ECB signals more to come with disinflation process “well on track”

- As expected the ECB today cut the key policy rate by 25bps, taking the deposit rate to 2.75%.

- ECB forward guidance was unchanged and the statement in general was largely unchanged signalling the potential for further cuts ahead.

- President Lagarde in the press conference described the idea of discussions on halting rate cuts as “premature”.

- The ECB outcome is less important than trade tariff outcomes for EUR.

ECB statement signals easing to continue

The ECB statement was broadly the same as the statement in December. The disinflation process remains “well on track” and the ECB repeated that it would continue to follow a “data-dependent and meeting-by-meeting” approach to adjusting the monetary policy stance going forward. The statement referred to the euro-zone economy as “still facing headwinds” but that rising real incomes and fading monetary restrictiveness “should support a pick-up in demand over time”. The ECB maintained its view that the monetary stance is “restrictive”. Given the cut today by the ECB was the fourth consecutive 25bp cut there is certainly nothing in the statement to suggest that the ECB is considering a change in approach by either accelerating or slowing the pace of rate cuts over the coming meetings.

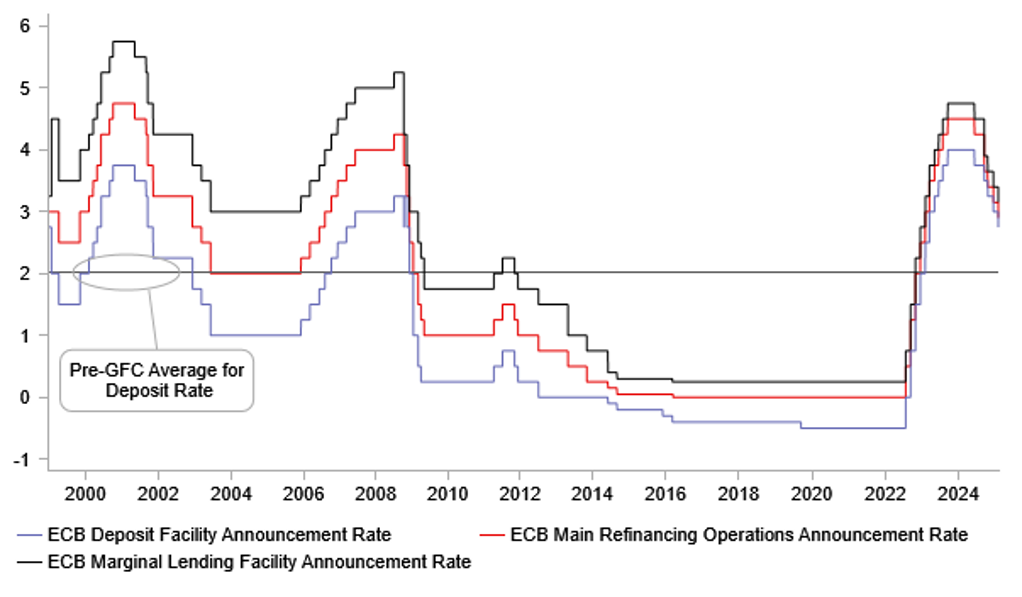

ECB CUTS AGAIN WITH PRE-GFC AVERAGE & NEUTRAL RATE IN SIGHT

Source: Bloomberg, Macrobond & MUFG GMR

Lagarde avoids neutral policy discussion

Given the 25bp rate cut today has taken the policy rate to 2.75% and closer to the neutral rate (deemed by most market participants to be around 2.00% but possibly as high as 2.50%) one of President Lagarde’s first questions in the press conference referred to ECB estimates of what the neutral rate is. President Lagarde was very clear in stating that discussing ending rate cuts in the context of reaching the neutral policy rate was “entirely premature”. The ECB did announce that the ECB staff on 7th February will release a report on an updated analysis of the estimated neutral rate. This helped deflect Lagarde from having to explicitly answer questions on where that level might now be. What was clear though is that it will not deter the ECB from cutting further with another cut now highly likely at the next meeting on 6th March.

Lagarde also refused to discuss the prospect of the ECB having to lower rates to below whatever that neutral rate may be. Referring to the “meeting-by-meeting” approach included in the statement, Lagarde would not be drawn on what might be required at future meetings. We certainly thought there was a risk that the ECB could have given more focus to the neutral rate approaching and with services inflation still elevated would have given justification for Lagarde signalling a less forceful message on further rate cuts. But that was clearly not the case and Lagarde was very strong in the message that discussions on pausing the easing cycle was premature. That gives this meeting a dovish bias. That is certainly reflected in the rates market with the 2-year yield down 10bps as market participants price further cuts with more conviction. The rates move makes entire sense to us.

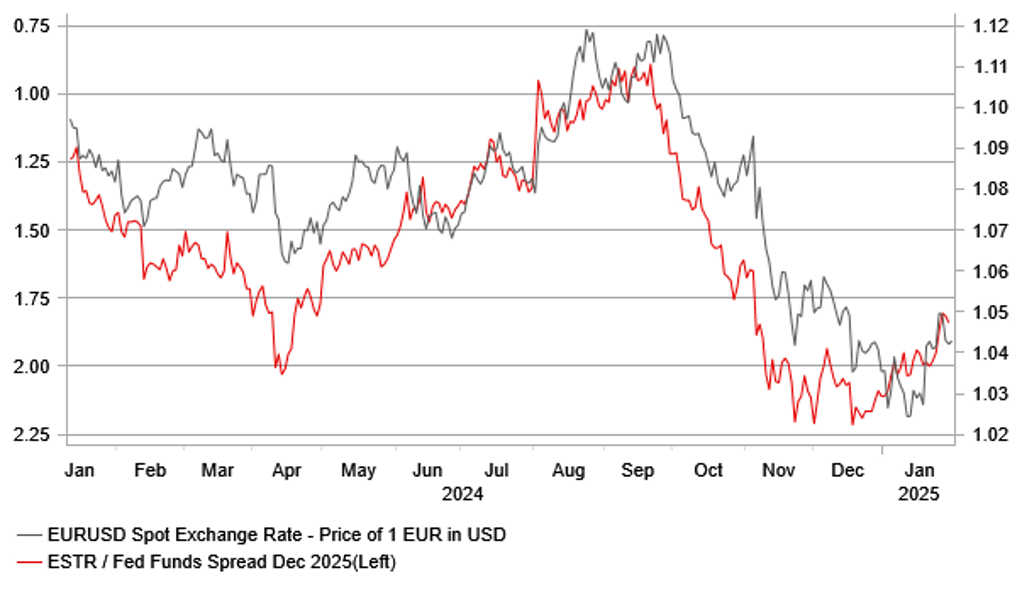

YEAR-END ECB/FED POLICY RATE EXPECTATIONS UNLIKELY TO SHIFT ON ECB MEETING SIGNALLING NEUTRAL EUR/USD IMPACT

Source: Bloomberg, Macrobond & MUFG GMR

Market Implications

While the rates move makes sense to us, the FX move suggests positioning was certainly different. EUR/USD shorts clearly remain substantial with broader US tariff risks and expectations of month-end flows likely encouraging a further increase in short-term EUR shorts. With the ECB meeting not delivering enough of a dovish message, these positions it seems from price action have been partially liquidated.

But the spike higher in EUR/USD has faded and like the drop in yields, the retracement in EUR/USD back lower from the press conference high (1.0467) also makes sense. Is this meeting a strong signal to sell EUR? No. Given the pricing in the OIS market indicates an expectation of the policy rate dropping to 2.00%, the meeting today certainly endorses that. Does it give market participants a signal to price in the policy rate going lower than neutral (say 2.00%)? No, not really although the implied level in December is a little below 2.00%. Still, lower yields is rightly the bias given how strongly Lagarde dismissed discussions of a pause but there was nothing explicit to lift market expectations of the ECB cutting the policy rate to levels below 2.00%.

Hence, EUR/USD now again remains at the mercy of US trade tariff policy developments. One reason for speculative short EUR positioning is the anticipation that trade tariffs will be announced. That of course could come this weekend – the 1st February date for the 25% tariffs on Canada and Mexico and 10% on China remains live according to the White House and hence upside risks for the US dollar remain. Given the size of the euro-zone’s US trade deficit, expectations of tariffs in Europe will rise sharply if President Trump goes ahead with the tariffs over the weekend. For the US dollar this can still go either way. USD/CAD and USD/MXN moves point to continued scepticism on these tariffs being implemented given the US inflation impact. If Trump backs down another EUR/USD short squeeze will unfold, one that is likely to be larger than today’s squeeze on the outcome of the ECB meeting.