Deepening equity market sell-off boosts demand for safe haven currencies

USD: Safe haven currencies gain as equity markets braced for more pain

The safe haven currencies of the Swiss franc and yen have continued to outperform at the start of this week driven by the intensifying retrenchment from risk assets from global investors. Asian equity markets have fallen sharply across the board overnight reflecting heightened fears over the risk of global recession in response to a more disruptive trade war. The Nikkei 225 index has fallen by almost 8% extending its decline to around 19% from the high in late March as it moves closer to falling into bear market territory. Market participants are braced for the global equity market sell-off to extend further when European and US markets open up today. The sell-off in risk assets was encouraged at the end of last week when China retaliated forcefully by outlining plans to match the reciprocal tariff rate to be applied by President Trump on imports of Chinese goods into the US. China also plans to impose an additional 34% tariff on all imports from the US into China. According to Bloomberg, it will lift the total average tariff rate applied on imported goods from the US into China up to 52% which compares to the total average tariff on imported goods from China into to the US of around 64%. Chinese imports from the US are smaller at USD164 billion when compared to China’s exports to the US of USD525 billion. At the same time, China will immediately restrict exports of seven types of rare earths, start an anti-dumping probe inot medical CT x-ray tubes from the US and India, halt imports of poultry products from two American companies, and will add 11 American defence companies to an unreliable entity list. China’s decision to retaliate forcefully was quickly criticized by President Trump who stated that China had “panicked” and “played it wrong”.

According to media reports, Chinese policymakers met over the weekend to discuss stabilizing the economy and markets, and considered moving forward some measures that were planned even before President Trump’s tariffs according to people familiar with the matter. Under plans outlined in the People’s Daily, China appears more committed to make bolstering domestic demand its “long-term strategy” and to turn consumption into a “major driver and ballast” for economic growth. The government will look to boost consumer spending with “extraordinary strength”, cut rates and pump more long-term liquidity into the banking system whenever needed. The article went on to add that China has room to raise the fiscal deficit and sell more bonds top expand public spending. Stepped up efforts to boost domestic demand could be one silver lining from the trade war that would help to rebalance the global economy alongside recent plans from Germany to significantly loosen fiscal policy. The Shanghai Composite equity index has fallen sharply by 7% overnight and USD/CNH has hit a high of 7.3311. The PBoC set the daily fixing rate for USD/CNY at a stronger level than expected in an attempt to preserve stability in the renminbi and dampen building speculation over the risk of a bigger devaluation in response to the worsening negative fallout from the trade war with the US.

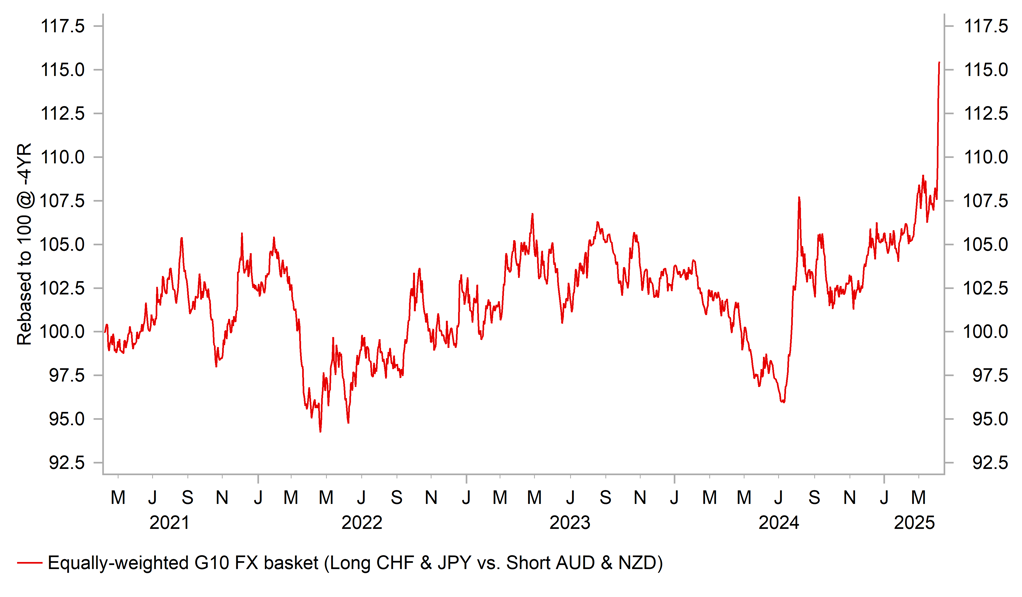

Fears amongst market participants over a bigger negative hit to global growth from the trade war have not been helped either by comments from the Trump administration over the weekend. President Trump stated that “I don’t want to go down, but sometimes you have to take medicine to fix something” when he told reporters to “forget markets for a second”. Furthermore, in a post on Truth Social he reiterated that the massive trade deficits with China, the EU and many others can only be cured with tariffs. It was backed up by comments from Commerce Secretary Howard Lutnick who added that the “tariffs are coming” and that President Trump “was not kidding”. Peter Navarro one the key intellectual architects of the shift to protectionist US trade policies even confidently claimed over the weekend that “the market will find a bottom. It will be soon, and from there, we’re going to have a bullish boom, and the Dow is going to hit 50,000 during Trump’s term”. The comments have dampened hopes for now that there could be a quick climb down on “reciprocal tariff” plans from the Trump administration to help restore stability to financial markets. The latest developments firmly suggest that the trade hawks are now in control in the White House. Peter Navarro was vocally criticized by Elon Musk over the weekend who objects to the direction of US trade policy and is leaving the government. As a result, we continue to favour defensive positioning in the FX market in the near-term as outlined in our latest FX Weekly report (click here).

SAFE HAVEN CURRENCIES IN DEMAND AS TRADE WAR INTENSIFIES

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

09:30 |

Sentix Investor Confidence |

Apr |

-8.9 |

-2.9 |

! |

|

EC |

10:00 |

Retail Sales (MoM) |

Feb |

0.5% |

-0.3% |

! |

|

US |

15:30 |

FOMC Member Kugler Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg