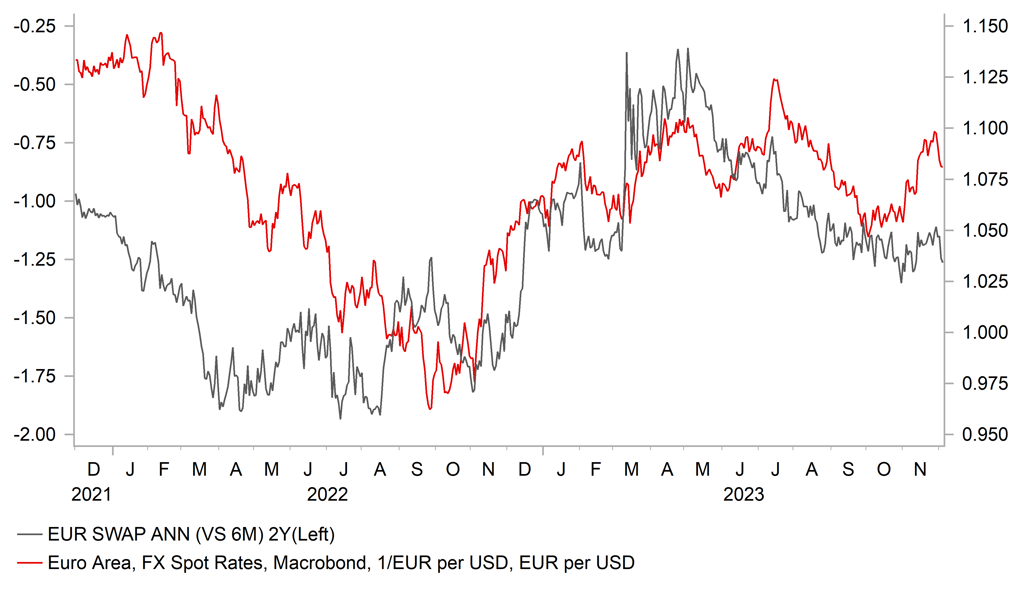

Short-end yields down sharper in EZ encourages EUR/USD retracement

USD: Rebound continues despite weak US data

The recovery of the US dollar over the last four trading days is a helpful reminder that FX is a relative price and while there is compelling evidence that the Fed’s tightening cycle is over and the labour market could be slowing, that same evidence is building elsewhere too and that has encouraged renewed selling of non-dollar G10 currencies as well. The RBA held rates yesterday and prior to the meeting the OIS market implied about a 25% probability of a rate hike at the meeting in February but following the meeting that gave no strong signal of a desire to hike again, that probability yesterday dropped sharply. It is a similar story in Europe as well and weak inflation data and some signs of a shift in tone from the ECB, rates at the front end of the curve have eased off. In the last seven trading days covering inflation releases across the euro-zone, the 2-year core yield has dropped 46bps. In the same period of the time the 2-year UST bond yield is down 35bps.

So the short-term yield has moved in favour of the US dollar and that has now prompted a re-think. This doesn’t surprise us and was one reason why we lowered our

EUR/USD forecasts for H1 2024 in our FX Outlook (here) despite the sharp rally in November. It seems premature to us to assume substantial gains for EUR/USD.

Of course Friday remains a key day for rate expectations in the US with the nonfarm payrolls data. The JOLTs report yesterday added to the belief that the labour market could now be about to convey clearer evidence of slowdown. The job openings total fell from a downwardly revised 9.35mn (9.55mn) to 8.73mn in October, the lowest total since March 2021. This tallies with the view that labour market participation is picking up as US consumer have run down their savings to levels that is encouraging a return to work. Fewer voluntary leavers from jobs is a likely by-product of this. The Quit rate remained unchanged at 2.3%, the level that prevailed prior to the pandemic and there’s scope for that to decline further, helping put further downward pressure on wage growth.

Further labour market weakness in the ADP today and of course in the nonfarm payrolls would probably encourage further pricing of cuts by March – the current implied probability is close to 75%. But for the ECB a cut in March is now an implied probability of nearly 90%. Known ECB hawk Isabel Schnabel encouraged this by simply acknowledging that another hike was “rather unlikely”. A cut to us by March seems unlikely and we suspect some push-back may come at next week’s policy meeting by President Lagarde. The jobs report on Friday, the Fed meeting next Wednesday followed a day later by the ECB meeting may well mean increased volatility but if short-term spreads remain in the recent range, a further retracement in EUR/USD may lie ahead.

EUR/USD OVERSHOOT RELATIVE TO 2-YEAR SWAP SPREAD

Source: Bloomberg, Macrobond & MUFG GMR

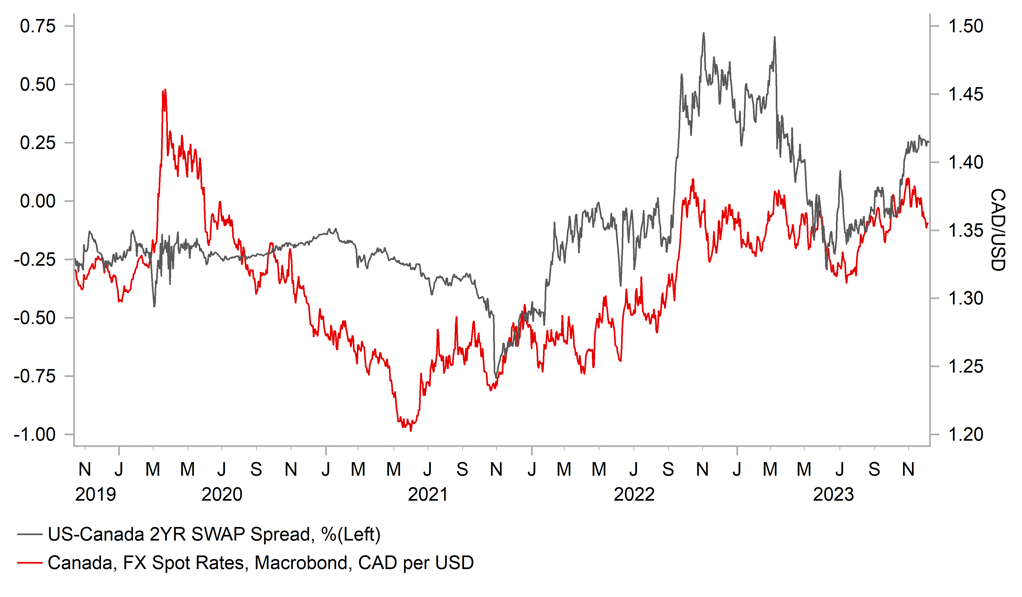

CAD: BoC on hold with statement key

The Canadian dollar has been one of the laggards in this period of US dollar selling and since the beginning of November is the 3rd worst performing G10 currency (only EUR and USD behind) with a similar extent of monetary easing priced into the OIS curve – a little over 100bps by Q4 2024. The data that has been coming in suggests to us that the extent of easing priced in Canada is more justified than in the US. The economy is on the brink of technical recession following the GDP data for Q3 released in November revealed a contraction of -1.1% on a SAAR basis.

In addition the PMI manufacturing and services readings this week were both weaker than expected and the jobs data released last Friday looked impressive in the headlines but the details were less so. While there was a large 59.6k increase in full-time employment, hours worked fell 0.7% and the supply dynamics in the labour market also do not point to wage inflation risks. While total employment increased 25k, the population increased by 78k and the labour force by 36k. This resulted in the unemployment rate ticking 0.1ppt higher to 5.8% - the highest level since January 2022.

So the BoC will maintain the key policy rate at 5.0%% today, which will be the 3rd consecutive pause. With inflation also lower in the most recent data and given the rapid demise of the “higher for longer” mantra for the Fed and the ECB, there is certainly scope today for the statement today to reveal a slightly softer tone that will help solidify the easing priced into the market next year.

We see greater risk today of some further widening of the 2-year spread in favour of the US dollar which could lead to renewed upside pressure on USD/CAD. The data over that period implies USD/CAD remains too low and hence risks are skewed to the upside on a dovish BoC. Recent crude oil price weakness could help reinforce a rates moves in that direction following today’s meeting. That at least implies AD underperformance is set to continue.

USD/CAD VS 2-YEAR SWAP SPREAD

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

10:00 |

Retail Sales (YoY) |

Oct |

-0.9% |

-2.9% |

! |

|

EC |

10:00 |

Retail Sales (MoM) |

Oct |

0.2% |

-0.3% |

! |

|

UK |

10:30 |

BoE Financial Stability Report |

-- |

-- |

-- |

!! |

|

UK |

10:30 |

BoE FPC Meeting Minutes |

-- |

-- |

-- |

! |

|

UK |

11:00 |

BoE Gov Bailey Speaks |

-- |

-- |

-- |

!!! |

|

CA |

11:00 |

Leading Index (MoM) |

Nov |

-- |

-0.01% |

! |

|

US |

13:15 |

ADP Nonfarm Employment Change |

Nov |

128K |

113K |

!!! |

|

US |

13:30 |

Nonfarm Productivity (QoQ) |

Q3 |

4.7% |

3.5% |

!! |

|

US |

13:30 |

Trade Balance |

Oct |

-64.10B |

-61.50B |

!! |

|

US |

13:30 |

Unit Labor Costs (QoQ) |

Q3 |

-0.8% |

2.2% |

!! |

|

CA |

13:30 |

Labor Productivity (QoQ) |

Q3 |

0.2% |

-0.6% |

!! |

|

CA |

13:30 |

Trade Balance |

Oct |

1.50B |

2.04B |

! |

|

CA |

15:00 |

BoC Rate Statement |

-- |

-- |

-- |

!!!! |

|

CA |

15:00 |

BoC Interest Rate Decision |

-- |

5.00% |

5.00% |

!!! |

|

CA |

15:00 |

Ivey PMI |

Nov |

54.2 |

53.4 |

!! |

|

GE |

15:00 |

German Buba President Nagel Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg