BoJ hikes rates and cuts JGB buying with hawkish guidance

JPY: Limited yen move after yesterday’s gains

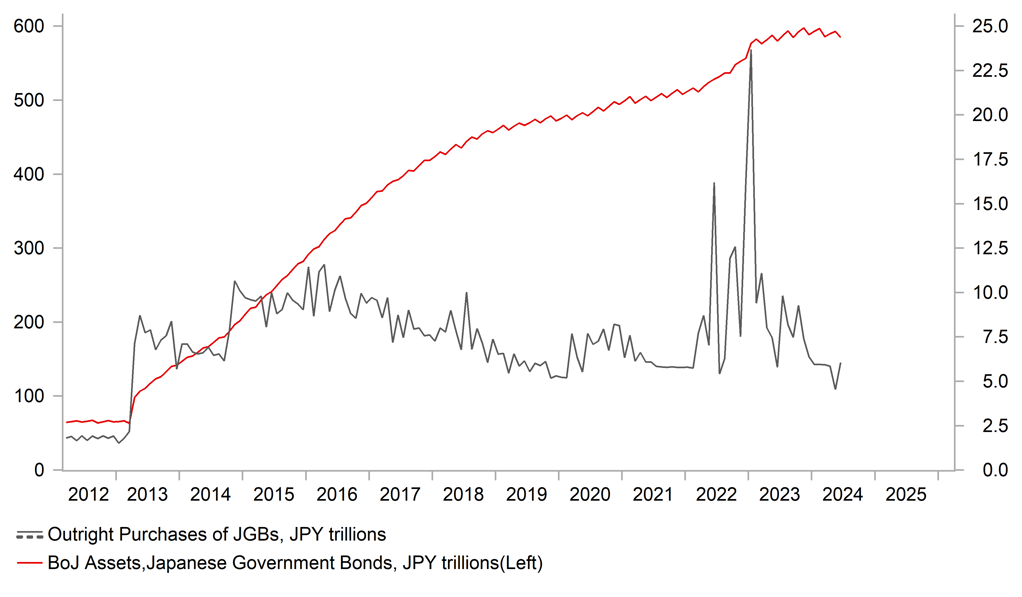

The yen reaction to the BoJ policy decisions is so far muted but that should not take away from what we believe is the key message here – the BoJ decisions are overall hawkish with less than half of market participants expecting the rate hike (MUFG called for a 15bp hike) while the JGB buying plan is roughly in line with expectations. Yes, there were some expecting something a bit more aggressive (JPY 0.5trn reduction per quarter) but at JPY 0.4trn, the JGB buying reduction per quarter through to Q1 2026 is roughly as expected and will take the monthly purchase rate of JGBs to approx. JPY 2.9trn by Q1 2026. The yen reaction so far must therefore be taken in the context of the leaked news story from NHK yesterday, the Japanese broadcaster that the BoJ were discussing raising the policy rate by 15bps at the meeting. That headline hit the Bloomberg terminal at just after 16:00 BST and USD/JPY dropped sharply from 154.70 – so from that point, USD/JPY has dropped two big figures, which to us is the scale of move you may have expected to see following this announcement.

Beyond the key announcements though there are other hawkish aspects to this announcement that should help provide support for the yen going forward. The most important is the guidance – the BoJ has now lowered the bar for further hikes with an explicit bias to tighten further going forward. As long as the BoJ believes the July Outlook report forecasts are being realised, the BoJ “will accordingly continue to raise the policy interest rate and adjust the degree of monetary accommodation”.

The updated forecasts have not changed notably, which again underlines the prospect of rate hikes under a status quo scenario. The nationwide core CPI forecast for this fiscal year was lowered from 2.8% to 2.5% but then the FY25 level was raised from 1.9% to 2.1% while FY26 was unchanged at 1.9%. This is more technical than anything with the extension of energy subsidies lowering this year’s forecast and the base effect from that lifting the FY25 forecast. The BoJ also clearly cited upside risks to the inflation projections for this year and next with a balanced risk assessment for FY26.

We see today’s decision as good news and can only help reinforce the optimism and expectations that Japan’s period of deflation has come to an end. While the growth projection was lowered (0.6% vs 0.8% previously), household consumption has been weaker in part due to higher inflation hitting real incomes, just like in Europe. Japan’s bank index has jumped 5% on this announcement with the Topix up 1.5%.

For the yen, in addition to the yen appreciation since the NHK announcement yesterday, we do also have the FOMC and BoE meetings to contend with and for USD/JPY the drop in US yields in July has been responsible for 75% of the spread move favouring the yen. So we need to get confirmation of that outcome this evening but assuming that meeting keeps the market priced for a September rate cut, USD/JPY has scope to move lower, even after the 10 big figure drop in July. The BoJ statement is emphasising the fact that real interest rates are at “significantly low levels” and hence the bias to tighten again. The OIS market is pricing for another hike by year-end which we would view as a reasonable scenario at this juncture. BoJ Governor Ueda is about to commence his press conference and we will provide further update if required.

BOJ TO CUT JGB BUYING PACE TO 2.9TRN BY Q1 2026 IMPLYING A 7-8% DROP IN TOTAL JGB HOLDINGS

Source: Macrobond & Bloomberg

USD: Powell to be more confident on coming rate cut

The dollar has continued to perform well in recent days despite front-end yields remaining close to recent lows after a notable drop throughout July – the 2yr UST note yield is down 40bps from the intra-day high on 1st July. The price action in FX certainly looks to be de-linking from US yields with the dollar (DXY basis) close to having fully retraced the drop since the weaker than expected CPI data on 11th July (104.85) while the 2-year yield remains around 25bps lower and close to the recent low of 4.34%.

That does suggest to us that the Fed communication this evening will be important not just for how yields respond but for how broader market conditions respond too. There is a greater feel of risk-off / dollar strength to the markets at present and hence corporate earnings results from the tech sector (Meta, today, Apple and Amazon tomorrow) could be just as important as the statement and communications from Fed Chair Powell in the press conference. Still, as always Powell’s words will be important and given that a 25bp rate cut is fully priced for September, Powell will need to provide some communication to hint that the FOMC has moved in that direction. The median dot from Fed officials currently only assumes one rate cut so we will need to see some evidence of a possible shift in thinking on that guidance in order to validate current market pricing and avoid a rebound in front-end yields.

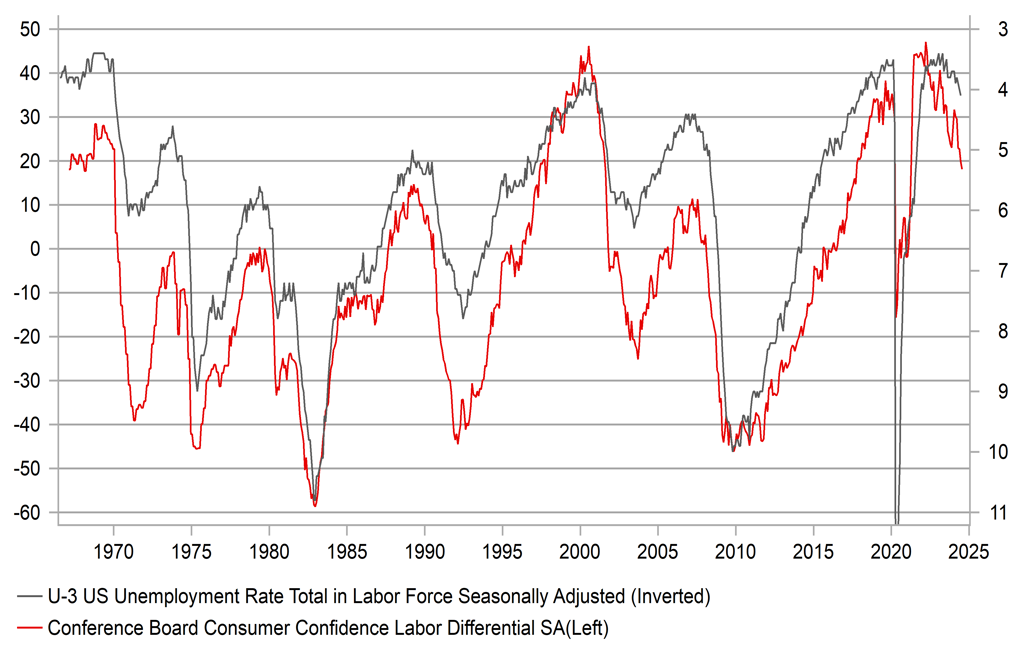

We certainly expect Powell to deliver and to present a surprisingly hawkish communication would be a big mistake. In our view the evidence continues to build that there is ample scope for removing some of the restrictiveness of the monetary stance. The latest was in the Consumer Confidence data yesterday – while the overall index moved higher, this was down to the expectations index rising, with the present conditions index falling again. The present conditions index is more a reflection of current labour market conditions – and conditions look to be worsening. The Labour Differential Index (jobs plentiful minus jobs hard to get) fell again in July to the lowest level since March 2021.

When Chair Powell spoke at his semi-annual testimony to Congress on 9th/10th July there was an acknowledgement that the two variables of the mandate (price stability and full employment) were now closer aligned and stated that this could allow for monetary easing if there was unexpected weakness in the labour market. We would expect some repetition of this kind of rhetoric with more focus on scenarios in which the FOMC could cut rather than hike.

Given the broader market conditions like the evidence of a break in the yield / FX correlation and the fragile risk appetite, any depreciation of the dollar on a signal of a cut from Powell this evening may not be sustained for long so we would be way of selling the dollar especially given a cut in September is fully priced. Falling commodity prices, record low yields in China and increased equity market volatility are not conditions for sustained dollar selling.

US CONSUMER CONFIDENCE LABOUR DIFFERENTIAL FALLS AGAIN AND SIGNALS IMMINENT RISE IN UNEMPLOYMENT RATE

Source: Macrobond, Bloomberg

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

GE |

08:55 |

German Unemployment Change |

Jul |

16K |

19K |

!! |

|

GE |

08:55 |

German Unemployment Rate |

Jul |

6.0% |

6.0% |

!! |

|

SZ |

09:00 |

ZEW Expectations |

Jul |

-- |

17.5 |

! |

|

IT |

10:00 |

Italian HICP (YoY) |

Jul |

1.2% |

0.9% |

! |

|

IT |

10:00 |

Italian HICP (MoM) |

Jul |

-1.1% |

0.2% |

! |

|

EC |

10:00 |

Core CPI (MoM) |

Jul |

-- |

0.4% |

!!! |

|

EC |

10:00 |

Core CPI (YoY) |

Jul |

2.8% |

2.9% |

!!!! |

|

EC |

10:00 |

CPI (YoY) |

Jul |

2.5% |

2.5% |

!!! |

|

EC |

10:00 |

CPI (MoM) |

Jul |

-- |

0.2% |

!!! |

|

US |

12:00 |

MBA Mortgage Applications (WoW) |

-- |

-- |

-2.2% |

! |

|

US |

13:15 |

ADP Nonfarm Employment Change |

Jul |

147K |

150K |

!!!! |

|

US |

13:30 |

Employment Benefits (QoQ) |

Q2 |

-- |

1.10% |

!! |

|

US |

13:30 |

Employment Cost Index (QoQ) |

Q2 |

1.0% |

1.2% |

!!!! |

|

US |

13:30 |

Employment Wages (QoQ) |

Q2 |

-- |

1.10% |

!!! |

|

CA |

13:30 |

GDP (MoM) |

May |

0.2% |

0.3% |

!! |

|

US |

14:45 |

Chicago PMI |

Jul |

44.8 |

47.4 |

!! |

|

US |

15:00 |

Pending Home Sales (MoM) |

Jun |

1.4% |

-2.1% |

!! |

|

US |

15:00 |

Pending Home Sales Index |

Jun |

-- |

70.8 |

! |

|

US |

19:00 |

FOMC Statement |

-- |

-- |

-- |

!!!!! |

|

US |

19:00 |

Fed Interest Rate Decision |

-- |

5.50% |

5.50% |

!!! |

|

US |

19:30 |

FOMC Press Conference |

-- |

-- |

-- |

!!!!! |

Source: Bloomberg