Technical correction after year-to-date low holds

USD: Fed rhetoric and shutdown risks help prompt correction

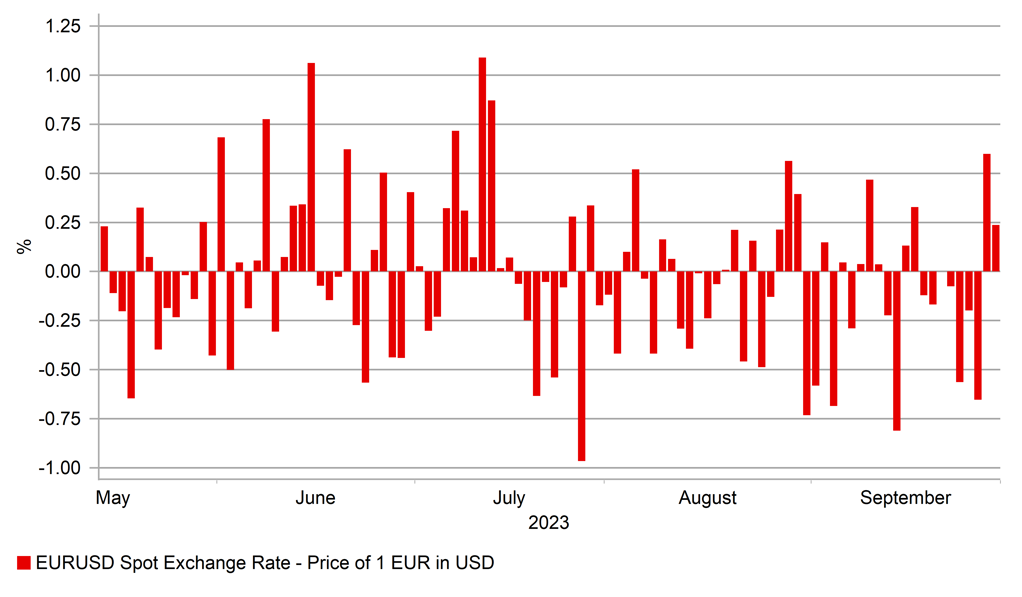

The sustained period of US dollar strength has finally met some resistance that has prompted a turnaround. The EUR/USD percentage gain of 0.6% was the largest one-day increase for EUR/USD since the middle of July and from a technical perspective is understandable. The year-to-date low from January of 1.0484 has held and two consecutive days of approaching that low (1.0488 & 1.0491) without breaching has certainly helped propel this reversal. From an RSI perspective, the move had also just become stretched with two days of the RSI falling below the 30-level – that was the first time since exactly a year ago that that had happened underlining the stretched nature of the move to the downside.

There were some fundamental factors that have helped too. The driver of the latest dollar strength has been the surge in 10-year yields (the correlation significance for the dollar has shifted from the 2yr to the 10yr of late) but from an intra-day high of 4.69% yesterday we had a decent reversal. Chicago Fed President Goolsbee helped trigger that by stating that a further sharp move higher in the 10-year yield would have to be taken into account at the next policy meeting given the move was a form of tightening. Goolsbee’s speech focused on the potential of the Fed making a policy error arguing that unique elements of this economic cycle meant the Fed should not give as much weight to the traditional expected trade-off between inflation and unemployment. Goolsbee was implying that inflation could come down more than in previous cycles without the unemployment rate moving as high as usually needed. Goolsbee is a voter this year.

The government shutdown also looms large and Minneapolis Fed President Kashkari stated on Wednesday that the Fed would potentially do less if the government shutdown was to weigh on economic activity. A big impact seems unlikely but the longer the shutdown the bigger the impact. As we stated here before, the shutdown is set to be more broad-based given this shutdown commences from the start of the fiscal year and hence no appropriation bills are passed unlike in 2018-19 when the shutdown took place in Dec-Jan when certain bills had been passed and therefore fewer workers were furloughed.

For now this correction of the dollar weaker looks mostly technical in nature. We are also at month-end and fiscal half-year-end for some and that too may be drawing non-fundamental FX flows that could fade quickly. Yields remain elevated despite the correction from yesterday’s intra-day high and while the government shutdown is a risk to yields coming lower it is unlikely to play out that way over the very short-term.

BIGGEST ONE-DAY GAIN FOR EUR/USD SINCE JULY

Source: Bloomberg, Macrobond & MUFG Research calculations

JPY: BoJ acts to stem 10yr JGB yield rise

The scale of the sell-off of global bonds prompted the BoJ today to announce an unscheduled bond-buying operation. It confirmed that it would buy JPY 300bn of 5-to-10-year bonds. But this was a relatively timid act from the BoJ which was reflected in the market reaction – the 10-year yield dropped 0.5ppt to 0.765% while the bond future is currently down 0.14 point. It was the third unscheduled buying operation since the YCC tweak was announced on 28th July.

The modest size of the buying probably reflects concerns over the possible reaction in the FX market. The yen initially weakened modestly but has since strengthened with the dollar continuing to sell-off more generally. If the dollar was performing more

strongly in broader markets, there’s a chance such a modest operation may have propelled USD/JPY through the 150-level. A reluctance to buying at these levels and essentially take on the resolve of the Japanese government also is playing a role in curtailing the upside move. For the fourth consecutive day, Finance Minister Suzuki spoke on FX and the opposition to further weakness. However, one of his comments today could ultimately encourage a move higher. Suzuki stated that the MoF had no specific line it would defend in USD/JPY.

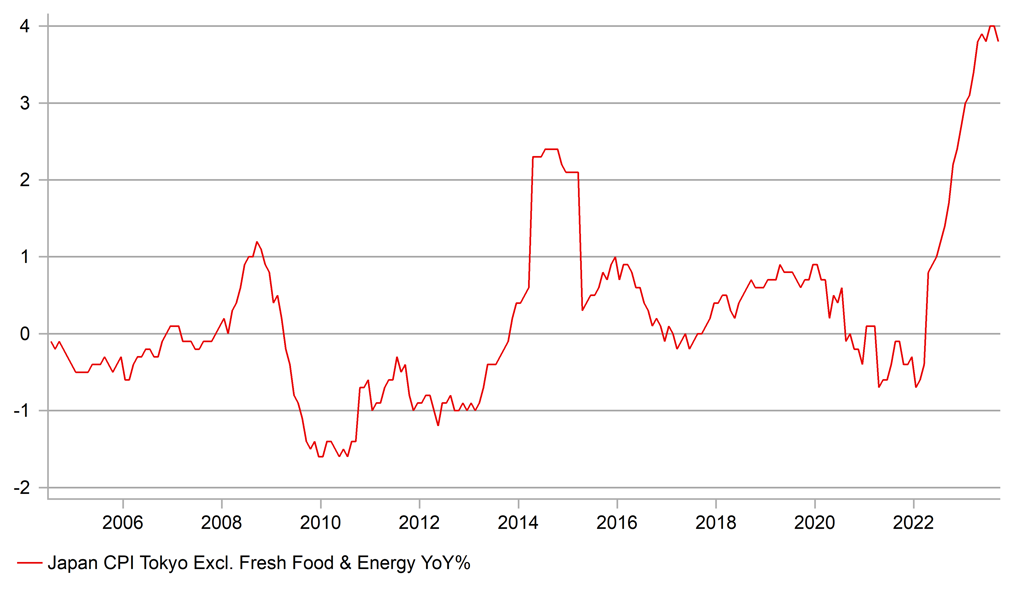

Also adding to a potential move back higher if broader USD sentiment turns around again was weaker than expected Tokyo inflation data. The core and core-core annual CPI rates both came in 0.1ppt weaker than expected suggesting the momentum of inflation in Japan is beginning to turn. As stated above, we are wary of this dollar sell-off given this is month-end and dollar selling could fade quite quickly. The modest BoJ bond buying announcement today does highlight the bind that Japan is in and a broader rebound of the dollar seems more likely than not at this juncture which will likely mean a break above the 150-level.

TOKYO CORE-CORE ANNUAL CPI COULD BE PEAKING IN JAPAN

Source: Macrobond & Bloomberg

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

SZ |

08:00 |

KOF Leading Indicators |

Sep |

90.5 |

91.1 |

!! |

|

EC |

08:40 |

ECB President Lagarde Speaks |

-- |

-- |

-- |

!!!! |

|

GE |

08:55 |

German Unemployment Change |

Sep |

14K |

18K |

!! |

|

GE |

08:55 |

German Unemployment Rate |

Sep |

5.7% |

5.7% |

!! |

|

UK |

09:30 |

BoE Consumer Credit |

Aug |

-- |

1.191B |

! |

|

UK |

09:30 |

M4 Money Supply (MoM) |

Aug |

0.2% |

-0.5% |

! |

|

UK |

09:30 |

Mortgage Approvals |

Aug |

48.00K |

49.44K |

!! |

|

UK |

09:30 |

Mortgage Lending |

Aug |

-- |

0.23B |

! |

|

UK |

09:30 |

Net Lending to Individuals |

-- |

1.5B |

1.4B |

! |

|

IT |

10:00 |

Italian HICP (YoY) |

Sep |

5.2% |

5.5% |

! |

|

IT |

10:00 |

Italian HICP (MoM) |

Sep |

1.2% |

0.2% |

! |

|

EC |

10:00 |

Core CPI (MoM) |

-- |

-- |

0.3% |

!!! |

|

EC |

10:00 |

Core CPI (YoY) |

-- |

4.8% |

5.3% |

!!! |

|

EC |

10:00 |

CPI (YoY) |

Sep |

4.5% |

5.2% |

!!! |

|

EC |

10:00 |

CPI (MoM) |

-- |

-- |

0.5% |

!! |

|

US |

13:30 |

Core PCE Price Index (MoM) |

Aug |

0.2% |

0.2% |

!!! |

|

US |

13:30 |

Core PCE Price Index (YoY) |

Aug |

3.9% |

4.2% |

!!! |

|

US |

13:30 |

Goods Trade Balance |

Aug |

-91.20B |

-90.92B |

!! |

|

US |

13:30 |

PCE Price index (YoY) |

Aug |

3.5% |

3.3% |

!! |

|

US |

13:30 |

PCE price index (MoM) |

Aug |

0.5% |

0.2% |

!! |

|

US |

13:30 |

Personal Income (MoM) |

Aug |

0.4% |

0.2% |

! |

|

US |

13:30 |

Personal Spending (MoM) |

Aug |

0.5% |

0.8% |

!! |

|

CA |

13:30 |

GDP (MoM) |

Jul |

0.1% |

-0.2% |

!! |

|

US |

14:45 |

Chicago PMI |

Sep |

47.4 |

48.7 |

!! |

|

US |

15:00 |

Michigan 1-Year Inflation Expectations |

Sep |

3.1% |

3.5% |

!! |

|

US |

15:00 |

Michigan 5-Year Inflation Expectations |

Sep |

2.7% |

3.0% |

!! |

|

US |

15:00 |

Michigan Current Conditions |

Sep |

69.8 |

75.7 |

! |

|

EC |

17:00 |

ECB President Lagarde Speaks |

-- |

-- |

-- |

!!!! |

|

US |

17:40 |

Dallas Fed PCE |

Aug |

-- |

2.40% |

! |

|

US |

17:45 |

FOMC Member Williams Speaks |

-- |

-- |

-- |

!!! |

Source: Bloomberg