The path to further BoE rate cuts is becoming more uncertain

- BoE leaves rates on hold and keeps door open to further gradual rate cuts.

- We expect another rate cut in May but majority of MPC members indicate it is not a done deal. Higher risk of a skip in August.

- BoE’s cautious approach to easing remains supportive for GBP as UK yields set to remain higher for longer compared to in other major economies.

BoE sticks to “gradual and careful” approach to setting policy

The BoE decided to leave their policy rate unchanged at 4.50% as expected at today’s MPC meeting. The decision to leave rates on hold was supported by 8 MPC members while 1 dissenting MPC member Swati Dhingra voted in favour of a 25bps. The voting pattern will be viewed as less dovish than at the previous MPC meeting in February when MPC member Swati Dhingra was joined by MPC Member Catherine Mann in voting for a larger 50bps rate cut than the majority vote for a 25bps rate cut. Catherine Mann no longer thought it was necessary to advocate a more activist approach to cutting rates at today’s MPC meeting. She had advocated the need for larger 50bp cut in February to give a clearer signal of financial conditions appropriate for the United Kingdom. Instead she decided to join the majority of MPC members today in voting for unchanged rates who judged that there had been “relatively little news” since the February MPC meeting from UK economic developments notwithstanding the intensification of global uncertainties reflecting the potential impact from President Trump’s economic policies and plans for a significant loosening of fiscal policy in Germany. For the majority of MPC members they expect the underlying disinflationary process to continue but stressed that an accumulation of evidence would be used to assess progress going forward. The second less dovish development was that the majority of MPC members stated that there was no presumption that monetary policy was on a pre-set path over the “next few meetings”. It highlights that it is not a done deal that the BoE will stick to the current path of quarterly rate cuts by lowering rates by a further 25bps in May.

Ahead the May MPC meeting, the Committee will consider risks around the medium-term inflation. The MPC is currently focusing on two main risks. Firstly, the Committee will consider the extent to which there could be greater or longer-lasting weakness in demand relative to supply in the economy which could push down on inflationary pressures in the medium-term. Heightened uncertainty was cited as a factor that could result in greater or long-lasting weakness in demand. Secondly, the Committee will consider the extent to which there could be more persistence in domestic wages and prices both from constrained supply relative to demand and from additional second-round effects from the near-term increase in inflation. The BoE still expects inflation to rise to a peak of around 3.75% in Q3. The BoE noted that they would review evidence on the impact and likelihood of these broad risks as part of its May policy round alongside its baseline forecast. At the current juncture, the latest developments were not sufficient to change their overall guidance that a “gradual and careful approach” to the further withdrawal of monetary policy restraint remains appropriate. It supports our view that the BoE will deliver another 25bps rate cut in May. We believe there is a higher risk that the BoE could skip a quarterly rate cut in August when there is expected to be bigger inflation overshoot.

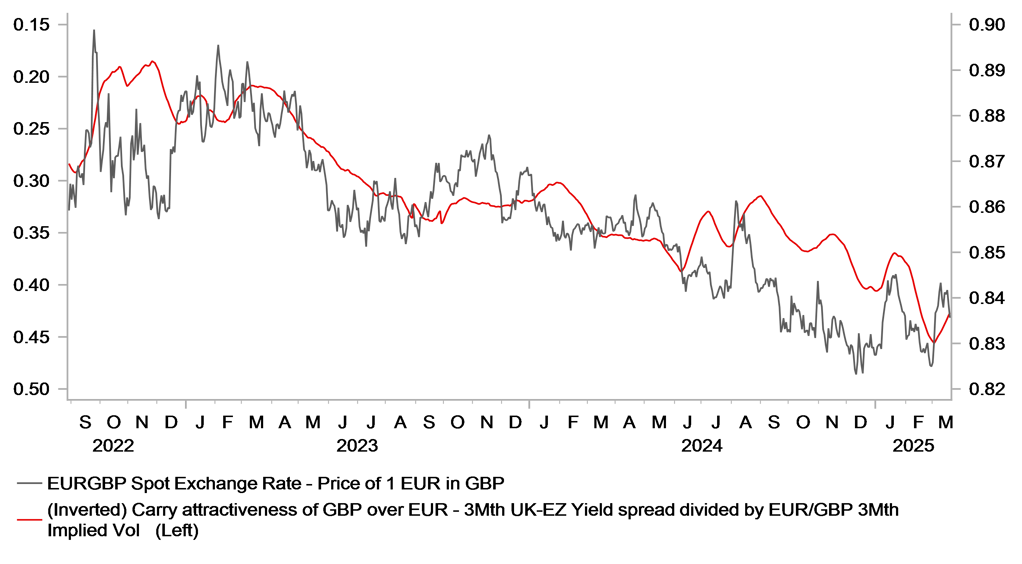

EUR/GBP VS. CARRY ATTRACTIVENESS OF GBP

Source: Bloomberg, Macrobond & MUFG GMR

Market Implications

In response to today’s MPC meeting, the UK rate market has moved to modestly pare back expectations for BoE rate cuts this year. The implied yield on the June and September 2025 SONIA futures contracts have risen by around 3 to 4bps. The probability of another rate cut being delivered at the next MPC meeting in May remains high at just over two thirds. In contrast, the probability of the BoE delivering a further rate cut in August has fallen back to around 50:50. We expect this probability to be scaled back further unless backed up by more evidence of softening UK labour market conditions including slowing wage growth in the coming months. It will become more challenging for to the BoE to continue delivering quarterly rate cuts if inflation is picking up heading into the summer.

There has been a mixed initial reaction for the GBP. Cable initially strengthened hitting a high of 1.2980 but has since fallen back towards today’s lows at 1.2936. Cable price action appears to be driven more by the broad-based rebound for the USD today. After the heavy sell-off for the USD this month, the recent weakening trend is showing more signs of exhaustion. Even the dovish policy reaction function presented by the Fed overnight (click here) indicating that they would be willing to look through higher tariff induced inflation and still lower rates further this year has not been sufficient to trigger another leg lower for the USD. In contrast, the GBP has strengthened modestly against the EUR since the MPC meeting resulting in EUR/GBP dropping back below support from the 200-day moving average at around 0.8380. The price action suggests that the initial boost for the EUR from Germany’s fiscal plans has run out of steam for now. After rising sharply from around 2.50% up to a high of 2.94%, the 10-year German Bund yield has since dropped back to 2.75%. Overall, the BoE’s continued caution over delivering further rate cuts remains supportive for the GBP as it helps to keep yields on offer in the UK higher than in other major economies.