Market focus shifts to the UK ahead of budget announcement

GBP: Budget announcement should help reduce uncertainty

We would be surprised if there is any notable FX or rates reaction to the UK budget to be presented in parliament at 12:30 GMT. It’s quite common for aspects of budget announcements to be released but the new Labour government has taken this form to a new level and the scope for a shock today seems more limited than before. UK Gilt yields have been rising this month with the 10-year yield up just over 30bps from the September close. But it is debatable how much of that move reflects fears over increased Gilt supply on the potential for increased borrowing. The US Treasury 10-year yield is up over 50bps this month on expectations of a Trump election victory next week and that is helping lift yields everywhere. The 10-year bund yield is over 20bps higher and the JGB yield is up over 10bps. There are two key objectives under budget rules – to meet current expenditures from tax revenues and second to ensure that debt as a percentage of GDP will falling by the 5th year of the forecast period. Based on hints or leaks or already announced plans Chancellor Reeves is set to adopt tax increase measures to raise around GBP 35bn. This total takes account of the already revealed GBP 22bn budget hole left by the previous government according to the new Labour government. On top of this given the government has promised there will be no austerity under labour, government spending needs to be increased to avoid a real terms spending cut in government departments not protected. There will also be additional spending for the NHS as has been confirmed by the Health Secretary Wes Streeting. Tax increase through an increase in employers’ national insurance contributions, increased capital gains taxes, the adding in of VAT on private education fees, the removal of the winter fuel allowance and maintaining income tax thresholds are some of the expected measures to help raise funds.

The change in the debt rule will be important for the Gilt market. The definition of debt is expected to change to Public Sector New Financial Liabilities which adds in certain assets like student loans and other government investments. This could add GBP40-50bn additional borrowing capacity under the debt rule and allow for a notable increase in long-term investment. This is ultimately a positive supply-side boost for the economy and should raise the economy’s potential growth rate over time.

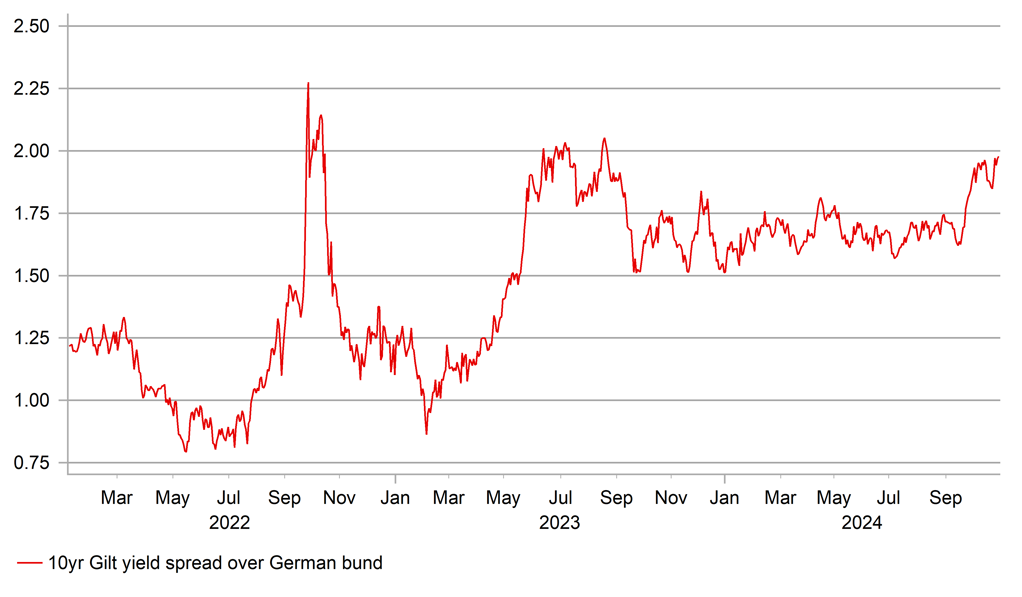

Hence, for the Gilt market we do not expect there to be much negative reaction assuming the broad macro figures are credible with no big surprises on the spending side. A median estimate of the increase in Gilt supply from Bloomberg was GBP 15bn for this fiscal year, which would equate to total borrowing of GBP 293bn this year, the largest ever bar 2020 due to the pandemic. The 10yr Gilt spread over bunds yesterday hit the highest level since August 2023 although with Germany in the doldrums and inflation falling sharply, to put this all down to supply concerns would be misleading.

The pound continues to perform well and there is little evidence of FX concerns over the budget. The pound remains the top performing G10 currency outperforming even the dollar and in October alone with the dollar surging, the pound has outperformed all other G10 currencies bar the Swiss franc. Assuming today’s details are credible, which we would expect, the pound response should be positive.

10-YEAR GILT YIELD SPREAD OVER GERMAN BUNDS HAS BEEN WIDENING AHEAD OF TODAY’S UK BUDGET

Source: Bloomberg & Macrobond

EUR: EU imposes tariffs on China EVs

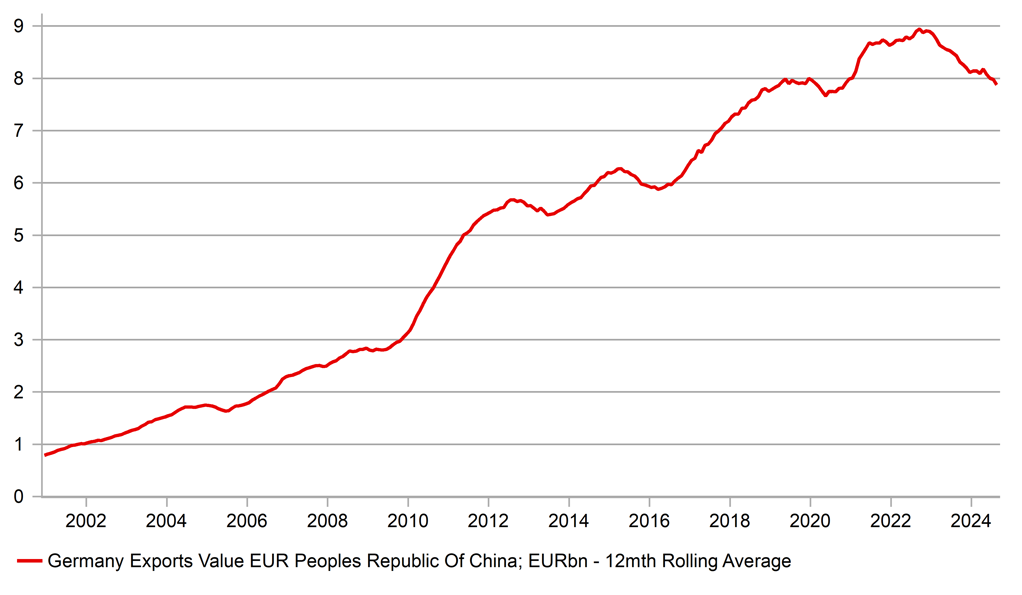

The EU last night published its regulation confirming officially the introduction of new tariffs on China EV imports to the EU that risks retaliation by China potentially against the EU auto sector that could add to the difficulties already evident. Volkswagen today confirmed its Q3 revenue figures with the core VW brand managing an operating profit margin of just 2% year-to-date. Sales in China are already suffering with VW sales down 15% in Q3. All German automakers are suffering with BMW sales plunging 30%. Retaliatory tariffs now by China would add to the woes.

The tariffs are less severe than in the US where the Biden administration placed a tariff of 100% due to Chinese government subsidies distorting the market. The EU last night confirmed that the tariffs would range from just 8% (Tesla) to a little over 35% (SAIC). These increases would be on top of the already existing 10% tariff.

China’s Ministry of Commerce issued a statement in response to the tariff increases stating that it would still seek an acceptable resolution with the EU but that it would take all necessary measures to defend its companies’ rights. On possible action could be to increase tariffs on large engine autos that were reduced from 25% to 15% in 2018 and would hurt the likes of BMW and Mercedes.

There has been limited reaction to this news given this step taken last night was the final formal step and the action was already known and widely expected. In addition, this step comes just before the US presidential election on 5th November that could quickly rank this EU action as very minor given Trump’s promise to implement a 60% tariff on all China imports into the US. Given the 4-big figure drop in EUR/USD this month, this Trump trade risk is a lot better priced. Even if Trump wins it is difficult to predict the timing and extent of his actions. The dollar weakened throughout 2017 after Trump focused on tax cuts with solar panel tariffs, the first tariff announcement, not coming until January 2018. A Trump clean sweep in Congress could mean the focus again is on tax policy. However, Trump’s recent Bloomberg interview when he described ‘tariff’ as the “most beautiful word in the English dictionary” suggests he could take a more aggressive approach if he wins a second term. We assume a USD forecast profile that is about 7-8% stronger if Trump wins the election.

GERMAN EXPORTS TO CHINA HAVE BEEN DECLINING STEADILY

Source: Bloomberg & Macrobond

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

GE |

08:55 |

German Unemployment Change |

Oct |

15K |

17K |

!! |

|

GE |

08:55 |

German Unemployment Rate |

Oct |

6.1% |

6.0% |

!! |

|

IT |

09:00 |

Italian GDP (QoQ) |

Q3 |

0.2% |

0.2% |

! |

|

SZ |

09:00 |

SNB Vice Chairman Schlegel Speaks |

-- |

-- |

-- |

! |

|

UK |

10:00 |

Autumn Forecast Statement |

-- |

-- |

-- |

!!! |

|

EC |

10:00 |

Business and Consumer Survey |

Oct |

96.4 |

96.2 |

! |

|

EC |

10:00 |

Consumer Confidence |

Oct |

-12.5 |

-12.5 |

! |

|

EC |

10:00 |

GDP (QoQ) |

Q3 |

0.2% |

0.2% |

!! |

|

US |

12:15 |

ADP Nonfarm Employment Change |

Oct |

101K |

143K |

!!!! |

|

UK |

12:30 |

Spring Statement |

-- |

-- |

-- |

!!!! |

|

US |

12:30 |

Core PCE Prices |

Q3 |

2.10% |

2.80% |

!!! |

|

US |

12:30 |

GDP (QoQ) |

Q3 |

3.0% |

3.0% |

!!! |

|

US |

12:30 |

GDP Price Index (QoQ) |

Q3 |

2.0% |

2.5% |

!! |

|

GE |

13:00 |

German CPI (MoM) |

Oct |

0.2% |

0.0% |

!!! |

|

GE |

13:00 |

German CPI (YoY) |

Oct |

1.8% |

1.6% |

!! |

|

EC |

15:00 |

ECB's Schnabel Speaks |

-- |

-- |

-- |

!! |

|

CA |

20:15 |

BoC Senior Deputy Governor Rogers Speaks |

-- |

-- |

-- |

!! |

|

CA |

20:15 |

BoC Gov Macklem Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg