The USD continues to extend rebound at start of 2024

AUD: RBA signals that it is likely to lag behind when cutting rates

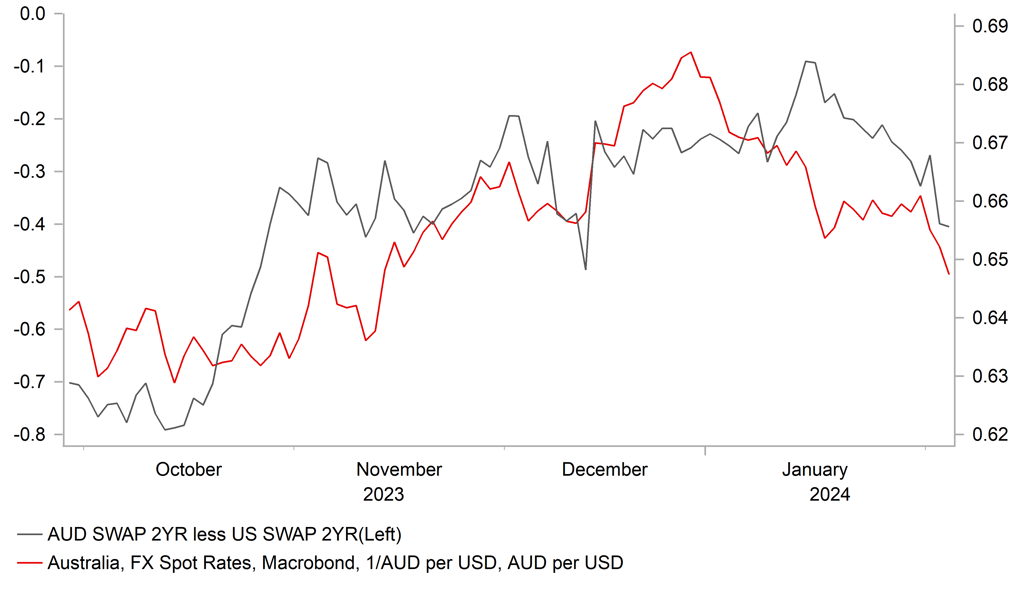

The Australian dollar has strengthened overnight following the RBA’s latest policy meeting resulting in AUD/USD rising back above the 0.6500-level. While the RBA left their policy rate on hold at 4.35% for the second consecutive meeting as expected, the updated guidance has disappointed market expectations for an earlier rate cut this year. The most hawkish part of the updated policy statement indicated that “a further increase in interest rates cannot be ruled out” which was a change from December when the RBA stated “whether further tightening of monetary policy is required”. Market participants had been expecting the RBA to potentially remove the reference to further rate hikes in response to further evidence of much weaker inflation at the end of last year in Australia. However, the RBA’s updated economic forecasts did signal a more dovish path for monetary policy going forward. Headline inflation forecasts were lowered by 0.6 point for Q2 2024 and it is expected to end this year lower by 0.3 point at 3.2%. Inflation is then expected to return to the top of the RBA’s target range in 2H 2025. At the same time, the RBA’s year-end forecasts for economic growth in Australia were lowered by 0.2 point to 1.8%Y/Y for 2024 and by 0.1 point to 2.3%Y/Y for 2025.

In the accompanying press conference, Governor Bullock noted that the RBA was “not ruling in or out anything” with risks currently balanced. The bank is still judged to be on a “narrow path”. When setting monetary policy, the RBA is highly dependent on incoming data. The RBA wants to see further data that convinces them that inflation is coming down and acknowledged that recent signs have been good. Overall, the RBA’s policy update indicates that the RBA is unlikely to be one of the first G10 central banks to begin cutting rates this year. We are expecting the first rate cut in Q3. The Australian rate market has adjusted accordingly to price in a higher probability of the first-rate cut being delivered in August rather than June. It helps to provide modest support for the Australian dollar in the near-term. Sentiment towards the Aussie has also been boosted indirectly overnight by the rebound in the Chinese equity market where speculation is building over further state policy action to provide stability. The latest announcements have been that China’s sovereign wealth fund has said it will continue to increase holdings of ETFs and restrictions on trading have been tightened further.

AUD/USD VS. SHORT-TERM YIELD SPREAD

Source: Bloomberg, Macrobond & MUFG GMR

EM FX: Resilient US economy contributing to weak start for EM FX in 2024

Emerging market currencies have continued to weaken at the start of the new calendar year. The worst performing EM currencies so far this year have been the CLP and the THB, while the INR has outperformed. Emerging market currencies have been undermined at the start of his year by the broad-based rebound for the USD which has been supported by the ongoing resilience of the US economy. There has been a strong run of positive US economic surprises in recent weeks including the US GDP report for Q4, US productivity for Q4, nonfarm payrolls report for January, and yesterday’s ISM services survey for January . The ongoing resilience of the US economy to higher rates should give the Fed more time to assess how inflation evolves in the 1H of this year before beginning to lower rates, and at the same time favours a slower pace of cuts once the easing cycle is underway. The Fed wants to be more convinced that the slower pace of inflation recorded in 2H of last year will be sustained. In this regard the Fed has already indicated that they will be closely scrutinizing revisions to the CPI data released on Friday. A Fed rate cut is now unlikely to be delivered until May or June.

Within EMEA FX, the HUF and PLN have outperformed over the past week. After weakening at the start of this year, the HUF has rebounded over the past week driven by an easing of tensions between the EU and Hungary. The EU finally reached an agreement last week on a multi-year EUR50 billion support package for Ukraine after Hungary’s prime minister Orban dropped his veto. The favourable development could encourage speculation that the EU could be more open to releasing more funding for Hungary as well. The recent pick-up in Hungary’s risk premium had discouraged the NBH from delivering a larger 100bp rate cut at their last policy meeting in response to slowing inflation. The NBP is scheduled to the next regional central bank to meet this week on Wednesday and is expected to keep rates on hold at 5.75%. The NBP has been reluctant to cut rates further since the last year’s election providing support for the PLN. Lower inflation prints for January and February could open the door for further rate cuts as soon as in March. The other main development within EMEA has been the resignation of CBRT Governor Erkan which has created some uncertainty over the ongoing commitment to tighter monetary policy in Turkey required to bring inflation back under control and stabilize the TRY. She has been replaced by Deputy Governor Karahan who is expected to maintain tight policy. He has emphasized that asserting price stability is their main policy objective. Inflation is expected to rise further to just over 70% in May before falling through the rest of 2024. Our forecast for slower TRY depreciation this year rests on the critical assumption that tight policy is maintained. Please see our latest EM EMEA Weekly for more details (click here).

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

10:00 |

Retail Sales (YoY) |

Dec |

-0.9% |

-1.1% |

! |

|

CA |

11:00 |

Leading Index (MoM) |

Jan |

-- |

0.05% |

! |

|

US |

13:55 |

Redbook (YoY) |

-- |

-- |

5.0% |

! |

|

US |

15:00 |

IBD/TIPP Economic Optimism |

-- |

47.2 |

44.7 |

! |

|

CA |

15:00 |

Ivey PMI |

Jan |

55.0 |

56.3 |

!! |

|

US |

17:00 |

FOMC Member Mester Speaks |

-- |

-- |

-- |

!! |

|

US |

18:00 |

FOMC Member Kashkari Speaks |

-- |

-- |

-- |

!! |

|

CA |

18:00 |

BoC Gov Macklem Speaks |

-- |

-- |

-- |

!! |

|

NZ |

21:45 |

Employment Change (QoQ) |

Q4 |

0.3% |

-0.2% |

! |

Source: Bloomberg