ECB to cut in September but has the curve priced too much?

EUR: ECB September rate cut confirmed but less clear beyond

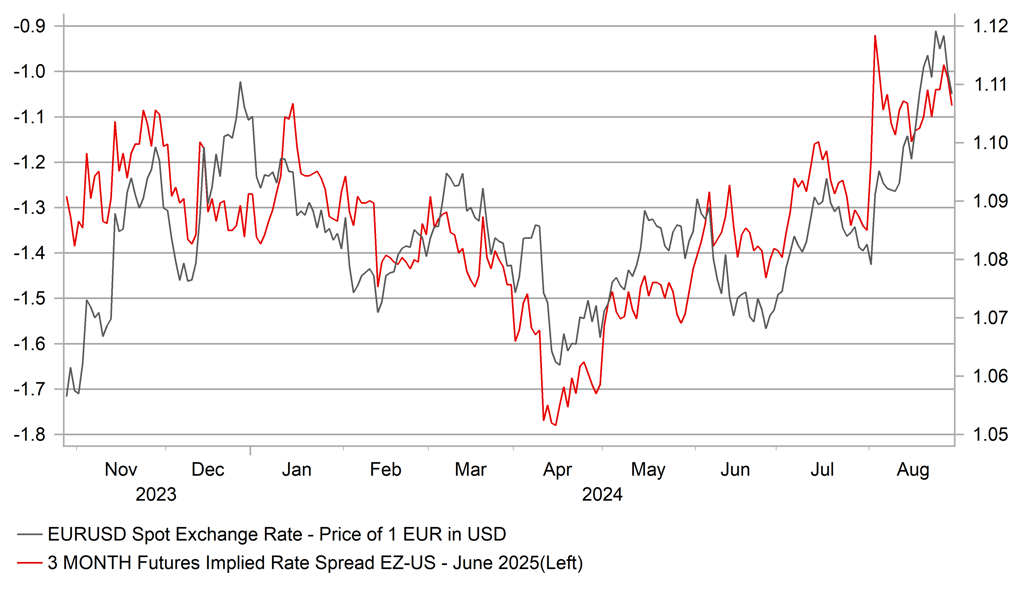

The release of weaker than expected inflation data in Spain and Germany yesterday means there are downside risks today to the euro-zone flash CPI estimate and with the consensus at 2.2%, a favourable figure close to the 2.0% target is likely. This has reinforced the correction lower in EUR/USD which given the scale of the jump last week was always more likely to happen this week. The EUR/USD move had already overshot moves in short-term spreads and hence further gains in EUR/USD always looked a stretch this week.

The inflation backdrop certainly looks favourable – the drop to 2.0% in the YoY CPI rate in Germany was the lowest since 2021 and CPI data from France and Italy today are also expected to slow notable slowdowns toward the 2.0% ECB target level. We also yesterday had some comments from ECB Chief Economist Philip Lane who admitted that wage data in the second half of this year would show “plenty of wage increases” but that the “catch-up process” from the previous inflation surge was now “peaking”. He was much more optimistic on wage growth in 2025 when he expects growth to be much slower. It was this view within the ECB that was giving the Governing Council more confidence on achieving the 2.0% inflation goal.

This is all very understandable and logical but when he set these comments and the positive inflation data and broader macro-economic data against the current pricing in the OIS curve for future ECB policy easing, there are greater reasons to question current market pricing. The curve in the euro-zone has definitely moved in part in sympathy with the move in the US but we suspect there is potential for greater divergence in policy paths than currently priced in the market. We think the steady decline in inflation over the next 12mths to the 2.0% inflation goal will result in the ECB cutting at each of the forecast meetings – implying four rate cuts by June 2025. To assume more than that would we believe require a deeper downturn in growth and inflation and/or a harder than expected landing for the US economy.

As of now that’s not our assumption but these scenarios seems to be at least partially priced given by June next year the OIS market is implying 140bps of cuts from the ECB, implying the policy rate dropping to around 2.25% (effective rate is 10bps lower than target currently). If you assume the achievement of the inflation goal by then that still implies a real policy rate from the ECB of just 0.25%. That’s on the low side in our view and hence the risk going forward is that we see this adjust higher. The rates market in core Europe saw a limited reaction to the weaker CPI data yesterday which highlights to us the richness of rate cut pricing. The 2-year UST note yield trading at 3.90% looks to have much more scope to move lower than the 2-year German yield at 2.35% when you consider current OIS pricing. This pricing discrepancy suggests better support for EUR/USD going forward.

3-MONTH FUTURES IMPLIED YIELD SPREAD EU-US VERSUS EUR/USD

Source: Macrobond & Bloomberg

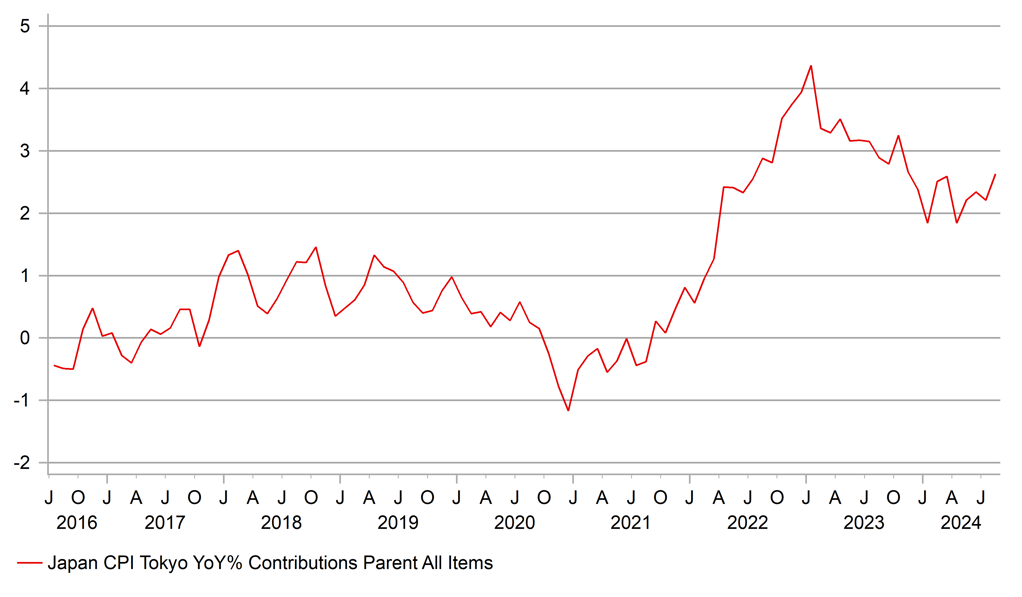

JPY: Inflation data supports our view of BoJ hikes under-priced

The yen is close to unchanged this morning similar to all G10 FX rates but that shouldn’t take away from the significance of the inflation data for Tokyo released today in Japan. The data in general was much stronger than expected with the core rate accelerating from 2.2% to 2.4% in August and the core-core rate picking up from 1.5% to 1.6% - the consensus was for a drop to 1.4%. Japan’s job-to-applicant ratio picked up while industrial production rebounded 2.8% MoM in July after the sharp 4.2% drop in June, although this rebound was less than expected.

The data is entirely consistent with what the BoJ have argued is required in order to justify further rate increases – strong wage growth feeding through into inflation. The latest wage data saw the same sample cash earnings YoY rate increase from 2.3% to 5.4%. The services side of the Tokyo economy is also seeing a pick-up in inflation with service inflation accelerating from 0.5% to 0.7% - the Tokyo services inflation rate is lower than the nationwide rate due to specific factors like education subsidies. A tax rebate implemented by the government, effective June, may also be helping underlying demand conditions which are also being reinforced by the return of positive wage growth in real terms.

The data is certainly consistent with our view that the BoJ will hike rates again this year, in December. Recent comments from Governor Ueda and Deputy Governor Himino are certainly consistent with a move. Both argued the case for a hike if the BoJ’s forecasts are realised and today’s data helps that case. With the very sharp rebound in global risk appetite, the argument of delaying a hike for financial market reasons is weakening by the day and we suspect upcoming speeches could soon drop references to watching financial markets with a “sense of urgency”. There is currently only 8bps of hikes priced by year-end which we maintain is too low and hence current OIS market pricing is a potential source of upside risk for JPY over the coming weeks.

ANNUAL TOKYO HEADLINE CPI LOOKS TO BE ACCELERATING ONCE AGAIN

Source: Macrobond & Bloomberg

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

SZ |

08:00 |

KOF Leading Indicators |

Aug |

100.6 |

101.0 |

!! |

|

EC |

08:05 |

ECB's Schnabel Speaks |

-- |

-- |

-- |

!! |

|

EC |

08:35 |

ECB's Schnabel Speaks |

-- |

-- |

-- |

! |

|

GE |

08:55 |

German Unemployment Change |

Aug |

17K |

18K |

!! |

|

GE |

08:55 |

German Unemployment Rate |

Aug |

6.0% |

6.0% |

!! |

|

NO |

09:00 |

Unemployment Change |

Aug |

-- |

76.57K |

! |

|

UK |

09:30 |

BoE Consumer Credit |

Jul |

1.300B |

1.162B |

! |

|

UK |

09:30 |

M4 Money Supply (MoM) |

Jul |

0.5% |

0.5% |

! |

|

UK |

09:30 |

Mortgage Approvals |

Jul |

61.00K |

59.98K |

! |

|

IT |

10:00 |

Italian HICP (MoM) |

Aug |

0.0% |

-0.9% |

!! |

|

IT |

10:00 |

Italian HICP (YoY) |

Aug |

1.3% |

1.6% |

!! |

|

EC |

10:00 |

Core CPI (YoY) |

Aug |

2.8% |

2.9% |

!!! |

|

EC |

10:00 |

CPI (YoY) |

Aug |

2.2% |

2.6% |

!!! |

|

EC |

10:00 |

CPI (MoM) |

Aug |

-- |

0.0% |

!!! |

|

EC |

10:00 |

Unemployment Rate |

Jul |

6.5% |

6.5% |

! |

|

US |

13:30 |

Core PCE Price Index (YoY) |

Jul |

2.7% |

2.6% |

!!!! |

|

US |

13:30 |

Core PCE Price Index (MoM) |

Jul |

0.2% |

0.2% |

!!!! |

|

US |

13:30 |

Personal Spending (MoM) |

Jul |

0.5% |

0.3% |

!! |

|

CA |

13:30 |

GDP (MoM) |

Jun |

0.1% |

0.2% |

!! |

|

CA |

13:30 |

GDP Annualized (QoQ) |

Q2 |

1.6% |

1.7% |

!! |

|

US |

14:45 |

Chicago PMI |

Aug |

45.0 |

45.3 |

!! |

|

US |

15:00 |

Michigan 1-Year Inflation Expectations |

Aug |

2.9% |

2.9% |

!! |

|

US |

15:00 |

Michigan 5-Year Inflation Expectations |

Aug |

3.0% |

3.0% |

!! |

|

US |

15:00 |

Michigan Consumer Sentiment |

Aug |

67.8 |

66.4 |

!! |

Source: Bloomberg