JPY outperformance likely fuelled by positioning

JPY: Peak divergence hits home

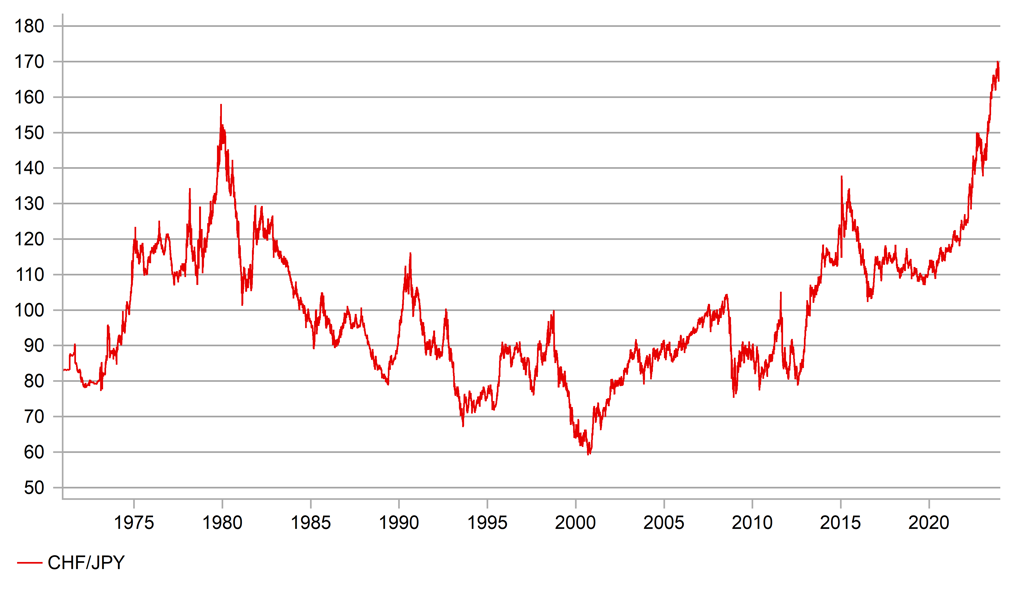

The yen surged again during the Tokyo trading session today to hit 142.50, after yesterday spiking briefly to 141.71, its strongest level versus the US dollar since the 7th August and the price action is a clear indication of a short yen squeeze fuelling forced JPY buying. That is not surprising and the IMM data of late has surprised us by the scale in which Leveraged Funds have actually been increasing yen short positions. Indeed, in the latest week to last Tuesday, the yen short position amongst Leveraged Funds had increased to the largest since the first week of May last year. That was in the early stages of the rally in USD/JPY when trading at around the 130-level. The global inflation shock and the required rise in yields globally has seen the yen perform worst in G10 last year and 2nd worst in 2021. It had been worst this year until this rally pushed NOK to worst performing. CHF has been the top or second top performing over those years and CHF/JPY advanced 47% over the period since 2021.

While JPY surged yesterday, CHF was the worst performing G10 currency and the only currency that failed to advance versus the US dollar suggesting JPY short positions held against CHF, a likely popular trade, were squeezed from the market as peak divergence between Japan and the rest of the world has probably passed.

The catalyst for the move was comments from Governor Ueda who presented his semi-annual report on currency and monetary control and according to Bloomberg stated in reference to managing monetary policy that “it will become even more challenging for the year-end and heading into next year”. BoJ rate hike speculation jumped as a result. But he also said plenty to suggest continued caution on concluding inflation was sustainable. On Wednesday, we believe a more important speech took place – by Deputy Governor Himino – the English version of which is now available on the BoJ website and he laid out his views on what might happen when NIRP is ended. His take was largely playing down negative impacts.

But the reality is that JPY, which underperformed so significantly through the global inflation shock and yield surge was also underperforming as inflation fell and global yields fell sharply. That wasn’t a sustainable scenario and this move was due to happen anyway given developments outside of Japan over recent weeks and months.

CHF/JPY HAS CAPTURED THE GLOBAL INFLATION SHOCK TRADE AND MAY NOW BE SET TO CORRECT

Source: Bloomberg, Macrobond & MUFG GMR

USD: Jobs data in focus ahead of the FOMC

The US dollar has rebounded this week against all G10 currencies apart from the yen of course which is perhaps understandable given the sharp sell-off of the US dollar in November. A number of different factors have helped provide the dollar support with UST bond yields in fact not a compelling one. After the 41bps drop in the 2-year yield last week, the 2yr yield is up only 7bps this week. The 10yr yield after a 27bp drop last week has fallen a further 4bps this week.

But there have been some external global factors that have helped the dollar this week. NOK is the worst performing G10 currency this week (-1.9%) in response to the plunge in crude oil prices – Brent fell 4.8% last Friday and has followed that with a 6% drop to yesterday. The RBA meeting this week disappointed hawks and AUD has weakened while weak China data has helped the dollar against higher beta G10 as well. But

nonfarm payrolls today could well see the influence of US yields come back depending on the outcome of the report. Anything very wide of the mark will drive yields notably and hence the US dollar. The consensus for today is for a gain of 186k after the 150k gain last month. The key jobs data this week ahead of NFP were weaker with the JOLTS data revealing a larger drop in job openings and the ADP on Wednesday came in weaker than expected for the second consecutive month. However, continued claims yesterday, after a big jump last week, retraced most of the move to suggest data quirks (Thanksgiving) rather than anything fundamental.

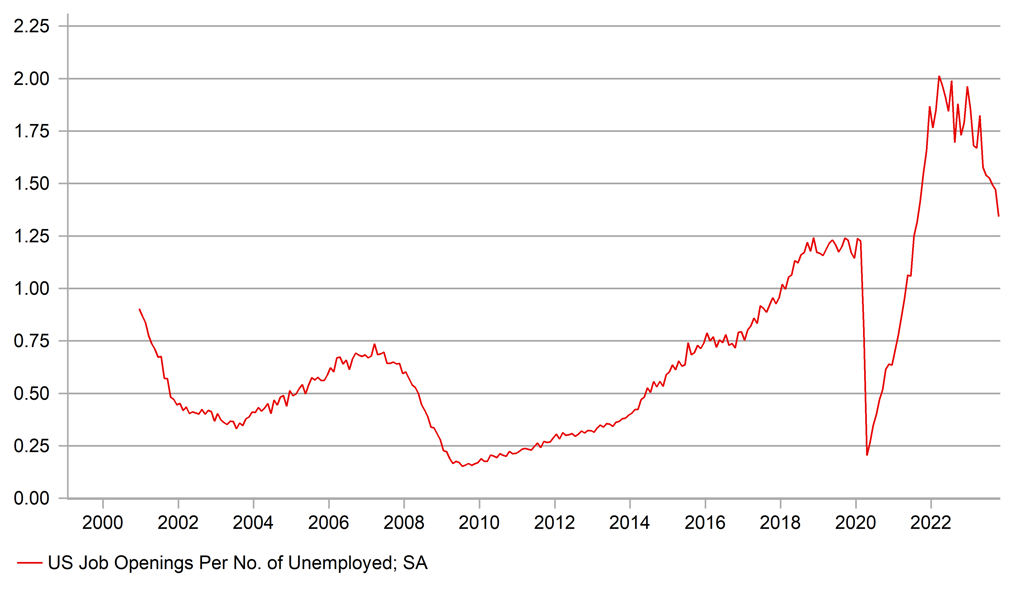

A gain around consensus, close to 200k would certainly help arrest the negative momentum in yields although the other two key components will be important too – the unemployment rate and the average hourly earnings gain. Certainly the JOLTS data and specifically the ratio of job openings to unemployed is correcting quickly – it peaked at 2.0 but has fallen to 1.34, still high but approaching the pre-covid average of about 1.2. That should limit the risks of a bad reaction to any modest upside surprise in wage growth today.

The Dec-Dec 2023-24 fed fund futures spread now implies 120bps of rate cuts by the Fed next year. That does seem a pretty high bar for additional easing to be built into the 2024 futures strip. There is 18bps worth of cuts priced for March and that’s where we may see some change this afternoon. A bad print seems required for March easing to be added to or even possibly maintained. A consensus print or better could see some of the March 2024 easing come out of the market and with that we may see some further positive momentum for yields and the dollar into the close of this week and ahead of the FOMC next Wednesday.

NORMALISING US LABOUR MARKET AS JOB OPENINGS FALL BACK SHARPLY RELATIVE TO TOTAL UNEMPLOYED

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

UK |

09:30 |

Inflation Expectations |

-- |

-- |

3.6% |

! |

|

CA |

11:00 |

Leading Index (MoM) |

Nov |

-- |

-0.01% |

! |

|

US |

13:30 |

Nonfarm Payrolls |

Nov |

180K |

150K |

!!!!! |

|

US |

13:30 |

Private Nonfarm Payrolls |

Nov |

153K |

99K |

!!! |

|

US |

13:30 |

Average Hourly Earnings (MoM) |

Nov |

0.3% |

0.2% |

!!!!! |

|

US |

13:30 |

Average Hourly Earnings (YoY) (YoY) |

Nov |

4.0% |

4.1% |

!!! |

|

US |

13:30 |

Average Weekly Hours |

Nov |

34.3 |

34.3 |

! |

|

US |

13:30 |

Participation Rate |

Nov |

-- |

62.7% |

!! |

|

US |

13:30 |

U6 Unemployment Rate |

Nov |

-- |

7.2% |

!! |

|

US |

13:30 |

Unemployment Rate |

Nov |

3.9% |

3.9% |

!!!! |

|

CA |

13:30 |

Capacity Utilization Rate |

Q3 |

81.0% |

81.4% |

! |

|

US |

15:00 |

Michigan 1-Year Inflation Expectations |

Dec |

-- |

4.5% |

!! |

|

US |

15:00 |

Michigan 5-Year Inflation Expectations |

Dec |

-- |

3.2% |

!! |

|

US |

15:00 |

Michigan Consumer Expectations |

Dec |

-- |

56.8 |

!! |

|

US |

15:00 |

Michigan Consumer Sentiment |

Dec |

62.0 |

61.3 |

!! |

|

US |

15:00 |

Michigan Current Conditions |

Dec |

-- |

68.3 |

! |

Source: Bloomberg