USD continues to consolidate at stronger levels after NFP report

USD: Stronger US employment growth but Fed still expected to cut rates

The US dollar has continued to trade on a stronger footing following the release of the latest nonfarm payrolls report at the end of last week. After hitting a low of 105.42 on Friday, the dollar index has since climbed back above the 106.00-level. In contrast, US yields remain close to recent lows. The US 2-year and 10-year yields both hit fresh lows on Friday at 4.08% and 4.13%. The release of the latest nonfarm payrolls report for November revealed that employment growth rebounded strongly by +227k after the weak reading of just +36k in October. Even after incorporating the +56k upward revision to prior months employment growth, the report was judged as not sufficient to discourage the Fed to drop plans to deliver another 25bps rate cut this month. The US rate market has subsequently moved to more confidently price in 22bps of easing by the end of this year. The dovish repricing of Fed rate cut expectations is helping to bring down US yields alongside the correction lower in market-based measures of US inflation expectations. After hitting a high of 2.4% on the day of the US election, the 10-year US breakeven rate has since fallen back to 2.25% reflecting less concern over inflation. The US dollar initially weakened alongside US yields after the release of the nonfarm payrolls report but those losses proved to be short-lived. A higher likelihood of the Fed delivering another 25bps rate cut this month is not sufficient to trigger a sustained reversal of US dollar strength built on expectations that the incoming Trump administration will put in place policies including higher tariffs that will support a stronger US dollar next year. At the same time, the nonfarm payrolls report provided reassurance that the US labour market is continuing to hold up well providing no need for the Fed to speed up rate cuts at the current juncture. Recent comments from Fed officials including Chair Powell have indicated that they are more likely to slow down easing further an potentially a skip a meeting most likely early next year unless the release this week of the US CPI report for November surprises significantly to the upside. After slowing over the summer months, US employment growth has picked back up again heading into year end. Nonfarm employment growth has averaged 173k/month over the last three months to November compared to 113k/month in the three months to August bringing it back into line with the average this year of 180k/month.

Further insights into Trump’s policy agenda at the start of his second term as president were provided by an interview he held with NBC News’ “meet the Press” over the weekend. In the interview he reiterated his vow to deport millions of individuals in the country illegally and to reshape the immigration system, and to end birthright citizenship. He also reiterated pans to impose tariffs on America’s biggest trading partners and to extend tax cuts passed during his first term in office. On tariffs, he acknowledged that he could not assure US consumers that they won’t pay more for some products under rules should they be imposed. He was optimistic that the newly created Department of Government Efficiency (DOGE) could cut as much as much as a third of the national budget or more than USD2 trillion. Ukraine should “possibly, probably” expect less financial support as he is trying to negotiate an end to the war with Russia. While there were no significant surprises in Trump’s comments, they do highlight again that he plans to prioritize tightening immigration and implementing higher tariffs at the start of his second term as president.

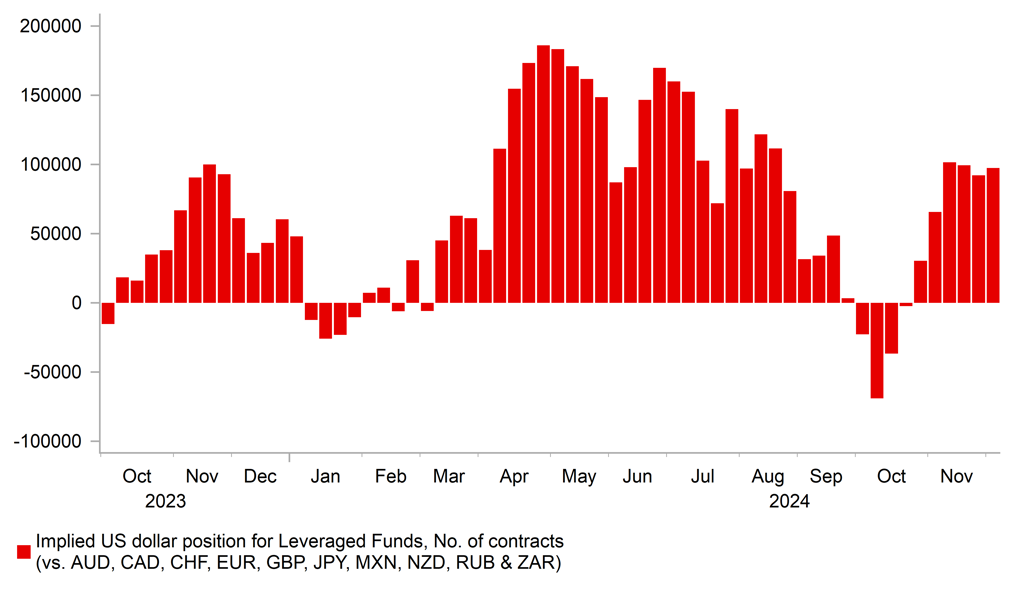

LEVERAGED FUNDS HAVE REBUILT LONG USD POSITIONS

Source: Bloomberg, Macrobond & MUFG GMR

CAD & EUR: More easing on the way as China shifts monetary policy strategy

Downside risks for the US dollar from the Fed cutting rates this month will be offset as well by further easing from other G10 central banks this week. The BoC, ECB and SNB are all expected to deliver further easing at their final policy meetings of this year. The case for the BoC to deliver a second consecutive larger 50bps rate cut this week lowering their policy rate to 3.25% was reinforced by the release of the latest Canadian labour market report for November. The report revealed an outsized jump in the size of the labour force by 137.8k in November. It resulted in the unemployment rate rising by 0.3 point to a new cyclical high of 6.8%. More evidence of a slacking labour market should encourage the BoC to keep bringing rates down more quickly to their estimate of the new policy range between 2.25% and 3.25%. We recommended a new long USD/CAD trade idea in our latest FX Weekly report released on Friday (click here).

In contrast, we expect the ECB to stick to a smaller 25bps rate cut this week. The euro-zone rate market shares a similar view but is pricing in a higher probability of the ECB delivering a larger 50bps cut in Q1. We expect the ECB to acknowledge that downside risks growth have increased recently from the threat of US tariffs being imposed and from unfavourable political developments in France but do not expect a strong signal to set up a larger 50bps rate at the current juncture. Without a strong signal for larger 50bps rate cut, we do not expect the policy meeting to trigger another leg lower for the euro heading into year end. The euro is benefitting as well this morning from China’s Politburo shifting their stance on monetary policy for the first time in 14 years to embrace a “moderately loose” strategy next year from this year’s “prudent” strategy. They also pledged to be "more proactive" in providing fiscal policy support. It has helped to boost investor optimism over China’s growth outlook for next year amidst looming downside risks from further tariff disruption.

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

09:30 |

Sentix Investor Confidence |

Dec |

-12.4 |

-12.8 |

! |

|

EC |

10:00 |

Eurogroup Meetings |

-- |

-- |

-- |

!! |

|

UK |

13:00 |

MPC Member Ramsden Speaks |

-- |

-- |

-- |

!! |

|

US |

14:00 |

Consumer Inflation Expectations |

-- |

-- |

2.9% |

! |

|

US |

15:00 |

CB Employment Trends Index |

Nov |

-- |

107.66 |

! |

Source: Bloomberg