USD takes a hit as UST market sell-off extends after Trump tariffs take effect

USD: Sell-off for US equities, bonds & dollar as tariffs take effect

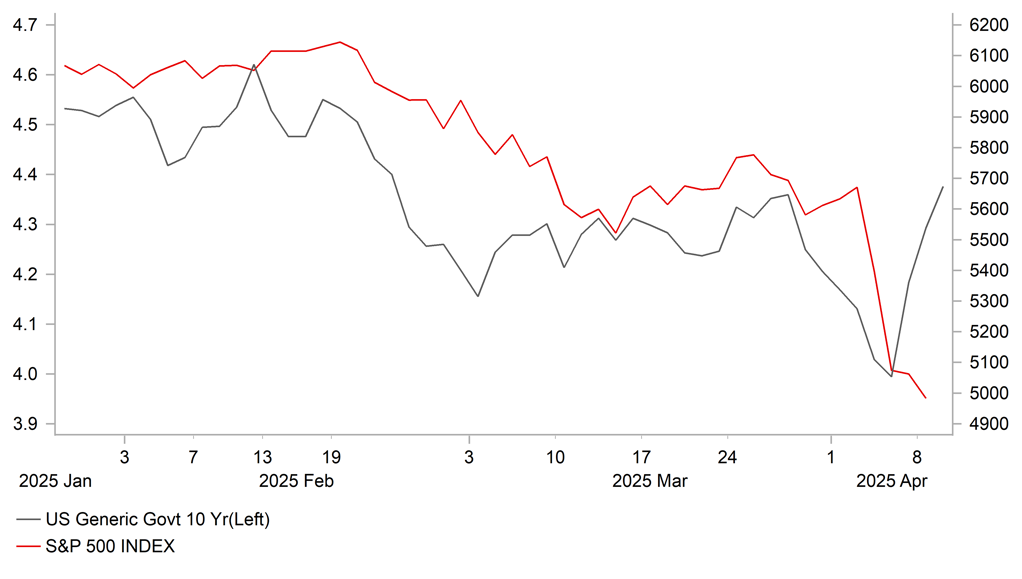

The sell-off in global equity markets has resumed overnight with the Nikkei 225 index falling by around 4.0%. It follows on from losses in US equity markets which also coincided with a sharp sell-off in the US Treasury market. Yields on the 10-year and 30-year US Treasury bonds have both surged higher by around 60bps over the last three trading days with the 30-year yield hitting a fresh year to date high of just over 5.00%. The unfavourable price action has cast some doubt on the safe haven status of the US government bond market and the US dollar at the time when the global trade war is intensifying. The US dollar has also fallen sharply overnight against the other major currencies of the euro, Swiss franc and yen resulting in the dollar index falling back below the 102.00-level. The sell-off in US equities, US bonds and the US dollar all at the same time follows President Trump’s decision yesterday to impose the higher “reciprocal tariffs” alongside the additional 50% tariff hike on imports from China. It lifts the US average tariff rate on imports from China up to around 114%. The implementation of the tariffs has reinforced concerns over the risk of a more stagflationary outcome for the US economy.

Despite US dollar weakness overnight the Chinese renminbi has fallen to a fresh low. USD/CNH hit a high of 7.4273 but has since dropped back towards the 7.3800-level as the US dollar has weakened. The PBoC set the daily fix for USD/CNY for the fifth consecutive day at 7.2066. Weakness in the renminbi continues to reflect building speculation over the potential for bigger devaluation in response to the intensifying trade war between the US and China. There were negative spill-overs yesterday to other Asian currencies and the Latam currencies of the Brazilian real and Chilean peso which both fell by over 1% against the US dollar. It has lifted USD/BRL and USD/CLP back up to the 6.0000 and 1,000.0 respectively. In these circumstances, we expect foreign exchange market volatility to remain elevated in the near-term, and continue to expect the traditional safe haven currencies of the yen and Swiss franc to outperform.

SHARP UST BOND SELL-OFF UNDERMINES CONFIDENCE IN USD

Source: Bloomberg, Macrobond & MUFG GMR

EM FX: Global growth fears trigger sharp reversal of recent EM FX gains

Emerging market currencies have correctly sharply lower so far this month triggered by President Trump’s plans for “reciprocal tariffs” that have fuelled fears over a sharper slowdown/recession for the global economy. The worst hit emerging market currencies have been ZAR (-7.2% vs. USD), COP (-5.5%), BRL (-5.1%), and CLP (-4.9%). In contrast, the RON (+2.3% vs. USD), CZK (+1.1%) and HUF (+0.7%) have all held up better so far.

President Trump’s plans for “reciprocal tariffs” including applying a universal 10% baseline tariff to all trading partners alongside higher rates for the 60 “worst offenders” have significantly increased downside risks for global trade and growth. The subsequent sharp sell-off in global equity markets and widening of credit spreads is reinforcing downside risks to global growth. Emerging markets including Asian countries will be hit by some of the highest “reciprocal tariffs”. President Trump plans to impose a tariff of 34% on China, a tariff of 46% on Vietnam, a 37% tariff on Thailand, 32% tariffs on Taiwan and Indonesia, a 27% tariff on India and a 26% tariff on South Korea. South Africa will also be hit with a higher 31% tariff. In contrast, Latam economies have gotten off relatively lightly with Brazil and Chile subject to only 10% tariffs. It would suggest that trade disruption from tariffs directly will be worse for Asia and will continue to place downward pressure on regional currencies. Furthermore, it has encouraged speculation that China could devalue the CNY rather than prioritizing stability. It has been reported that Chinese policymakers are already considering bringing forward plans for stimulus to support domestic demand growth.

Building fears over a sharper global slowdown/recession have weighed more heavily on commodity prices and related emerging market currencies. It has resulted in Latam currencies underperforming alongside other commodity currencies such as the ZAR even though they were hit by relatively smaller tariffs. The ZAR has been undermined as well by negative domestic political developments after the government passed the Budget without support from the Democratic Alliance party casting doubt on the sustainability of the coalition. Elsewhere within EMEA FX, the PLN has weakened more in response to the dovish policy signal from NBP Governor Glapinski who surprisingly indicated that the NBP could start to cut rates sooner in May by even 50bps, and by more than 100bps by the end of this year if the government prevents energy prices from rising. It has helped to lift EUR/PLN up to the 4.3000-level after hitting a low of 4.1272 at the end of February which was the lowest level since 2015. It has meant the PLN has underperformed other regional currencies of the CZK and HUF.

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

UK |

10:00 |

5-Year Treasury Gilt Auction |

-- |

-- |

4.311% |

! |

|

GE |

10:25 |

German Buba Balz Speaks |

-- |

-- |

-- |

!! |

|

UK |

10:30 |

BoE FPC Meeting Minutes |

-- |

-- |

-- |

! |

|

US |

17:30 |

FOMC Member Barkin Speaks |

-- |

-- |

-- |

! |

|

US |

18:00 |

10-Year Note Auction |

-- |

-- |

4.310% |

!! |

|

US |

19:00 |

FOMC Meeting Minutes |

-- |

-- |

-- |

!!! |

Source: Bloomberg