JPY reverses post-election losses after BoJ policy update

JPY: Governor Ueda appears less concerned by hurdles to further rate hikes

The yen has continued to rebound overnight resulting in USD/JPY falling further below the high from the start of this week at 153.88. The pair has now reversed the initial move higher following the election in Japan at the weekend that resulted in the government losing its majority in parliament. The yen has continued to rebound following the BoJ’s latest policy update although there were no significant policy changes. In the accompanying press conference Governor Ueda reiterated that the BoJ will continue to raise rates if the outlook for the economy is realized. The updated economic forecasts from the Outlook for Economic Activity ad Prices report revealed that the majority of Board members still expect inflation to meet their 2.0% target in the coming fiscal years. The forecast for CPI less fresh food was lowered marginally by 0.1 point to 1.9% for FY2025 but remained unchanged at 1.9% for FY2026. The marginal downgrade to the FY2025 forecast was due to the recent decline in the price of oil and does not reflect a significant loss of confidence in the inflation outlook. For the same fiscal year, the BoJ kept its assessment that risks are titled to the upside for the inflation forecasts. Two of the reasons why the BoJ became more cautious over raising rates further at the previous policy meeting in September were the much stronger yen and financial market instability over the summer.

However, Governor Ueda did seem less concerned by financial market developments in today’s press conference. He stated that the markets rout in early August had no negative impact on Japan’s financial system and no huge negative impact is seen on lenders’ sentiment from the July rate hike. He believes markets have slowly regained stability. At the same time, he expressed more optimism over the performance of the US economy which he described as having quite good results recently although can’t be full relieved yet. The updated policy statement added in the line today that “the Bank needs to pay due attention to the future course of overseas economies, particularly the US economy”.

On the yen, Governor Ueda added that they want to judge the impact of the weak currency and its background. Overall the comments create the impression that obstacles in the way of the BoJ hiking rates further have diminished since their last policy meeting in September. When asked about the comments from the September meeting that the BoJ can afford to spend time scrutinizing risks, Governor Ueda stated that they don’t have to use that term today. It supports our forecast for the BoJ to raise rates sooner than current market expectations although we have pushed back the timing of our forecast for the next rate hike from December to January in light of recent political instability in Japan. One final rate hike this year can’t be completely ruled out if the yen weakens sharply after the US election. Governor Ueda also highlighted that the BoJ will reveal the results of the broad policy review at the next meeting in December. He did though downplay any potential immediate impact that the policy review is likely to have on the BoJ’s policy stance at the December meeting. He indicated it is more likely to include an insight into the BoJ’s views on the neutral policy rate providing more insight into future policy direction.

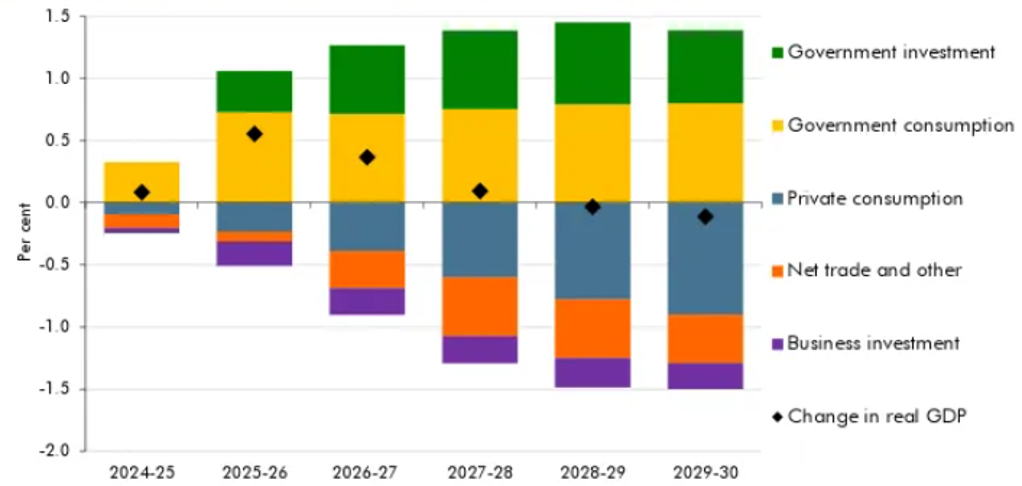

UK BUDGET IS EXPECTED TO DELIVER SHORT-TERM BOOST TO GROWTH

Source: OBR: Economic & Fiscal Outlook October 2024

EUR/GBP: Hawkish repricing of BoE & ECB policy expectations

The euro was one of the best performing G10 currencies yesterday supported by the hawkish repricing of ECB rate cut expectations. It has resulted in EUR/USD rising back up towards resistance from the 200-day moving average that comes in at around 1.0870 while EUR/GBP hit an intra-day high overnight at 0.8382. In recent weeks, market participants have become increasingly pessimistic over the outlook for growth in the euro-zone with leading indicators point to slowing growth momentum heading into year end. Building concern over slowing growth in the euro-zone was one of the reasons cited by the ECB when they decided to deliver a back-to-back rate cut earlier this month. However, the release yesterday of the latest GDP reports for Q3 revealed that the euro-zone economy performed much better than expected. Economic growth unexpectedly picked-up to +0.4% in Q3 from +0.2% in Q2. It was the fastest quarter of growth since Q3 2022. Growth surprised to the upside in France (+0.4%), Germany (+0.2%) and Spain (+0.8%) which offset a downside surprise in Italy (0.0%). At the same time, inflation readings from Germany surprised to the upside ahead of the release today of the euro-zone CPI report for October. The developments have prompted market participants to scale back expectations for the ECB to deliver larger 50bps rate cuts providing support for the euro.

There was also a hawkish repricing of BoE rate cut expectations following the release of the Budget although it has not initially encouraged a stronger GBP. The OBR announced that they expect the Budget policies to deliver a temporary boost to growth in the near-term. They estimate that the policy package will boost real GDP by 0.6% at its peak in 2025-26 as the fiscal loosening temporarily raises output above its potential level (1.6%). Growth is expected to pick-up to 2.0% in 2025 from 1.1% this year as a small positive output gap opens up. It will also help to lift inflation to 2.6% in 2025 due to the direct and indirect impact of the Budget measures. The OBR estimates that the Budget measures will increase inflation by 0.4 percentage points at their peak effect in 2026. The combination of stronger growth and inflation will curtail room for the BoE to keep cutting rates in the year ahead. We are now less confident that the BoE will deliver back-to-back rate cuts in November and December. Higher yields for longer should help to maintain a stronger pound. The other reason why long-term yields increased was the government’s plans for increased borrowing. The net effect of the Budget is to increase borrowing by GBP19.6 billion this year and by an average of BP32.3 billion over the next five years. Budget spending policies will add GBP69.5 billion a year over the next five years. Of which only GBP36.2 billion a year will be offset by Budget tax raising measures.

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

IT |

09:00 |

Unemployment Rate |

Sep |

6.2% |

6.2% |

!! |

|

EC |

10:00 |

CPI Estimate YoY |

Oct |

1.9% |

1.7% |

!!! |

|

EC |

10:00 |

CPI Core YoY |

Oct P |

2.6% |

2.7% |

!!! |

|

US |

11:30 |

Challenger Job Cuts YoY |

Oct |

-- |

53.4% |

!! |

|

US |

12:30 |

Employment Cost Index |

3Q |

0.9% |

0.9% |

!!! |

|

CA |

12:30 |

GDP MoM |

Aug |

- |

0.2% |

!!! |

|

US |

12:30 |

Core PCE Price Index MoM |

Sep |

0.3% |

0.1% |

!!! |

|

US |

12:30 |

Initial Jobless Claims |

Oct-26 |

230k |

227k |

!! |

Source: Bloomberg