JPY boosted by speculation that December BOJ meeting could be “live”

JPY: BoJ rate hike speculation builds ahead of December meeting

The yen has outperformed overnight resulting in USD/JPY falling below the 146.00-level after breaking below support provided by the low from 4th December at 146.23. The main driver has been heightened speculation amongst market participants that the BoJ could tighten monetary policy as soon as at the 19th December meeting. It follows reports overnight that BoJ Governor Ueda met Prime Minister Kishida to explain monetary policy ahead of the December policy meeting. According to Bloomberg, Governor Ueda discussed the state of the economy with the premier and told him that he would monitor how wages affect prices. Governor Ueda did emphasize though that it was a regular meeting between a BoJ Governor and the prime minister that happens a few times a year. Governor Ueda also spoke today in parliament when he delivered a semi-annual report on currency and monetary control. He told parliament that he is still not seeing certainty in achieving the inflation goal and is keeping easy policy patiently to support wage gains. He did note though that there were various options for the policy rate if the BoJ decides to raise. He sees no specific new rate level in mind in case of a rate hike.

The comments on the timing of an exit from negative rate policy did not suggest either that it was imminent this month. He stated that they may not be at stage to emphasize an exit and believes it is important to communicate beforehand for a smooth exit. He stated that it was too early to do an exit simulation. Still, heightened nervousness over the BoJ exiting negative rate policy soon is clearly having an impact on the performance of the JGB market overnight. The 10-year JGB yield has risen by around 10bps which is the most in a year. The latest 30-year JGB auction also drew the lowest bid-cover ratio since 2015. The developments support our current short USD/JPY trade idea (click here). Our analysts were already expecting the BoJ to exit negative rate policy at the start of next year in January helping to narrow the policy divergence between the BoJ and other major central banks. Recently the move lower in USD/JPY has been mainly driven by the fall in US yields as market participants moved to price in earlier and deeper Fed rate cuts during next year. The release yesterday of the weaker than expected ADP survey for November revealing that private employment increased by only 103k has supported those expectations although doubts remain over accuracy of the ADP survey as a leading indicator of payrolls.

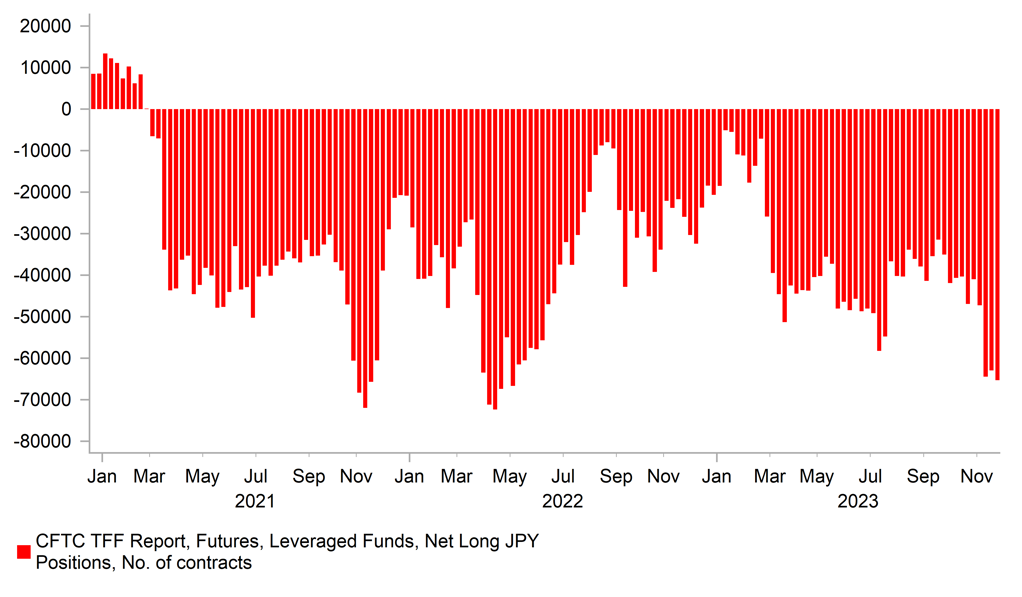

LEVERAGED FUNDS HAVE BUILT UP ELEVATED SHORT JPY POSITIONS

Source: Bloomberg, Macrobond & MUFG GMR

CAD: BoC policy update does not alter expectations for rate cuts next year

The BoC’s last policy update of 2023 had limited immediate impact on the performance of the Canadian dollar. According to Bloomberg, it was the smaller percentage percentage move for USD/CAD in the first 30 minutes (-0.06%) following a BoC policy decision this year. The updated policy guidance has not materially altered market expectations for the BoC to begin a rate cutting cycle next year. The Canadian rate market is still fully pricing in the first rate cut at the April policy meeting, and around 110bps of cuts in total to be delivered by the end of next year. It is roughly similar to what is priced in for the Fed which is consistent with previous cycles when the BoC and Fed have tended to adjust policy alongside each other.

While the BoC’s policy guidance continued to signal that they remain prepared to raise the policy rate further if needed, recent evidence of slowing inflation and weak economic growth are casting serious doubts on the need to maintain the current restrictive policy rate. At 5.00% the policy rate is already well above the BoC’s estimate of the neutral rate between 2.00% and 3.00%. In the updated policy statement, the BoC acknowledged that higher interest rates are clearly restraining spending. They noted that consumption growth has been close to zero in the last two quarters, and business investment has been essentially flat over the past year. The data gives the BoC more confidence that Canada’s economy has moved into modest excess supply in Q4 and likely to increase further through most of 2024 as forecast back in the October Monetary Policy Rate.

A development that should help to further dampen inflation pressures in the year ahead. The updated policy statement acknowledged as well that the slowdown in the economy is reducing inflationary pressures in a broadening range f goods and services prices. Headline inflation fell back to 3.1% in October and is likely to fall back within the BoC’s 1.0% to 3.0% target range in the coming months. The Governing Council wants to see further and sustained easing in core inflation before becoming more confident that it can begin to reverse the current restrictive policy stance. It leaves the Canadian dollar vulnerable to further weakness heading into early next year if evidence of slowing growth and inflation continues to build.

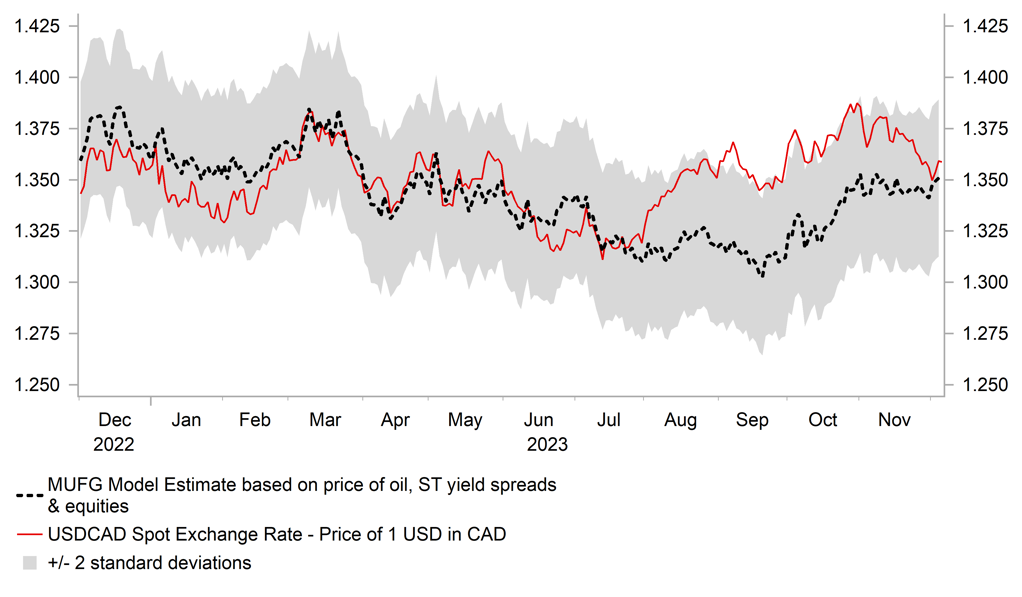

After attempting and failing to break above the 1.3900-level at the start of November, USD/CAD has fallen back into line with our short-valuation model estimate at around the 1.3500-level. It suggests that the pair is currently reasonably priced based on important fundamental drivers. The model fair value for USD/CAD has though been drifting higher since the summer driven by the ongoing decline in the price of oil and building expectations for more aggressive BoC rate cuts.

USD/CAD HAS CORRECTED BACK IN LINE WITH FUDAMENTAL DRIVERS

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

IT |

09:00 |

Italian Industrial Production (MoM) |

Oct |

-0.3% |

0.0% |

! |

|

EC |

10:00 |

Employment Change (QoQ) |

Q3 |

0.3% |

0.2% |

! |

|

EC |

10:00 |

Eurogroup Meetings |

-- |

-- |

-- |

!! |

|

EC |

10:00 |

GDP (QoQ) |

Q3 |

-0.1% |

0.1% |

!! |

|

CA |

11:00 |

Leading Index (MoM) |

Nov |

-- |

-0.01% |

! |

|

US |

12:30 |

Challenger Job Cuts (YoY) |

-- |

-- |

8.8% |

! |

|

US |

13:30 |

Initial Jobless Claims |

-- |

222K |

218K |

!!! |

|

CA |

17:40 |

BoC Gov Macklem Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg