Assessing the FX impact from Trump’s opening salvo of tariff threats

- Trump has threatened to impose tariff hikes on Canada, China & Mexico at start of second term as President.

- Tariffs viewed as a negotiating tool to force change at borders to address illegal immigration and drug problems.

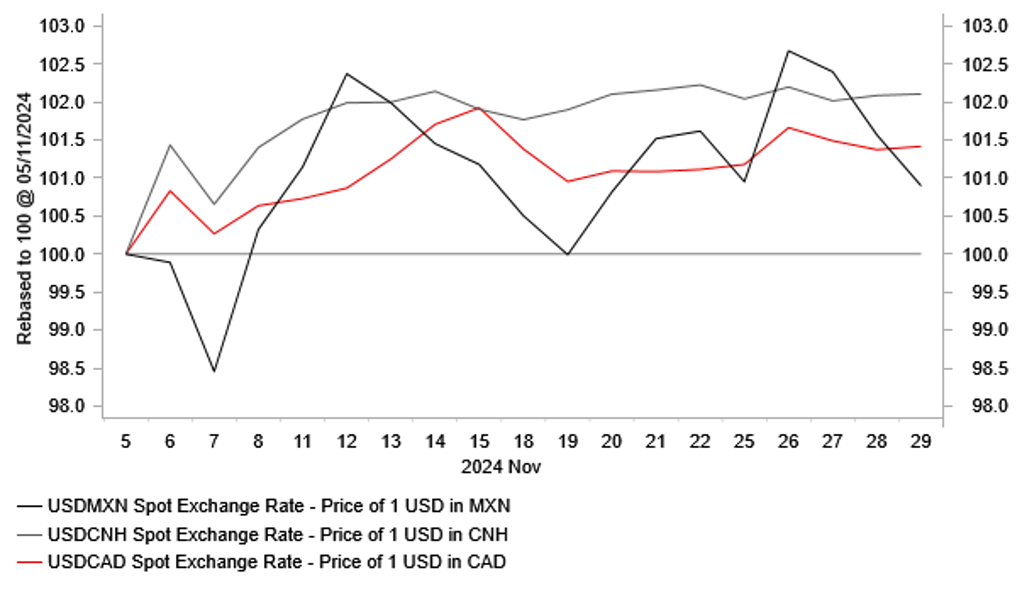

- CAD & MXN price action highlights that market participants are not expecting tariff hikes to be implemented. Trump threats have mainly raised volatility.

- Higher likelihood that tariff hike will be implemented on China as part of a series of hikes encouraging a weaker CNY.

President-elect Trump to target Canada, China & Mexico at start of 2nd term

In a series of posts earlier this week on Truth Social President-elect Donald Trump stated that he would impose additional tariffs on imports from Canada, China and Mexico. He has vowed to implement 25% tariffs on all goods imports from Canada and Mexico, and an additional 10% tariff on imports from China. During the election campaign Donald Trump had proposed raising tariffs on major trading partners by 10% or even 20%, and for China specifically by up to 60%. This week’s threat to implement 25% tariff hikes on Canada and Mexico even exceeds his campaign proposals while for China the 10% tariff hike could just be the first down payment with further tariff hikes likely to come. The 25% tariff hikes on Canada and Mexico would be implemented on 20th January whereas he did not include a specific date for the 10% tariff hike on China. He is likely to draw authority from International Emergency Economic Powers Act (IEEPA) to implement tariff hikes on Canada and Mexico which would require the President to declare a national emergency. To impose a further 10% tariff hike on China, he is more likely to utilize powers granted under Section 301 of the Trade Act of 1974 which provides authority for the US Trade Representative to address unfair trade practices.

The scale and timing of tariff hike plans for Canada and Mexico were surprising, and indicate his initial policy focus will be to crack down on immigration and drug problems in the US. In the posts on Truth Social, President-elect Trump highlighted that he plans to use the tariff hikes threat as a negotiating tool. He stated that the 25% tariff hikes for Canada and Mexico would remain in place “until such time as Drugs, in particular Fentanyl, and all illegal Aliens stop this Invasion of our country”. It fits with his decision to select Tom Homan as the new “border czar” who advocates strict immigration policies. The timing of the tariff threats is earlier than we had been expecting as we thought he would wait until closer to the upcoming review of the USMCA trade agreement between Canada, Mexico and the US that was signed during Trump’s first term as President. The USMCA trade deal is not scheduled for joint review unitl 1st July 2026 when parties must confirm in writing whether they wish to extend the agreement for another 16 years, otherwise it will expire in 2036. Tariff threats are one way though to gain negotiating leverage ahead of renegotiations on select parts of the USMCA. However, if he follows through with his threat and implements 25% tariffs on Canada and Mexico it would essentially blow up the USMCA which was viewed as one of the success stories of his first term in power.

PRICING IN TARIFF RISKS SINCE US ELECTION HAS BEEN MODEST SO FAR

Source: Bloomberg, Macrobond & MUFG GMR

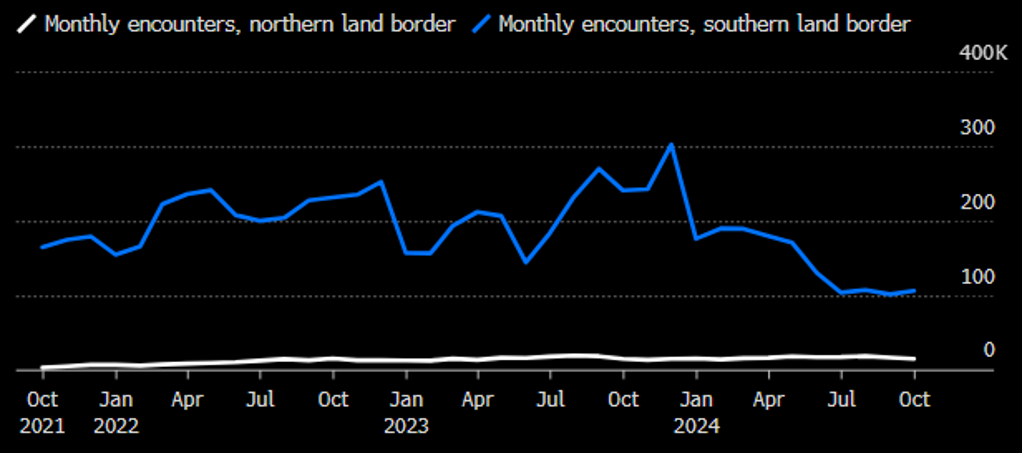

Canada can feel relatively more hard done by than Mexico to be threatened by 25% tariffs. Problems with drugs and immigration are much bigger at the southern border. US Customs and Border Protection data show the number of migrants attempting to get into the US from Canada without authorization is about a tenth of those trying to enter from Mexico. Encounters at the northern border totalled almost 199k during the twelve months to the end of September compared with more than 2.1 million at the southern border. Those figures include people who are trying to get through regular border entry points but who lack necessary paper work or are deemed inadmissible for other reasons. Similarly, the US Customs and Border Protection statistics show that agents captured on average 1,810 pounds of fentanyl a month at the US-Mexico border from January 2022 to October 2024 in comparison to an average of only 1.8 pounds a month at the northern border. It should mean though that the hurdle for Canada to avoid being hitting by the 25% tariff hike should be relatively lower. Canadian Prime Minister Trudeau was quick to speak with President-elect Trump attempting to provide reassurance that “we talked about some of the challenges that we can work on together. It was a good call”.

During Trump’s first term as President there was a mixed record for trade disputes between Canada, Mexico and the US. Trump slapped 25% tariffs on Canadian and Mexican steel imports and 10% tariffs on aluminium imports effective from 1st June 2018. These tariffs applied to approximately 8% of Canada’s total exports and 2% of Mexico total exports. In response, Canada imposed retaliatory tariffs on USD16.6 billion of US goods including steel, aluminium and other products starting on 1st July. Mexico imposed retaliatory tariffs on USD3.6 billion of US imports from 5th June and 5th July. These joint tariffs remained in place until 20th May 2019 when they were lifted to facilitate the ratification of the USMCA. In a further step, Donald Trump also threatened on 31st May 2019 to impose tariffs on all goods from Mexico that would gradually escalate to 25% that would be lifted only “if illegal migration crisis was alleviated through effective actions taken by Mexico”. The threat was quickly dropped on 7th June when Mexico agreed to help stem the tide of migrants. After protracted trade negotiations, the USMCA free trade agreement came into effect on 1st July 2020 replacing NAFTA. An agreement that includes stricter rules of origin for automobiles requiring that 75% of a vehicle’s components be made in North America up from 62.5% under NAFTA.

CANADA-TO-US CROSSINGS ARE ABOUT 10% OF OVERALL EVENTS

Source: Bloomberg & US Customs and Border Protection

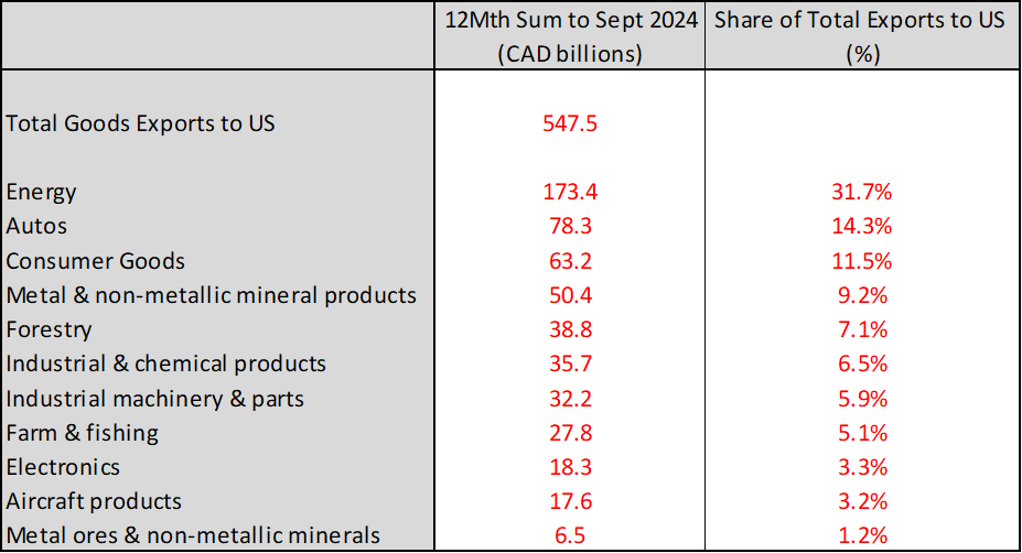

Trump’s current threat to impose 25% tariffs on all goods imported on Canada would be a significant step up from trade tensions during Trump’s first term when the aluminium and steel imports accounted for only around 8% of Canada’s total exports. Looking at the latest trade data until September of this year, Canada’s total exports of goods to the US totalled around CAD548 billion over the past year. The US accounts for roughly 75% of Canadian goods exports and weigh in at about 25% of Canadian GDP. As a small open economy that trades heavily with the US, the disruption to Canada’s economy from implementing 25% tariffs would likely trigger a recession. The sectors that would be hit the hardest would be Energy that accounts for around 31.7% of total goods exports to the US followed by Autos (14.3%) and consumer goods (11.5%). Canada is the largest supplier of crude oil to the US at over 3.8 million barrels/day or around 60% of US crude imports. It would be significantly disruptive for the US economy as well putting upward pressure on US gasoline prices and consumer goods prices, and damaging supply chains for auto production in North America that are tightly linked.

It is for these reasons that market participants remain optimistic that Donald Trump is unlikely to fully follow through with threats to impose 25% tariff hikes on all goods imported from Canada and Mexico. A view that has quickly been backed up by a subsequent post from President-elect Trump on Truth Social stating that he had a “wonderful conversation” with Mexican President Claudia Sheinbaum in which “she has agreed to stop Migration through Mexico, and into the Unites States, effectively closing our southern Border”. They also talked about “what can be done to stop the massive drug inflow into the United States, and also, consumption of these drugs”. Mexican President Sheinbaum felt the need to quickly clarity that “Mexico’s stance is not to close borders, but to build bridges among governments and people”. She explained the strategy Mexico has had so far to contain migration, “attending to migrants and caravans before they reach the border” and “respecting human rights”. It appears that Trump is already claiming a win from the use of tariff hike threats to force a change in border behaviour from Mexico. A development that is further dampening expectations that the tariff hikes will be implemented on Mexico and Canada, although Trump has not yet explicitly rescinded his tariff threat and may wait to see what concrete policy measures are put in place at the border in the coming months.

BREAKDOWN OF EXPORTS FROM CANDADA TO US

Source: Statcan & MUFG GMR

Implications for CAD & MXN

In the foreign exchange market, the CAD and MXN initially weakened in response to Trump’s tariff threat at the start of this week but the scale of the sell-offs relative to the size of the proposed tariff hikes were relatively modest. USD/CAD rose by around +1.4% on Tuesday hitting a fresh year to date high of 1.4178 before dropping back close to levels that were recorded prior to Trump’s tariff threat at just below the 1.4000-level. Similar price action was evident for USD/MXN although the MXN did initially weaken more sharply perhaps reflecting a view amongst market participants that there was higher likelihood of tariff hikes being implemented against Mexico than Canada given the bigger immigration and drug problems at the southern border. USD/MXN initially jumped higher by around +2.6% hitting a high of 20.831 on Tuesday but has since fully reversed course dropping back towards pre-Trump tariff threat levels at around the 20.300-level.

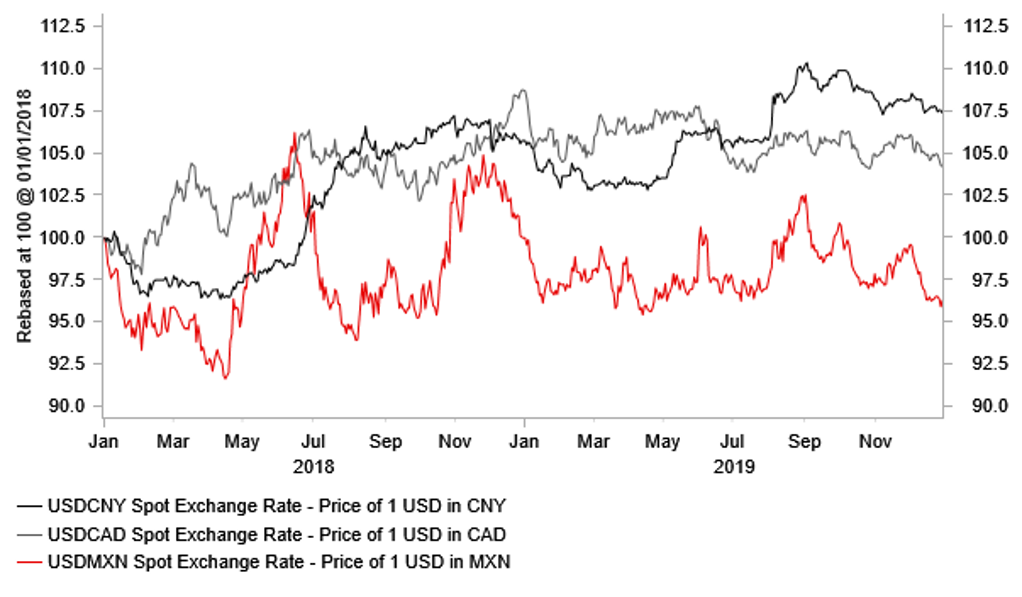

With USD/CAD and USD/MXN both having returned close to pre-Trump tariff threat levels, the main impact from Trumps’ posts this week has been to lift volatility for CAD and MXN. We expect higher volatility to be sustained until there is confirmation from Trump that he will not implement tariff hikes as planned at the start of next year. A clear indication that tariff hikes will not be implemented would provide further relief for the CAD and MXN and encourage further near-term gains at least until Trump’s focus shifts back to the upcoming review of the USCMA trade deal in 2026. For comparison during Trump’s first term, USD/MXN peaked right at the start hitting a high of 22.039 on 11th January 2017. It then never retested those initial highs even when the aluminium and steel tariff hikes were implemented in 2018 and threatened to impose a 25% tariff hike on all goods in 2019. USD/MXN did rebound by around 17% between April 2018 and June 2018 but only to a high of 20.961.

If we and other market participants are wrong and Trump follows through and implements 25% tariff hikes as planned early next year, then the CAD and MXN will need to weaken significantly to offset the impact of the higher tariffs. For comparison the average tariff rate on Chinese imports into the US rose from around 3% to 19% during Trump’s term. The CNY weakened against the USD by around 13% between 2018 and 2019 when the tariff hikes were implemented. If 25% tariff hikes were implemented on Canada and Mexico one could conservatively assume that the CAD and MXN would weaken against the USD by at least 10-15%. It would lift USD/CAD back closer to the record high from in 2002 at 1.6193, and USD/MXN towards 2020 COVID shock highs in the mid-20.000’s. One other alternative option could be for Trump to implement watered down tariff hikes that would trigger relatively smaller sell-off for the CAD and MXN. Even a smaller 10% tariff hike on all goods imported from Canada could see USD/CAD test the COVID high from 2020 at 1.4668.

BULK OF TARIFF ADJUSTMENT HAPPENED BY MIDDLE OF 2018

Source: Bloomberg, Macrobond & MUFG GMR

US potential tariffs on its imports from China: magnitude, timing and impact

Trump’s plan of raising tariffs by an additional 10% on all US imports from China came as a surprise too. The level of additional 10% tariff is smaller than what market participants expected. We certainly shall not expect Trump’s tariff increase on China goods to stop here, as US’s trade deficit still running large with China and the direction of US-China relationship is unlikely to be turned. This announcement actually implies that Trump’s tariffs on China goods during Trump’s second term will be phased, and path of tariff increase could span couple quarters.

Trump’s Trade War 1.0 has brought the US’s average tariff on China goods to 19.3% from about the 3.1% prior. Considering excessively high tariffs face constraints from economic fundamentals for the US, for this highly uncertain matter, we are currently expecting a total extra 20% tariff on US imports from China in 2025, rather than a roughly additional 40% tariff that would bring the US’s average tariff on US imports from China to 60% tariff (mentioned by Trump during his presidential election campaign). And, Trump may start the levying of this additional 10% tariff shortly after he takes the office. Trump’s victory and the GOP’s red sweep in both US Senate and House likely make the progress of Trade War 2.0 much faster than what happened during Trump’s first term, when the tariff was launched more than one year after Trump took the office.

Trade War 2.0 could bring larger negative impact on the Chinese economy, due to the following reasons: 1) although exports to US are accounting for a smaller share of China’s total exports, China’s GDP growth is more dependent on the contribution from the net trade now due to soft domestic demand and the weak property sector. A significant tariff on China and a wide-spread US tariff on other economies, will lower global demand and pressure the demand from other countries for Chinese goods lower as well. 2) Chinese companies hedged some of the negative impact they received though re-exports and going overseas. This time around, Trump is likely to focus on “forcing” manufacturing to return back to the US through tariffs and limit activities of re-exporting and Chinese firms’ actions to bypass tariffs.

For the case of increasing US tariff on Chinese goods to 40%, this could push USD/CNY to 7.5000, a roughly 3.5% depreciation of CNY against the USD. Such level of tariff hikes is largely in line with consensus expectation, the impact can be largely managed, by the government increasing its budgeted fiscal deficit (an extra 0.5%-0.8%) to stimulate domestic demand. Whereas, a tariff of 60% will post a much more challenging situation for the Chinese economy, our scenario analysis of the US increasing import tariffs on China to 60%, a 10~12% depreciation of CNY against the dollar is needed to bring China’s economic imbalances into balance. Such significant depreciation from an already weak exchange level would create instability in the financial system, which could require strong intervention by the PBOC. In our base case scenario assuming an additional 20% tariff, we expect USD/CNY to reach 7.3000 by year-end and 7.5000 by the middle of 2025. Having said that, a large fiscal spending (should it happen, the odds is low though) could reduce the scale of CNY depreciation.