Fed gives green light for further US dollar weakness ahead of ECB meeting

USD: Is the Fed’s hiking cycle now over?

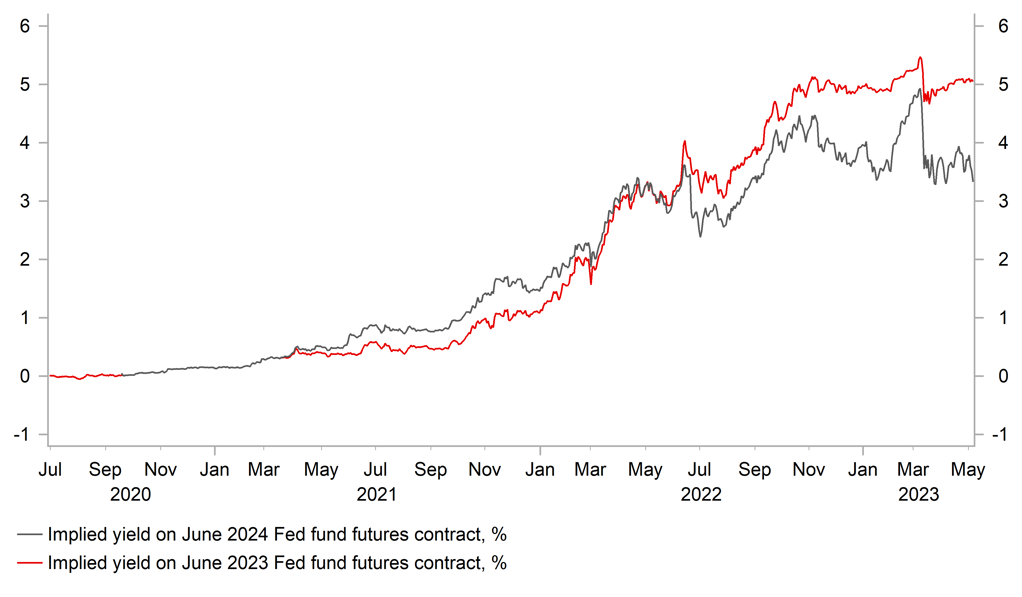

The US dollar has continued to trade at weaker levels during the Asian trading session following last night’s latest FOMC meeting. It has resulted in the dollar index moving back to within touching distance of the year to date low of 100.79 from last month. The pound and Swiss franc have already risen to fresh year to date highs against the US dollar while USD/JPY has continued to correct sharply lower hitting an intra-day low overnight of 134.35 as it moves further below the high from Tuesday at 137.77. The US dollar has weakened further against other major currencies in response to the Fed’s updated policy guidance that has signalled it is moving closer to pausing their rate hike cycle. It has triggered another move lower in US yields with the two-year US Treasury yield falling back to 3.80% from an intra-day high of 4.16% on Tuesday. The US rate market is no longer pricing in any further rate hikes from the Fed but has moved to price in more rate cuts (currently pricing in around 81bps) by the end of this year. The move lower in the US dollar and US yields was encouraged by the Fed’s decision to soften their guidance over the need for further rate hikes. In the policy statement, the Fed signalled that in determining the extent of additional policy firming that may be appropriate…“the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments”. While it is not a clear signal that the Fed has paused or finished their rate hike cycle, the Fed is less sure of the need for further hikes compared to at their last meeting when the guidance stated “the Committee anticipates that some additional policy firming may be appropriate”. In the press conference, Fed Chair Powell emphasized that policy setting would be data dependent going forward and that no decision has been made yet to pause their hiking cycle. However, he did provide dovish hints that the 25bps hike delivered overnight could be the last in the tightening cycle. He did note that the Fed is getting close “or maybe even there” in terms of setting sufficiently restrictive policy which was an important admission in our view.

We would even argue that the Fed should not have hiked rates again overnight at a time when there are further signs of distress in the regional banking system, and growth and inflation have slowed recently. The share prices of US regional banks fell sharply again yesterday to fresh lows while the Fed continued to hike rates with S&P’s regional bank index down a further -2.6% and bringing the cumulative decline since late last month to just over 11%. The worst loses have been sustained by PacWest Bancorp which has fallen by around -50% over the same period is now firmly in the market’s cross hairs after First Republic became the latest bank to fail over the weekend. The Fed’s actions suggest it is falling behind the curve and it is why market participants are increasingly pricing in rate cuts through the rest of this year as US recession risks continue to build. The Fed did at least add into the policy statement that “tighter credit conditions for households and businesses are likely to weigh on economic activity, hiring and inflation”. Overall, the developments support our view that the Fed has finished their hiking cycle. With the debt ceiling stand off set to intensify in the coming months and confidence in the banking sector continuing to deteriorate, it will be difficult for the Fed to hike at upcoming policy meetings in June and July. As a result, we remain confident the US dollar will weaken further against other major currencies (click here).

US RATE MARKET IS ANTICIPATNG FED POLICY REVERSAL

Source: Bloomberg, Macrobond & MUFG GMR

EUR: ECB to step down pace of hikes but leave door open to more hikes

The next key event for the FX market will be the ECB’s latest policy meeting later today. Ahead of the meeting, the EUR/USD rate is perched just below the year to date high from 26th April at 1.1095. Like the Fed overnight the ECB is expected to deliver a 25bps hike later today but there is a non-negligible risk that it could yet deliver one final larger 50bps hike. Recent comments from ECB policymakers including Chief Economist Lane signalled that it was still on the table as a policy option for today’s meeting. The euro-zone rate market though views a larger 50bps hike as highly unlikely and is currently pricing in around 31bps of hikes for today’s meeting.

The case for stepping down the pace of hikes to 25bps has been supported this week by the release of the latest bank lending survey that showed euro area banks indicated that their credit standards for loans or credit lines to enterprises tightened further substantially in the first quarter of 2023. The ECB noted that the pace of net tightening in credit standards remained at the highest level since the euro area sovereign debt crisis in 2011. It should give policymakers more reassurance that their tightening actions to date are having the desired impact and will help to slow growth and inflation in the euro-zone. The latest euro-zone CPI report for April also revealed a modest drop in the annual rate of core inflation although it remained elevated at 5.6%. The developments could be used by the President Lagarde today to justify stepping down the pace of hikes with the policy rate set to move into more restrictive territory above 3.00%. However, we do expect the ECB’s updated rate guidance to sound relatively more hawkish than the Fed’s supporting our updated forecast for a higher policy rate peak of 3.75%. The narrowing policy divergence supports our outlook for the euro to strengthen further against the US dollar (click here).

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

09:00 |

Services PMI |

Apr |

56.6 |

55.0 |

!!! |

|

UK |

09:30 |

BoE Consumer Credit |

Mar |

1.200B |

1.413B |

!! |

|

UK |

09:30 |

Services PMI |

Apr |

54.9 |

52.9 |

!!! |

|

EC |

10:00 |

PPI (YoY) |

Mar |

5.9% |

13.2% |

!! |

|

US |

12:30 |

Challenger Job Cuts |

Apr |

-- |

89.703K |

!! |

|

EC |

13:15 |

Deposit Facility Rate |

May |

3.25% |

3.00% |

!!! |

|

EC |

13:15 |

ECB Monetary Policy Statement |

-- |

-- |

-- |

!!! |

|

US |

13:30 |

Initial Jobless Claims |

-- |

240K |

230K |

!!! |

|

US |

13:30 |

Trade Balance |

Mar |

-63.30B |

-70.50B |

!! |

|

US |

13:30 |

Unit Labor Costs (QoQ) |

Q1 |

5.5% |

3.2% |

!!! |

|

EC |

13:45 |

ECB Press Conference |

-- |

-- |

-- |

!!! |

|

CA |

17:50 |

BoC Gov Macklem Speaks |

-- |

-- |

-- |

!!! |

Source: Bloomberg