BoJ rate hike speculation behind swings in the JPY

JPY: Will the BoJ hike in December or wait until January?

The yen has been the best performing G10 currency overnight resulting in USD/JPY falling back below the 150.00-level after hitting a high yesterday at 151.23. The stronger yen has been encouraged overnight by comments from BoJ board member Toyoaki Nakamura who stated that “I’m not against rate hikes” and that “it’s important to make decision based on data”. He added that he is closely watching upcoming wages data and the Tankan survey. The comments have boosted market expectations that the BoJ will raise rates again as soon as this month. There are currently around 9bps of hikes priced in for the 19th December policy meeting and 19bps for the following meeting on 24th January. Board member Nakamura is one of the most dovish BoJ members after voting against earlier rate hikes in March and July and also objecting to making adjustments to the BoJ’s yield curve control. Fluctuations in the yen in recent days have highlighted that the BoJ’s communication has not clearly signalled whether they will hike this month or wait until the next meeting in January. Th yen weakened yesterday after Market News released a report stating that the potential political reaction to rate hikes is making senior BoJ officials tend towards normalising policy more slowly, despite data showing it is moving towards achieving its inflation target. Given the BoJ’s concerns over politics, and also over how markets might react to hgiher rates, it means that an increase in the policy rate at the 19th December meeting will be unlikely unless USD/JPY rises up to the 160.00-level. A weaker yen would reportedly provide cover for BoJ to hike rates sooner this month. The Market News report went on to add that while BoJ officials are not presently overly concerned about the cost of delaying policy normalisation, they will not be able to delay rate hikes further should underlying inflation reach 2% or the chances of this occurring increase. After taking into account the conflicting signals over the timing of the BoJ’s next rate hike, we are sticking to our forecast for the next 25bps hike to be delivered at this month’s policy meeting. A development that would help the yen continue to outperform heading into year end. The BoJ remains on track to deliver further gradual rate hikes while other major central banks continue to cut rates.

The recent move lower in USD/JPY has been encouraged as well by the decline in US yields. The 2-year US Treasury yield hit a low yesterday of 4.11% as it continues to move further below the high from 22nd November at 4.38%. US yields continued to correct lower yesterday after the release of the much weaker than expected US ISM services survey for November. The 3.9 point drop in the ISM services survey was unexpected as the US election victory for Donald Trump and Red Sweep were expected to be welcomed to businesses as favourable for domestic growth. The survey will at least initially dampen any hopes for a pick-up in growth following the US election although the economy was already growing strongly at close to 3.0% prior to the election. Market attention will now focus on the release tomorrow of the latest nonfarm payrolls report for November to see if employment growth rebounded after weakness related to strikes and hurricane disruption in ‘October. We believe that a significant upside surprise will be required to prompt the Fed to skip cutting rates again this month. Comments from Fed Chair Powell overnight to the New York Times did though signal that the Fed is becoming more cautious over cutting rates. He stated that “we can afford to be a little more cautious as we try to find neutral”. He appears to be teeing up a skip at an upcoming policy meeting to slow the pace of easing indicating that another cut as soon as this month is not a done deal.

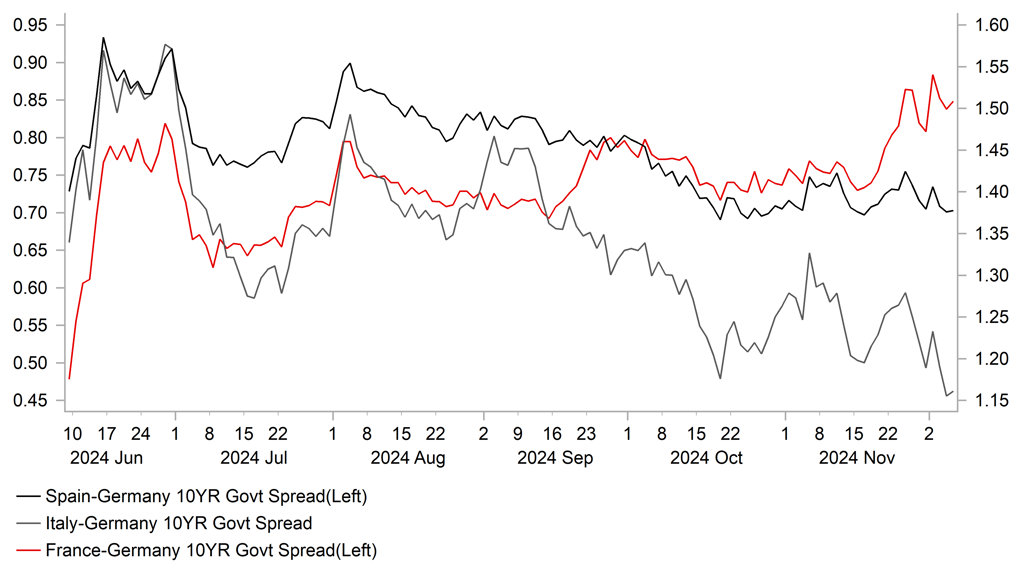

LIMITED CONTAGION HELPING TO DAMPEN NEGATIVE EUR IMPACT

Source: Bloomberg, Macrobond & MUFG GMR

EUR: French government falls but limited initial negative impact for euro

The euro has held up well overnight following the collapse of the French government yesterday afternoon. EUR/USD back closer to the 1.0500-level following the vote of no confidence in the French government but failed to break below and has since risen back to levels prior to the vote at around 1.0540. The limited euro sell-off highlights that the vote of no confidence was already well anticipated by market participants. French President Macron is scheduled to make a statement later this evening at 8pm, and will now be tasked with appointing a new premier. It could open the door to a technocratic government being put in place until new parliamentary elections can be held next year. The earliest date they can be held is in July. With the current government’s Budget for next year also rejected, an emergency budget would need to be passed. With the fiscal consolidation measures being implemented, the budget deficit could rise further above 6% of GDP. The French government bond market has moved to price in a higher fiscal risk premium to reflect the deteriorating budget outlook. The 10-year yield spread between French and German government bonds has widened by around 10bps over the past month hitting the highest level since the euro-zone debt crisis in 2012. However, there has been little evidence of contagion within other euro-zone government bond markets so far which is another reason why the negative euro reaction has been muted. The 10-year yield spread between Italian and German government bonds has even narrowed further indicating that Italian bonds are initially benefitting from the shift away from French bonds.

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

08:30 |

IHS S&P Global Construction PMI (MoM) |

Nov |

-- |

43.0 |

! |

|

FR |

08:45 |

French Government Budget Balance |

Oct |

-- |

-173.8B |

! |

|

US |

10:00 |

OPEC Meeting |

-- |

-- |

-- |

!! |

|

FR |

10:00 |

French 10-Year OAT Auction |

-- |

-- |

3.24% |

! |

|

FR |

10:00 |

French 30-Year OAT Auction |

-- |

-- |

3.78% |

! |

|

EC |

10:00 |

Retail Sales (MoM) |

Oct |

-0.4% |

0.5% |

! |

|

CA |

11:00 |

Leading Index (MoM) |

Nov |

-- |

0.25% |

! |

|

US |

12:30 |

Challenger Job Cuts |

Nov |

-- |

55.597K |

! |

|

US |

13:30 |

Initial Jobless Claims |

-- |

215K |

213K |

!!! |

|

US |

13:30 |

Trade Balance |

Oct |

-75.70B |

-84.40B |

!! |

|

CA |

13:30 |

Trade Balance |

Oct |

-0.60B |

-1.26B |

!! |

|

US |

16:30 |

FOMC Member Barkin Speaks |

-- |

-- |

-- |

! |

|

US |

21:30 |

Fed's Balance Sheet |

-- |

-- |

6,905B |

!! |

|

JP |

23:30 |

Overall wage income of employees |

Oct |

2.6% |

2.8% |

!! |

Source: Bloomberg