USD slides further – can US jobs data provide support?

USD: Technical breach keeps negative momentum intact

The FX market has been reinvigorated over the last two days of trading with the semi-annual testimony from Fed Chair Powell on Wednesday and then the ECB press conference yesterday helping to fuel renewed US dollar selling. The breach in DXY of the 200-day moving average on Wednesday at 103.37 has worsened the near-term technical outlook and after the prior phase of renewed dollar buying by speculative market participants, that US dollar speculative buying appetite has certainly faded again given that worsening technical outlook. Of course, the February US jobs market data today will be key although the consensus is for a clear slowdown after the above consensus 353k increase in the January data.

The two fundamental factors could certainly see this period of dollar selling extended (if the jobs data is as expected or weaker) with Fed Chair Powell on Wednesday not indicating any real change in stance despite the disappointing inflation data in February. Market participants were braced for some degree of a hawkish shift that never materialised. The reaction in the rates market was more muted than in the FX market and the FX move certainly looks a little excessive relative to the rates market move. That would point to perhaps the technical breach and momentum and positioning playing more of a role in this dollar selling than anything more fundamental.

Similarly, we didn’t really see the dial move in terms of ECB rate expectations with front-end yields yesterday dropping about 2bps. Our view is that Lagarde’s communication points to a clear consensus within the ECB Governing Council for a rate cut coming no sooner than in June. Lagarde’s comment that the Governing Council “will know a little more in April, but we will know a lot more in June” looks to us like a good reflection of GC thinking – June is most likely but let’s not completely rule out April. Still, April is now in our view much less likely and it would take much weaker inflation, wage and activity data to bring April into play. That implies the first rate cut by the ECB and the Fed could come within one week of each other and again reinforces the lack of divergence prospects at this juncture which we think will limit the scope for EUR/USD to sustain a break higher. Yesterday, we covered the ECB meeting in an FX Focus piece (here).

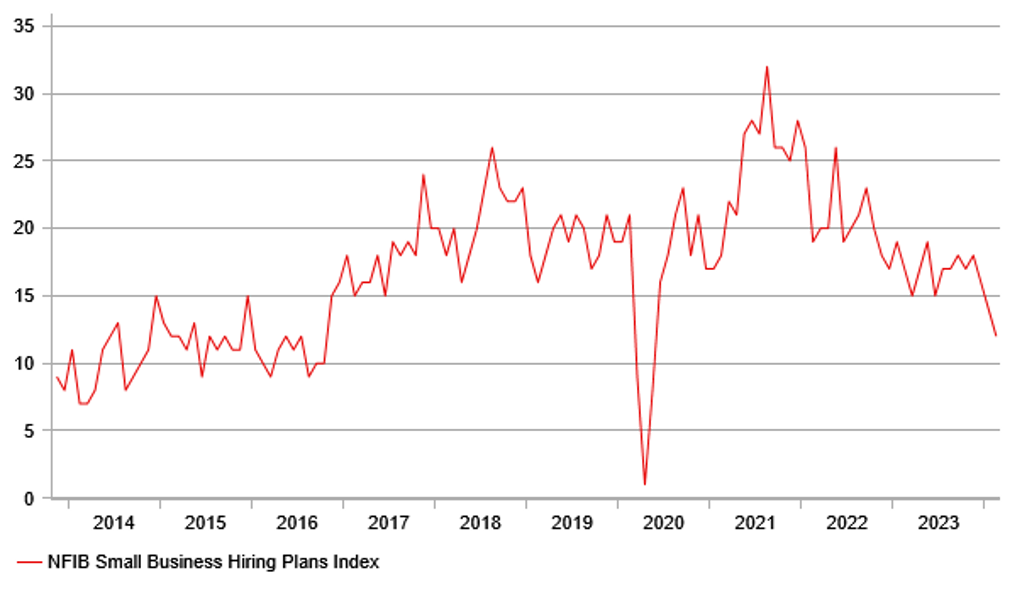

Today’s jobs report will be key and there is certainly a risk of a bigger dollar move on a weaker payrolls print given the current momentum and technical breaches to the downside for the dollar. Fed Chair Powell’s comments this week indicate a readiness to cut – yesterday he stated the Fed was “not far” from having the confidence on inflation to cut rates. A much weaker NFP print today (close to 100k rather than the 200k consensus) with a weaker earnings increase could bring May back into play and would extend the dollar selling beyond our expectations. The NFIB Small Business Hiring Plans Index fell to the weakest since the pandemic period, the services ISM Employment index fell back below the 50-level and the manufacturing ISM Employment index 3,6 and 12mth averages all fell to the weakest levels since the pandemic – so the risks seem higher to us that the strength last month was an aberration that could correct the other way.

NFIB SMALL BUSINESS SURVEY - HIRING PLANS LOWEST SINCE PANDEMIC

Source: Bloomberg, Macrobond & MUFG GMR

JPY: Trade surplus expands further underling yen support

The yen is the second best performing G10 currency this week with only the Australian dollar marginally outperforming the yen. The driver of course is the increasing speculation that the BoJ will raise the official policy rate by 10bps at the next meeting on 19th March. The probability of a 10bp hike at that meeting has increased from around 30% to 70% fuelled by the stronger wage data, the Rengo initial estimate of the ‘shunto’ wage agreement for the fiscal year commencing in April and the comments from BoJ officials (Junko Nakagawa & Governor Ueda) suggesting March as being a feasible timeframe for a hike and growing progress toward the price stability target.

Our forecast of yen recovery this year is not just predicated on BoJ rate hikes and cuts from the Fed but also on the reversal of the pronounced deterioration of Japan’s external position that took place throughout the period of sharp yen selling, mainly due to the energy price shock. That’s now reversed and today Japan BoP data revealed a larger than expected current account surplus. The seasonally adjusted current account surplus increased from JPY 1,810bn in December to JPY 2,728bn in January, marginally below the record set in July last year. On a 12mth basis Japan’s non-seasonally adjusted current account surplus totalled over JPY 23trn in January, close to record highs and the largest since January 2018.

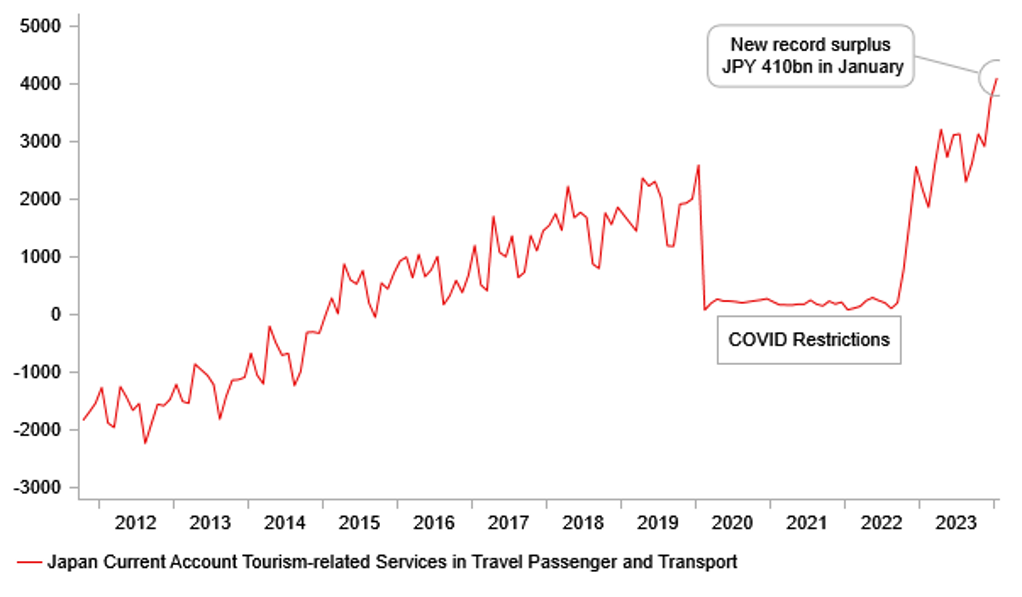

While the reversal of the energy price shock is important in this turnaround, the services trade component is being helped by surging tourism activity in Japan. Japan’s services trade in tourism-related services in travel passengers and transport has surged with yen weakness and government policy playing key roles. The surplus hit another new record of JPY 410bn in January. In 2023 the surplus totalled a record JPY 3,350bn – during covid it was close to zero but the 2023 total was also 53% larger than in 2019. Yield divergence is of course key for the yen but with that factor turning more favourable for the yen, Japan’s external position will certainly help reinforce yen strength.

JAPAN'S SURGING TOURISM-RELATED TRAVEL SERVICES SURPLUS

Source : Macrobond & Bloomberg

KEY RELEASES AND EVENTS

|

EC |

10:00 |

Employment Change (YoY) |

Q4 |

1.3% |

1.3% |

! |

|

EC |

10:00 |

Employment Change (QoQ) |

Q4 |

0.3% |

0.2% |

! |

|

EC |

10:00 |

GDP (YoY) |

Q4 |

0.1% |

0.0% |

!! |

|

EC |

10:00 |

GDP (QoQ) |

Q4 |

0.0% |

-0.1% |

!! |

|

US |

12:00 |

FOMC Member Williams Speaks |

-- |

-- |

-- |

!! |

|

US |

13:30 |

Nonfarm Payrolls |

Feb |

198K |

353K |

!!!!! |

|

US |

13:30 |

Average Hourly Earnings (MoM) |

Feb |

0.2% |

0.6% |

!!!!! |

|

US |

13:30 |

Average Hourly Earnings (YoY) (YoY) |

Feb |

4.4% |

4.5% |

!!! |

|

US |

13:30 |

Average Weekly Hours |

Feb |

34.3 |

34.1 |

! |

|

US |

13:30 |

Participation Rate |

Feb |

-- |

62.5% |

!! |

|

US |

13:30 |

U6 Unemployment Rate |

Feb |

-- |

7.2% |

!! |

|

US |

13:30 |

Unemployment Rate |

Feb |

3.7% |

3.7% |

!!!! |

|

CA |

13:30 |

Capacity Utilization Rate |

Q4 |

80.2% |

79.7% |

! |

|

CA |

13:30 |

Employment Change |

Feb |

21.1K |

37.3K |

!! |

|

CA |

13:30 |

Participation Rate |

Feb |

-- |

65.3% |

! |

|

CA |

13:30 |

Unemployment Rate |

Feb |

5.8% |

5.7% |

!! |

Source: Bloomberg