China stimulus remains in focus as geopolitical risks rise in Middle East

JPY: New LDP leader Shigeru Ishiba calls early election for 27th October

The yen has continued to strengthen overnight following the LDP leadership election at the end of last week. It has resulted in USD/JPY falling to an intra-day low overnight of 141.65 as it moves further below last week’s high of 146.49. The bigger moves have been in the Japanese equity market overnight. The Nikkei 225 index has fallen sharply by almost 5%. It is the biggest sell-off since the market turbulence in early August. It follows the LDP’s decision on Friday to elect Shigeru Ishiba as their new president and the next prime minister of Japan. Shigeru Ishiba is known as someone who has opposed PM Abe in the past and is much more aligned with the current policy direction of the BoJ. He wants to keep pushing policies that will “decisively” beat deflation and has promised to work strongly to lift wage growth and strengthen consumer spending. He voiced support for the BoJ’s policy stance and said he would introduce policies to protect households from rising mortgage rates. As a result, the LDP election result has supported market expectations for further BoJ policy normalisation and a stronger yen.

The main development over the weekend have been local media reports that the new prime minister is likely to call a national election on 27th October that has just been officially confirmed. Shigeru Ishiba has been consistently one of the most popular leadership candidates amongst the public and he will seek to take advantage of that to win a mandate from the public for his government in a snap election. The main opposition party has similarly just replaced its own leader in an attempt to revive its flagging support. The timing of the election is just before the BoJ’s next monetary policy meeting on 31st October. It still leaves the door open for our forecast for the BoJ to hike rates again at the following meeting on 19th December. However, we do acknowledge that if the yen continues to strengthen sharply and Japanese equity market weakens then it will argue against another rate hike this year. When Shigeru Ishiba was asked about BoJ policy in a TV interview at the weekend, he stated “I don’t think we should be talking about interest rates in a situation where we still can’t say for sure that deflation”. The comments suggest some softening in his support for higher rates now that he’s in power. He has also appointed Katsunobu Kato to the role of finance minister and Takeshi Iwaya as his foreign minister.

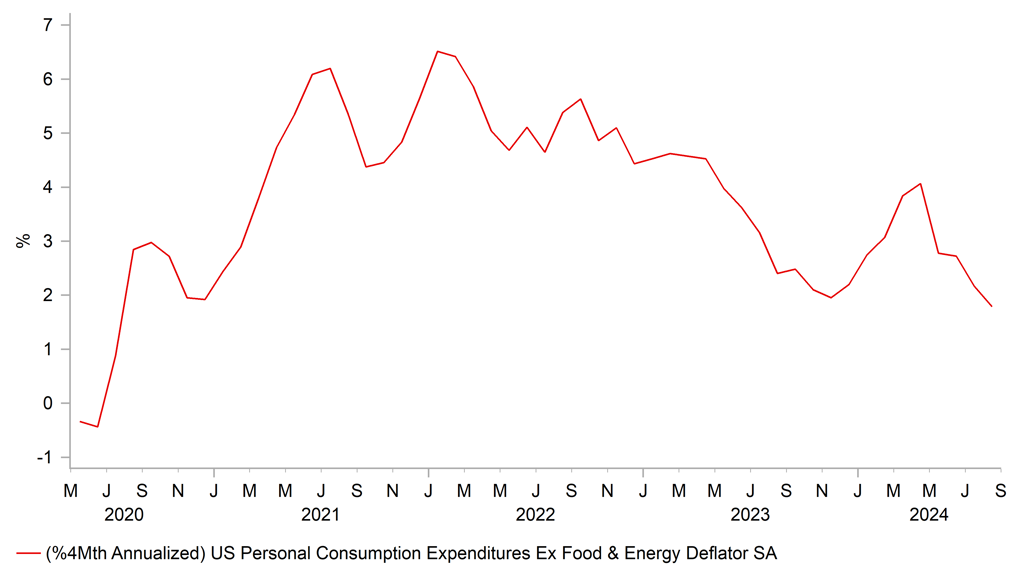

PCE DEFLATOR PROVIDES GREEN LIGHT FOR FURTHER FED CUTS

Source: Bloomberg, Macrobond & MUFG GMR

USD: Slowing US inflation & China stimulus optimism both weigh on the USD

The US dollar has continued to trade close to year to date lows at just above the 100.00-level for the dollar index. It follows the release on Friday of another soft US PCE deflator report for August that has reinforced market expectations for faster Fed rate cuts. The US rate market is currently pricing in around 38bps of cuts for the next FOMC meeting on 7th November just after the US election on 5th November. Market expectations for a second consecutive 50bps rate cut were supported by further evidence of slowing US inflation. The core PCE deflator increased by just 0.1%M/M in August which was the fourth consecutive soft monthly print. Over that period the core PCE deflator has slowed to an annualized rate of just 1.8% down sharply from 4.1% in April. The Fed acknowledged the recent improvement in the inflation outlook at the last FOMC meeting when it lowered their core PCE deflator forecasts for this year and next to 2.6% and 2.2% respectively. Fed Chair Powell is scheduled to give an address at the National Association for Business Economic conference today that could provide further insight into the Fed’s policy outlook ahead of the release of the latest nonfarm payrolls report on Friday. With the Fed’s focus shifting to supporting the labour market, further evidence of a softening labour market will be required to encourage the Fed to deliver another larger 50bps rate cut and to further weaken the US dollar. On the other hand, the release of much weaker inflation data from the euro-zone on Friday has provided justification for the ECB to speed up the pace of their rate cut plans. We now expect the ECB to deliver back-to-back rate cuts in October that should help to dampen further US dollar downside especially against the euro.

At the same time, the sharp improvement in investor sentiment towards China’s economy is contributing towards a weaker US dollar by helping to ease investor concerns over the global growth outlook. The main beneficiaries overnight at the expense of the US dollar have been the G10 commodity currencies of the Australian and New Zealand dollars. The price action is supportive for our long AUD/USD trade idea recommendation in our latest FX Weekly report (click here). The sharp improvement in investor sentiment towards China is also evident by the performances of the domestic equity market and price of iron ore. The Shanghai composite equity index has continued to surge higher overnight when it advanced by around 6.7% taking cumulative gains to almost 25% over the last couple of weeks. The price of iron ore has risen by a similar amount as well. It reflects investor optimism that Chinese policymakers are now taking more decisive action to support growth heading into year end. Further steps to support the weak housing market were announced over the weekend. One downside risk to the global growth outlook, although it is having less market impact so far, are escalating geopolitical tensions in the Middle East.

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

UK |

09:30 |

M3 Money Supply |

Aug |

-- |

3,067.2B |

! |

|

IT |

10:00 |

Italian CPI (YoY) |

Sep |

0.8% |

1.1% |

! |

|

GE |

13:00 |

German CPI (YoY) |

Sep |

1.7% |

1.9% |

!! |

|

US |

13:50 |

FOMC Member Bowman Speaks |

-- |

-- |

-- |

!! |

|

US |

14:00 |

Dallas Fed PCE |

Aug |

-- |

1.70% |

! |

|

EC |

14:00 |

ECB President Lagarde Speaks |

-- |

-- |

-- |

!! |

|

US |

18:55 |

Fed Chair Powell Speaks |

-- |

-- |

-- |

!!! |

Source: Bloomberg