in Tokyo have become less confident over their rate hike call given the lack of guidance from BoJ officials. Bloomberg reported on Friday that it has been 38 days since Governor Ueda last spoke about monetary policy which is an unusually long time. The last time Governor Ueda spoke publicly was on 18th June, and he indicated in parliament that there’s a chance of a rate hike if backed up by the incoming economic data. We believe that recent inflation developments including stronger wage growth should provide justification to raise rates further this week. However, it has been reported that some BoJ members could favour a delay given recent weakness in consumer spending. If the BoJ disappoints market expectations for a rate hike this week, the yen could quickly give back some of the strong gains recorded over recent weeks resulting in USD/JPY rising back above 155.00-level. If the BoJ does not hike this week, the timing of any future hike could then be complicated by the timing of the LDP leadership election in September and US election in November. As a result, the BoJ may not be in a position to hike again until December if they skip this week. In contrast, we are more confident that the BoJ will announce plans for a “sizeable” slowdown the pace of JGB purchases from around JPY6 trillion/month to around JPY2 trillion/month over the next two years. It is consistent with purchases slowing in quarterly steps of around JPY500 billion. A development that should continue to place upward pressure on Japanese yields further out the curve even if the BoJ delays hiking rates next week. Please see our latest FX Weekly for more details (click here).

PARING BACK OF SPECULATIVE JPY SHORTS

Source: Bloomberg, Macrobond & MUFG GMR

GBP: Government laying ground for tax hikes ahead of BoE policy meeting

The pound has given back some of its recent gains over the past week as it has been caught up in the broad-based positioning unwind. It has resulted in cable falling back towards support from the 200-day moving average at around 1.2850 after failing to sustain a break above the 1.3000-level earlier this month. The release of the latest IMM report revealed that Leveraged Funds had continued to sharply build up long pound positions prior to last week. Long pound positions increased sharply for the second consecutive week and totalled 83,168 contracts in the week ending 23rd July. It was the longest pound position since the end of July 2014 which leaves it more vulnerable to a position squeeze in the near-term. Those long pound positions have been encouraged by the improving fundamentals for the UK economy. The UK economy’s cyclical momentum has been much stronger than expected in the 1H of this year, and the large majority for the Labour government should provide greater political stability which should be more supportive for the growth outlook. The new government is expected to announce the results today of public spending audit. It has been reported in recent days that the audit will indicate that there is an additional spending gap of GBP20 billion that the government has to fill. It will set the stage for the government to announce tax hikes in the autumn budget as the government seeks to put in place unfavourable policy steps at the start of their term in power. The government has pledged not to raise income tax, national insurance or VAT which limits their room for manoeuvre.

The higher yields on offer in the UK than in most other G10 economies remain attractive for the pound. We are sticking to our call for the BoE to begin lowering rates this week but acknowledge that it is a close call. Our call for a 25bps cut mainly rests on the guidance from the June meeting in which it was revealed that some MPC members’ decision to leave rates on hold was “finely balanced”. It would only take three MPC members to change their mind and vote for a rate cut this week. The most likely candidates to change their mind are Governor Bailey, Deputy Governor Breeden, and Chief Economist Pill. New Deputy Governor Lombardelli will also be voting for the first time. However, in a recent speech Chief Economist Pill indicated that he was unlikely to vote for a cut as soon as this week. The UK rate market is currently pricing in around 14bps of cuts for this week. We judge that the balance of risks to be skewed to the upside for the GBP. If the BoE disappoints and leaves rates on hold then the GBP will strengthen further. On the other hand, if the BoE cuts rates, the GBP will initially weaken but could quickly rebound once the dust settles supported by cautious guidance from the BoE over further easing. We are expecting the BoE to deliver similar guidance to the ECB by indicating policy is not on a pre-determined path and they’ll continue to monitor inflation persistence risks. The upshot being that rates in the UK are still likely to remain higher than in most other G10 economies.

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

SW |

07:00 |

GDP Indicator SA QoQ |

2Q |

- |

-0.1% |

!! |

|

SW |

07:00 |

Retail Sales MoM |

Jun |

-- |

0.2% |

!! |

|

UK |

09:30 |

M4 Money Supply YoY |

Jun |

-- |

0.3% |

!! |

|

UK |

11:00 |

CBI Total Dist. Reported Sales |

Jul |

-- |

-9.0 |

!! |

|

US |

15:30 |

Dallas Fed Manf. Activity |

Jul |

-15.5 |

-15.1 |

!! |

Source: Bloomberg