FX market impact from falling price of oil & pullback for US yields

USD: Will lower US yields prompt a hawkish shift from the Fed?

The major foreign exchange rates have stabilized overnight with EUR/USD trading just above the 1.0700-level and USD/JPY just below the 151.00-level. The main market move yesterday was the ongoing sell-off in the oil market where the price of Brent has fallen back below USD80/barrel. It has helped to drag market-based measures of inflation expectations lower. The US 10-year break-even rate has fallen from just below 2.50% on 19th October to around 2.35%. Over the same period the 10-year US Treasury yield has fallen by around 0.50 point from just over 5.00%, and is currently testing support at 4.50%. The initial rally for the price of oil triggered by the conflict between Hamas and Israel has proven to be short-lived, and provides more reassurance that inflation will continue to slow in the year ahead. It supports market expectations that the Fed is unlikely to raise rates further, and will begin to reverse rate hikes next year encouraged by slower inflation and growth. After the release of the much weaker non-farm payrolls report for October, the US rate market is more confident to price in again further rate cuts from the Fed by the end of next year. There are currently around 88bps of cuts priced by December 2024 which is almost exactly the same as what it expected from the ECB over the same period. In light of the recent resilience of the US economy relative to the euro-zone economy, US rate cut expectations appear relatively more aggressive than those for the ECB. The US economy would have to start slowing more notably in the coming quarters and/or inflation continue to fall more quickly than expected for the US rate market to price in even deeper rate cuts. It should help to prevent a sharper sell-off for the US dollar in the near-term. We are not yet convinced that the sharp US dollar sell-off at the end of last week will be sustained at least on a broad-based basis.

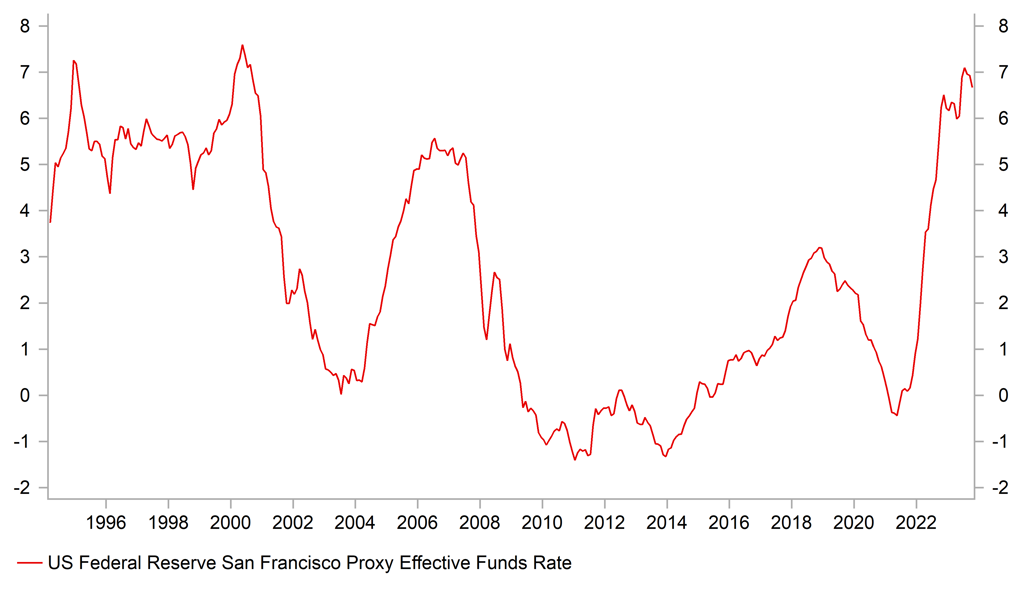

The pullback in US yields has also raised some doubts over whether Fed will need to raise rates further if market yields continue to correct lower. As we highlighted above the 10-year US Treasury yield has already fallen by around 0.50 point from the recent peak. Nevertheless, it is still well above levels that were in place prior to the summer period when the US Treasury yield averaged just over 3.8% between June and July and just over 3.6% in the first half of this year. Even after the recent pullback in US yields, financial conditions remain significantly tighter and are easing pressure on the Fed to hike rates further in response to much stronger growth in Q3. Market participants will be listening closely to comments from Fed officials today including Chair Powell. We would be surprised if the recent drop in yields was sufficient to make the Fed signal with more confidence again that they plan to hike in December. Unless there is a hawkish surprise from the Fed, market participants should remain confident that the Fed and other major central banks have now finished raising rates which is contributing to lower foreign exchange market volatility.

TIGHTER FINANCIAL CONDITIONS REINFORCING IMPACT OF FED HIKES

Source: Bloomberg & MUFG GMR

CAD: Domestic fundamentals & lower oil price are encouraging weaker loonie

The Canadian dollar has underperformed since late in September. It has weakened by around -2.3% against our equally-weighted basket of other G10 currencies after peaking out on 27th September. Only one other G10 currency has declined more than the Canadian dollar over that period and that is the other G10 oil-related currency of the Norwegian krone. Both currencies have been undermined in part by the sharp adjustment lower for the price of oil. After hitting a peak of USD97.7/barrels at the end of September, the price of Brent fell back below USD80/barrel yesterday for the first time since July. Initial gains after the outbreak of the Hamas-Israel conflict have been quickly reversed as market participants have become more confident that the conflict will remain contained in the region and limit supply disruptions in the oil market. The CRB’s raw industrials commodity price (RIND) index has also fallen to fresh year to date lows at the start of this month and to the lowest level since in early 2021. The price action could be an indication as well that the global demand continues to slow heading into year-end which is creating an unfavourable backdrop for commodity currencies.

At the same time, the Canadian dollar has been undermined by recent evidence revealing that Canada’s economy is slowing more in response to higher rates. The release of the latest monthly GDP data for August revealed that growth remained flat for the second consecutive month and accompanying guidance suggest flat growth again in September. It has added to concerns that Canada’s economy could have fallen into a mild technical recession in Q3 following a contraction of -0.2% in Q2. It is is clear that Canada’s is now experiencing a period of sub-trend growth that will help to bring down inflation. The annual rate of rate of GDP growth slowed to 1.0% in August which is below the BoC’s range for potential output for this year between 1.4% and 3.2%.

Another downside surprise for growth in Q3 (the BoC was expecting growth of 0.8% in the October Monetary Policy Report) is reinforcing market expectations that the BoC’s rate hike cycle ended back in July when the last 0.25 point hike to 5.00% was delivered. It has resulted in relatively bigger dovish repricing in the Canadian rate market than in the US rate market since the end of September. The yield on the 2-year Canadian government bond has fallen by around 0.56 point since the peak in September compared to around 0.35 point in the US. Even after the recent adjustment, market participants are still pricing in more Fed (-88bps) than BoC (-66bps) cuts next year with both expected to begin cutting rates by the middle of the year. With the US economy currently holding up better than Canada’s economy, we see room for short-term yield spreads to continue in favour of a stronger US dollar. It should help to keep USD/CAD trading in the high 1.3000’s in the near-term which is already towards the top of the long-term trading range for the pair. Please see our latest FX Focus report for more details (click here).

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

08:10 |

ECB's Lane Speaks |

-- |

-- |

-- |

!! |

|

UK |

08:30 |

BoE MPC Member Pill Speaks |

-- |

-- |

-- |

!! |

|

JP |

08:35 |

BOJ Gov Ueda Speaks |

-- |

-- |

-- |

! |

|

US |

13:30 |

Initial Jobless Claims |

-- |

215K |

217K |

!!! |

|

US |

14:30 |

FOMC Member Bostic Speaks |

-- |

-- |

-- |

!! |

|

EC |

17:30 |

ECB President Lagarde Speaks |

-- |

-- |

-- |

!! |

|

US |

19:00 |

Fed Chair Powell Speaks |

-- |

-- |

-- |

!!! |

Source: Bloomberg