ECB signals job nearly done with focus shifting to getting to neutral

- ECB lowers policy rate for a fourth time and at the third consecutive policy meeting by 0.25 point to 3.00%.

- ECB drops its reference to keeping policy rates “sufficiently restrictive for as long as necessary” signalling a willingness to get to neutral.

- The updated forecasts contained few surprises with GDP and inflation projections lowered.

- Lagarde acknowledges a larger cut was discussed today which we believe keeps EUR/USD risks skewed to the downside

ECB heading to neutral on price stability confidence

The ECB did not surprise the financial markets today and the 25bp cut to the key policy rate has resulted in minor moves in FX and rates. The initial communication via the statement has given a clear indication of increased confidence in the achievement of its inflation goal. The ECB in the policy statement dropped the reference to keeping the monetary stance “sufficiently restrictive for as long as necessary” and this really isn’t much of a surprise. Following four rate cuts totalling 100bps such a comment no longer made sense and now the focus of the Governing Council is getting to whatever might be deemed as neutral. While understandable, the removal is important and

signals a formal end to a hawkish element of ECB communication that has been with us as the ECB fought to bring inflation under control. The second key change to the statement related to the inflation target. In October the ECB stated that “the Governing Council is determined to ensure that inflation returns to its 2% medium-term target in a timely manner”. In today’s statement the ECB states that “the Governing Council is determined to ensure that inflation stabilises sustainably at its 2% medium-term target”. So this is a clear message that the ECB now believes it is there or there abouts in achieving its goal as defined by its own price stability definition.

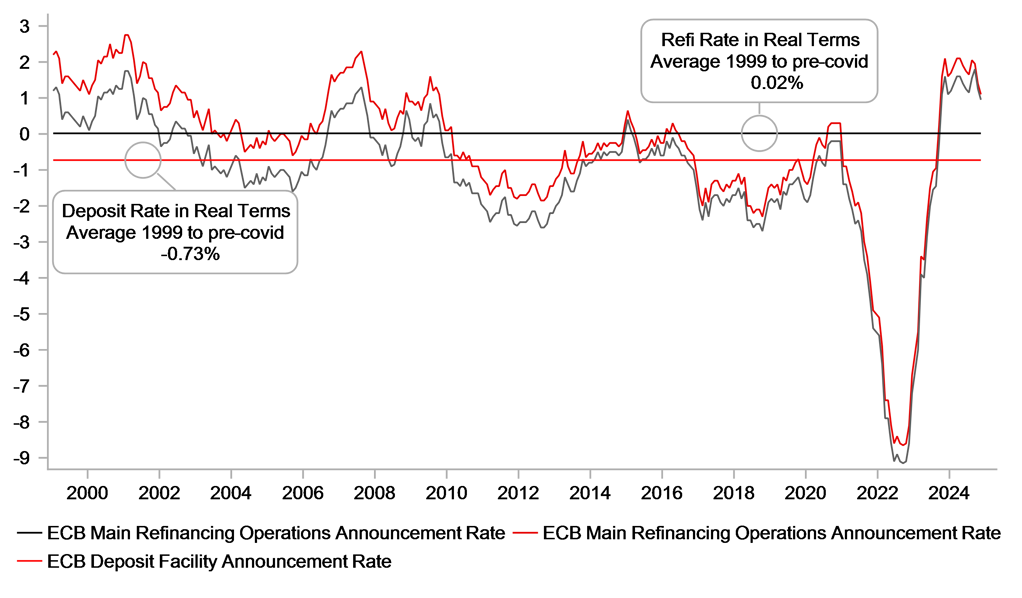

ECB POLICY RATES REMAIN WELL ABOVE LONG-TERM AVERAGE

Source: Bloomberg, Macrobond & MUFG GMR

The updated forecasts released today were certainly consistent with the message in the statement that the monetary stance may no longer need to be restrictive. The 2025 inflation projection was lowered by 0.1ppt to 2.1% with the 2026 forecast unchanged at 1.9%. Somewhat surprisingly, the ECB’s first forecast for 2027 was higher at 2.1%. The core CPI forecast in 2027 was put at 1.9% implying an energy-related impact on the headline forecast. Real GDP growth forecasts as expected were lowered 0.1ppt, 0.2ppt and 0.1ppt to 0.7%, 1.1% and 1.4% in 2024, 2025 and 2026 respectively. Those new estimates are around the market consensus and hence was little surprise. In 2027 GDP growth is expected to be just 1.3% underlining the ongoing weak growth profile. It gave further reason for the Governing Council to signal the plan to remove policy restrictiveness and get back to neutral.

The limited move in FX and rates also reflects the limited guidance on offer from President Lagarde in the press conference. Lagarde stated that the neutral rate could not be “determined with precession” and that there was no discussion on where the neutral rate might be. The meeting today though did include “some discussions, with some proposals to consider possibly 50bps cut” but Lagarde added that “overall agreement” was for a cut of 25bps. But ultimately going forward, the ECB stance on future moves was the same – those decision would be “data-dependent” and “meeting-by-meeting” with no pre-committed path ahead. However, Lagarde did acknowledge when referring to the future path of the policy rate that “the direction of travel is very clear” given that the current policy stance is unquestionably still restrictive.

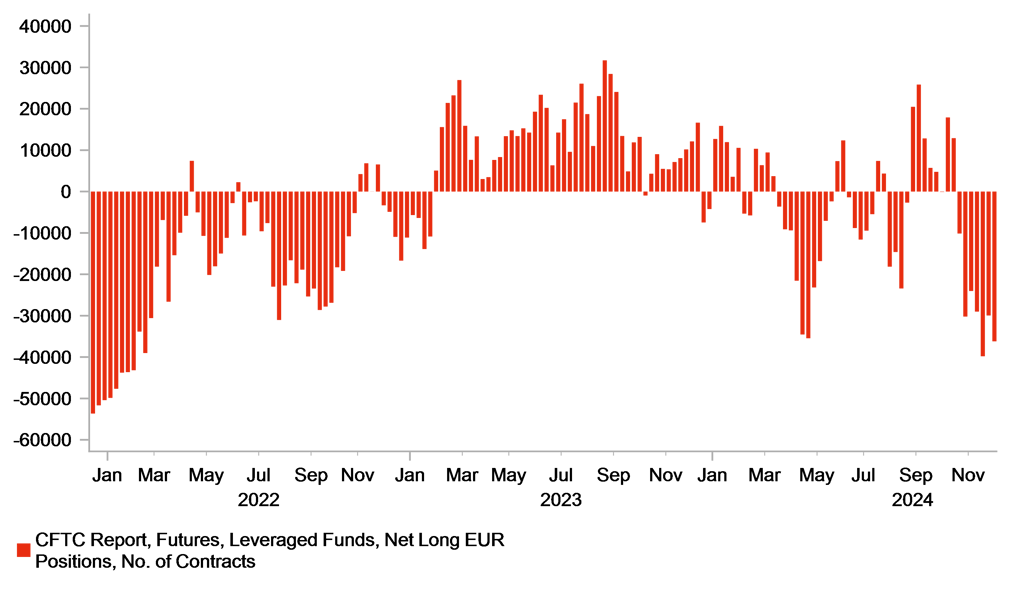

FX MARKET ALREADY WELL POSITIONED FOR DOVISH ECB

Source: Macrobond

Market Implications

There is not a lot for market participants to trade off. Considering the OIS market was implying the policy rate moving to between 1.50% to 1.75% by October next year, the changes today to the text of the statement, the forecasts and the comments from Lagarde all merely endorse the current market pricing. That said, we believe there is enough in today’s statement to feasibly see a scenario in which the ECB cuts by 50bps at the next one or two policy meetings. The downgrade to the growth and inflation forecasts, the acknowledgement that there was at least a discussion of cutting by 50bps today and the fact that inflation risks are now two-way are all important developments. If incoming economic data was to weaken further say on elevated uncertainties over trade tariffs or in response to Trump being more aggressive with trade tariffs in the early part of his presidency then a larger cut would be feasible.

We certainly have no issue with expecting the ECB to get the policy rate to neutral. At MUFG we view neutral in nominal terms as being roughly around 2.00%-2.25%. Lagarde did not want to be drawn to a specific level (central bankers never do!) but past ECB studies imply R* of being around zero and possibly moving a little higher.

While we have some issues on the extent of easing priced in 12mths time, the nearer-term take-away from today’s ECB meeting is that the Governing Council has shifted to a more dovish outlook and there is a plausible scenario of getting to some measure of neutral more quickly. That to us will keep EUR/USD under downward pressure despite trade tariff risks being much better priced now following the drop in EUR/USD from around the 1.1200-level in September.