Risk off tone supports yen amidst global growth concerns

Commodity FX: Saudi oil price adjustment adds to growth fears

The foreign exchange market has remained relatively stable overnight after the release of the latest nonfarm payrolls report on Friday triggered only a short-lived pick-up in volatility. The biggest mover amongst G10 currencies at the start of this week has been the Norwegian krone which has been undermined by the sharp decline in the price of oil yesterday. The price of Brent hit an intra-day low of USD75.26/barrel in response to reports that Saudi Arabia cut the official selling price for its flagship Arab Light crude to a USD1.50/barrel premium to the Asia regional benchmark for February. According to the Bloomberg, the USD2/barrel reduction was deeper than had been expected and lowers the premium over the regional benchmark to the lowest level since November 2021. The development has added to investor concerns over softening global demand especially in Asia. After the strong performance over the holiday period, the Norwegian krone is now in the process of correcting lower. EUR/NOK fell sharply from a high of 11.870 on 13th December to a low of 11.176 on 27th December where it has found support from the lows recorded during the summer of last year.

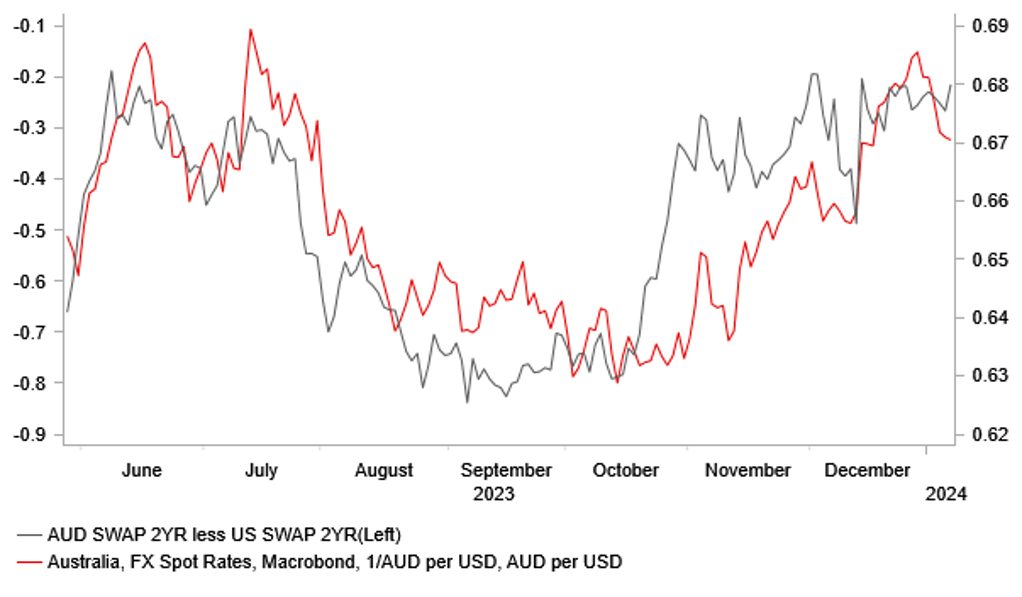

The more risk-off tone has also seen the other G10 commodity currencies of the Australian and New Zealand dollars underperform overnight. The AUD/USD rate has fallen back towards the 0.6700-level. The Aussie has failed to derive support from the release overnight of the stronger than expected retail sales report for November. The report revealed that retail sales increased by 2.0%M/M in November which was almost twice as strong as the Bloomberg consensus forecast. The ABS head of business statistics stated that “Black Friday sales were again a big hit this year, with retailers starting promotional periods earlier and running them for longer, compared to previous years” which helped to boost sales. It did though contribute to weakness in the prior month when October sales were revised lower to a bigger contraction of -0.4%M/M. The ABS also noted that shoppers may have brought forward some Christmas spending that would usually happen in December. As Bloomberg noted, retail sales were up just 2.2% in November compared to the same period of last year which is a weak outcome when one incorporates working age population growth of around 3% over the same period and above target inflation. As a result, we do not expect the report to materially alter market expectations that the RBA’s next policy move is more likely to be a rate cut rather than another hike. The Australian rate market expects the RBA to begin cutting rates during the second half of this year lagging behind other major central banks such as the Fed. Short-term yield spreads have been providing support for the Aussie in recent months.

AUD/USD VS. SHORT-TERM YIELD SPREAD

Source: Bloomberg, Macrobond & MUFG GMR

EM FX: Fed policy outlook, geopolitical risks & China growth concerns in focus

Emerging market currencies have suffered a setback at the start of the new calendar year giving back gains recorded over the holiday period. The worst performing currencies so far this year have been the CLP (-2.9% vs. USD), KRW (-2.1%), and THB (-2.1%). In contrast, the carry currencies of the MXN (+0.8% vs. USD) and HUF (+0.8%) have outperformed.

Emerging market currencies have been undermined in part by the modest rebound for the USD and US yields at start of this year. Market participants have been paring back expectations for the first Fed rate cut as early as March. After the release of stronger non-farm employment growth in December, the US rate market is now pricing in around 16bp of cuts by the March FOMC meeting. While employment growth has been slowing it is not yet weak enough to justify imminent rate cuts on its own. The next important data release in the week ahead will be the latest US CPI report December. Recent reports have shown that inflation pressures have slowed during the second half of last year which is encouraging Fed rate cut expectations. A much stronger CPI report (core > +0.3%M/M) for December would be required to challenge current expectations that inflation continues to slow back towards the Fed’s target. On the other hand, comments from Dallas Fed President Logan have heightened speculation that the Fed could move to slow the pace of QT in the 1H of this year. She noted the Fed should begin discussions on slowing asset runoff as overnight reverse repo balances approach a low level. A development that would be supportive for EM FX.

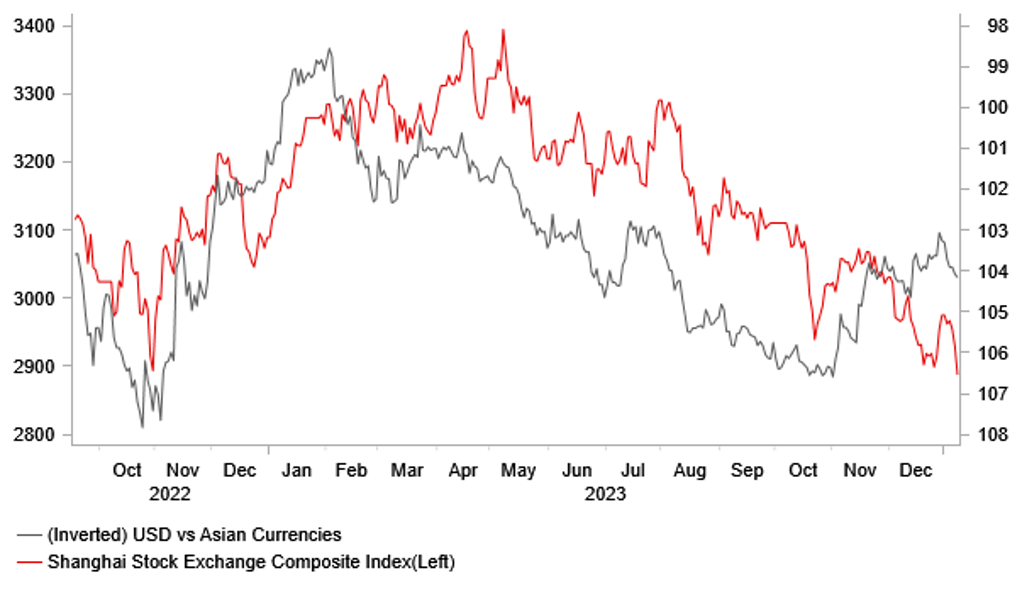

Emerging market currencies that have underperformed (CLP, THB & KRW) at the start of this year are more tightly linked to China where growth concerns have intensified again recently. Equity markets in China have fallen to fresh lows at the start of the new calendar year. Recent economic data releases have indicated that China’s economy slowed at the end of last year keeping pressure on domestic policymakers to provide more support for growth. In the week ahead, the upcoming election in Taiwan on 13th January will be important for assessing geopolitical risk in the region. The current DPP government’s candidate Lai Ching-te is the favourite to be the next president, but they could lose their majority in the legislature to a possible coalition between the opposition parties of the KMT and TPP. A stronger than expected performance for the TPP party would increase the risk that relations between Taiwan and Chia deteriorate further in the coming years potentially triggering an initial sell-off for the TWD and other Asian currencies in the week ahead, and vice versa.

CHINA GROWTH CONCERNS REMAIN A HEADWIND

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

10:00 |

Unemployment Rate |

Nov |

6.5% |

6.5% |

!! |

|

US |

11:00 |

NFIB Small Business Optimism |

Dec |

90.7 |

90.6 |

! |

|

US |

13:30 |

Trade Balance |

Nov |

-65.00B |

-64.30B |

!! |

|

CA |

13:30 |

Building Permits (MoM) |

Nov |

-1.7% |

2.3% |

!! |

|

CA |

13:30 |

Trade Balance |

Nov |

2.00B |

2.97B |

!! |

|

US |

16:30 |

Atlanta Fed GDPNow |

Q4 |

2.5% |

2.5% |

!! |

|

JP |

23:30 |

Overall wage income of employees |

Nov |

1.5% |

1.5% |

! |

Source: Bloomberg