USD is trading on softer footing heading into NFP report

USD: NFP report pivotal for Fed rate cut expectations & US dollar

The US dollar has continued to correct lower ahead of the release today of the latest nonfarm payrolls report for November. It has resulted in the dollar index falling to a low yesterday of 105.70 as it moves further below the high of 108.07 recorded on 22nd November. The recent correction lower for the US dollar has been encouraged by the pullback in US yields. The 2-year and 10-year US Treasury yields have both fallen by around 22bps and 33bps respectively from their recent peaks. The softer US dollar and lower US yields highlight that “Trump trades” have lost some upward momentum and are currently waiting for a fresh catalyst to trigger further upside. The US data flow in recent days has not helped the US dollar with the ISM services survey revealing a larger than expected drop in business confidence following the US election in November, and the ADP survey for November and latest weekly claims data still indicating that the labour market is softening. It casts some doubt on expectations for employment growth to bounce back strongly in today’s nonfarm payrolls report for November. After employment growth slowed sharply to just 12k in October, the consensus expectation amongst US economists polled by Bloomberg is for employment growth to pick-up to 220k in November. It compares to an average monthly employment increase in the first ten months of this year of 170k. After stripping out the weak October data, employment growth has averaged 188k/month so far this year.

After today’s nonfarm payrolls data is released, we will be able to better assess how much of the employment weakness in October was due to temporary factors such as strikes, hurricane disruption and political uncertainty ahead of the election. The US rate market is currently pricing in a higher probability that the Fed will follow through with their plans to cut rates again by 25bps this month. By the end of next year the US rate market is pricing just over 75bps of rate cuts with the Fed’s policy rate expected to fall to a low of around 3.8%. However, Fed officials including Chair Powell this week have indicated that it is not a done deal that the Fed will cut rates again this month with the decision data dependent. Today’s nonfarm payrolls report and next week’s US CPI report for November will be important in determining whether the Fed delivers a 25bps cut this month or adopts a more cautious policy stance by skipping this month and waiting for more data to give them confidence to keep cutting rates.

With the consensus expectation for today’s employment increase set at 220k it provides a relatively high bar for an upside surprise. Unless there is a significant upside surprise today, we expect the Fed to deliver a 25bps cut this month. In this regard the report is likely to prove pivotal for US dollar performance heading into year end. It could provide a trigger for renewed upward momentum if the employment growth bounces back even more strongly than expected helping to boost investor optimism that the US economy could strengthen after the US election win for Donald Trump and a Red Sweep. Alternatively, if the bounce back in employment growth proves weaker than expected it could trigger a deeper correction lower for the US dollar although we would still expect the US dollar to strengthen further (click here) in the first half of next year at the start of Donald Trump’s second term as president.

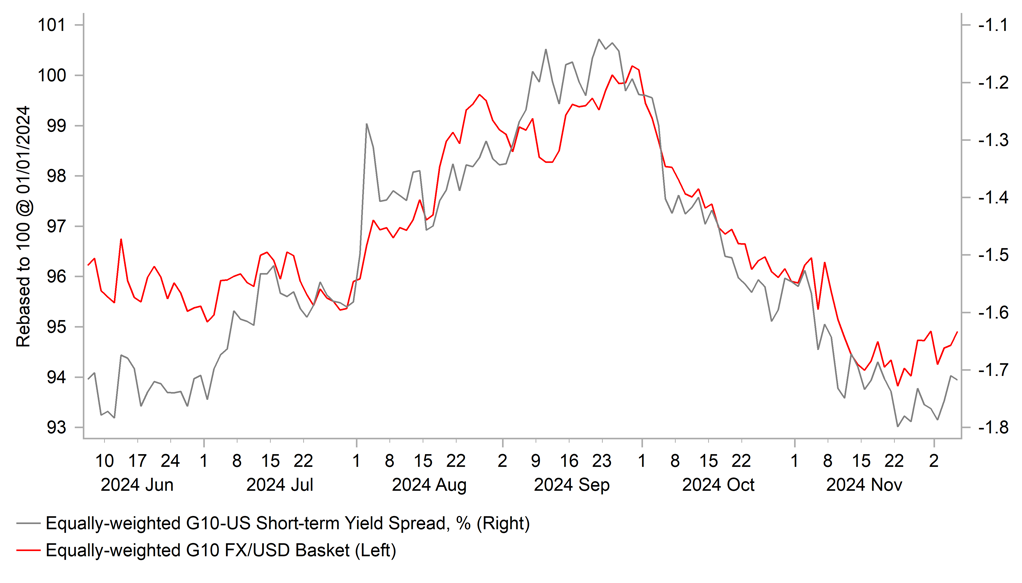

USD PERFORMANCE REMAINS TIGHTLY LINKED TO YIELD SPREADS

Source: Bloomberg, Macrobond & MUFG GMR

EUR: President Macron vows to see out his term

The euro extended its advance yesterday rising to back up to recent highs at around the 1.0600-level after the limited negative impact from the collapse of the French government when the pair failed initially to break below support at the 1.0500-level. At the same time the yield spread between 10-year French and German government bonds narrowed back below 0.80%, and fell back into the 0.70% to 0.80% range where it had been trading since the middle of this year. The main developments yesterday were that French President Macron stated that he intends to serve out the remainder of his five year presidential term. He blamed far-right and far-left lawmakers for using the vote of no confidence as an attempt to provoke an early presidential election. He said he will appoint a new premier in the coming days who will be tasked with forming a government of general interest representing all the political forces committed to not censuring it. The new government’s priority will be to approve a budget for next year, with a special law submitted to parliament before mid-December to keep the state running in the interim.

National Rally leader Marine Le Pen also held an interview yesterday in which she stated they would be willing to support a budget so long as there was a “reasonable trajectory” for the lowering the budget deficit. The previous government’s plans to narrow the deficit from around 6% of GDP this year to closer to 5% next year was too much to stomach. She said it doesn’t matter who is named the next prime minister and it is more important what policies they propose. Political uncertainty in France is set to remain elevated in the near-term, but it is clear that a significant tightening of fiscal policy is unlikely to be adopted in the current parliament. We are not expecting the developments to significantly alter next week’s ECB policy update. Another 25bps rate cut still appears more likely than a larger 50bps rate cut.

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

IT |

09:00 |

Italian Retail Sales (MoM) |

Oct |

0.9% |

1.2% |

! |

|

EC |

10:00 |

Employment Change (QoQ) |

Q3 |

0.2% |

0.2% |

! |

|

EC |

10:00 |

GDP (QoQ) |

Q3 |

0.4% |

0.4% |

!! |

|

EC |

10:00 |

GDP (YoY) |

Q3 |

0.9% |

0.6% |

!! |

|

CA |

11:00 |

Leading Index (MoM) |

Nov |

-- |

0.25% |

! |

|

US |

13:30 |

Average Hourly Earnings (MoM) |

Nov |

0.3% |

0.4% |

!!! |

|

US |

13:30 |

Nonfarm Payrolls |

Nov |

220K |

12K |

!!! |

|

US |

13:30 |

Unemployment Rate |

Nov |

4.2% |

4.1% |

!!! |

|

CA |

13:30 |

Employment Change |

Nov |

25.0K |

14.5K |

!! |

|

CA |

13:30 |

Unemployment Rate |

Nov |

6.6% |

6.5% |

!! |

|

US |

14:15 |

FOMC Member Bowman Speaks |

-- |

-- |

-- |

!! |

|

US |

15:00 |

Michigan Current Conditions |

Dec |

-- |

63.9 |

! |

|

US |

15:00 |

Total Vehicle Sales |

Nov |

16.00M |

16.20M |

! |

|

US |

15:30 |

Fed Goolsbee Speaks |

-- |

-- |

-- |

! |

|

US |

18:00 |

FOMC Member Daly Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg