Downside risks to growth overseas support stronger USD

USD: Fed comments signal another cut this month remains the plan

The major foreign exchange rates have remained relatively stable overnight after the US dollar staged a rebound at the start of this week. The main developments overnight were comments from Fed officials ahead of the next FOMC meeting on 18th December. The US rate market has recently moved to price back in a higher probability of the Fed following through with current plans to cut rates again by 25bps this month although only expects the Fed to deliver a further 50bps of cuts next year. Market expectations for another rate cut this month were supported by comments from Fed Governor Waller who stated that “at present I lean toward supporting a cut”. He said he will be paying close attention to the releases of the latest JOLTS, NFP, CPI/PPI and retail sales reports before he finalises his policy decision later this month. He added that he could shift his decision in favour of leaving rates on hold if the data “surprises to the upside and alters my forecast for the path of inflation”. He believes that the Fed still “has ways to go to get back to neutral” and expects “rate cuts to continue over the next year until we approach a more neutral setting”.

It was view shared by New York Fed President Williams who stated “I expect it will be appropriate to continue to move to a more neutral policy setting over time”. He added that “the path for policy will depend on the data. If we’ve learned anything over the past five years, it’s that the outlook remains highly uncertain”. He will factor in the “totality” of the data when making his decision on rates later this month. Overall, the comments from Fed Governor Waller and New York Fed President Williams highlight that the Fed remains on track to cut rates again this month as planned although it is not a done deal. It supports our forecast for a 25bps rate cut this month unless there is significant upside surprise from the release of the nonfarm payrolls report on Friday. We outlined our latest forecasts in yesterday’s monthly FX Outlook report (click here). We expect the US dollar to strengthen further heading into year end and during the 1H of next year.

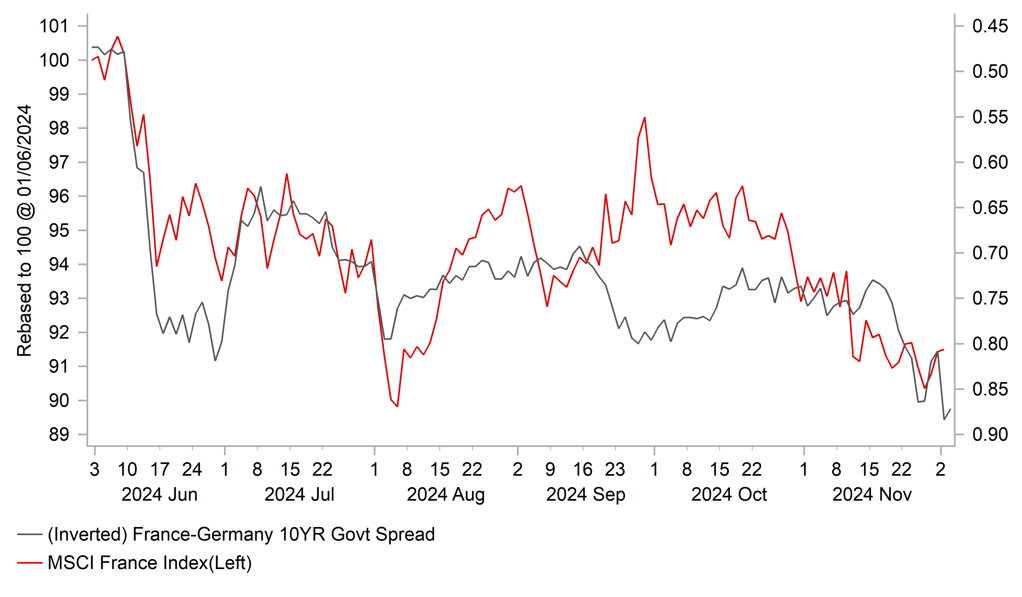

FRENCH BONDS & EQUITIES CONTINUE TO UNDERPERFORM

Source: Bloomberg, Macrobond & MUFG GMR

EUR: Heightened political uncertainty weighs on euro

The euro has continued to trade at weaker levels overnight following yesterday’s sell-off. After hitting a high yesterday at 1.0589, EUR/USD fell to an intra-day low of 1.0461 and has remained below the 1.0500-level for most of the time during the Asian trading session. The euro came under renewed selling pressure yesterday in response to heightened investor fears that the French government could collapse this week adding to political uncertainty in France and unease over the ability/willingness of the government to put in place fiscal consolidation measures required to bring the budget deficit down from around 6% of GDP this year. The French government bond market has moved to price in an even bigger risk premium with the 10-year yield spread over German government bonds widening out to fresh year to date highs at 88bps. Similarly, the French equity market has underperformed since the run up to the elections held back in June and July. MSCI’s France equity index has declined by around 8.5% since the start of June.

It follows the decision yesterday by the National Rally to file a motion to hold a no confidence vote in the government alongside the left alliance parties. Prime Minister Barnier used a constitutional mechanism, called Article 49.3, that allows for legislation to be adopted without a vote to pass a budget bill yesterday related to social security. The government made another last minute compromise to appease National Rally by abandoning a proposal to reduce drug reimbursements after dropping plans to raise electricity prices last week, but again it was not sufficient to secure their support who also wanted the government to drop plans to delay the indexation of pensions to inflation. French Finance Minister Antoine Armand has warned that there would be painful consequences across the French economy if the government is defeated in a vote of confidence that it expected tomorrow. He said relying on emergency legislation would tip 380k more households into paying income tax and another 18 million would see their bills rise. If the government loses the vote of confidence, ministers remain in place with caretaker status to manage current affairs, potentially including the emergency legislation to avoid a shutdown. It would then be up to President Macron to appoint a new prime minister. The president could dissolve parliament again but not until July, a year after the previous elections. The unfavourable political developments add to downside risks for the euro alongside a potential trade war with the US.

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

US |

15:00 |

JOLTS Job Openings |

Oct |

7.490M |

7.443M |

!!! |

|

US |

17:35 |

FOMC Member Kugler Speaks |

-- |

-- |

-- |

! |

|

US |

20:45 |

Fed Goolsbee Speaks |

-- |

-- |

-- |

! |

Source: Bloomberg