FX market implications from the upcoming LDP leadership election

- The result from the LDP leadership election will be announced on 27th September.

- The three leading candidates to become the next prime minister of Japan are Shinjiro Koizumi (45%), Shigeru Ishiba (35%) and Sanae Takaichi (20%)

- A win for Sanae Takaichi would have the biggest impact on the performance of the yen. She favours maintaining loose BoJ policy and a weaker yen.

Political risks to garner more market focus

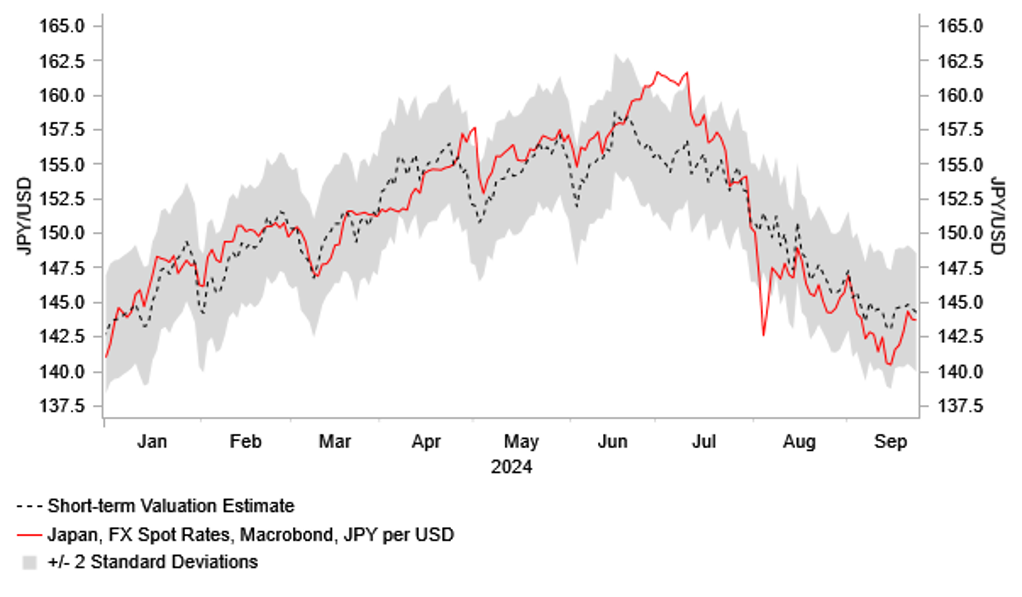

Market attention has recently been focused on the Fed’s decision to begin their monetary easing cycle with a larger 50bps rate cut which has encouraged a weaker US dollar over the summer. At the same time, the BoJ has continued to tighten monetary policy delivering their second rate hike at the end of July. The narrowing policy divergence between the BoJ and Fed has contributed to the sharp adjustment lower for USD/JPY which briefly fell back below the 140.00-level last week after hitting at a high of 161.95 on 3rd July. In the month ahead, we expect political risks to become a more important driver for USD/JPY ahead of the upcoming US elections on 5th November. Before then the ruling Liberal Democratic Party (LDP) will elect a new leader who will become the next Prime Minister of Japan after Fumio Kishida announced last month that he would not seek re-election as LDP leader and would step down as Prime Minister. In the following piece, we will assess whether there are any potential implications for JPY performance from the LDP leadership election.

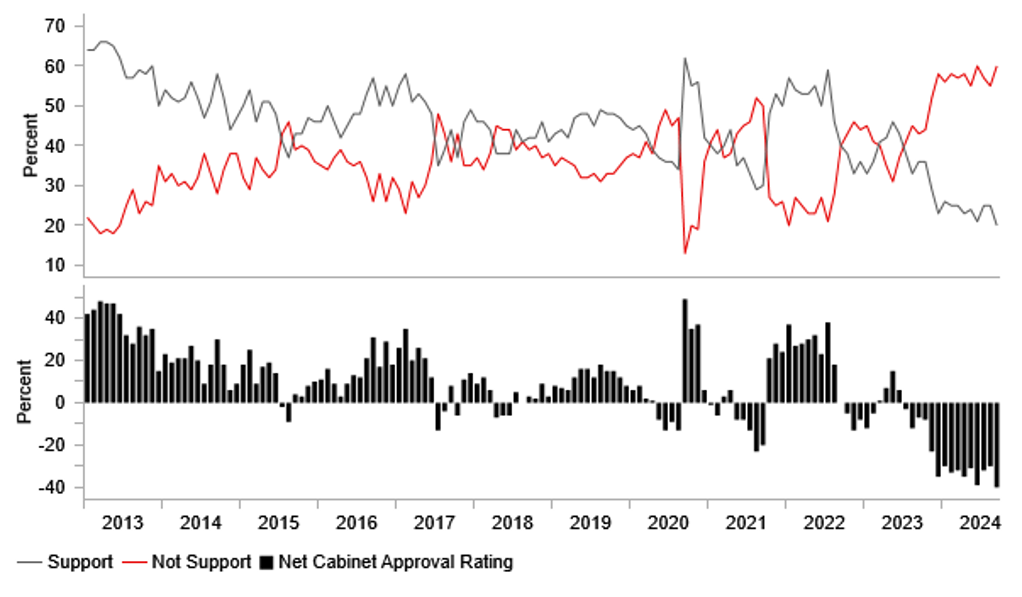

CABINET SUPPORT RATING AT RECORD LOWS AHEAD OF LDP ELECTION

Source: Bloomberg, Macrobond & MUFG GMR

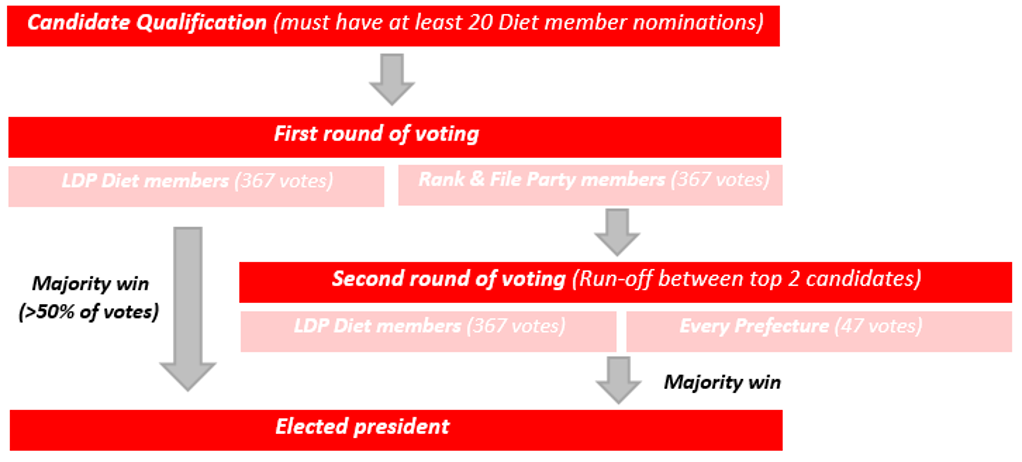

Complex & unpredictable process to elect new LDP leader

The Liberal Democratic Party (LDP) are scheduled to elect a new leader on 27th September. The voting will begin from 1pm Tokyo time and based on the timeline from 2021, the first round result should be approximately an hour later and then assuming a second round an hour after that with a confirmed winner in or around 3pm Tokyo time (7am BST). The LDP selects its president through a structured election system. To qualify, candidates must first receive nominations from 20 LDP lawmakers. In the initial round of voting, both LDP Diet members and rank-and-file LDP members cast their votes. There are a total of 734 votes. Of those 367 votes are allocated to LDP Diet members and the other 367 votes are allocated by share of party member votes. If a candidate wins more than half of the total votes (lawmakers & rank-and-file party members), they are elected as president. However, if no candidate wins a majority, there will be a run-off between the two top candidates. In the second round, there are 414 votes. Of those 367 votes are allocated again to LDP Diet members, and 47 votes for LDP prefectural committees (1 per prefecture). The candidate who secures the most votes in the run-off is elected as president. Voting from the 2012 election highlights that the candidate with the most votes in the first round is not guaranteed to go on to become president if a run-off is required. On that occasion, Shigeru Ishiba received more votes than Shinzo Abe in the first round but then lost in the run-off. The outcome of the upcoming LDP leadership election has been made even more uncertain by the reduced influence of factions within the LDP.

LDP PRESIDENTIAL ELECTION SYSTEM

Source: EGA & MUFG GMR

Three front runners emerge to become next prime minister

Prime Minister Fumio Kishida’s decision to resign as Prime Minister was driven by the negative fallout from the slush fund scandal that involved the misuse of campaign funds by members of the LDP. It has hurt the popularity of the ruling LDP government. According to polling by NHK (Japan Broadcasting Corporation) the net approval rating of the cabinet has recently fallen to a record low of -40% in the series dating back to 2013. 60% of respondents do not support the cabinet compared to only 20% who support the cabinet. The upcoming election provides the LDP with an opportunity to choose a new leader as they seek to distance themselves from the slush fund scandal. In this regard, the decision on who to choose as their new leader could be determined more by their current public popularity and having a clean image alongside pollical clout to build alliances within the LDP.

There are an unusually large number (9) of candidates who are competing to be the next LDP president. Therefore, it is unlikely that one candidate will secure a majority in the first round of voting, and a run-off will be required to determine who becomes the next president. The nine candidates are: i) Shigeru Ishiba who is the former secretary general of the LDP, ii) Sanae Takaichi who is the minister in charge of economic security, iii) Shinjiro Koizumi who is the former environment minister, iv) Yoko Kamikawa who is the foreign minister, v) Taro Kono who is the digital transformation minister, vi) Yoshimasa Hayashi who is the chief cabinet secretary, vii) Takayuki Kobayashi who is the former economic security minister, viii) Toshimitsu Motegi who is the LDP secretary general, and ix) Katsunobu Kato who is the former chief cabinet secretary.

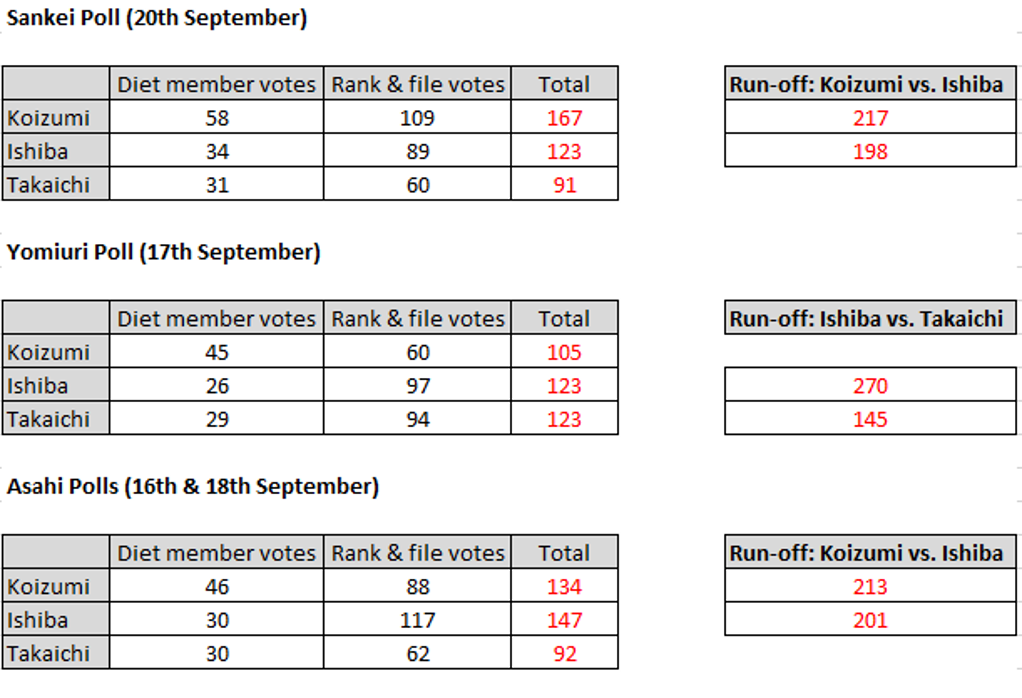

The latest polls by the Yomiuri Shimbun, Sankei and Asahi which surveyed LDP members, supporters and lawmakers have revealed that the three leading candidates to be elected as the next president are Shigeru Ishiba, Sanae Takaichi and Shinjiro Koizumi. According to the Asahi polls conducted on 16th and 18th September, Shigeru Ishiba secured 147 votes compared to 134 votes for Shinjiro Koizumi and 92 for Sanae Takaichi. In a run-off Shinjiro Koizumi was expected to narrowly beat Shigeru Ishiba by 213 votes to 201. A similar outcome was revealed by the Sankei poll from 20th September in which Shinjiro Koizumi secured 167 votes compared to 123 for Shigeru Ishiba and 91 for Sanae Takaichi. In the run-off, Shinjiro Koizumi got 217 votes compared to 198 for Shigeru Ishiba. The outcome from the Yomiuri poll from 17th September was less favourable for Shinjiro Koizumi was he secured fewer votes (105) than Shingeru Ishiba (123) and Sanae Takaichi (123). In the run-off Shingeru Ishiba won more comfortably (270) against Sanae Takaichi (145). Together the polls suggest that Shinjiro Koizumi and Shigeru Ishiba are the favourites to become Japan’s next prime minster followed by Sanae Takaichi. Based on the polls, we are currently attaching a probability of 45% to Shinjiro Koizumi winning followed by a probability of 35% for Shingeru Ishiba and a probability of 20% for Sanae Takaichi.

LATEST POLLS POINT TO THREE-HORSE RACE TO BE NEXT PM

Source: Asahi, Yomiuri, Sankei & MUFG GMR

Market Implications

Of the three leading candidates to become Japan’s next prime minister, Sanae Takaichi has the potential to have the biggest impact on yen performance. At the start of this week, Sanae Takaichi reiterated her opposition to premature monetary tightening. On an online program she stated that “it’s stupid to raise rates now”, and described “a weak yen as great”. She believes that a tax hike, curbing fiscal spending and monetary tightening are “forbidden steps”. Those recent comments remain consistent with her position as the candidate most closely aligned with the reflationist policy platform implemented under former premier Shinzo Abe. She has warned that Japan will fall back into deflation again unless it continues with “active fiscal spending properly and monetary easing patiently”.

Market participants would understandably become concerned that the BoJ would come under political pressure to slow down and even reverse policy tightening if Sanae Takaichi becomes the next prime minister. It would provide encouragement for market participants to rebuild short yen positions following the heavy liquidation of carry trades over the summer. Price action since last week’s BoJ policy meeting highlights that the performance of the yen remains sensitive to expectations for the timing of the BoJ’s next rate hike. USD/JPY has climbed back up towards the 145.00-level up from closer to the 142.00-level during last week’s BoJ press conference. The yen sell-off was encouraged by comments from Governor Ueda signalling that they are not in a rush to raise rates again as soon as at the next policy meeting in October. The sharply stronger yen over the summer and financial market instability has made the BoJ more cautious over continuing to raise rates in the near-term. It fits with our own view for the next hike to be delivered in December. A view that would be challenged if Sanae Takaichi becomes the next Prime Minister. A further dovish repricing of BoJ rate hike expectations following an election win for Sanae Takaichi could see USD/JPY extend its rebound back up towards the 150.00-level. While this is not our base case scenario, we do acknowledge it poses a material upside risk to our forecast for USD/JPY to keep moving lower into the mid-130.00’s over the next 6-12 months.

In contrast, a win for either Shinjiro Koizumi or Shigeru Ishiba is expected to have less impact on yen performance. Shinjiro Koizumi has stated that he “will respect the BoJ’s independence” and would focus on ensuring sooth dialogue and communication between the government and BoJ. Shigeru Ishiba has gone one step further by endorsing the BoJ’s current policy path. He stated that the “BoJ is on the right track to gradually align with a world with positive interest rates”. A victory for either candidate would support our expectation for further BoJ rate hikes and a stronger yen.

USD/JPY TO REBOUND FUTHER IF SANAE TAKAICHI WINS

Source: Bloomberg, Macrobond & MUFG GMR