ECB cuts emphasising meeting-by-meeting approach ahead

- As expected the ECB today cut the key policy rate by 25bps, taking the deposit rate to 2.25%.

- The ECB’s removed the reference implying policy as still being “restrictive” suggesting we have reached some broad area of neutral but Lagarde emphasised a continued meeting-by-meeting approach to policy decisions.

- The impact from the elevated trade uncertainty was increased downside risks to growth and “uncertainty to the outlook for inflation”.

- Today’s decision and communications were in line with expectations and we see limited impact on rates and FX.

ECB statement indicates growth rather than inflation risk concerns

The statement from the ECB after today’s meeting when the policy rates were cut by 25bps as expected indicated a leaning more toward concerns over downside growth risks than toward upside inflation risks. The ECB maintained its view that the “disinflation process is well on track” and that most measures of inflation suggest that inflation will settle around the 2.0% target “on a sustained basis”. The statement included no views on the potential impact on inflation from the increased trade tensions. However, in regard to growth, the ECB was clear – factors like increased uncertainty for households and firms and increased financial market volatility would “weigh on the economic outlook” and tighten financial conditions. The very clear view taken on downside growth risks but the lack of conclusion on the inflation impact was a clear indication in the statement of the potential for the ECB to cut further going forward. The ECB repeated its now regular guidance on its reaction function stating it would remain “data-dependent” and take decisions “meeting-by-meeting”. The emphasis on downside growth risks rather than referencing any concerns over upside inflation risks helped counter the removal from the statement that policy was “meaningfully less restrictive” – the description used in March when the ECB last cut. So even though the ECB may now believe the policy rate has entered some rough range of what might be described as “neutral”, there was enough in the statement to imply that did not signal an appetite necessarily to pause.

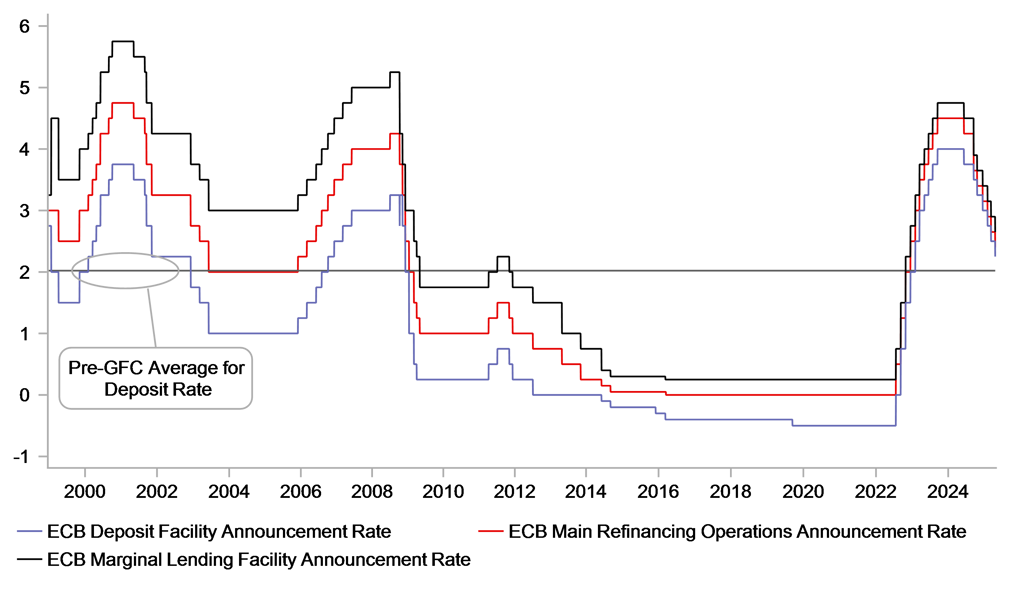

ECB POLICY STANCE NO LONGER DEEDED “RESTRICTIVE”

Source: Bloomberg, Macrobond & MUFG GMR

Press conference – Lagarde emphasises “readiness” and “agility”

There were no surprises in the press conference from President Lagarde either and as expected the focus was very much on the impact from increased trade uncertainty. Again, Lagarde was clear that the impact was negative for growth but in relation to inflation the impact was unclear. The decision to cut by 25bps was unanimous but there had been debate as usual with different options discussed, including a pause and a 50bp cut, but nobody argued in favour of a larger cut.

In explaining the decision to remove a reference to policy being “restrictive” Lagarde explained that it was related to the current environment. The extent of restrictiveness is measured against a perceived ‘neutral’ rate but this measure is only usefully in a “shock-free” environment and given the scale of uncertainty, this was no longer appropriate. Lagarde added that it meant little in terms of the way forward and stated that “readiness” and “agility” were now the two primary characteristics under which the ECB would be operating in the face of the high level of uncertainty due to US trade policy uncertainty.

Market implications

Overall, the rate decisions, the statement and the press conference were broadly in line with expectations. However, we would certainly conclude that there was a slightly greater emphasis on downside growth risks relative to upside inflation risks than perhaps expected. Lagarde clearly did not want to entertain for any amount of time the potential for inflation to move higher. The focus was very much on negative growth concerns which reinforces the prospect of more rate cuts ahead. Lagarde’s communication certainly differed from Fed Chair Powell’s communication last night with Powell emphasising much more the inflation risks. This of course makes sense given the potential scale of tariffs hitting domestic inflation in the US.

In our April Foreign Exchange Outlook monthly report, (published just before Liberation Day) we assumed a pause from the ECB at 2.00% from June. We have since added one further rate cut to 1.75% which we are maintaining for now. The risk at this juncture is that the ECB could cut further this year, to 1.50%. But for now we will assess the tariff risks. In FX, of course the co-moves in FX and rate spreads have broken down due to the loss of confidence in the US dollar in the aftermath of Trump’s policy announcements. If those rate spreads were to reassert themselves in influencing FX, then the dollar would likely recover. It would imply EUR/USD breaking back below the 1.1000-level. However, we doubt that is going to happen at this juncture and it would take something more meaningful from President Trump in terms of backtracking on trade policy for the dollar to recover on a more sustained basis.