Trump criminal conviction injects more uncertainty into US election outcome

USD: US economy & heightened US political uncertainty in focus

The major foreign exchange rates have remained relatively stable overnight after the US dollar corrected modestly lower yesterday. It has resulted in USD/JPY falling back below the 157.00-level. The main trigger for the US dollar’s setback was the release yesterday of softer US economic data although it has not significantly altered market expectations for Fed rate cuts later this year. The release of the second estimate of US GDP for Q1 revealed that growth was revised lower by 0.3 point to an annualized rate of 1.3%. The main drivers for the downward revision to growth were: i) a bigger drag from goods consumption which subtracted -0.42 point from GDP, ii) the contribution from CAPEX was revised to close to flat from an initial estimated contribution of +0.1 point, and iii) a bigger drag from inventories which subtracted -0.45 point from growth. Similarly, growth in final sales to private domestic purchasers was revised lower by 0.3 point to 2.8% in Q1. It highlights that despite the revision, underlying domestic demand growth remained strong for the third consecutive quarter.

At the same time, the report revealed a marginal downward revision to the core PCE price index by 0.1 point to 3.6% in Q1. It still marks a significant pick up in core inflation pressures at the start of this year after expanding by around 2% in 2H of last year. Market participants will be closely watching the release later today of the latest PCE deflator report for April for further confirmation that the recent pick-up in core inflation eased at the start of Q2. The Bloomberg consensus forecast is looking for the core PCE deflator to slow to +0.2%M/M in April after increasing by +0.3%M/M in both February and March. In a speech yesterday to the Economic Club of New York, New York Fed President Williams stated that he remains confident that inflation will resume moderating in the 2H of this year as the economy is coming into better balance and disinflation is taking place in other economies. He also sees ample evidence that the behaviour of the economy over the past year provides ample evidence that monetary policy is restrictive in a way that helps achieve their goals. Yet he does not feel any urgency or need to make a decision now on when he’d be willing to support a rate cut. The timing of the first rate cut will be data dependent and recent inflation data has not supported cutting rates.

The other main development in the US yesterday was the announcement that former President Trump has been found guilty on 34 counts of falsifying business records for payments made to his former lawyer Michael Cohen. It is the first time a former or serving US president has been found guilty of committing a crime, and Trump is the first presumptive major-party nominee to become a convicted felon as well. The unprecedented development injects additional uncertainty into the outcome from the US election in November. He will now be sentenced on 11th July just days before the Republican National Convention on 15th July where the Republican party is set to officially select Donald Trump as its presidential nominee. According to Bloomberg, a typical defendant convicted of a felony charge is sentenced to serve some prison time, but there is nothing in the law that requires it. The judge could instead sentence Trump to probation given his age and that he is first time offender with no criminal record, and could also be ordered to pay a financial penalty. Donald Trump has immediately vowed to appeal against the verdict, and it would be up to the judge to decide whether to jail Trump if that sentence is delivered or remain free while he appeals. The appeal process could run beyond the US election. However, the developments do not mean that Trump can’t run for office. Market participants will be watching closely to see if the guilty verdict has a significant negative impact on his public support. Prior to the verdict Trump held narrow leads in key swing states putting him in a strong position to be re-elected as president for a second term. Evidence of softening support for Trump would help to ease upside risks for the US dollar later this year, but that is far from guaranteed at this stage.

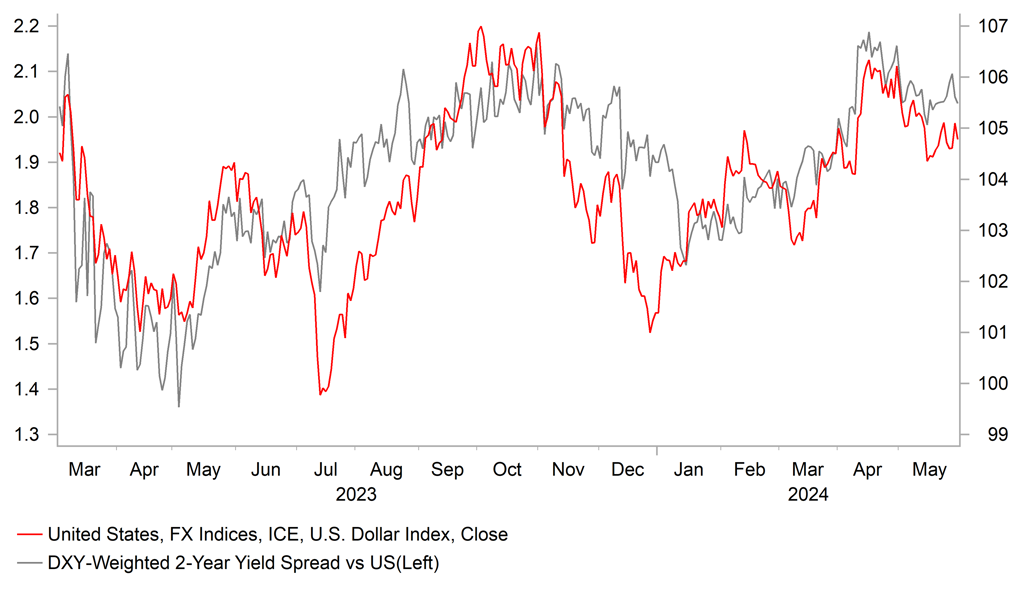

USD PERFORMANCE REMAINS CLOSELY LINKED TO YIELD SPREADS

Source: Bloomberg, Macrobond & MUFG GMR

CHF/SEK: More evidence of stronger growth in Europe

The European currencies of the Swedish krona and Swiss franc were two of the best performing G10 currencies yesterday. It has resulted in EUR/SEK and EUR/CHF falling back below 0.9900 and 11.500 respectively. For this month as a whole the Swedish krona has been the second best performing G10 currency after the Norwegian krone, while the recent rebound for the Swiss franc represents more of near-term reversal. For most of this year the Swiss franc has weakened markedly alongside the other low yielding funding currency of the yen.

The Swedish krona and Swiss franc both benefitted yesterday from the release of further evidence revealing that European economies staged a stronger than expected recoveries at the start of this year. Sweden’s economy expanded strongly by +0.7%Q/Q in Q1 and the middle contraction of -0.1%Q/Q in Q4 was revised away to show flat growth. However the breakdown of growth in Q1 did reveal that it overstated the underlying health of the economy. Net trade added 0.5ppt to growth and household consumption contracted again as did investments in dwellings. While the growth was much stronger than the flat growth that the Riksbank was forecasting for Q1, it is unlikely to materially alter their plans to deliver two further rate cuts in the second half of this year.

At the same time economic growth in Switzerland surprised to the upside in Q1 when GDP expanded by +0.5%Q/Q. It was the strongest quarter of growth since Q2 2022. The combination of stronger Swiss growth and hawkish comments for SNB President Jordan have triggered a squeeze of popular short Swiss franc funding positions. Comments from President Jordan indicated that the SNB is becoming less tolerant to further Swiss franc weakness. He stated that the Swiss franc is currently the most likely source of higher Swiss inflation, and could counteract this by “selling foreign exchange”. The developments have encouraged market participants to scale back expectations for the SNB to deliver back to back rate cuts in June. The Swiss rate market is now pricing in only 9bps of cuts by June and 20bps by year end. The developments make us more confident that the bulk of the adjustment lower for the Swiss franc has now been completed.

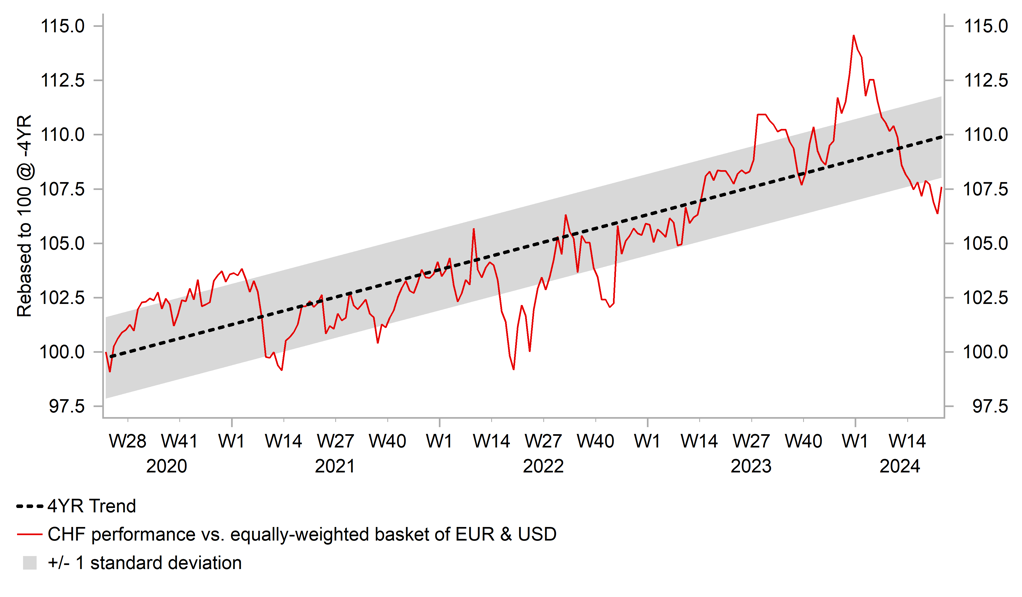

SNB SIGNALS MORE CONERN OVER CHF WEAKNESS

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

IT |

09:00 |

Italian GDP (QoQ) |

Q1 |

0.3% |

0.2% |

! |

|

EC |

10:00 |

Core CPI (YoY) |

-- |

2.7% |

2.7% |

!! |

|

EC |

10:00 |

CPI (YoY) |

May |

2.5% |

2.4% |

!!! |

|

US |

13:30 |

Core PCE Price Index (MoM) |

Apr |

0.3% |

0.3% |

!!! |

|

CA |

13:30 |

GDP Annualized (QoQ) |

Q1 |

2.2% |

1.0% |

!! |

|

US |

23:15 |

FOMC Member Bostic Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg