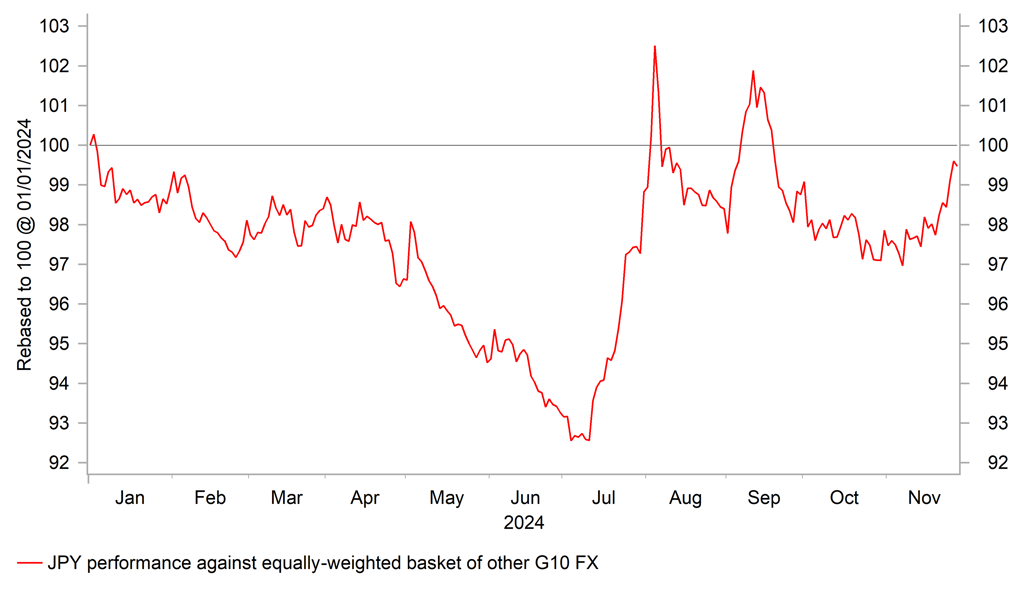

JPY finishing the week strongly as BoJ rate hike speculation builds

JPY: BoJ rate hike expectations boosted by Tokyo CPI report

The yen has continued to strengthen sharply overnight resulting in USD/JPY falling back below the 150.00-level as it moves further below the high of 156.75 set on 15th November. The yen has been by far the best performing G10 currency this week and is currently up by just over 3% against the US dollar. While the broad-based correction lower for the US dollar this week has helped to lower USD/JPY, the yen’s outperformance has been driven by building expectations for the BoJ to hike rates again as soon as next month. According to Bloomberg, there are around 15bps of hikes priced in by the BoJ’s next policy meeting on 19th December and 20bps by the following policy meeting on 24th January. Market expectations for another BoJ rate hike as soon as next month have been encouraged overnight by the release of the latest Tokyo CPI report for November. The report revealed that headline inflation in Tokyo picked up more than expected to an annual rate of 2.6% in November from 1.8% in October. The core measures of inflation also picked up but more modestly. The ex-fresh food CPI measured increased by 0.4 point to 2.2% in November and the ex-fresh food and energy measure by 0.1 point to 1.9%. The break down revealed that stronger core inflation reflected a rise in utility prices after energy subsidies were rolled back.

There was further evidence as well of stronger service sector inflation as companies continue to pass on higher wage costs. The headline service-price measure of inflation increased by 0.1 point to 0.9%. Overall, the report should give the BoJ more confidence that Japan’s economy and inflation are moving in line with their outlook which they have reiterated on a number of occasions would be sufficient to support further rate hikes. While it is not a done deal that the BoJ will hike rates next month, we now believe the recent run of stronger data will be sufficient to encourage the BoJ to hike rates and have brought forward our forecast for the next hike from January. An earlier rate hike from the BoJ is already helping to provide more support for the yen heading into year end. On 21st November, Governor Ueda stated that it’s not possible to predict the outcome of the December policy meeting and implied that the decision would be dependent on a lot more data and information available by then.

At the same time, the move lower in USD/JPY has been helped by the broad-based correction lower for the US dollar this week. The dollar index is on course to record its first weekly decline since the US election. It has corrected lower this week after failing to sustain a break above resistance at the 107.00-level. Similar price action has been evident in the US bond market where the 10-year US Treasury yield has fallen back to pre-election levels. Trump trades including the stronger US dollar and higher US yields have clearly lost upward momentum this week even as President-elect Trump threatened to implement higher tariffs on Canada, China and Mexico. We see no major change in fundamentals for the US dollar with the correction lower expected to be temporary after strong gains in the weeks following the US election. The main risk of a deeper pullback in the near-term is posed by next week’s nonfarm payrolls report for November. If the report does not reveal that employment bounced back strongly following storm and strike related weakness in October, then the US rate market will be less confident that the Fed will deliver only three more 25bps cuts by the end of next year.

JPY IS REBOUNDING HEADING INTO YEAR END

Source: Bloomberg, Macrobond & MUFG GMR

EUR: ECB rate cut expectations & French budget drama in focus

The euro has benefitted as well from the broad-based correction lower for the US dollar this week that has helped to lift EUR/USD back up towards the 1.0600-level from last week’s low of 1.0335. At the same time, the euro has benefitted from some initial relief that the EU was not included in Present-elect Trump’s list of tariff targets as he initially threatened to impose higher tariffs on Canada, China and Mexico at the start of next year. However, we expect such relief to prove short-lived as he eventually turns his attention to the EU trade surplus with the US next year.

The euro has derived support as well this week from the paring back of ECB rate cut expectations. At the end of last week following the release of the much weaker PMI surveys for November signalling a renewed risk of economic contraction in the euro-zone, the euro-zone rate market moved to price in more fully a larger 50bps cut form the ECB at next month’s policy meeting. However, the euro-zone rate market has since scaled back those expectations and is currently pricing in around 30bps of cuts by the December policy meeting and 65bps of cuts by the following policy meeting in January. Comments from ECB officials this week have not provided a clear indication that they are planning to deliver a larger 50bps cut as soon as next month. ECB Executive Board member Schnabel stated she sees only limited further room for cuts with the policy rate moving closer to the estimated range of the neutral rate between 2.00% and 3.00%. In contrast, Governing Council member Villeroy de Galhau struck a more dovish tone but did not explicitly signal he favours larger 50bps cut next month. He still sees significant room to ease and reverse the current restrictive policy stance. He even noted that rates may need to be cut deeper below neutral territory which according to the Bank of France is between 2.00% and 2.50%.

Those favourable developments this week have offset any negative impact from a further loss of investor confidence in the French government bond market. The yield spread between 10-year French and German government bonds has hit fresh year to date highs and reached the widest level since the euro-zone debt crisis in the middle of 2012. The renewed sell-off in the French government bond market reflects heightened investor concern that the French government could fall before the end of this year in their attempt to push through the budget. Finance Minister Armand stated yesterday that the government is prepared to make concessions on the budget bill to prevent the National Rally from backing a vote of no confidence in the government. Prime Minister Barnier has made a concession by stating he will not raise electricity prices but will do everything to bring the budget deficit down from around 6% of GDP this year to about 5% next year. However, the concession has quickly been followed by more demands from the National Rally President Bardella calling on Barnier to reduce drug reimbursements, call a moratorium on any new or higher taxes, help to boost competitiveness for small and medium firms and to index pensions on inflation from 1st January. The lack of majority in parliament to support much needed fiscal consolidation continues to provide an unfavourable backdrop for French government bonds. So far though any negative spill-overs for the euro have been relatively limited.

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

GE |

08:55 |

German Unemployment Change |

Nov |

20K |

27K |

!! |

|

UK |

09:30 |

BoE Consumer Credit |

Oct |

1.300B |

1.231B |

! |

|

IT |

10:00 |

Italian CPI (YoY) |

Nov |

1.4% |

0.9% |

! |

|

EC |

10:00 |

CPI (YoY) |

Nov |

2.3% |

2.0% |

!!! |

|

UK |

10:30 |

BoE Financial Stability Report |

-- |

-- |

-- |

!! |

|

UK |

11:00 |

BoE Gov Bailey Speaks |

-- |

-- |

-- |

!!! |

|

GE |

13:00 |

German Buba President Nagel Speaks |

-- |

-- |

-- |

!! |

|

CA |

13:30 |

GDP (QoQ) |

Q3 |

-- |

0.5% |

!! |

|

US |

21:30 |

Fed's Balance Sheet |

-- |

-- |

6,924B |

!! |

Source: Bloomberg