The Bank of England maintains caution in 8-1 vote

- BoE leaves policy rate on hold following 25bp cut in August.

- The 8-1 vote was not a surprise with Swati Dhingra the lone dissenter and Alan Taylor voting for the first time with the majority.

- We see a cut in November and an increased chance of another in December.

- The pound remains the top G10 currency performer year-to-date but we see scope for that outperformance to start to fade.

BoE caution and gradualism remains prominent

The BoE’s MPC as expected announced an unchanged monetary stance today and opened up a divergence with the US following the more aggressive 50bp cut by the Fed yesterday. That will serve to encourage continued GBP/USD buying for now with the MPC still much more concerned over inflation risks than the FOMC. The vote was 8-1 with Swati Dhingra the lone dissenter voting for a 25bp cut. The fact that Deputy Governor Ramsden voted unchanged is one element of this announcement being on the hawkish side. In addition, any hope that the new MPC member, Alan Taylor, may be more dovish than expected has not materialised with Taylor also voting with the majority. A second hawkish element was the statement from Governor Bailey who stated that it was “important not to cut too fast or by too much”. A third element that was more on the hawkish side was the clear lack of any shift in terms of guidance that may have suggested a willingness to move away from the cautious approach to easing. The key guidance line in the final paragraph of the statement remained unchanged – “Monetary policy will need to continue to remain restrictive for sufficiently long until the risks to inflation returning sustainably to the 2% target in the medium term have dissipated further.”

As a result of these different elements of the announcement, the pricing for rate cuts into year-end have been reduced somewhat with about 6bps of cuts taken out of the OIS market which now indicates 43bps of cuts by year-end. With a November rate cut still highly likely, the pricing implies that market participants are less convinced of a follow-through cut in December. This is an understandable reaction given the lack of evidence of any change in thinking over the current approach to the pace of easing.

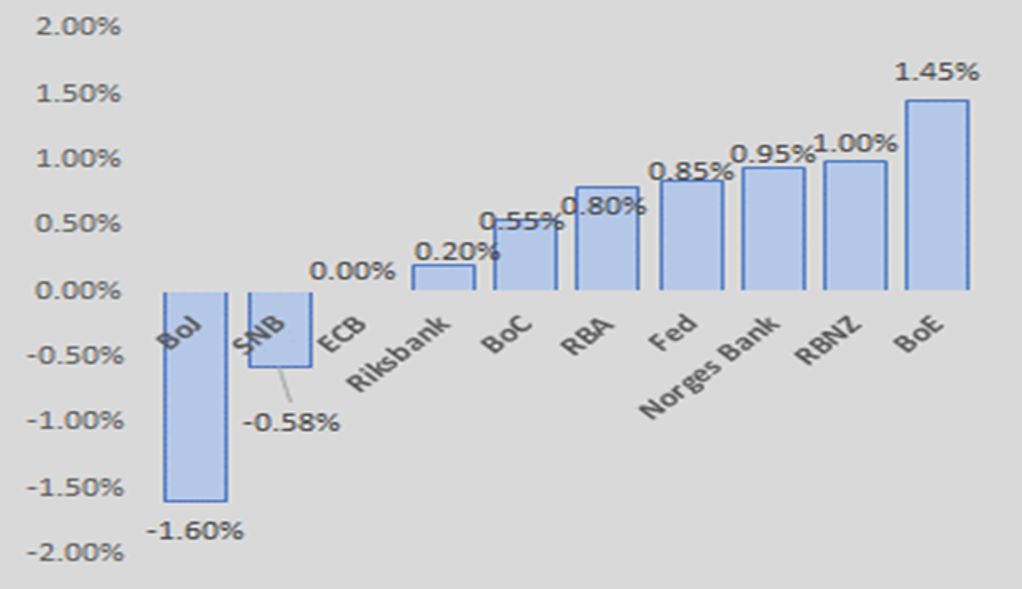

MARKET IMPLIED REAL POLICY RATES BY MID-2025 HIGHLIGHT POTENTIAL FOR FASTER PACE OF BOE EASING TO EMERGE

Source: Bloomberg, Macrobond & MUFG GMR

QT pace maintained

If there’s a dovish element to today’s announcement we could point to the QT announcement. As expected, the BoE have maintained the pace of QT at GBP 100bn for the 12mths ahead. Some analysts though were predicting the pace of QT could pick up given the fact that the maturity profile of the BoE’s gilts holdings show a little over GBP 80bn will be rolling off the balance sheet over the next 12mths. This means the outright selling will drop from nearly GBP 50bn in the 12mths just gone to around GBP 20bn. Some expected the BoE to announce a GBP 120bn QT level today to avoid a sharp drop-off in the pace of outright sales. The BoE decided not to do that and this will be good news for the government. Outright sales of Gilts essentially realises losses that have to be covered by the government. Bloomberg estimates that the QT announcement will provide Chancellor Reeves with about an extra GBP 3bn assuming the OBR uses the same assumptions it has been using since November 2023.

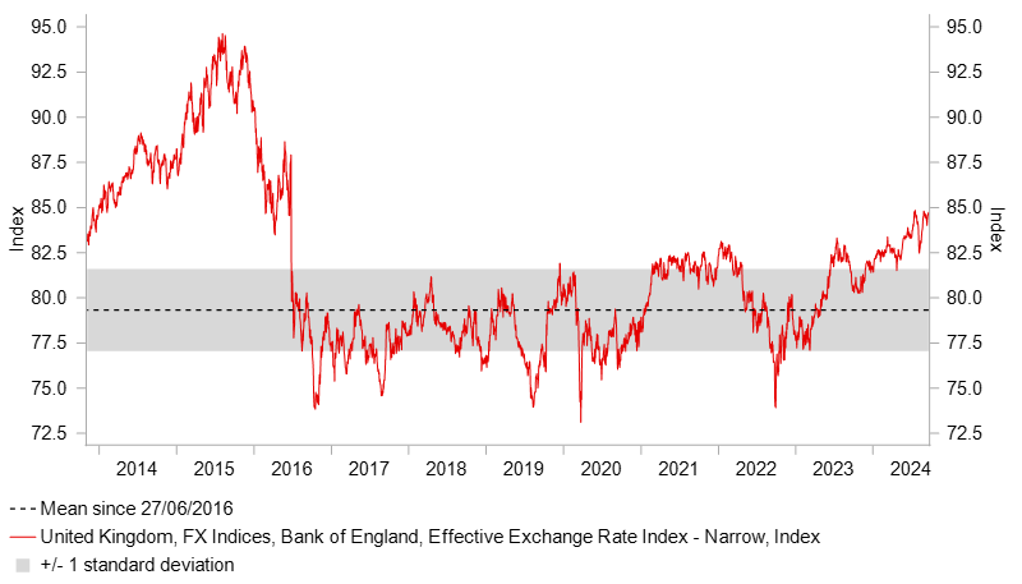

GBP CONTINUES TO SLOWLY RETRACE THE 2016 BREXIT PLUNGE

Source: Bloomberg, Macrobond & MUFG GMR

Market Implications

The BoE’s more hawkish policy announcement today will create some near-term uncertainty over the prospect of back-to-back cuts at the final two meetings of the year. The caution of the BoE is well grounded and the progress made in dampening underlying inflationary pressures and wage growth is not as compelling in the UK as in the US. But we still believe that by the November MPC meeting we will have had more evidence of underlying inflation pressures easing and wage growth slowing further. By then we will also have had the first budget from the new Labour government and based on the communications from Chancellor Reeves we should expect a budget of tax rises that may dampen the outlook for economic activity ahead. That could provide the scope for the MPC signalling a greater willingness to up the pace of rate cuts at that stage and prompt a move lower in front-end yields.

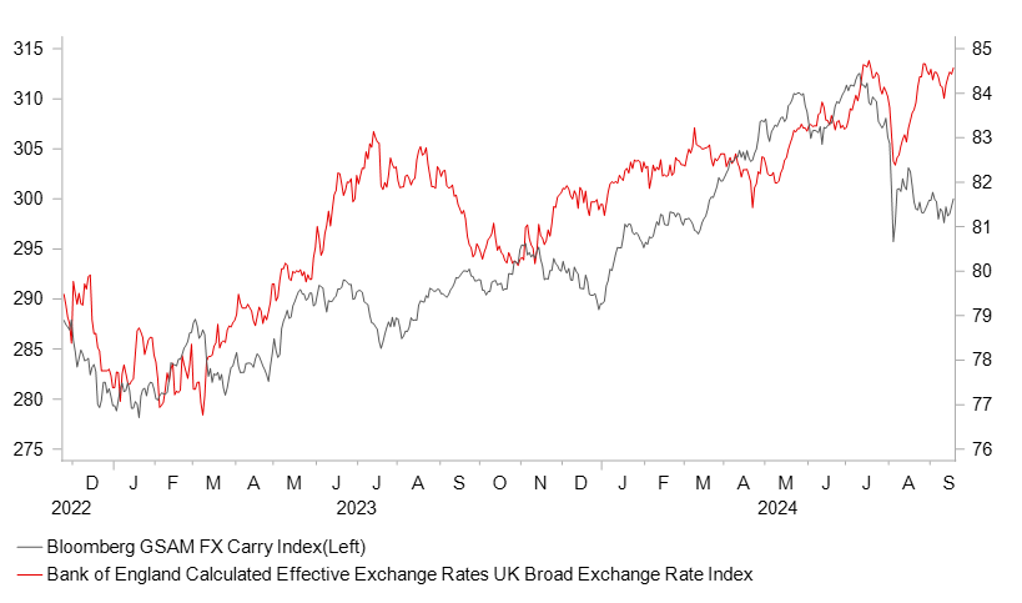

So we see some danger here of the current GBP outperformance starting to fade as the BoE softens the messaging on gradualism and indicates that conditions are falling into place for the potential of faster rate cuts ahead. This will be more the case if markets increase expectations of further bigger rate cuts from the Fed. There are two NFP reports before the next FOMC meeting and another bigger cut is very feasible if those jobs reports are weaker than expected. In Europe, the German economy remains in the doldrums. A GBP overshoot is something the BoE would want to avoid and will also encourage a pick-up in the pace of rate cuts. Carry is also turning less favourable as a trading strategy which we expect to continue and that will likely weigh on GBP performance further ahead. Our FX monthly forecasts indicate some modest retracement in Q4 in GBP/USD from our 1.3400 end September level.

BLOOMBERG CARRY INDEX POINTS TO DOWNSIDE RISKS FOR GBP

Source: Bloomberg, Macrobond & MUFG GMR