BoE sends timely reminder not to get too carried away in pricing out rate cuts

- The BoE left rates on hold as expected at 4.75%. The decision to leave rates on hold was more balanced than expected (6 votes to 3 in favour of a hold).

- Forward guidance continues to emphasize gradual pace of rate cuts. We still expect next cut to be delivered in February.

- It sends timely reminder to UK rate market participants not to get too carried away in pricing out further cuts in 2025.

- BoE-Fed policy divergence at start of next year to weigh further on cable pushing down closer to 1.2000-level.

BoE to leave rates on hold but decision was more balanced than expected

The BoE decided to leave their policy rate unchanged today as expected at 4.75%. It follows the second 25bps rate cut in the current easing cycle that was delivered at the November MPC meeting. The main dovish surprise today was that the decision to leave rates on hold was a closer call than anticipated. The MPC voted by a majority of 6-3 to leave the policy rate unchanged. The three dissenters in favour of cutting rates by a further 25bps were MPC members Swati Dhingra, Dave Ramsden and Alan Taylor. While Swati Dhingra was widely expected to vote for another rate cut again, the votes in favour of another rate cut from Dave Ramsden and Alan Taylor were more surprising. After the first rate cut in August, the BoE then voted 8-1 in favour of keeping hold at the next meeting in September with Swati Dhingra dissenting in favour of a cut. Today’s meeting was the first time that Dave Ramsden had dissented since the June MPC meeting when he voted in favour of an earlier start to the BoE’s rate cut cycle. For Alan Taylor it was the first time he has dissented since he started voting on the MPC in September. Today’s vote reinforces the perception amongst market participants that Alan Taylor is one of the more dovish MPC members after he replaced Jonatan Haskel in August who had been one of the more hawkish MPC members. The three dissenters voted for a rate cut as they believed that the evolving balance of risks warranted a less restrictive policy rate. They highlighted recent data developments pointing to sluggish demand and a weakening labour market which would see further downward pressure on demand, wages and prices. They also noted higher uncertainty and weak global conditions. They were concerned that overt the medium-term inflation could undershoot the BoE’s inflation target and open an unduly large output gap if the policy rate remained at current restrictive levels.

However, it was a view not backed by the majority of MPC members who favoured leaving rates on hold today. For five out of six of those MPC members, recent developments added to the argument for a gradual approach to the withdrawal of policy restrictiveness and they wanted to deliberately avoid providing a commitment to changing policy at any specific future MPC meetings. On the one hand they acknowledged that most indicators of economic activity had weakened in the near-term but on the other hand inflation, wage growth and inflation expectations had risen adding to the risk of more persistent inflation in the UK. For the other MPC member who voted to leave rates on hold, they believed that the evolution of and prospects for disaggregated measures of activity and inflation could warrant an activist strategy. When weighing up these opposing views on the MPC, the BoE reiterated that a “gradual approach” to removing restrictive monetary policy restraint remains appropriate, and will continue to decide on the appropriate degree of monetary policy restrictiveness at each meeting. The BoE is weighing up the inflation impact from supply constraints against the disinflationary impact from weaker demand. The MPC is optimistic though that the labour market is now “broadly in balance” helping to dampen upside inflation risks.

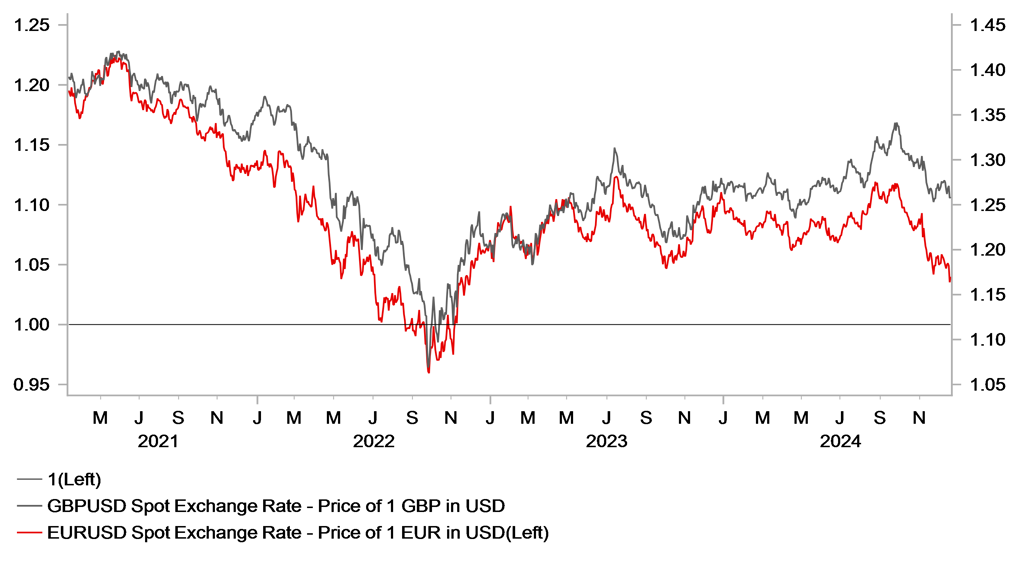

GBP CONTINUES TO HOLD UP BETTER THAN EUR FOR NOW

Source: Bloomberg, Macrobond & MUFG GMR

Market Implications

The GBP has weakened modestly in response to today’s BoE policy update. Cable has fallen to a low of 1.2583 from around 1.2630 prior to the BoE policy update. Similarly, EUR/GBP has risen up to a high of 0.8265 after trading closer to 0.8240 prior to the BoE’s policy announcement. The initial GBP sell-off was mainly triggered by the closer vote to leave rates on hold although has since been dampened by the largely unchanged forward guidance that continues to emphasize a gradual approach to rate cuts. We still expect the BoE to stick the current quarterly pace of rate cuts and deliver another rate cut in February. In contrast, the Fed’s hawkish policy update (click here) strongly signalled that they plan to slow down the pace of rates cuts next year. We expect the Fed to leave rates on hold at their next meeting in January and the rate pause could be extended further into 2025 if Trump follows through and puts in place inflationary policies at the start of his second term as president. Building expectations for a widening policy divergence between the BoE and Fed will encourage a weaker cable heading into early 2025. The pair is currently testing support at the 1.2600-level. A break below would open the door for cable to move into the low 1.2000’s at the start of next year. For the UK rate market, today’s BoE policy update provided a timely reminder not to get too carried away about pricing of rate cuts in the year ahead with only two further cuts currently priced in by the end of 2025.