EUR/USD risks remain skewed to the downside for now

EUR: Challenging macro backdrop to continue

EUR/USD continues to trade close to recent lows with the US presidential and congressional elections next Tuesday a key near-term risk event that will likely keep the US dollar well underpinned and EUR under downward pressure – see below. But the economic backdrop in the euro-zone continues to encourage EUR selling as well with no sign of an imminent turnaround in sentiment. The news from Volkswagen will certainly not help. Volkswagen announced plans to shut at least three of its factories in Germany, slash wages by 10% with pay to be frozen in 2025 and 2026 with plans to also abolish one-off payments to long-term employees. The closures would be the first in the 87-year history and will be hugely significant in Germany. An employee representative has given VW two days to retract the plans, hinting at the potential for strikes. The news from VW highlights the importance of demand for autos in China given the ongoing struggles for automakers due to weakening demand in China. VW is aiming for a profit margin of 6.5% by 2026 but margins fell to just 2.3% in the first half of the year. Before the pandemic, German cars accounted for 25% of the Chinese auto market but that share has now fallen to 15%. For EVs, the drop in market share in China for German cars has been even larger. Rising costs in Germany is exacerbating the squeeze and it’s clear that German manufacturing has lost competitiveness. Real GDP in Germany is set to contract this year for the second consecutive year.

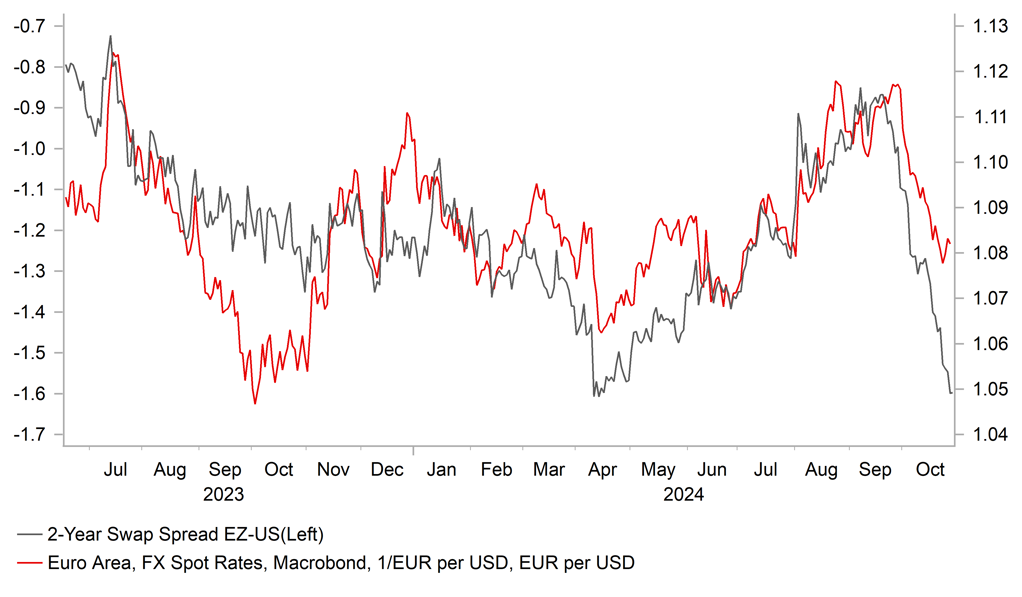

The developments in Germany will keep pressure on the ECB to continue cutting rates at consecutive meetings. This is contrasting with expectations on Fed action in the US and resulting in a substantial move in rate spreads. The 2-year EZ-US swap spread has plunged by 75bps in a little over a month to reach levels not seen since toward the end of 2022 when the euro-zone was emerging from the energy price shock that hit growth severely. EUR/USD at that stage had just rebounded back above the parity level and underlines the scale of downside risks for EUR if this spread move consolidates over the coming weeks. Obviously the election next week will be important in that context.

EZ-US 2-YEAR SWAP SPREAD HAS PLUNGED WITH EUR/USD RISKS TO DOWNSIDE

Source: Bloomberg

USD: One week to go as polls lean to Trump

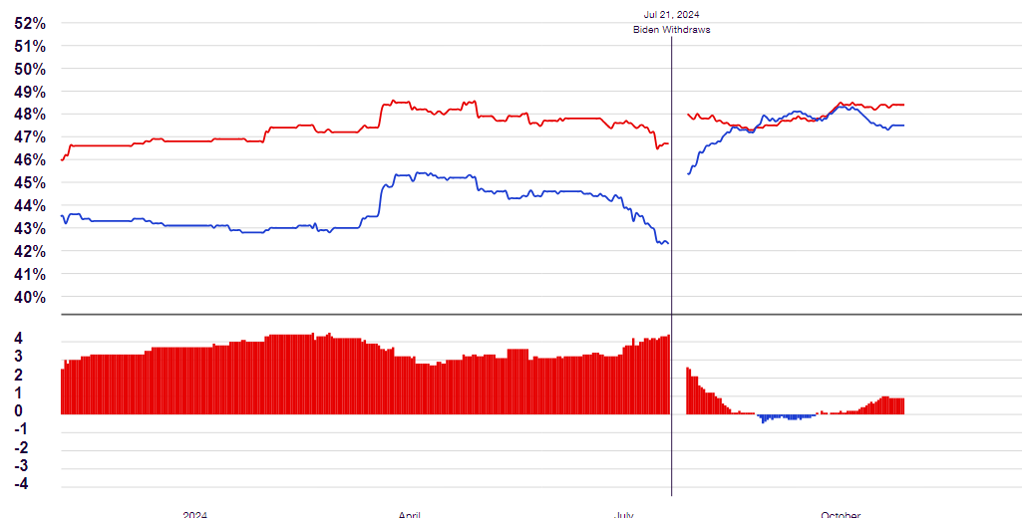

We are exactly one week away from one of the key events of 2024 – the US presidential and congressional elections with polling continuing to look extremely tight. Having just returned from a two-week business trip to the US, I can confirm that the vast majority of clients I saw had no conviction whatsoever on who will win the presidency. The betting markets appear to be where the conviction lies with our own simulated probability calculation based on state-by-state betting on Polymarket showing an implied probability of a Trump victory of 74%. How much we can rely on betting markets remains debatable with Bloomberg highlighting in a piece that only a very small number of active betting market participants on Polymarket are driving the divergence between Trump and Harris that likely means a far wider margin favouring Trump than is the reality on the ground.

Real Clear Politics is possibly one of the drivers of the betting markets with current polling indicating that Trump is ahead in all of the seven key swing states with an average lead over Harris of 0.9ppt. From about 5th October onwards, support for Harris in these swing states has subsided. Before then, the average difference since mid-August has been no more than 0.3/0.4ppt with Harris often leading.

538 gives a slightly different and better picture for Kamala Harris who is marginally ahead in Wisconsin and Michigan and then Trump marginally ahead in Pennsylvania and Nevada and ahead by a wider margin in Arizona, North Carolina and Georgia. If the polls are under-reporting Trump’s support like in 2016 and 2020, then it looks like Trump is in a strong position to win. However, I did also hear a theory when in the US that in this election there is a greater risk of female voting intentions not being accurately captured in the polling with the potential for the abortion rights issue resulting in a larger swing in the female vote to Harris than assumed in the polls.

Whatever the outcome, it seems highly likely that this election result will be as close as in 2016 and 2020 which could mean a period of uncertainty following the election if there are disputes in certain states or even districts following the initial results. We are maintaining our view that there could be about an 8% difference in US dollar performance between the two candidates with the dollar stronger, yields higher and equities higher (initially at least) on a Trump victory. Policy sequencing in a Trump presidency will be important and based on Trump’s Bloomberg interview last week, there does appear a higher risk on this occasion that Trump focuses on trade policy more quickly than he did in his first term in office when the first key tariff announcements were not made until March 2018. It’s questionable though that Trump would in one swoop implement the tariffs to the levels he has stated in election campaigning (60% on China; 10% to 20% on all other imports). It raises the prospect of a quicker dollar response although the near-4% appreciation in October does of course suggest that this is being priced already and could dampen the dollar response afterwards. We would still expect EUR/USD to break below 1.0500 but remain above parity on a Trump victory.

SEVEN KEY SWING STATES AVERAGE – TUMP LEADS HARRIS BY 0.9PPT

Source: Real Clear Politics as of 17:00 GMT 28th October 2024

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

UK |

09:30 |

BoE Consumer Credit |

Sep |

1.400B |

1.295B |

! |

|

UK |

09:30 |

M4 Money Supply (MoM) |

Sep |

0.1% |

-0.1% |

! |

|

UK |

09:30 |

Mortgage Approvals |

Sep |

65.00K |

64.86K |

! |

|

UK |

09:30 |

Net Lending to Individuals |

Sep |

4.100B |

4.156B |

! |

|

CA |

11:30 |

BoC Gov Macklem Speaks |

-- |

-- |

-- |

!! |

|

US |

12:30 |

Goods Trade Balance |

Sep |

-96.10B |

-94.22B |

!! |

|

US |

12:30 |

Wholesale Inventories (MoM) |

Sep |

0.2% |

0.1% |

! |

|

US |

13:00 |

House Price Index (MoM) |

Aug |

0.2% |

0.1% |

! |

|

US |

13:00 |

House Price Index (YoY) |

Aug |

-- |

4.5% |

! |

|

US |

13:00 |

S&P/CS HPI Composite - 20 n.s.a. (YoY) |

Aug |

4.6% |

5.9% |

!! |

|

US |

14:00 |

CB Consumer Confidence |

Oct |

99.2 |

98.7 |

!!! |

|

US |

14:00 |

JOLTS Job Openings |

Sep |

7.920M |

8.040M |

!!!! |

|

SZ |

18:00 |

SNB Vice Chairman Schlegel Speaks |

-- |

-- |

-- |

! |

|

CA |

19:30 |

BoC Senior Deputy Governor Rogers Speaks |

-- |

-- |

-- |

!! |

|

CA |

19:30 |

BoC Gov Macklem Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg