Jobs in focus as yield drop leaves USD vulnerable

USD: Low threshold for further dollar selling

The 35bp drop in the UST bond 10-year yield since hitting 5.00% last week we believe leaves the US dollar vulnerable to further selling. The FOMC meeting this week was telling in that Fed Chair Powell appeared more confident in suggesting the FOMC was done hiking despite the latest GDP growth highlighting still robust growth driven by the consumer. That confidence is down to the growing belief that the economy is slowing and that this will lead to slower employment growth and wages. So as usual, the non-farm payrolls data will be important in that regard. But coming so soon after that message from Powell, it would likely need a much stronger than expected jobs report to disrupt the momentum in the market that reflects increased expectations that the Fed is done. There are also two payroll reports before the next FOMC meeting and hence a possible bias to ignore surprise strength this month but react to weakness that endorses the message from Powell this week.

The consensus for today is for non-farm payrolls to increase by 180k in October, down markedly from the September gain of 388k. Today’s report follows the ADP data on Wednesday that revealed a jobs increased of 113k, weaker than expected and followed a gain of only 89k last month. The two-month total ADP jobs gain was the weakest since covid times back in January/February 2021. The fact that we have now had two weak ADP reports certainly strengthens the case of a marked slowdown in job gains in the NFP report today.

There has also been some tentative signs of softness in the household survey data as well. The unemployment rate remained unchanged at 3.8% last month, which was the highest level February of last year. Initial claims remain at very low levels but the continuing claims data has seen an increase in six consecutive weeks with the move higher in the last four weeks nearly fully retracting the decline that took place over the last five months. The ISM services data will be released after the payrolls report but the manufacturing ISM data released earlier this week revealed a drop in employment to 46.8 – the second weakest reading since the covid period in 2020. The true NFP consensus today is probably less than 180k.

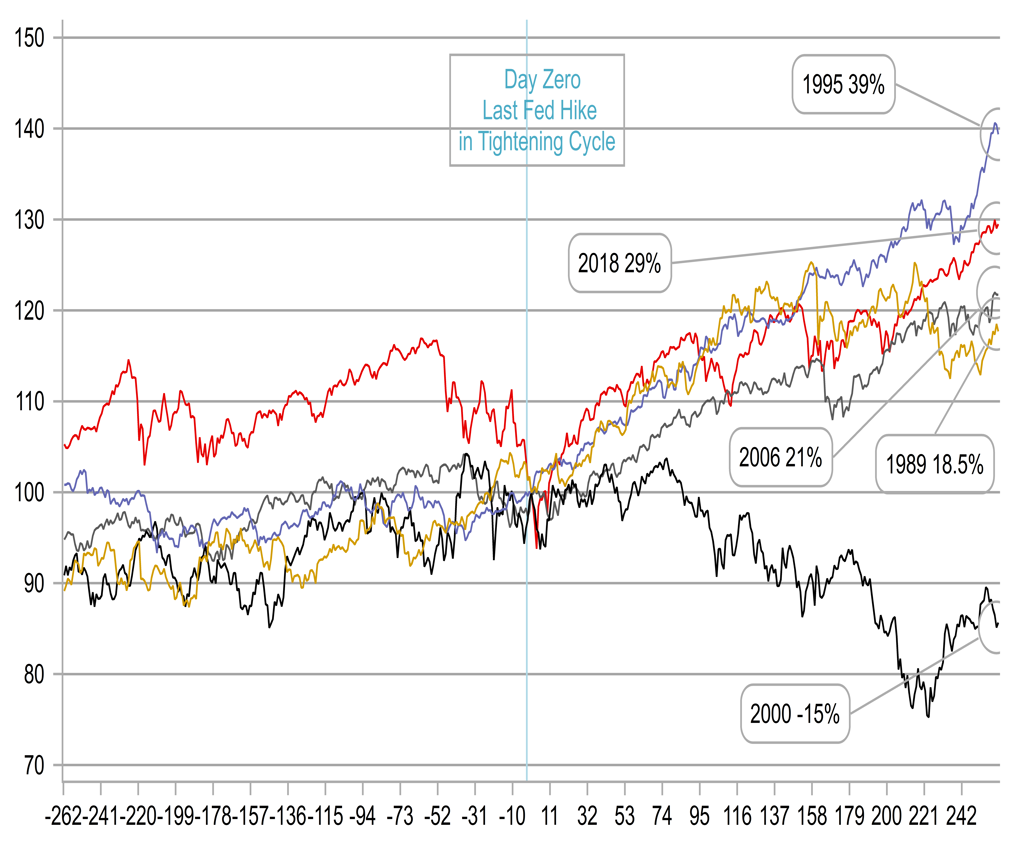

A jobs report that endorses the essence of Powell’s communication this week and reinforces the growing view in the markets that the “Fed is done” will certainly help lift risk appetite. The chart above highlights the performance of the S&P 500 in the 12mths following the last rate hike. While we are sceptical of a strong equity market performance over this next 12mth period (this time we have massive QT to deal with), the initial period of trading on the tightening cycle being done will likely lift equities further, lower front-end yields and weaken the dollar.

S&P 500 PERFORMANCE IN 12MTHS FOLLOWING FINAL FED RATE HIKE

Source: Macrobond & MUFG GMR

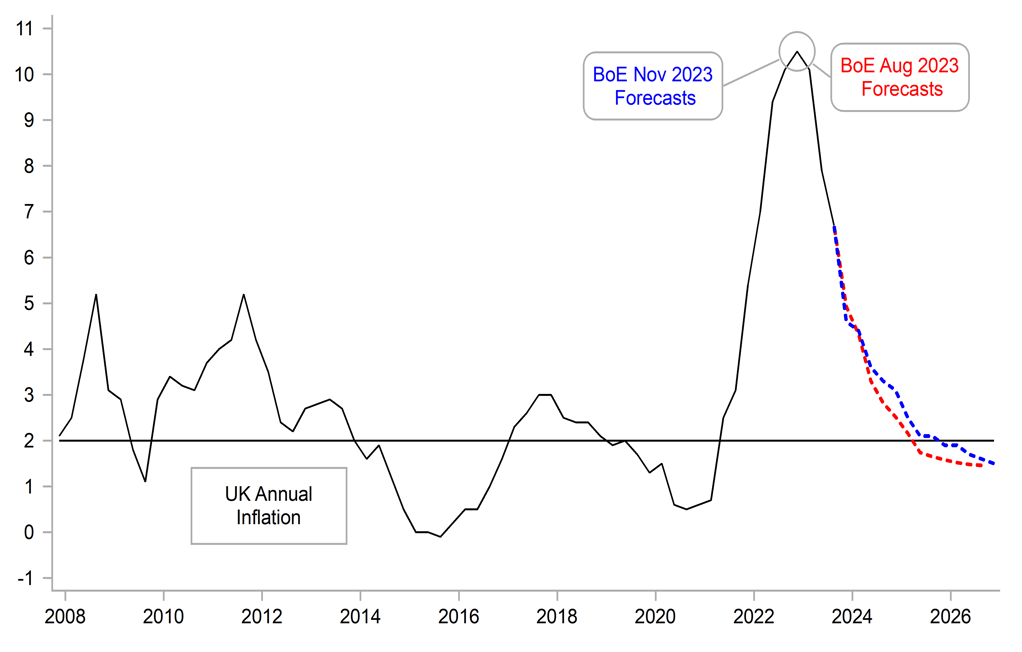

GBP: BoE on hold as focus shifts from hiking to holding

As usual we released an FX Focus piece in response to the Bank of England monetary policy announcement yesterday (here) and GBP has remained broadly unchanged since the initial reaction after the meeting – which to be honest was relatively modest anyway. The MPC members who voted for no change summed that up by stating that “there had been little news in UK economic data since the previous meeting”. Of course we did have the quarterly Monetary Policy Report, which seems to be an increasingly irrelevant piece of information in terms of providing guidance on future moves. Yet again, it projected inflation below target at 1.9% in two years and 1.5% in three years. Inflation projections were lifted somewhat by market rates that imply more active rate cuts than in August when inflation was projected at 1.65% in two years and 1.46% in three years. As expected the growth backdrop was weak with little growth all the way through until the end of next year with a recession probability of 50%. But with the labour still tight (and tighter than assumed given revised employment data) three MPC members voted to hike. The 6-3 vote was expected with incoming Deputy Governor Sarah Breeden (replacing Jon Cunliffe) voting with the majority.

The OIS curve added around 5-6bps of cuts by September 2024 in response to the MPC announcement, while focusing more on signalling “higher for longer”, has strengthened expectations that the BoE has finished hiking. We concur with that view and see scope for the 2024 rate cut pricing to extend further. We can understand why the UK curve is priced for less than elsewhere – wages and inflation are more problematic here compared to the US or Europe – but we see the inflation data improving notably and softer labour demand will help ease wage growth. By Q1 next year the market will expect much more easing and hence in the meantime, GBP is set to underperform.

MARGINALLY HIGHER CPI FORECASTS THAN IN AUG BUT STILL BELOW 2%

Source: Macrobond & Bloomberg

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

IT |

09:00 |

Italian Monthly Unemployment Rate |

Sep |

7.4% |

7.3% |

! |

|

NO |

09:00 |

Unemployment Change |

Oct |

-- |

66.39K |

! |

|

NO |

09:00 |

Unemployment Rate n.s.a. |

Oct |

-- |

1.80% |

! |

|

UK |

09:30 |

Composite PMI |

Oct |

48.6 |

48.6 |

!!! |

|

UK |

09:30 |

Services PMI |

Oct |

49.2 |

49.2 |

!!! |

|

EC |

10:00 |

Unemployment Rate |

Sep |

6.4% |

6.4% |

!! |

|

UK |

12:15 |

BoE MPC Member Pill Speaks |

-- |

-- |

-- |

!!! |

|

US |

12:30 |

Average Hourly Earnings (MoM) |

Oct |

0.3% |

0.2% |

!!!! |

|

US |

12:30 |

Average Hourly Earnings (YoY) (YoY) |

Oct |

4.0% |

4.2% |

!!! |

|

US |

12:30 |

Average Weekly Hours |

Oct |

34.4 |

34.4 |

! |

|

US |

12:30 |

Nonfarm Payrolls |

Oct |

188K |

336K |

!!!!! |

|

US |

12:30 |

Participation Rate |

Oct |

-- |

62.8% |

!! |

|

US |

12:30 |

U6 Unemployment Rate |

Oct |

-- |

7.0% |

!! |

|

US |

12:30 |

Unemployment Rate |

Oct |

3.8% |

3.8% |

!!! |

|

CA |

12:30 |

Avg hourly wages Permanent employee |

Oct |

-- |

5.3% |

!! |

|

CA |

12:30 |

Part Time Employment Change |

Oct |

-- |

47.9K |

! |

|

CA |

12:30 |

Participation Rate |

Oct |

-- |

65.6% |

! |

|

CA |

12:30 |

Unemployment Rate |

Oct |

5.6% |

5.5% |

!! |

|

US |

13:45 |

S&P Global Composite PMI |

Oct |

51.0 |

51.0 |

!! |

|

US |

13:45 |

Services PMI |

Oct |

50.9 |

50.9 |

!!! |

|

US |

14:00 |

ISM Non-Manufacturing |

Oct |

53.0 |

53.6 |

!!! |

|

US |

14:00 |

ISM Non-Manufacturing Prices |

Oct |

-- |

58.9 |

!! |

|

UK |

16:00 |

MPC Member Haskel Speaks |

-- |

-- |

-- |

!!! |

Source: Bloomberg