USD is struggling to extend advance after bullish breakout after NFP report

USD: US exceptionalism continues to encourage a stronger US dollar

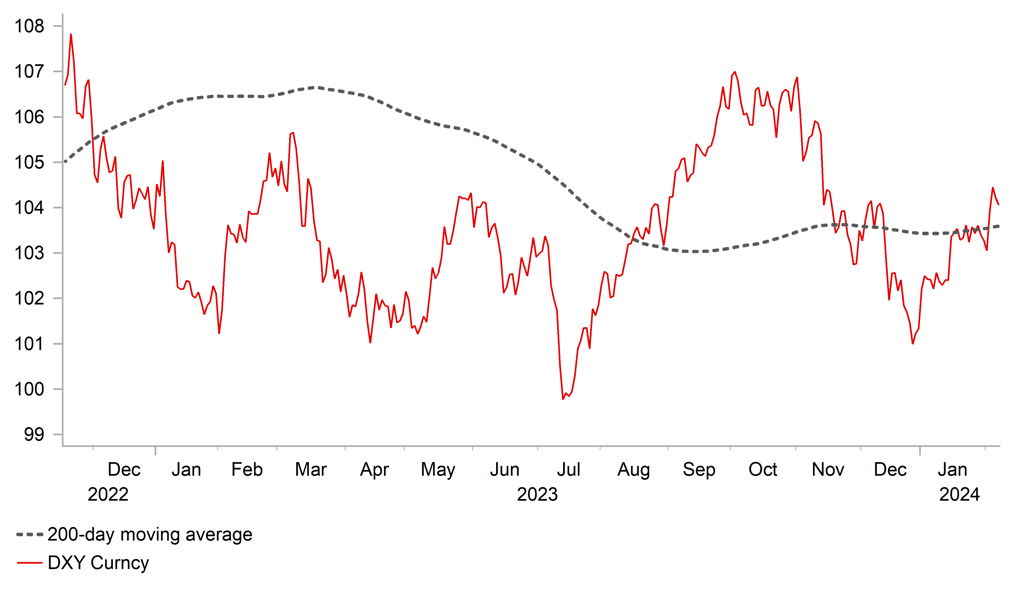

The US dollar has lost some upward momentum over the last couple of trading sessions. The dollar index has fallen back towards the 104.00-level after hitting a year to date high of 104.60 on Monday with limited positive follow through for the US dollar after the strong gains recorded on Friday after the release of the blow out US nonfarm payrolls report. Similar price action has also been evident in the US bond market where yields have consolidated at higher levels. The 2-year and 10-year US Treasury yields have held at around 4.40% and 4.10% respectively. The main fallout from the blow out nonfarm payrolls report has been that market participants have pushed back expectations for the timing of the first Fed rate cut from March to May, and taken out one 25bps cut by the end of this year. The US dollar has failed to extend its post-payrolls advance at the start of this week even as US economic data releases have continued to surprise to the upside including the ISM services survey for January and the latest Fed Senior Loan Officer Opinion Survey (SLOOS) on bank lending both showed improvement and reinforced the revival of the US exceptionalism theme.

One potential downside risk for the US dollar in the near-term that attracted market attention last week was renewed concerns over the health of US regional banks through exposure to the commercial real estate sector. In a testimony to the House Financial Services Committee yesterday, US Treasury Secretary Yellen stated that losses in commercial real estate may leave financial institutions “quite stressed” as loans come due, vacancy rates in some cities persist at high levels and interest rates remain elevated. She added that federal regulators are trying to ensure that banks troubled by loans to commercial property owners hold adequate liquidity, trim dividends if needed and build loan-loss reserves. In their annual report released in December, the Financial Stability Oversight Council warned that “CRE is the largest loan category among almost one-half of Us banks, and more than a quarter of US banks have CRE loan portfolios that are large relative to the capital they hold”. KBW’s regional bank equity index has continued to fall at the start of this week and has extended its declined since the end of last month to just over 12%. Renewed concerns over the health of US regional banks have brought back memories of March last year when the dollar index fell temporarily by around 4-5% and KBW’s regional bank index fell by around 25%.

SHORT-TERM BULLISH BREAKOUT FOR USD AFTER NFP REPORT

Source: Bloomberg, Macrobond & MUFG GMR

NZD: Labour market report dampens expectations for earlier RBNZ rate cut

The main economic data release overnight was the latest labour market report from New Zealand. The report revealed that the New Zealand labour market was stronger than expected at the end of last year which has dampened market expectations for an earlier rate cut by the RBNZ. While the unemployment rate increased to a two year high of 4.0%, it still undershot the RBNZ’s forecast of 4.2% which was set in November of last year. The RBNZ expects employment growth to stall this year while labour supply surges on the back of the re-opening of the international border that should result in a sharper increase in the unemployment rate in 2024. At the end of last year employment growth surprised to the upside increasing by 0.4%Q/Q in Q4.

Overall, the report indicates that the New Zealand labour market was tighter than expected at the end of last year. It will discourage the RBNZ from shifting to a more neutral policy stance as soon as at the next policy meeting on 28th February. However, if employment growth slows at the start of this year while labour supply picks up the resulting rise in the unemployment rate should encourage the RBNZ to cut rates in the second half of this year. The New Zealand rate market is currently pricing in around a 50:50 probability of the first RBNZ rate cut being delivered in July and it is fully priced by August. At the margin a slower start to the RBNZ’s rate cut cycle could offer some support for the kiwi but it is offset by the weak global growth backdrop at the start of this year which is contributing to commodity prices remaining close to multi-year lows.

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

UK |

08:40 |

BoE Breeden Speaks |

-- |

-- |

-- |

! |

|

UK |

12:15 |

BoE Deputy Governor Woods Speaks |

-- |

-- |

-- |

!! |

|

US |

13:30 |

Trade Balance |

Dec |

-62.00B |

-63.20B |

!! |

|

CA |

13:30 |

Trade Balance |

Dec |

1.10B |

1.57B |

!! |

|

US |

16:30 |

Fed Collins Speaks |

-- |

-- |

-- |

! |

|

US |

17:30 |

FOMC Member Barkin Speaks |

-- |

-- |

-- |

! |

|

CA |

18:30 |

BOC Summary of Deliberations |

-- |

-- |

-- |

! |

|

US |

19:00 |

FOMC Member Bowman Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg