Post-Budget GBP sell-off reverses as BoE sticks to gradual rate cuts

- BoE delivered second 25bps rate cut in easing cycle.

- No change to BoE plans for gradual rate cuts.

- Updated forecasts reveal Budget expected to lift growth & inflation adding to BoE caution in lowering rates.

- Slower pace of BoE cuts remains supportive for GBP.

BoE sticks to gradual rate cut path

The BoE delivered the second rate cut in the current easing cycle at today’s MPC meeting when the policy rate was lowered by 25bps to 4.75%. The decision was supported by a clear majority with eight MPC members voting in favour of the rate cut while only one MPC member Catherine Mann voted against. It was a more clear-cut decision than the first rate cut delivered back in August when the decision was narrowly backed by only five MPC members out of nine. On both occasions Catherine Mann voted to leave rates on hold. She remains concerned that structural factors in wage and price-setting dynamics will continue to draw out the underlying disinflation process and wants to wait more time to assess if upside inflation risks materialize. However, the clear majority of MPC members were of the view at today’s MPC meeting that there had been continued progress in disinflation. They were more confident that previous external shocks to inflation had abated although noted that remaining domestic inflationary pressures were resolving more slowly.

The update guidance from the BoE signalled that they will continue to cut rates gradually and are not currently planning to deliver back-to-back rate cuts like the ECB and Fed. The BoE still judges that a gradual approach to removing policy restraint remains appropriate. The decision to stick to a gradual path for rate cuts has been supported by last week’s UK budget. The updated economic projection from the latest Quarterly Inflation Report revealed that BoE expects the policy measures to boost the level of GDP by around 0.75% at their peak in a year’s time compared to the previous projections from August. At the same time, the Budget measures are expected to boost CPI inflation by just under 0.5 of a percentage point at the peak reflecting both the indirect effects of the smaller margin of excess supply and direct impacts from Budget measures.

The BoE estimates that there will now be around 0.5% of GDP of slack in the medium-term which is less than prior to the Budget especially in 2025 and the 1H 2026. The BoE’s GDP forecast for next year was raised by 0.5 percentage point to 1.5% and the unemployment rate forecast for Q4 2025 was lowered by 0.6 percentage point to 4.1%. As a result, the BoE’s inflation forecast in two years’ time was raised by 0.5 percentage point to 2.2% and more modestly by 0.3 percentage point in three years’ time.

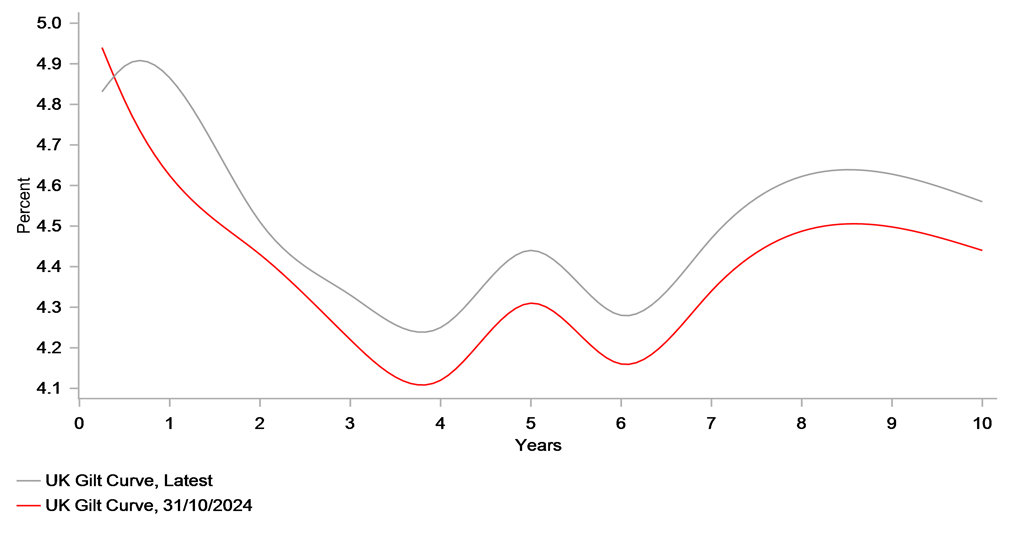

However, the updated economic forecasts were based on market rates that were in place prior to the release of the Budget covering the 15 working days to 29th October. Market rates have since adjusted materially higher after the Budget was released posing downside risk to the updated growth and inflation forecasts if sustained. For comparison, the market rates that the updated economic forecasts were based had the policy rate falling towards 3.7% in Q4 2025 whereas current market pricing has the policy rate falling to just above 4.0%. If market rates remain higher for longer than initially assumed, it could be one factor that places more pressure on the BoE to speed up rate cuts next year. Based on the updated guidance from the BoE, we continue to expect the next rate cut to be delivered in February. Faster rate cuts cut be delivered beyond if inflation and wage slows more than expected in the coming quarters.

UK YIELD CURVE HAS ALREADY SHIFTED HIGHER SINCE BUDGET

Source: Bloomberg, Macrobond & MUFG GMR

Market Implications

Today’s BoE update is supportive for the pound. Unlike the ECB and Fed, the BoE remains comfortable for now to stick to plans for gradual rate cuts. With yields in the UK set to remain at relatively higher levels at least until early next year, the pound is set to remain attractive as a G10 carry currency. The pound has already reversed initial losses sustained against the euro after the UK Budget was released last week when EUR/GBP hit a high of 0.8448. The pound’s rebound should be encouraged by today’s BoE policy update which alongside the US election outcome has increased downside risks for EUR/GBP heading into early next year. The euro-zone economy is likely to be hit harder than the UK economy if incoming US President Trump implements higher tariffs when he comes into power next year. We expect EUR/GBP to fall to fresh year to date lows and move closer to support from the 0.8200-level which the pair hasn’t traded below since the initial fallout from the Brexit referendum in June 2016. In contrast, the bullish implications for the US dollar from a Trump victory and likely Red Sweep will cap further upside for cable beyond the 1.3000-level.

In the UK rate market, bond yields initially moved higher after today’s BoE policy update but have since quickly given back those gains. The price action could reflect the fact that UK yields had already moved sharply higher since the UK Budget to price in a slower pace of BoE rate cuts. There are currently only 5bps of cuts priced in for the next MPC meeting in December and around 21bps of cuts by February. Beyond February, the UK rate market is only pricing in a further 40bps of rate cuts by the end of next year. We believe that the UK rate market has now gone too far in pricing out BoE rate cuts as we still expect the policy rate to fall below 4.00% next year.

TEMPORARY GBP SELL-OFF AFTER UK BUDGET

Source: Bloomberg, Macrobond & MUFG GMR