Rising price of oil adding to doubts over Fed rate cuts

USD: Fed Chair Powell’s speech in focus to assess outlook for Fed rate cuts

The US dollar has lost some upward momentum after the dollar index ran into resistance at the 105.00-level at the start of this week. The US dollar has failed to strengthen further even as US yields especially at the long-end of the curve continue to adjust higher. The 10-year US Treasury yield hit a fresh year to date high yesterday at 4.40% although yields at the shorter end of the curve remained more stable. Yields at the long end of the curve are being driven by the uptick in market-based measures of inflation expectations. The 10-year US break-even rate rose to a fresh year to date high as well yesterday at 2.37% as it moved further above the low set in December at around 2.15%. The upward adjustment in market-based measures of inflation expectations has been encouraged by the ongoing rebound in the price of oil. Escalating geopolitical tensions between Israel and Iran have helped to lift the price of Brent back to within touching distance of USD90/barrel for the first time since October of last year. It follows reports that Iran has vowed revenge on Israel after blaming it for an airstrike on its embassy in Syria which killed 13 people including seven Iranian military personnel according to Iranian state media. While Israel has frequently struck Iran-linked targets in Syria, the attack on Monday would be the first time that it’s directly hit an Iranian diplomatic facility.

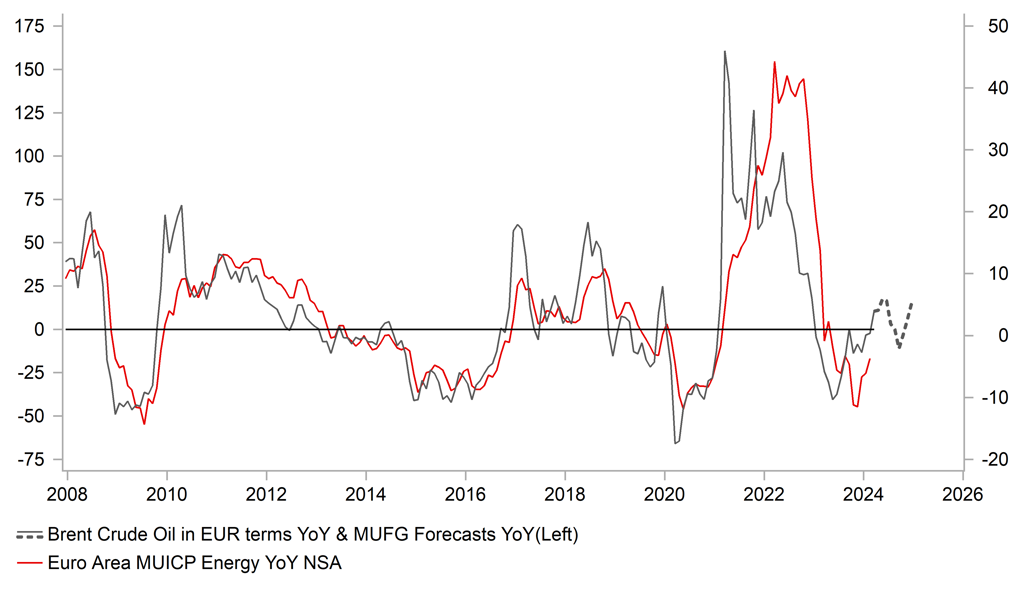

The rebound in the price of oil is an unfavourable development for the inflation outlook which will contribute to disinflationary pressure from last year’s energy price decline reversing further in the coming months if oil price gains are sustained. A development which is in part contributing to building doubts over the scale of rate cuts that major central banks are likely to deliver this year. As we highlighted in yesterday’s FX Daily report, the US rate market is no longer fully pricing in 75bps of Fed cuts by the end of this year. However, there were some dovish comments from Fed officials yesterday that still indicated that they are planning to deliver three cuts this year. San Francisco Fed President Daly stated that three rate cuts is a “very reasonable baseline” although with growth still going strong, “there’s really no urgency to adjust the rate”. Similarly, Cleveland Fed President Mester told reports yesterday that three rate cuts is still likely appropriate this year but that “it’s a close call”. She wants to see more evidence that inflation is headed lower before beginning to cut rates. Both are voting members on the FOMC. Market attention will now shift to the upcoming speech later today from Fed Chair Powell who is scheduled to speak on the economic outlook. The release later today of the ISM services survey for March will also attract more attention than normal after the upward surprise earlier this week from the ISM manufacturing survey cast further doubt on the need for Fed rate cuts.

DISINFLATIONARY IMPACT FROM ENERGY PRICES SET TO FADE

Source: Bloomberg, Macrobond & MUFG GMR

EUR: Downside euro-zone inflation surprises reinforce case for ECB rate cuts

The euro has staged a modest rebound against the US dollar resulting in EUR/USD rising to within touching distance of 1.0780 overnight as it moves further above the low from yesterday at 1.0725. The sell-off in the US bond market spilled over into euro-zone bond markets yesterday as they re-opened after the Easter holidays. The yield on the 10-year German Bund hit a high of 2.44% yesterday up from a close of 2.30% on 28th March. In contrast, yields at the short-end of the euro-zone bond market remained more stable. The euro-zone rate market is now pricing in more ECB rate cuts (-92bps) by the end of this year than the Fed (-69bps) which has recently been been placing downward pressure on EUR/USD which is trading closer to the bottom of the year to date range between 1.0700 and 1.1100.

The combination of weak growth in the euro-zone and slowing inflation is making market participants more confident that the ECB will cut rates more than the Fed this year. Those expectations were supported yesterday by the release of weaker than expected CPI reports from euro-zone countries for March. The March HICP prints for Germany, France, Italy and Spain all came in below expectations which significantly raised the risk that headline inflation for the euro-zone as a whole when it is released today will fall more than expected to 2.4% in March from 2.6% in February. Prior to the release of the national reports yesterday there had been some concern that the early timing of Easter could have lifted inflation especially tourism-related prices but that dd not materialize. Furthermore, core inflation softened meaningfully in both France and Italy.

The developments will reinforce expectations that the ECB will begin to cut rates in June and could cuts rates more this year than Fed. A view backed in part by ECB Governing Council member Holzmann who told Reuters that a June rate cut was possible if by then the data shows a strongly based environment for a cut. He said that with inflation at 2% and productivity expanding by 1%, a 3% deposit rate could be a “good target”. However, “if the productivity dap towards the US is as wide as now, then even 3% may be too tight”. Please see our latest monthly FX Outlook report for our latest FX forecasts (click here).

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

IT |

09:00 |

Italian Monthly Unemployment Rate |

Feb |

7.2% |

7.2% |

! |

|

EC |

10:00 |

Core CPI (YoY) |

Mar |

3.0% |

3.1% |

!! |

|

EC |

10:00 |

CPI (YoY) |

Mar |

2.5% |

2.6% |

!!! |

|

EC |

10:00 |

Unemployment Rate |

Feb |

6.4% |

6.4% |

!! |

|

US |

10:15 |

OPEC Meeting |

-- |

-- |

-- |

!! |

|

US |

13:15 |

ADP Nonfarm Employment Change |

Mar |

148K |

140K |

!!! |

|

US |

14:45 |

Services PMI |

Mar |

51.7 |

52.3 |

!!! |

|

US |

15:00 |

ISM Non-Manufacturing Business Activity |

Mar |

56.7 |

57.2 |

! |

|

US |

17:10 |

Fed Chair Powell Speaks |

-- |

-- |

-- |

!!! |

Source: Bloomberg