Easing bank concerns & growth optimism to help risk

USD: Weaker dollar factors

Banking sector fears in the US have continued to ease which has helped to lift risk appetite generally with equity markets in Asia stronger across the board and the US dollar weaker against most of G10 and Asia. The latest balance sheet data from the Federal Reserve last night revealed a reduction in the usage of liquidity windows to support banks suggesting the strains in the banking sector are easing. The Bank Term Funding Program had USD 64.4bn outstanding, up from USD 53.7bn but the Discount Window saw a reduction from USD 110.2bn to USD 88.2bn. Combined the total usage declined from USD 163.9bn to USD 152.6bn. The drop of course is modest but at least it helps lift expectations that the steps taken are addressing the problems and easing the stress and liquidity risks in the banking system.

The additional focus in the data is on the Foreign and International Monetary Authorities repo facility as this showed an increase of USD 60bn last week. This declined modestly as well to USD 55bn. Finally, the loans to the FDIC for SVB and Signature bank increased modestly, from USD 179.8bn to USD 180.1bn. The conclusion here is; yes, the strains have eased somewhat but the decline in support evident in the Fed balance sheet data is hardly on a scale to prompt celebration. This therefore may be helpful for risk but it hasn’t changed the dial much in regard to expectations of future Fed policy action with the OIS market still indicating nearly 50bps of easing by December. That’s key for the dollar and it will be difficult to see any real rebound for the dollar with the market expecting rate cuts. We still see a greater risk of the extent of easing priced in the US declining the longer banking sector conditions remain stable which would likely see some recovery for the dollar.

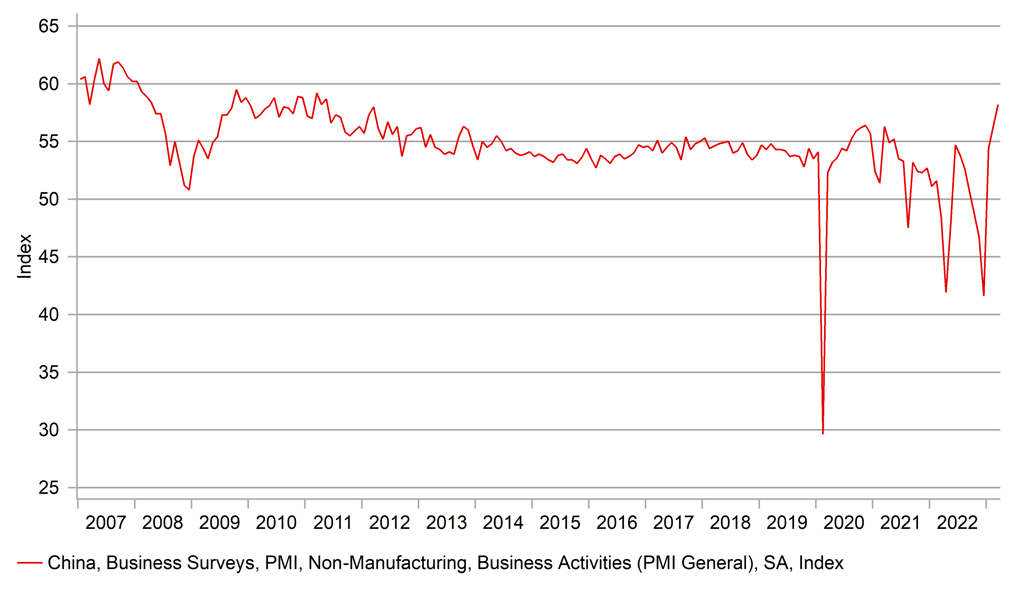

Global risk today has also been helped by the data from China that revealed further signs of strong recovery in China economic activity. The non-manufacturing PMI (where the post-covid rebound would likely be strongest) revealed a jump from 56.3 to 58.2 – the highest reading since May 2011 when post GFC record stimulus was fuelling surging economic growth. There is clearly pent-up demand unfolding in China and that likely has more to run over the coming months which should help global growth expectations and provide support for Asia FX versus the dollar.

SLOWING CREDIT GROWTH IN THE EURO-ZONE

Source: Macrobond & MUFG GMR

EUR: Inflation in focus after big drop in Germany

The euro-zone flash CPI data for March will be released later today and we are now at the point when energy base-effects will start to kick in with the energy inflation surge from a year ago beginning to fall out of the annual calculations. March 2022 was the first month of that and hence the annual inflation consensus for the euro-zone is for a drop from 8.5% in February to 7.1% in March. However, the core rate is set to creep marginally higher from 5.6% to 5.7%. The extent of the base effect was more apparent in Spanish inflation data yesterday with the overall CPI YoY rate falling from 6.0% to 3.1%. However, the core rate stands at 7.5%.

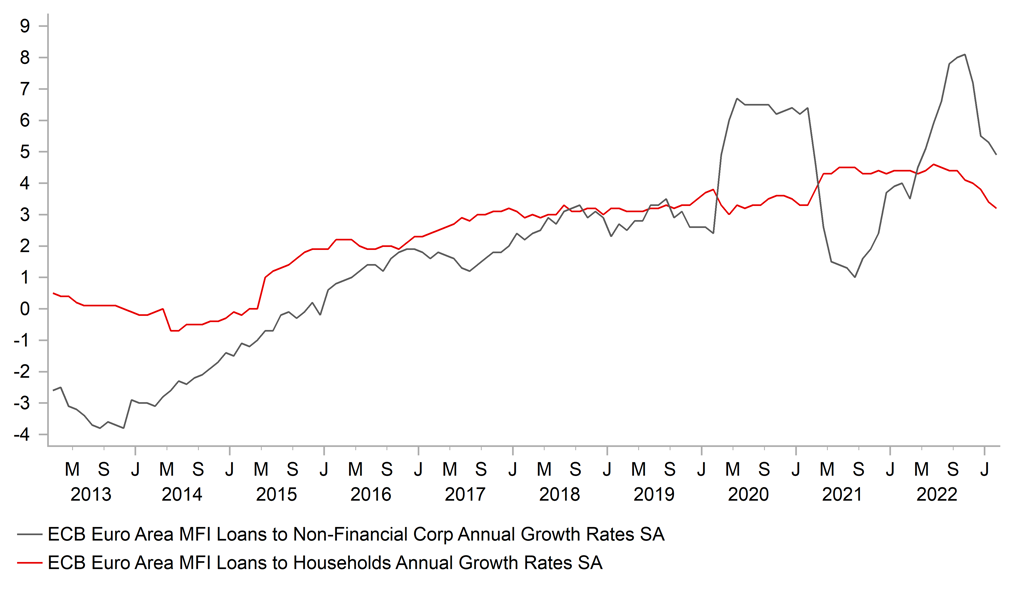

The German data yesterday revealed the extent of the impact with the annual inflation rate slowing from 9.3% to 7.8% as the annual rate of natural gas prices declined sharply. The drop though was a little less than expected which suggests upside risks to the euro-zone consensus today. The still high levels of core inflation and the mathematical nature of the base-effect decline will mean limited market reaction today, it still marks a key turning point and the easing of energy inflation will play a key role in reducing wage inflation risks and shaping inflation expectations which will help ease core inflation pressures later in the year. A credit slowdown was already evident in the data before the events of this month. Both the rate of growth for household loans and loans to non-financial corporations has slowed markedly so the credit impulse is already a growth negative for the euro-zone and opens up scope for underlying inflation to slow later in the year.

We remain unconvinced that the ECB will have to tighten by a further 50bps but expectations continue to grind higher with the 2yr government bond spread more indicative of EUR/USD trading up closer to 1.1500. But with the market still priced for about 50bps of easing from the Fed by year-end, that spread looks set to continuing supporting EUR/USD for now. We remain wary over that spread dynamic remaining so compelling which could prompt a correction in EUR/USD – next week’s US data may be the catalyst for that if the data remains resilient. Month-end (quarter-end and FY-end for Japan) FX flows today could also spark some unpredictable moves that could alter the complexion of the market ahead of the key data from the US next week.

SLOWING CREDIT GROWTH IN THE EURO-ZONE

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

GE |

08:55 |

German Unemployment Change |

Mar |

3K |

2K |

! |

|

GE |

08:55 |

German Unemployment Rate |

Mar |

5.5% |

5.5% |

!! |

|

NO |

09:00 |

Unemployment Rate n.s.a. |

Mar |

1.90% |

1.90% |

! |

|

IT |

10:00 |

Italian HICP (YoY) |

Mar |

8.9% |

9.8% |

!! |

|

IT |

10:00 |

Italian HICP (MoM) |

Mar |

1.4% |

0.1% |

!! |

|

EC |

10:00 |

Core CPI (YoY) |

-- |

5.7% |

5.6% |

!!! |

|

EC |

10:00 |

Core CPI (MoM) |

-- |

-- |

0.8% |

!!! |

|

EC |

10:00 |

CPI (MoM) |

-- |

-- |

0.8% |

!!! |

|

EC |

10:00 |

CPI (YoY) |

Mar |

7.1% |

8.5% |

!!! |

|

EC |

10:00 |

Unemployment Rate |

Feb |

6.7% |

6.7% |

! |

|

US |

13:30 |

Core PCE Price Index (MoM) |

Feb |

0.4% |

0.6% |

!!! |

|

US |

13:30 |

Core PCE Price Index (YoY) |

Feb |

4.7% |

4.7% |

!!! |

|

US |

13:30 |

Personal Income (MoM) |

Feb |

0.2% |

0.6% |

! |

|

US |

13:30 |

Personal Spending (MoM) |

Feb |

0.3% |

1.8% |

! |

|

CA |

13:30 |

GDP (MoM) |

Jan |

0.3% |

-0.1% |

!! |

|

US |

14:45 |

Chicago PMI |

Mar |

43.4 |

43.6 |

!! |

|

US |

15:00 |

Michigan 5-Year Inflation Expectations |

Mar |

2.80% |

2.90% |

!! |

|

US |

15:00 |

Michigan Consumer Expectations |

Mar |

61.5 |

64.7 |

!! |

|

US |

15:00 |

Michigan Inflation Expectations |

Mar |

3.8% |

4.1% |

!! |

|

EC |

16:00 |

ECB President Lagarde Speaks |

-- |

-- |

-- |

!!! |

|

US |

20:05 |

FOMC Member Williams Speaks |

-- |

-- |

-- |

!! |

|

US |

22:45 |

Fed Governor Cook Speaks |

-- |

-- |

-- |

! |

Source: Bloomberg