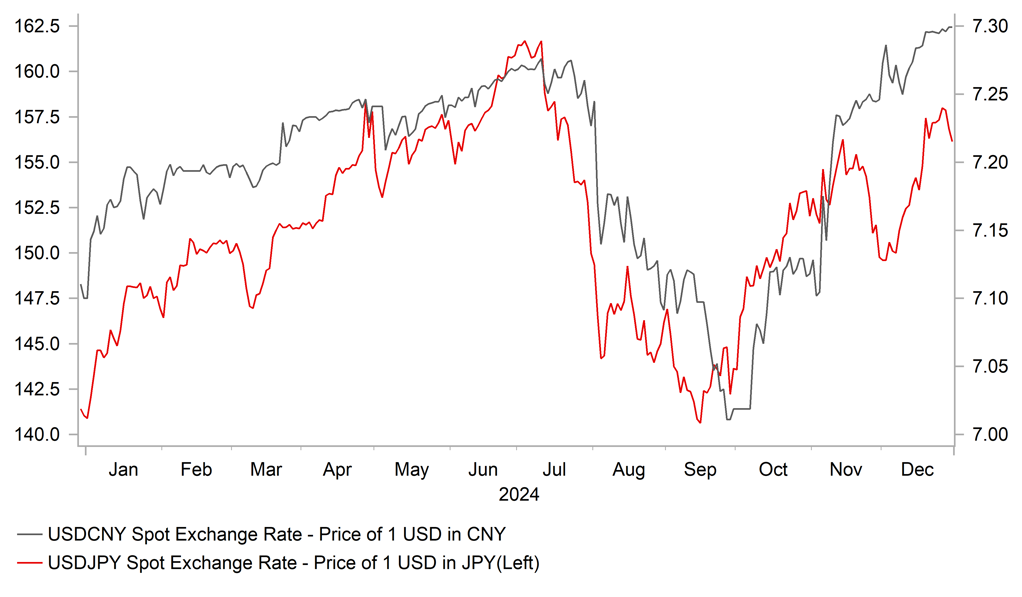

USD finishing the year on a stronger footing against CNY & JPY

CNY: Widening policy divergence between US & China adds to downside risks

The main event overnight has been the release of the latest PMI surveys from China. The surveys revealed a bigger than expected pick-up in business confidence from the non-manufacturing sector of China’s economy. The non-manufacturing PMI increased by 2.2 points to 52.2 in December and reached the highest level since March. The pick-up in confidence was led by the construction sector whose PMI rose to a seven month high of 53.2 in December up from 49.7 in November. The Bureau of Statistics explained that construction companies are speeding up building before the Lunar New Year holiday season which starts in the second half of January. At the same time, the service PMI increased by 1.9 points to 52.0 in December. The improvement in business confidence at year end will provide some encouragement that policy support measures rolled out by domestic policymakers are helping to support growth although it was partially offset by continued weakness in the manufacturing sector. The manufacturing PMI declined marginally by 0.2 points to 50.1 in December leaving it around 0.3 points above its average for this year of 49.8. In a speech published by the official Xinhua news agency overnight, President Xi Jinping stated that China’s 2024 GDP growth is expected to meet their growth target of around 5%. He described China’s economy as “overall stable and progressing amid stability”. He stated that risks in key areas were effectively addressed, while employment and prices remained steady. He reiterated a call to adopt more proactive macroeconomic policies to aid the economy’s continued recovery. With domestic policymakers planning to step up both monetary and fiscal support for growth next year, the government is expected to set similar growth target of around 5% for 2025 although it will face additional headwinds to growth from Trump’s tariff hikes that will undermine external demand.

The Chinese bond market has seen a sharp drop in yields over the past month partly in anticipation of further rate cuts from the PBoC. Yields on the 2-year and 10-year government bonds have fallen by around 30-35bps this month taking them to new record lows. PBoC Governor Pan encouraged rate cut expectations yesterday when he told the People’s Daily that he believes China still has room to cut banks’ reserve requirement ratio as the local industry average of about 6.6% is high compared with other major economies. While yields have fallen sharply in China at the end of this year, yields in other major economies have been rising. The US 2-year and 10-year government bond yields have risen by around 10bps and 35bps respectively. The 10-year US Treasury yield is finishing the year closer to the year to date high set in April at 4.74%. Upward pressure on US yields particularly at the long end of the curve reflects investor unease over the potential inflationary impact from the incoming Trump administration’s policy agenda. The Fed has already displayed more caution over cutting rates further next year in light of potential policy changes. With yield spreads continuing to widen between the US and China it should encourage a further adjustment higher for USD/CNY with a weaker CNY likely to be used as well as an adjustment mechanism to help offset the negative impact from Trump’s tariff hikes. USD/CNY has been held just below the 7.3000-level over the Christmas holiday period and domestic policymakers are likely to continue to favour a gradual move lower for the renminbi rather than sharp one-off adjustment. Our latest forecasts show the renminbi weakening against the US dollar throughout 2025 moving up towards the 7.5000-level with risks skewed in favour of a bigger move higher for USD/CNY.

USD/CNY IS FINISHING 2024 AT YEAR TO DATE HIGHS

Source: Bloomberg, Macrobond & MUFG GMR

JPY: Verbal intervention helps to slow USD/JPY’s move back towards 160.00

The yen has finished this year on a weaker footing with USD/JPY rising back up to the high 150.00-levels as it moves closer to the year to date high of 161.95 set in July. The renewed yen sell-off in December has been driven by two main factors. Firstly, as highlighted above yields in the US have adjusted higher to price in the potential inflationary impact from the incoming Trump administration’s policy agenda including tariff hikes, tighter immigration policy and maintaining loose fiscal policy. Some Fed officials already started to take that into consideration at this month’s FOMC meeting when they unveiled plans for only two rate cuts next year.

Secondly, the BoJ have expressed more caution over continuing to raise rates. After leaving their policy rate unchanged again this month, Governor Ueda delivered a dovish message in the press conference when he signalled that the next rate hike may not be delivered until at least March when they would have more information on wage growth in Japan and President-elect Trump’s policy agenda at the start of his second term. The Japanese rate market is now pricing in around 18bp of hikes by March and only 10bps for next month. The subsequent release of the minutes from the December policy meeting has since indicated that a rate hike as early as next month can’t be completely ruled out. If the yen continues to weaken ahead of the 24th January policy meeting lifting USD/JPY up closer to this year’s highs then the BoJ could come under pressure to speed up rate hikes. Government officials have already stepped up verbal intervention over the holiday period in an attempt to provide more support for the yen.

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

SZ |

08:00 |

Official Reserves Assets |

Nov |

-- |

810.3B |

! |

|

US |

13:55 |

Redbook (YoY) |

-- |

-- |

5.9% |

! |

|

US |

14:00 |

House Price Index (MoM) |

Oct |

0.5% |

0.7% |

! |

|

US |

14:00 |

S&P/CS HPI Composite - 20 s.a. (MoM) |

Oct |

-- |

0.2% |

! |

|

US |

15:30 |

Dallas Fed Services Revenues |

Dec |

-- |

10.9 |

! |

|

US |

15:30 |

Texas Services Sector Outlook |

Dec |

-- |

9.8 |

! |

Source: Bloomberg