Political risks continue to impact the FX market

AUD: Political risks and weak Australian GDP in focus

The biggest mover during the Asian trading session has been the South Korean won which is rebounding following yesterday’s sharp sell-off. After hitting a high yesterday of 1,444.1, USD/KRW has fallen back towards the 1,400.0-level overnight. After imposing martial law yesterday in South Korea, President Yoon Suk Yeol has quickly backed down and rescinded martial law after Korean assembly members passed a vote to overturn martial law in spite of efforts by the police and special forces to secure the building to prevent the vote. The failed “auto-coup” is likely to lead to President Yoon being impeached followed by new presidential elections. According to reports, parliament may vote on an impeachment motion on 7th December at the latest after the main opposition party the Democratic Party and five other opposition parties submitted the motion today. Impeachment would require support from two thirds of parliament thereby requiring support from 8 members from the ruling party as well. In an effort to dampen financial market volatility, the BoK held an extraordinary meeting just a week after delivering a surprise rate cut. The BoK stated that it will increase short-term liquidity and take “active” steps in the FX market as needed to ensure stability. While there is relief that the period of martial law proved to be short-lived which should limit economic disruption and dampen initial fears over disruption to global semiconductor supply, it could have a more lasting impact on investor confidence towards South Korea. The period of political instability comes at a bad time when South Korea is facing looming challenges including the potential threat of higher tariffs from the US. The US trade deficit with South Korea has more than doubled in recent years to USD62.8 billion in the twelve months to September compared to USD28.9 billion in the twelve months to September 2021.

We expect spill-overs to G10 currencies from political developments in South Korea to remain limited beyond the initial safe haven flows that saw the yen strengthen and US yields drop. The biggest mover amongst G10 currencies overnight has been the Australian dollar which has fallen by around -0.7% against the US dollar. The main trigger was the release of the latest Australian GDP report for Q3. The report revealed that the economy expanded more weakly than expected by 0.3%Q/Q in Q3 resulting in the annual rate of growth slowing to just 0.8%. The RBA had been expecting growth of 0.4%Q/Q as outlined in the November Statement on Monetary Policy. After revisions to prior data, the level of output was in line with the RBA’s forecast level. The breakdown of growth revealed that public consumption was the main driver of growth contributing 0.3ppt to growth. In contrast, private consumption fell marginally by -0.04%Q/Q in Q3 following a -0.3% drop in Q2. The continued weak performance of Australia’s economy will keep pressure on the RBA to lower rates although is unlikely to be sufficient on its own to encourage the RBA to cut rates as soon as this month.

Market attention will then shift later today to political risks in France. Lawmakers are expected to begin debating the no confidence motion later today at 4pm in Paris according to Bloomberg with voting likely to start shortly thereafter. With the National Rally expected to join the Left Alliance parties it currently appears that the government will be brought down. Prime Minister Barnier would then have to tender the resignation of the government. His outgoing cabinet would remain in place with limited powers to manage current affairs. The caretaker government will likely rely on untested emergency legislation to collect taxes and delver minimal spending it considers vital while French President Macron attempts to put together another government with no new legislative election allowed until July. The unfavourable political developments in France continue to pose a downside risk for the euro although are not necessarily sufficient to trigger another leg lower on their own.

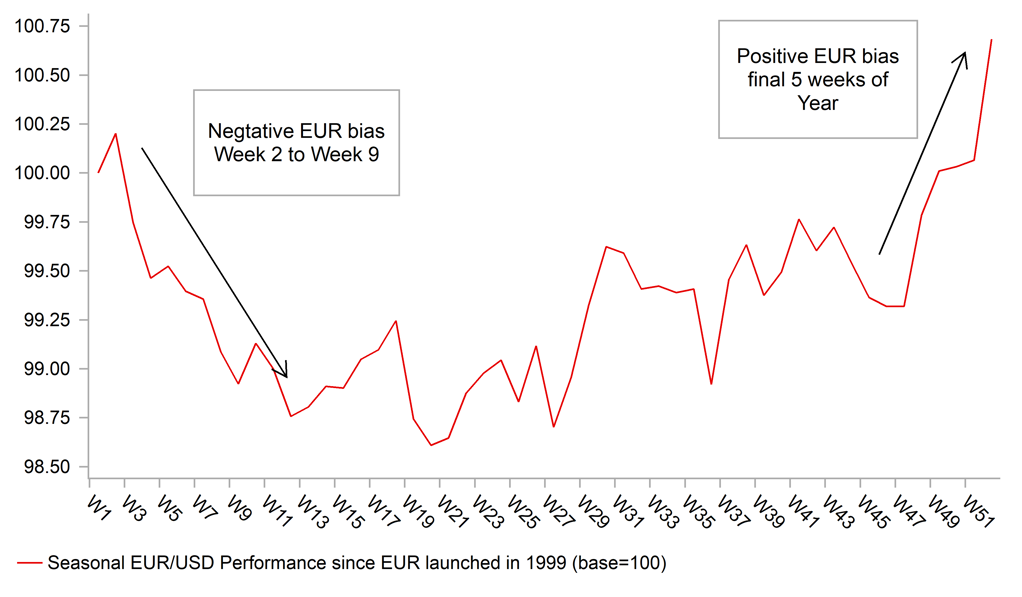

AVERAGE MOVE IN EUR/USD MOVES OVER LAST 24YRS (REBASED TO 100)

Source: Bloomberg, Macrobond & MUFG GMR

EUR: Seasonal bias higher is compelling

December trading began this week with a backdrop of quite a consistent seasonal bias favouring EUR/USD moving higher into the end of the year. Over the last ten years, the bias to the upside has been strong with eight of the last ten December showing a move higher in EUR/USD. In the last twenty years, EUR/USD has closed higher in December in fourteen of those years, a less compelling pattern but nonetheless still showing a 70% upside bias over that period of time. The scale of moves in December do not stand out (when 2008 is excluded) but when EUR/USD has moved higher in the last ten years, the average increase was 1.7% while in the two down years, the average was -1.8%. Over a 20-year period (including 2008), the average over the fourteen upside moves was 2.3% and in the six declines, the average was -2.1%. The last year EUR/USD declined in December was in 2016.

In this Friday’s FX Weekly we will analyse in more detail whether this December pattern is indeed “seasonal” or not. This could merely be coincidental and the data set is relatively small. This could relate in part to the reported bias shaping the behaviour of market participants that becomes part of the explanation behind the move.

But what could be behind such a move that could be explained by more fundamental developments in the market? There is certainly a pattern going into the end of the year related to positioning. The tendency of there being a positive carry more often than not in shorting EUR/USD does mean that positioning amongst Leveraged Funds does show a short EUR/USD position being run going into December. While the IMM data doesn’t necessarily show that position always being reduced in December, the fact that positioning in general is short EUR in seven of the last ten years may mean there is increased EUR demand within the speculative market going into year-end as positions are pared.

In addition there is a pattern of US equity markets outperforming European equity markets in the final month of the year and in the final quarter of the year. While not as compelling as the EUR/USD upside bias, the S&P 500 has outperformed the Euro Stoxx 600 in six of the last ten Decembers. On a quarterly basis, US markets have outperformed Europe in seven of the last ten final quarters of the year. Investors’ hedging flows are therefore biased toward increase US dollar selling and given the lighter volumes, especially in the final week of trading, these flows may have a tendency to help push EUR/USD higher. While month-end FX flows are well-known hedging flows can influence the market at other times, perhaps especially in December when volumes are lower. Please look out for our FX Weekly on Friday when we will analyse this seasonal bias in more detail.

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

GE |

08:55 |

German Composite PMI |

Nov |

47.3 |

48.6 |

!! |

|

GE |

08:55 |

German Services PMI |

Nov |

49.4 |

51.6 |

!! |

|

UK |

09:00 |

BoE Gov Bailey Speaks |

-- |

-- |

-- |

!!! |

|

EC |

09:00 |

S&P Global Composite PMI |

Nov |

48.1 |

50.0 |

!! |

|

EC |

09:00 |

Services PMI |

Nov |

49.2 |

51.6 |

!! |

|

UK |

09:30 |

Composite PMI |

Nov |

49.9 |

51.8 |

!!! |

|

UK |

09:30 |

Services PMI |

Nov |

50.0 |

52.0 |

!!! |

|

EC |

10:00 |

PPI (MoM) |

Oct |

0.4% |

-0.6% |

! |

|

EC |

10:00 |

PPI (YoY) |

Oct |

-- |

-3.4% |

! |

|

US |

12:00 |

MBA Mortgage Applications (WoW) |

-- |

-- |

6.3% |

! |

|

US |

13:15 |

ADP Nonfarm Employment Change |

Nov |

166K |

233K |

!!!! |

|

EC |

13:30 |

ECB President Lagarde Speaks |

-- |

-- |

-- |

!!! |

|

US |

14:45 |

S&P Global Composite PMI |

Nov |

55.3 |

54.1 |

!! |

|

US |

14:45 |

Services PMI |

Nov |

57.0 |

55.0 |

!! |

|

US |

15:00 |

Durables Excluding Defense (MoM) |

Oct |

0.4% |

0.4% |

! |

|

US |

15:00 |

Factory Orders (MoM) |

Oct |

0.3% |

-0.5% |

! |

|

US |

15:00 |

ISM Non-Manufacturing Business Activity |

Nov |

-- |

57.2 |

!!! |

|

EC |

15:30 |

ECB President Lagarde Speaks |

-- |

-- |

-- |

!! |

|

GE |

17:10 |

German Buba President Nagel Speaks |

-- |

-- |

-- |

!! |

|

US |

18:45 |

Fed Chair Powell Speaks |

-- |

-- |

-- |

!!!! |

|

US |

19:00 |

Beige Book |

-- |

-- |

-- |

!! |

Source: Bloomberg