ECB cuts but signals pause may be on the horizon

- As expected the ECB today cut the key policy rate by 25bps, taking the deposit rate to 2.50%.

- The ECB’s “meeting-by-meeting” forward guidance was unchanged but the monetary stance is now described as “more meaningfully less restrictive” signalling the potential for a more considered approach to future cuts.

- President Lagarde in the press conference very much focused on the high level of uncertainty as reason for providing limited guidance.

- The prospect of a pause is EUR-supportive but after the scale of the move this week the net impact will be limited.

ECB statement signals possible more cautious approach to cuts

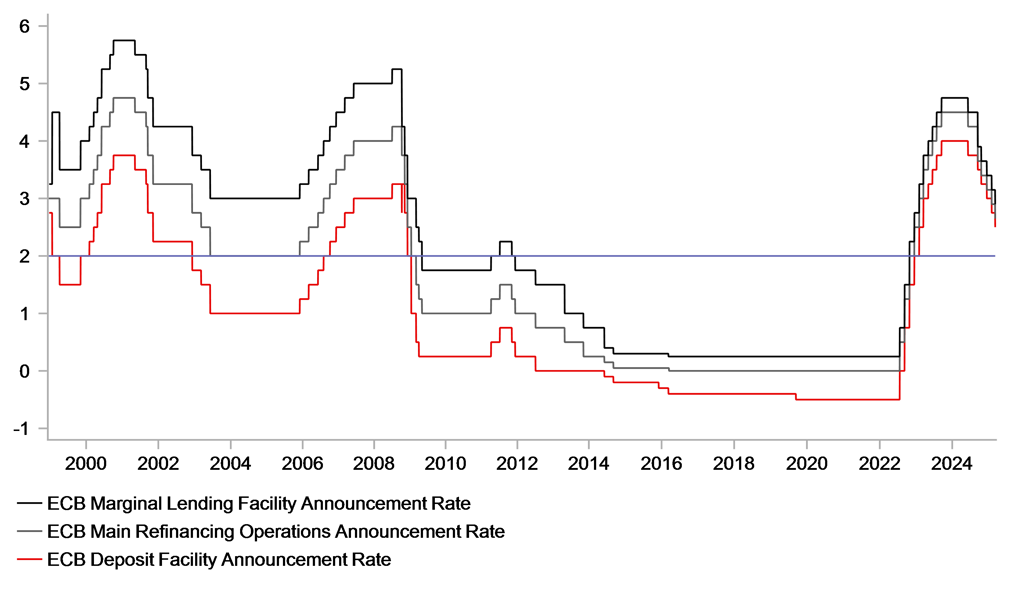

The ECB statement was largely similar to the statement from January. The primary difference was the reference to the description of the monetary stance which is now “becoming meaningfully less restrictive, as the interest rate cuts are making new borrowing less expensive for firms and households and loan growth is picking up”. This kind of shift to the description of the monetary stance was expected given we are much closer to what could be deeded as the neutral level (seen by the ECB as being between 1.75% and 2.25%). But that description of the monetary stance was also cited with a caveat that there was a headwind to the easing stance given that past easing was “still transmitting to the stock of credit, and lending remains subdued overall”. But certainly the words used described the stance tally well with the consensus view that there is potentially another 50bps of cuts to come in order to get to that assumed neutral rate of 2.00%. Prior to the announcement of the meeting the implied terminal rate priced in the market was 2.00% with the OIS curve flattening at that level from September onwards. Indeed, further out the OIS curve turns higher again in response to the announced defence and infrastructure spending plans this week.

The updated ECB forecasts were also consistent with the statement citing that the “disinflation process is well on track” with core HICP at 2.2% this year (down from 2.3%); 2.0% in 2026 (from 1.9%); and 1.9% in 2027 (unch). Growth was revised lower by 0.2ppt to 0.9% this year and by 0.2ppt to 1.2% in 2026. The 2027 growth rate was unchanged at 1.3%. Germany’s policy announcement was not incorporated in these forecasts. The inflation objective has been achieved and whatever restrictiveness that is left in the monetary stance can be removed. The statement very much emphasises the high level of uncertainty as being factors lowering the GDP growth projections due to lower exports and weak investment.

ECB POLICY STANCE “BECOMING MEANINGFULLY LESS RESTRICTIVE

Source: Bloomberg, Macrobond & MUFG GMR

Lagarde fails to provide clarity on an April pause

President Lagarde very much emphasised that high level of uncertainty in the press conference and stressed that due to this uncertainty the ECB would continue with its data-dependent, meeting-by-meeting approach stating that incoming data over the coming weeks would determine whether the ECB at futures meetings was in a position to cut or pause. Still, a pause is now a consideration which again is reflected in the description of the restrictiveness of the monetary stance. Lagarde also did not want to be drawn too much on the implications of the fiscal spending announcements this week from Germany and from Brussels. The obvious was of course stated that the policies could lift both inflation and GDP growth going forward. However, the defence spending plans are a “work in progress” and therefore Lagarde stated that the ECB must first wait to understand the details of the plans before passing a judgement on the monetary policy implications. Overall, there were no major surprises in the press conference and President Lagarde did a good job in presenting a similar message to previous meetings that the disinflation process continues but also adding that considerable easing is now behind us and there will be greater caution going forward. The ECB has now cut by 150bps and the Governing Council is largely still unified. ECB President Holzmann abstained in the cote to cut by 25bps today.

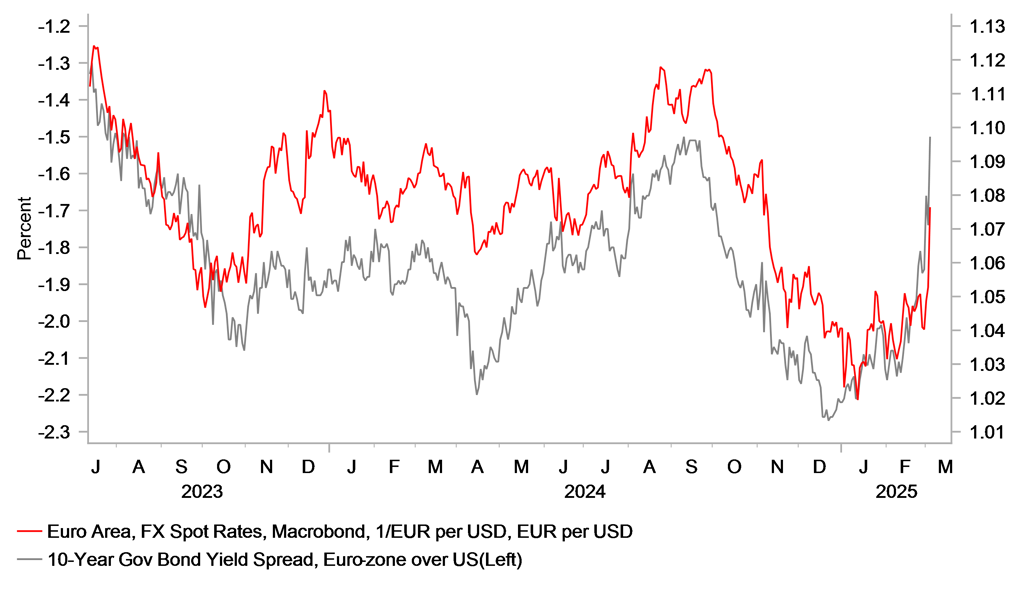

CONSIDERABLE SHIFT IN 10YR EZ-US SPREAD KEY IN DRIVING EUR/USD HIGHER

Source: Macrobond

Market Implications

The upgraded description of the restrictiveness of the monetary stance implying greater scope for a pause going forward, there has been a further more modest move higher in yields and strengthening of the euro consistent with the momentum prior to the meeting following the fiscal spending announcements on Tuesday. We don’t expect this meeting to fuel much in the way of additional momentum given the meeting was very much as expected. The scale of the move in Bund Yields yesterday was remarkable and our initial estimate in terms of the impact on real GDP growth in Germany is to add potentially up to 1.0ppt to the 2026 growth rate. The Bloomberg consensus for 2026 ahead of this week’s announcements was 1.0%, so feasibly we could be witnessing growth in or around 2.0% next year in Germany.

President Lagarde did not want to delve too deeply into the topic at this very early stage. The vote in the Bundestag still needs to take place, which itself is quite contentious given the general election has taken place and a new parliament is soon to commence. The final day for convening in the current parliament is 25th March, so clarity in the details of this plan will likely be much clearer by the time of the ECB meeting on 17th April. If the data is ambiguous enough (or stronger) by the time of that meeting and we have had progress and increased clarity on German fiscal spending plans the ECB could pause. Of course the flip side is tariff action by the US should also be clearer and if more aggressive than expected could argue in favour of a cut at that meeting.

Overall, with limited strong guidance, we don’t see EUR/USD getting much direction from here. There is too much uncertainty for the ECB to provide any clearer guidance and for now the huge increase in yields in Europe will act to underpin EUR/USD. The focus now shifts to the US and the US jobs data tomorrow. We remain wary on turning outright bearish on the US dollar at this stage given the uncertainties for the global economy and on whether the US economy is already at a sustained turning point.